Bears were ready to pounce when stocks gapped down this morning, but prices remained in a range for most of the day despite their efforts. Let’s recap what you missed. 👀

Today’s issue covers Pinterest’s lackluster earnings, Chegg’s failing grade, and deal announcements from the day. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Utilities (+0.85%) led, and technology (-1.22%) lagged. 🔻

In economic news, the U.S. plans to implement a 200% tariff on Russian aluminum as soon as this week. Meanwhile, Treasury Secretary Janet Yellen says ‘you don’t have a recession’ when the employment rate is at a 53-year low. 🤷

Bed Bath & Beyond soared 92% as meme stocks caught investor interest again. Shares of $AMC, $GME, and other meme stocks also picked up steam later in the day. 📈

In crypto news, Binance is temporarily suspending U.S. Dollar bank transfers this week and is notifying impacted customers directly. U.S. Congress is set to hold a ‘crypto crash’ hearing on February 14th. And the bankrupt lender Genesis and its parent Digital Company Group reached an initial agreement with its main creditors. ₿

Other symbols active on the streams included: $BBAI (+17.73%), $KAL (+37.33%), $AI (+6.45%), $SOUN (+42.91%), $XELA (+10.37%), $GNS (+4.29%), and $TRKA (-3.81%). 🔥

Here are the closing prices:

| S&P 500 | 4,111 | -0.61% |

| Nasdaq | 11,887 | -1.00% |

| Russell 2000 | 1,958 | -1.40% |

| Dow Jones | 33,891 | -0.10% |

Earnings

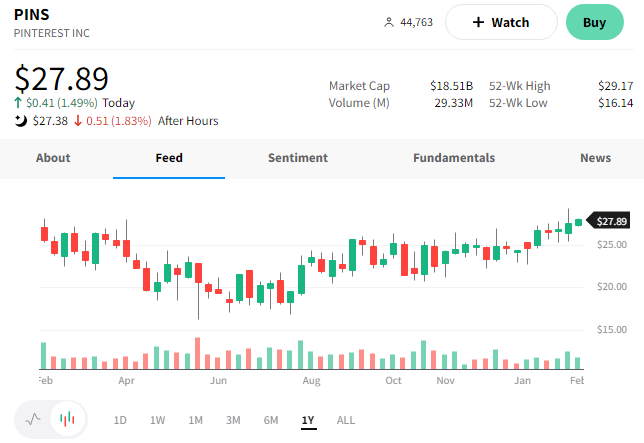

$PINS Earnings Pop Investor’s Hopes

It was another Pinteresting day for shareholders as Pinterest reported fourth-quarter earnings. 📝

The company’s earnings per share of $0.29 beat the $0.27 expected. Meanwhile, revenues of $877 million missed the $886.3 million consensus estimate.

Global monthly active users rose 4% YoY to 450 million. And its average revenue per user (ARPU) for the U.S. and Canada rose 6% YoY to $7.60. 📈

Its guidance was also a disappointment. It now expects first-quarter revenue growth in the “low single digits” versus last year, well below the 6.9% analysts expected. It also announced that its CFO and head of business operations, Todd Morgenfeld, is leaving the company on July 1, 2023.

The company is struggling with the advertising slowdown facing the entire industry. However, Pinterest CEO Bill Ready says the company is “ready” for what’s ahead. He says they are adapting quickly to the environment and continue to create a more positive online experience for users and advertisers.

$PINS shares were initially down over 10% on the news, but prices recovered to nearly flat in extended hours. 😮

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort in Montego Bay, Jamaica.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

M&A

A Day Of Deals

It was a busy day on Wall Street, so let’s recap the buyouts, IPOs, and more dealmaking you might’ve missed. 👀

First up is the Mediterranean restaurant chain Cava confidentially filing for an IPO. The fast-casual restaurant was founded in 2006 and expanded in 2018 by buying Zoes Kitchen for $300 million. It recently raised $230 million in April 2021 at a valuation of $1.71 billion. Now, the company is looking to go public as the market reheats following an ice-cold 2022. 🥗

Newmont Mining shares fell 5% after offering $17 billion to acquire Australia’s Newcrest Mining Ltd. The stock-only proposal would be the largest takeover deal globally so far this year. Elsewhere in the industry, Pan American Silver Corp. and Agnico Eagle Mines Ltd. are taking over Yamana Gold Inc. in a $4.8-billion deal. ⚒️

As part of their alliance restructuring, Nissan is set to buy up to a 15% stake in Renault’s electric vehicle unit Ampere. Nissan’s chief operating officer said, “Previously the alliance was more about synergies…and global volumes.” and“…the next 15 years is about how we become the number one value creator for each other and our shareholders.” ⚡

Public Storage is going hostile on competitor Life Storage, looking to buy it for $11 billion. The proposed all-stock deal would give Life Storage shareholders 0.4192 shares of Public Storage, roughly $129.3 per share based on Public Storage’s most recent closing price. That represents an approximately 19% premium and would value Life Storage at approximately $15 billion. 📦

Paris-listed investment bank Rothschilds & Co. rose 17% on news that the Rothschild family is looking to take it private. As of the end of last year, the Rothschild family owned close to 55% of the bank’s shares and 69% of exercisable voting rights. 🏦

And in slightly less noteworthy news…

The National Enquirer was sold to a group that includes a company Theodore Farnsworth, the indicted ex-chairman of MoviePass, founded. Pricing wasn’t disclosed, but speculation is that it was slightly below $100 million. 📰

Finally, Social Chain, the social media agency founded by Dragons’ Den star Steven Bartlett is being sold in a 7.7 million euro deal. Social media and digital media group Brave Bison is purchasing the agency in hopes that it will increase its social media advertising revenue. 📱

Earnings

It’s Chegg-mate For These Investors

The student-first connected learning platform, Chegg, is falling after hours.

Revenues of $205.2 million were down slightly YoY, while earnings per share of $0.01 were well below the $0.15 in the prior year’s quarter. Lower enrollment, a strong labor market, and inflation hampered last year’s results. However, the company says subscriber growth troughed in mid-2022 and should trend well into 2023. ◀️

With that said, the company’s guidance left a lot to be desired. Its first-quarter revenue guidance of $184 to $186 million was well below the $200.3 million expected. And full-year revenue of $745 to $760 million fell short of the $817.5 million consensus estimate.

Chegg has declined significantly from its pandemic-era growth like other subscription tech and consumer-focused companies. That struggle continued after hours, with $CHGG shares falling another 22%. 📉

Bullets

Bullets From The Day:

🤖 Google’s new Bard A.I. set to challenge ChatGPT. With artificial intelligence (AI) becoming the talk of the town, it was only a matter of time before Google’s parent-company Alphabet responded. Today, it announced that its new conversational AI technology, called Bard AI, will be open to public testing in the coming weeks. The software is powered by the company’s large language model LaMDA or Language Model for Dialogue Applications. With Microsoft set to use ChatGPT to enhance its Bing search engine, Google’s first order of business is applying its own model to its own web service. CNBC has more.

🎞️ AMC to begin testing “airline seating” pricing for movies. The theatre chain is testing a new system where ticket prices will vary depending on the seat chosen. The new tiered pricing scheme, Sightline, which splits the auditorium seats into three differently priced tiers, will roll out nationwide on Friday. This is the company’s latest attempt to generate additional revenue and improve profitability. Of course, we’ll have to see how moviegoers take to it in the coming months. More from The Verge.

🚫 India to block over 230 betting and loan apps. The country is cracking down on apps that offer betting and loan services to prevent the misuse of its citizens’ data. The move was prompted by the Ministry of Home Affairs, which claims the apps sought to mislead customers into taking enormous debts without understanding the terms. They also expressed concerns that these apps could be used as tools for espionage and propaganda. This comes after the Reserve Bank of India introduced stricter rules for digital lending firms last year, aiming to provide more transparency and control to consumers. TechCrunch has more.

💽 Dell is “defragmenting and optimizing” its company. A slowing PC and laptop market has the company cutting 5% of its workforce (6,650 employees) to “stay ahead of downturn impacts.” While it’s already taken steps to reduce costs, like reducing travel, pausing external hiring, and reducing outside services spending, further measures are required. However, co-COO Jeff Clarke says these steps will allow Dell to be ready to take advantage of the market when it rebounds. More from CNBC.

📈 Elon Musk says Twitter is ‘trending to breakeven.’ Just months after acquiring the company for $44 billion, Elon Musk says his drastic changes to the company have moved it from the depths of potential bankruptcy to trending toward a breakeven point. The response comes in a tweet where Musk acknowledges how taxing the last few months have been as he juggles his responsibilities at Twitter, Tesla, and SpaceX. With that said, many questions remain about the bird app’s next steps and its direction. CNBC has more.

Links

Links That Don’t Suck:

🥶 Watch Mt. Washington endure historic wind chill of -108°F

🔻 Retailers in China enact rare price cuts for Apple’s high-end iPhone 14 line

🛬 Dramatic air traffic control audio captures near miss between FedEx, Southwest planes

⚠️ The CEO of America’s second-largest bank is preparing for possible U.S. debt default

📺 Fox sells out super bowl ad inventory, with some 30-second spots fetching upwards of $7 million

😮 From Nike to Nutella: Company names you have probably been mispronouncing your whole life