It was a volatile week in the markets, but it’s a three-day weekend, so we’ve got plenty of time to decompress. 😴

Let’s recap and prep for the shortened week ahead. 📝

What Happened?

🔻 Stocks had a volatile week and closed near the flat line, but crypto continued its strong run. Meanwhile, bonds and commodities had a rough week as the market continued to price in higher interest rate expectations.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🥵 Inflation was this week’s key economic data point, with the consumer price index (CPI) and producer price index (PPI) both rising more than expected. Other economic data was mostly in line with current trends.

🧭 The Biden Administration changed its top economic council, choosing Federal Reserve Vice Chair Lael Brainard as the new White House National Economic Council (NEC) Director.

📝 Earnings were center stage this week, with Roblox, Krispy Kreme, Analog Devices, and many more companies reporting.

🤖 Several tech stocks positively surprised investors, including Airbnb, Twilio, Datadog, DoorDash, and Palantir.

📺 Media businesses were also making headlines, with Paramount Global missing estimates and AMC Networks beating consensus expectations.

👍 Two other beaten-down tech stocks caught a bid after analysts released positive outlooks.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $GNS, $BBBY, $LMFA, and $RDW.

Here are the closing prices:

| S&P 500 | 4,079 | -0.28% |

| Nasdaq | 11,787 | +0.59% |

| Russell 2000 | 1,946 | +1.44% |

| Dow Jones | 33,827 | -0.13% |

Bullets

Bullets From The Weekend

😬 Binance’s CEO may have just landed himself in hot water with U.S. regulators. After days of rumors, the U.S. partner of the global cryptocurrency exchange Binance has confirmed that a trading firm managed by Binance CEO Changpeng Zhao operated as a market maker on its platform. The global Binance exchange is not licensed to operate in the U.S. Still, the transfers to Merit Peak suggest that it controlled the finances of Binance.US despite saying publicly that the American entity is “fully independent” and operates as its “U.S. partner.” The transfers identified amount to roughly $400 million and put this issue on the radar of reporters and other stakeholders. Reuters has more.

📝 China sets new rules to revive offshore listings. The country’s securities watchdog released new rules to regulate offshore listings last week, hoping to revive foreign initial public offerings (IPOs) by Chinese firms following a regulatory freeze imposed in July 2021. The trial rules would go into effect on March 31 and are designed to guide companies in properly accessing liquid capital markets. The rules also include guidance for listing in U.S. markets after Beijing and Washington resolved a long-standing audit dispute in December, reducing the risk of Chinese companies being delisted from U.S. exchanges. Chinese companies raised just $230 million via U.S. listings last year, down from a massive $12.85 billion in 2021. More from Reuters.

🕵️ Several agencies are investigating Abbott’s infant formula business. The U.S. Securities and Exchange Commission (SEC) and Federal Trade Commission (FTC) are probing the company’s operations after discovering Cronobacter sakazakii bacteria caused a massive formula recall and shortage last year. The organizations took action to handle the immediate threat and tackle the nationwide shortage. But now that conditions have improved, they’re launching additional investigations into the company to explore Abbott’s potentially exploitative marketing, aggressive lobbying methods, and other practices. ABC News has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

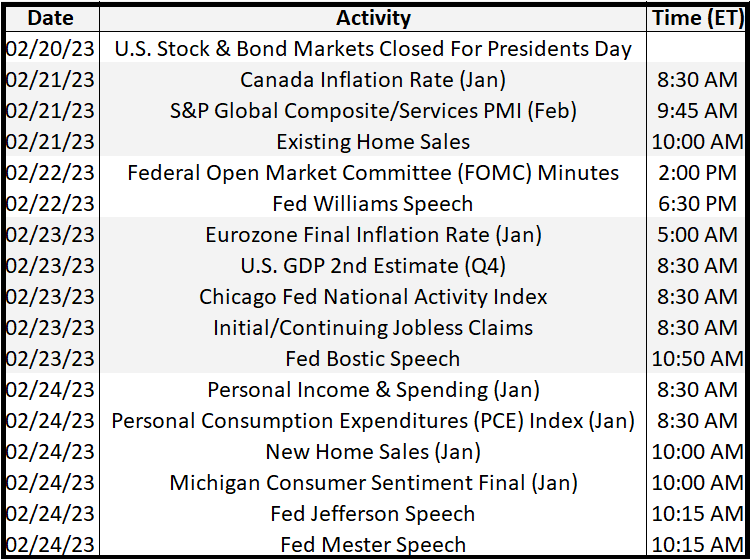

Economic Calendar

It’s a quieter week for economic data, but Friday’s PCE index and personal income and spending data will be the main focus. In addition to the above, check out this week’s complete list of economic releases.

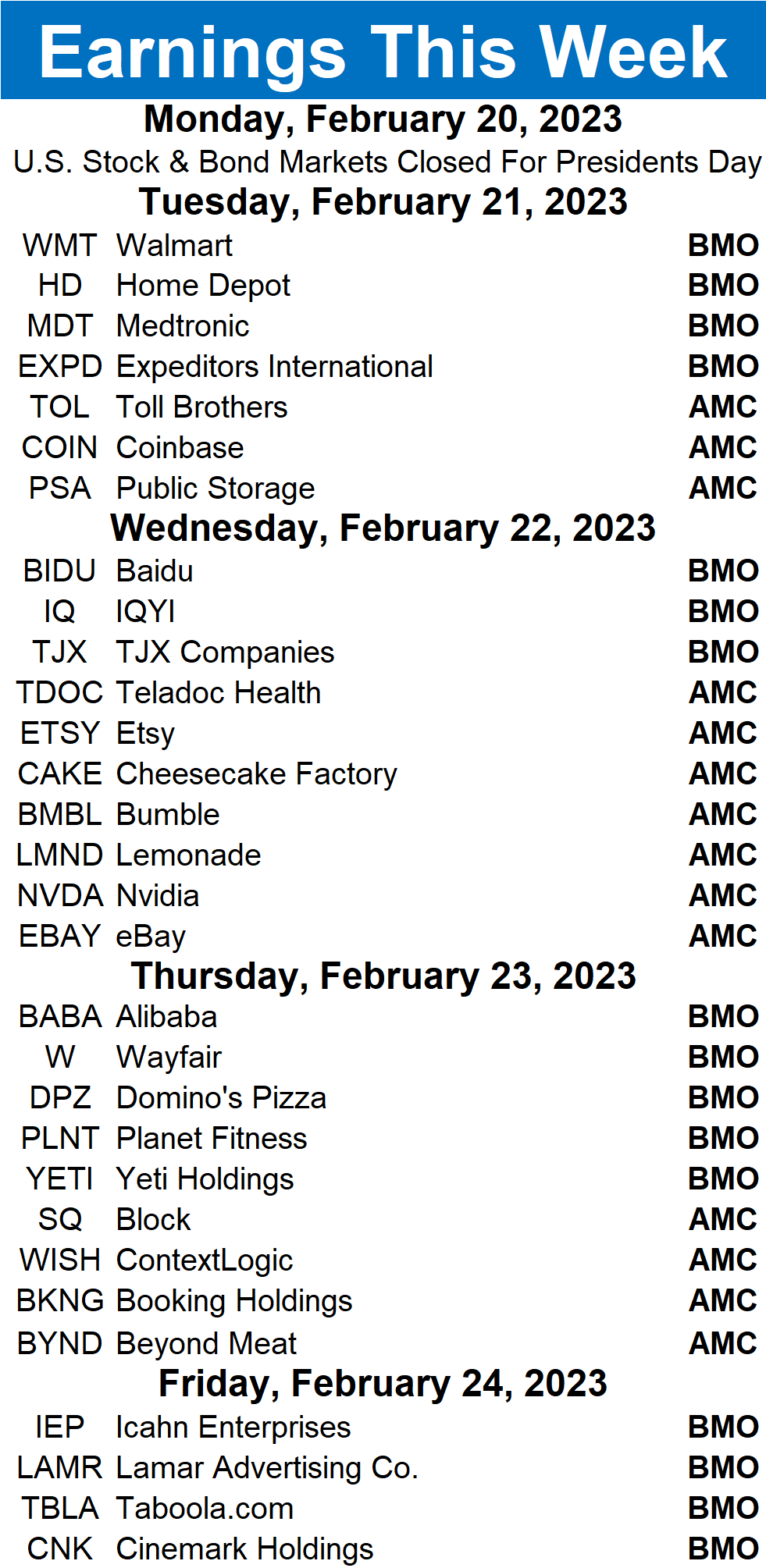

Earnings This Week

Earnings season is in full swing, with 574 companies reporting this week. Some tickers you may recognize are $WMT, $HD, $TOL, $BIDU, $BABA, $NVDA, $DPZ, $BYND, $WISH, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

⌨️ Roblox to let people build virtual worlds just by typing

💊 Apellis wins FDA approval for first geographic atrophy drug

🚫 TikTok, Twitter, Facebook set to face EU crackdown on toxic content

🔐 How to keep your Twitter secure without giving Elon Musk any money

🍔 White Castle collecting burger slingers’ fingerprints looks like a $17B mistake

🪦 ‘Human composting’ on the rise as ‘green funerals’ become increasingly popular

🚑 $166,000 to $197,000: New estimates for retirement health care costs may be too low