Despite the public/private efforts to restore confidence in the banking sector and markets, it was a volatile start to what’s likely to be a volatile week. Let’s recap what you missed. 👀

Today’s issue covers an update on the banking sector, why Gitlabs is gitting wrecked, and other earnings reports that got lost in the shuffle. 📰

Check out today’s heat map:

7 of 11 sectors closed green. Real estate (+1.58%) led, and financials (-3.95%) lagged. 💚

Healthcare and biotech stocks remain in focus. Seagen shares rose 15% on news that Pfizer will purchase the company for $43 billion in order to bolster its cancer treatments portfolio. And Provention Bio also jumped 260% on news that Sanofi will buy it for $2.9 billion. 💰

In crypto news, regulators stepped in to close the crypto-focused Signature Bank because of system risk. Stablecoin USDC regained its $1 peg after falling as low as 86 cents over the weekend. Crypto lender Euler Finance lost $200 million in the industry’s latest hack. And the crypto price rebound continued, with the total crypto market cap climbing back above $1 trillion. ₿

Other symbols active on the streams included: $TRKA (-6.51%), $MYO (+4.05%), $TENX (+14.71%), $FRC (-61.83%), $WAL (-47.06%), $PACW (-21.05%), $SCHW (-11.57%), and $SBNY (-22.87%). 🔥

Here are the closing prices:

| S&P 500 | 3,856 | -0.15% |

| Nasdaq | 11,189 | +0.45% |

| Russell 2000 | 1,744 | -1.60% |

| Dow Jones | 31,819 | -0.28% |

Stocks

The Banking Boogeyman

The banking sector remains the market’s key focus after a weekend of news. 👀

Friday, we gave a brief overview of the second-largest bank failure in the U.S. Today, we’ll build on that by explaining what happened over the weekend and how investors responded today.

As we discussed, the critical issue heading into the weekend was the declining confidence in smaller regional banks and the broader U.S. financial system. So, in an effort to restore confidence, the Federal Deposit Insurance Corporation (FDIC) took steps to make all Silicon Valley Bank depositors whole. 💰

First, it removed management and took control of the bank’s operations. Then, it announced that depositors would have access to all of their money on Monday. And now, it’s in the process of running the operations and figuring out a long-term plan of what to do with the bank.

The FDIC also announced similar measures for crypto-focused Signature Bank, which was closed on Sunday by New York state regulators.

Additionally, it assured Americans that any losses to the Deposit Insurance Fund would be recovered by a special assessment on banks, not by U.S. taxpayer funds. And it introduced a new program that will make additional funding available to banks that need it.

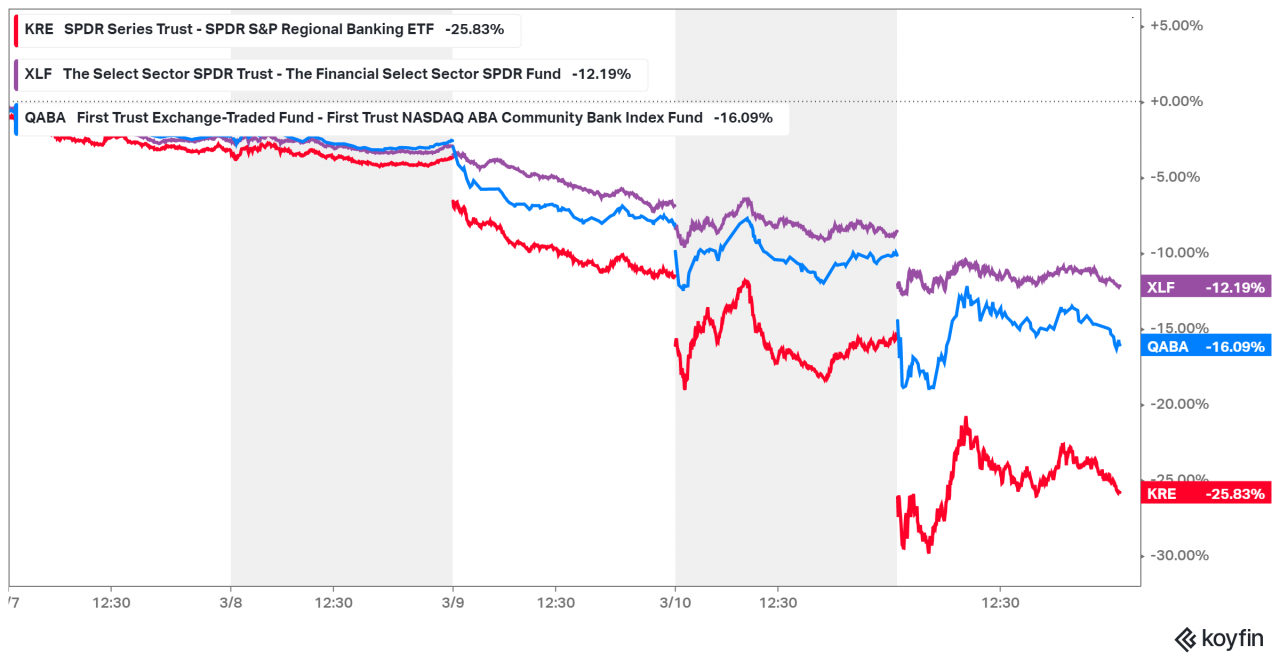

Ultimately, the FDIC did its job of protecting depositors (aka consumers). It did not protect shareholders, creditors, or company management. And that was very clear based on today’s action, where most major bank ETFs extended their declines. 🔻

So if the FDIC insured deposits and Joe Biden came out to reassure Americans that ‘the banking system is safe,’ why is there still turmoil in the markets?

That’s a loaded question, but we’ll try to cover the main angles briefly below. 👇

First, let’s talk about depositors. Because without depositors and their money, banks cannot operate. So, where does this weekend’s news leave them?

Well, depositors of Silicon Valley Bank and Signature Bank are feeling fine. Despite the massive scare, they’re getting their funds back and can continue to live, operate their businesses, etc.

However, there is a broad swath of other depositors who have money at other regional banks that were not mentioned as part of the FDIC press release. While many would like to believe other banks would receive similar treatment inherently, that wasn’t explicitly said by the FDIC. And in times of turmoil where governments and other stakeholders act fast, nothing is guaranteed. 😬

As a result, many individuals and businesses are reassessing where they’re holding their money. Some may be thinking about moving their funds to a more diversified, “too big to fail” bank like JPMorgan and Bank of America. And if many people continue to do that, we could see more institutions face similar financial pressure. 🏦

That’s partially why many of these regional banks are coming under pressure in the equity markets. Remember, the government made depositors whole, but equity and debt holders will likely be wiped out completely (or left to fight over scraps).

As a result, investors and traders are hammering these publicly-traded bank stocks. 🔨

The collapse of Silicon Valley Bank, Silvergate Capital, and Signature bank has essentially given market participants a blueprint to find what other stocks might be at risk. Whether these companies are risky because of direct exposure to these failed banks or because of other indirect factors doesn’t matter right now. The market is selling them almost indiscriminately, albeit to various extents.

For example, one name taking people by surprise is Charles Schwab. The stock fell over 40% at its lows over the last three days, and it’s not even a regional bank. Sure, will its business be impacted by the current environment? Absolutely. But is a 40% decline justified? That’s what many investors are trying to figure out, as investors shoot first and ask questions later. But doing that analysis in real-time is very, very difficult. 🤔

Then, you’ve regulators trying to shore up confidence in the short term while figuring out how to prevent more issues in the future. Also, the Federal Reserve is likely rethinking its game plan ahead of next week’s rate decision. Or at least that’s what Goldman Sachs analysts believe.

So as you can see, there are a lot of layers to this onion. The factors that caused these collapses and their ramifications cannot be fixed overnight. And as a result, this “banking boogeyman” is likely to remain a headwind for the market for some time.

As always, we’ll do our best to keep you updated as the situation unfolds. 📝

Earnings

Gitlab Gits Wrecked

Mid-cap software company GitLab is gitting wrecked after hours despite beating estimates. 🔮

It reported an adjusted loss per share of $0.03, while analysts expected a $0.14 loss. Revenues of $122.9 million also beat the $119.6 million expected.

So, they beat expectations. Why is it falling after hours? The company’s first-quarter and full-year revenue guidance was well below the consensus view. It now expects revenues of $529 to $533 million, while the consensus view was $586.4 million. 🔻

However, its earnings per share forecasts did beat as its cost-cutting efforts drive results.

The company announced it will raise the price of its premium service tier from $19 to $29 per month in April. But it’s going to need more than that if it’s going to reaccelerate revenue growth.

Overall, the growth slowdown remains the key issue for investors. $GTLB shares have lost a third of their value after hours, trading at a fresh all-time low. 😱

Earnings

Some Earnings Worth $HEARing

While everyone is focused on the “bigger-picture” risks in the market, there are still plenty of companies reporting earnings. 📝

Let’s recap some of today’s biggest movers (besides Gitlab). 👇

Digital media company Buzzfeed reported weaker-than-expected results and guidance. Its fourth-quarter revenue was down 8% YoY to $134.6 million, driven by a 27% decline in advertising revenue. Its adjusted net loss of $106.2 million included a $102.3 million non-cash goodwill impairment charge, but adjusted EBITDA was still cut in half YoY. Time spent by users also fell 27% YoY to 135 million hours. 🔻

Even accounting for today’s challenging digital media environment, executives’ forecasts surprised investors. They expect first-quarter 2023 revenue of $61 to $67 million, representing a 30% YoY and 50% QoQ decline. Lastly, the company noted it had the majority of its cash at Silicon Valley Bank but assured investors it’s accessing the funds and does not anticipate any operational disruptions. $BZFD shares fell 13% on the news. 😮

Gaming headset maker Turtle Beach also missed Wall Street estimates for its fourth-quarter earnings. It reported an adjusted loss per share of $0.10, while analysts expected $0.20 in earnings. Revenues of $100.9 million were also shy of the $110.8 million expected. The company pulled forward much of its growth during the pandemic and is now dealing with a significant slowdown. The more challenging macro environment and change in consumer spending habits will remain key headwinds for the company. $HEAR shares fell 13% after hours. 🎧

Small-cap AI and machine learning company BigBear.ai Holdings reported weaker-than-expected results. Its loss per share of $0.23 missed the consensus estimate by $0.08, though revenues of $40.4 million topped the $39.96 million expected. Its guidance was also soft, with Q1 2023 revenue of $155 to $170 million, well below the $173.03 consensus view. $BBAI shares were down about 10% after hours. 🤖

United Airlines doesn’t report for another month but issued a first-quarter profit warning. It now expects an adjusted loss of $0.60 to $1.00, with prior guidance of $0.50 to $1.00 in earnings per share. The consensus estimate was $0.65 per share in earnings. Executives also trimmed their unit revenue growth estimate from 25% to 22%-23%. $UAL shares are down about 7% after hours, adding to their 4% regular-session decline. 🛬

Meanwhile, ZIM Integrated Shipping Services delivered some positive results for investors today. The company’s fourth-quarter sales of $2.19 billion fell 37% YoY but beat the consensus estimate of $2.11 billion. Its $3.44 earnings per share also topped the $3.05 expected. A significant drop in freight rates drove the revenue decline, as carried volume of 823 thousand TEUs fell just 4% YoY. Executives expect adjusted EBITDA of $1.8 to $2.2 billion and adjusted EBIT of $100 to $500 million in 2023. The company also declared a cash dividend of $6.40 per share. $ZIM shares were up over 15% initially but closed +6.59%. 🚢

Bullets

Bullets From The Day:

🤔 Rivian rethinks its Amazon exclusivity agreement. The electric vehicle maker and retailer are discussing changes to the exclusivity clause of their agreement for Rivian’s electric delivery trucks. The adjustment would allow it to find new customers as it looks to scale production of the vans and its R1 series pickup and SUV. Amazon originally agreed to buy over 100,000 electric trucks in 2019, but it has only ordered 10,000 vehicles so far, which was the low end of a previously stated range. CNBC has more.

🛰️ SpaceX partners with T-Mobile to test Starlink’s satellite-to-cell service. As growth here on the ground starts to slow, some companies are looking at space to help drive returns. One industry focused on the area is telecom, with terrestrial mobile network operators (MNOs) and device makers partnering with satellite companies to help fill current gaps in coverage. Now, SpaceX and T-Mobile are teaming up to “end mobile dead zones,” beginning to test the technology sometime this year and expanding it if the results are positive. More from CNBC.

🔋 U.K. revives a decade-old power project that could power one million homes. The River Mersey is already a major hub for shipbuilding and industry, also inspiring writers, artists, and other creatives throughout the decades. But, if Liverpool authorities get their way, it will also play a significant role in the country’s sustainable future. The city’s leaders want to build a tidal power project with at least 1-gigawatt capacity, drawing on Mersey’s second-highest tidal range in the country. The multi-billion-pound development has many steps ahead of it, including obtaining government support to signal confidence in the idea and move it forward. CNBC has more.

🚗 Luxury automaker Porsche reports record 2022 earnings, strong outlook. The carmaker saw operating profits rise 27% to $7.23 billion last year, with deliveries increasing by 2.6% to nearly 310,000 units. Executives point to a favorable product mix, operational efficiency, and current tailwinds at the end of the year. They expect group operating return on sales of 17% to 19% in fiscal 2023, with sales between 40 and 42 billion euros. In addition, their position as a luxury brand gives them the power to continually increase prices over time, reducing the volatility other brands are experiencing based on the macro environment. More from CNBC.

🛢️ Saudi oil giant Aramco posted a record full-year profit of $161.1 billion. The state-controlled company nearly tripled that of its nearest competitor ExxonMobil, given the tailwinds of higher prices, higher sales volumes, and improved margins for refined products. With oil prices down roughly 25% YoY, executives are still cautiously optimistic and believe the market will remain tightly balanced in the short to mid-term. However, they warned the industry on the risk of underinvestment and reiterated that they’re continuing to work towards increasing its maximum production capacity to 13 million barrels per day by 2027. CNBC has more.

Links

Links That Don’t Suck:

⚡ Opinion: electric vehicles should stop trying to be actual cars

👍 Qualtrics accepts $12.5B all-cash acquisition offer to go private

🤖 ChatGPT and generative AI are booming, but the costs can be extraordinary

🏘️ Report: 3 million U.S. households making over $150K a year are still renting

🏭 From Apple to Boeing, India is being put to the test as China manufacturing alternative

🚀 Second attempt at launch of 3D-printed rocket from Relativity Space scrubbed on Saturday