The banking sector remains the market’s key focus after a weekend of news. 👀

Friday, we gave a brief overview of the second-largest bank failure in the U.S. Today, we’ll build on that by explaining what happened over the weekend and how investors responded today.

As we discussed, the critical issue heading into the weekend was the declining confidence in smaller regional banks and the broader U.S. financial system. So, in an effort to restore confidence, the Federal Deposit Insurance Corporation (FDIC) took steps to make all Silicon Valley Bank depositors whole. 💰

First, it removed management and took control of the bank’s operations. Then, it announced that depositors would have access to all of their money on Monday. And now, it’s in the process of running the operations and figuring out a long-term plan of what to do with the bank.

The FDIC also announced similar measures for crypto-focused Signature Bank, which was closed on Sunday by New York state regulators.

Additionally, it assured Americans that any losses to the Deposit Insurance Fund would be recovered by a special assessment on banks, not by U.S. taxpayer funds. And it introduced a new program that will make additional funding available to banks that need it.

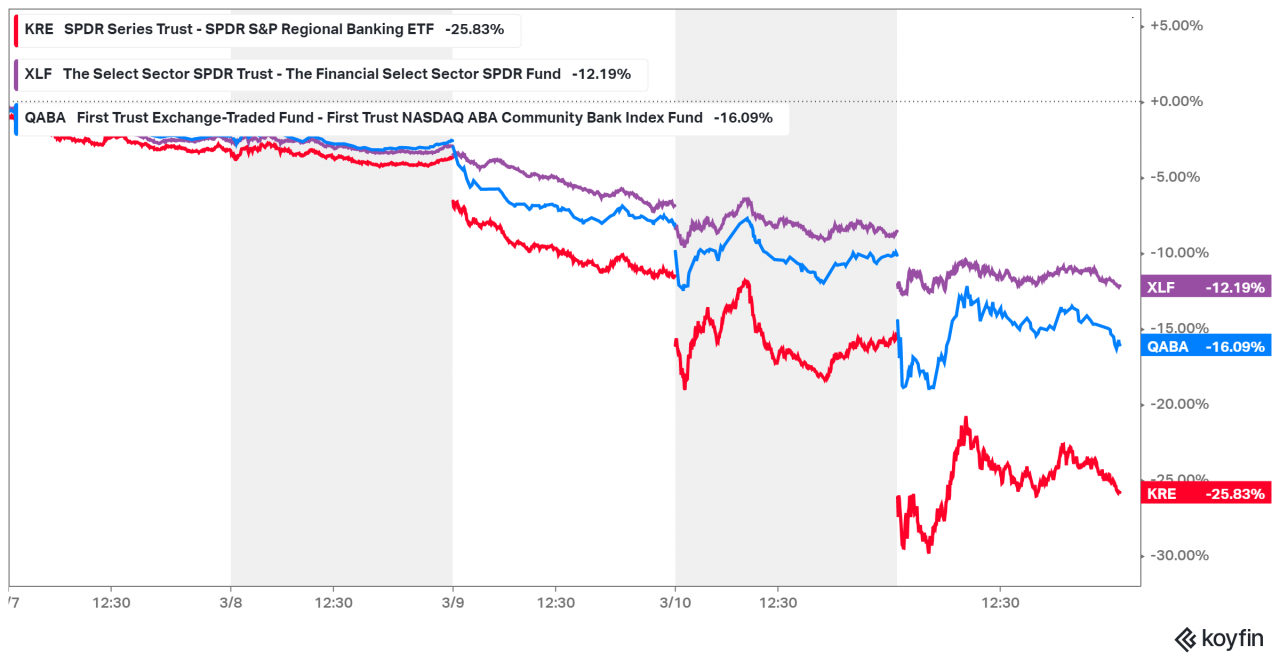

Ultimately, the FDIC did its job of protecting depositors (aka consumers). It did not protect shareholders, creditors, or company management. And that was very clear based on today’s action, where most major bank ETFs extended their declines. 🔻

So if the FDIC insured deposits and Joe Biden came out to reassure Americans that ‘the banking system is safe,’ why is there still turmoil in the markets?

That’s a loaded question, but we’ll try to cover the main angles briefly below. 👇

First, let’s talk about depositors. Because without depositors and their money, banks cannot operate. So, where does this weekend’s news leave them?

Well, depositors of Silicon Valley Bank and Signature Bank are feeling fine. Despite the massive scare, they’re getting their funds back and can continue to live, operate their businesses, etc.

However, there is a broad swath of other depositors who have money at other regional banks that were not mentioned as part of the FDIC press release. While many would like to believe other banks would receive similar treatment inherently, that wasn’t explicitly said by the FDIC. And in times of turmoil where governments and other stakeholders act fast, nothing is guaranteed. 😬

As a result, many individuals and businesses are reassessing where they’re holding their money. Some may be thinking about moving their funds to a more diversified, “too big to fail” bank like JPMorgan and Bank of America. And if many people continue to do that, we could see more institutions face similar financial pressure. 🏦

That’s partially why many of these regional banks are coming under pressure in the equity markets. Remember, the government made depositors whole, but equity and debt holders will likely be wiped out completely (or left to fight over scraps).

As a result, investors and traders are hammering these publicly-traded bank stocks. 🔨

The collapse of Silicon Valley Bank, Silvergate Capital, and Signature bank has essentially given market participants a blueprint to find what other stocks might be at risk. Whether these companies are risky because of direct exposure to these failed banks or because of other indirect factors doesn’t matter right now. The market is selling them almost indiscriminately, albeit to various extents.

For example, one name taking people by surprise is Charles Schwab. The stock fell over 40% at its lows over the last three days, and it’s not even a regional bank. Sure, will its business be impacted by the current environment? Absolutely. But is a 40% decline justified? That’s what many investors are trying to figure out, as investors shoot first and ask questions later. But doing that analysis in real-time is very, very difficult. 🤔

Then, you’ve regulators trying to shore up confidence in the short term while figuring out how to prevent more issues in the future. Also, the Federal Reserve is likely rethinking its game plan ahead of next week’s rate decision. Or at least that’s what Goldman Sachs analysts believe.

So as you can see, there are a lot of layers to this onion. The factors that caused these collapses and their ramifications cannot be fixed overnight. And as a result, this “banking boogeyman” is likely to remain a headwind for the market for some time.

As always, we’ll do our best to keep you updated as the situation unfolds. 📝