It was another volatile session as the market digested February’s mixed inflation data and the ongoing banking situation. Let’s recap what you missed. 👀

Today’s issue covers February’s consumer price index reading, the AMC shareholder vote, and why shares of retailer Guess are tumbling after hours. 📰

Check out today’s heat map:

Every sector closed green. Communication services (+2.87%) led, and consumer staples (+0.84%) lagged. 💚

Geopolitical tensions are on the rise after a Russian jet downed a U.S. Reaper drone over the Black Sea. Meanwhile, Ohio is suing Norfolk Southern over the East Palestine train derailment. 🗺️

Credit Suisse fell to a new all-time low after finding “material weaknesses” in its ’21 and ’22 financial reporting processes. 🕵️

The auto industry’s electric vehicle push continues, with Volkswagen announcing a five-year $193 billion investment plan. ⚡

Uber and Lyft shares were both driven higher by the news that a California court overturned drivers’ opposition to Proposition 22. The ruling allows the original proposition to stand; meaning can continue classifying their drivers as independent contractors rather than employees. 🚗

In crypto news, Meta is removing NFT support on Facebook and Instagram as it cuts lower-impact projects. And Bitcoin and the broader cryptocurrency space continued their rally today, marking a fourth straight day of gains. ₿

Other symbols active on the streams included: $TRKA (-5.80%), $MYO (-6.84%), $AMBI (+116.81%), $FRC (+26.98%), $WAL (+14.36%), $PACW (+33.85%), $SCHW (+9.19%), and $BAC (+0.88%). 🔥

Here are the closing prices:

| S&P 500 | 3,919 | +1.65% |

| Nasdaq | 11,428 | +2.14% |

| Russell 2000 | 1,777 | +1.87% |

| Dow Jones | 32,155 | +1.06% |

Economy

Markets Refocus On Inflation

This week we get the last two inflation reading’s before the Federal Reserve’s next meeting on March 21-22. And while the market is mainly focused on the banking sector, the inflation data still does matter. So let’s see what we got… 👀

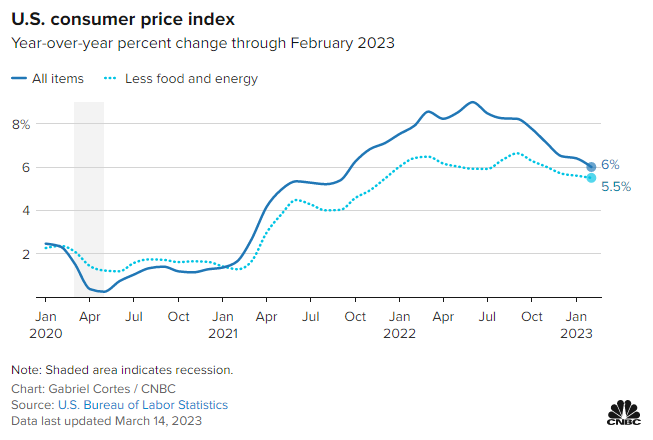

The headline consumer price index (CPI) was +0.4% MoM and +6.0% YoY, both in line with expectations. However, excluding food and energy inputs, core consumer prices rose by 0.5% MoM and 5.5% YoY. That monthly number was 0.1% higher than expected.

Within that core number, used car and truck prices fell 2.8% MoM, bringing the YoY decline to 13.6%. But services inflation remained sticky, with transportation services rising 1.1% MoM and shelter rising 0.8% MoM. 🏘️

The rise in shelter prices accounted for over 60% of the core consumer price index’s rise in February. The other significant factors included vehicle insurance (+14.5% YoY), household furnishings and operations (+6.1% YoY), recreation (+5.0% YoY), and new vehicles (+5.8% YoY).

Overall, the market seemed to take this number well. The optimistic view is that there remains a significant lag in how shelter prices are calculated in the CPI and that real-time indicators suggest shelter price growth has decelerated. It’s just a matter of time before it reflects in the official data. 🐂

However, the pessimistic view is that, as the CNBC chart below shows, the pace of deceleration in core consumer prices is slowing. And with inflation still well above the Fed’s 2% long-term target, the stalling of downward progress could signal a real risk of inflation turning back higher. Especially if the labor market remains strong and/or the recent turmoil in the banking sector causes financial conditions to loosen. 🐻

We’ll have to see what tomorrow’s producer price index (PPI) tells us. But for now, slightly less downward progress is better than no progress in the market’s eyes.

Meanwhile, the banking sector will also be on the Fed’s radar this week. Let’s see what updates we got today. 📰

First, we had Moody’s cut its outlook on the U.S. banking system from stable to negative, citing a ‘rapidly deteriorating operating environment.’ The move could impact credit ratings and borrowing costs for the sector and/or individual institutions. Ultimately, the rating agency says that the core issues of unrealized securities losses and heavy deposit competition remain. As a result, that leaves some institutions at risk of an adverse event.

The U.S. Department of Justice (DOJ) and Securities & Exchange Commission (SEC) opened probes into Silicon Valley Bank. And the Federal Deposit Insurance Company (FDIC) continues to run the bank’s operations as it looks to restore confidence in the market further. 🕵️

Meanwhile, many bank CEOs took to the media to shore up confidence in their own stocks. Some, like Charles Schwab CEO Walt Bettinger, even put their money where their mouth is. He confirmed that he bought 50,000 shares of the company’s stock during Tuesday’s decline. 💰

Some of the historic moves we saw in regional bank stocks and other assets, like the U.S. 2-year Treasury bond, also reversed today. Most bank stocks and the ETFs that track them experienced sharp rebounds, stemming their week-long declines. The two-year Treasury yield rose 20 basis points after experiencing its largest 3-day decline since 1987. 😮

Overall, the current situation is likely far from over. Investors, depositors, and other institutions’ stakeholders are still assessing the fallout. Moreover, history shows us that significant volatility events are rarely a few-day phenomenon. As a result, most market participants are strapping in for continued swings in these stocks and the broader market.

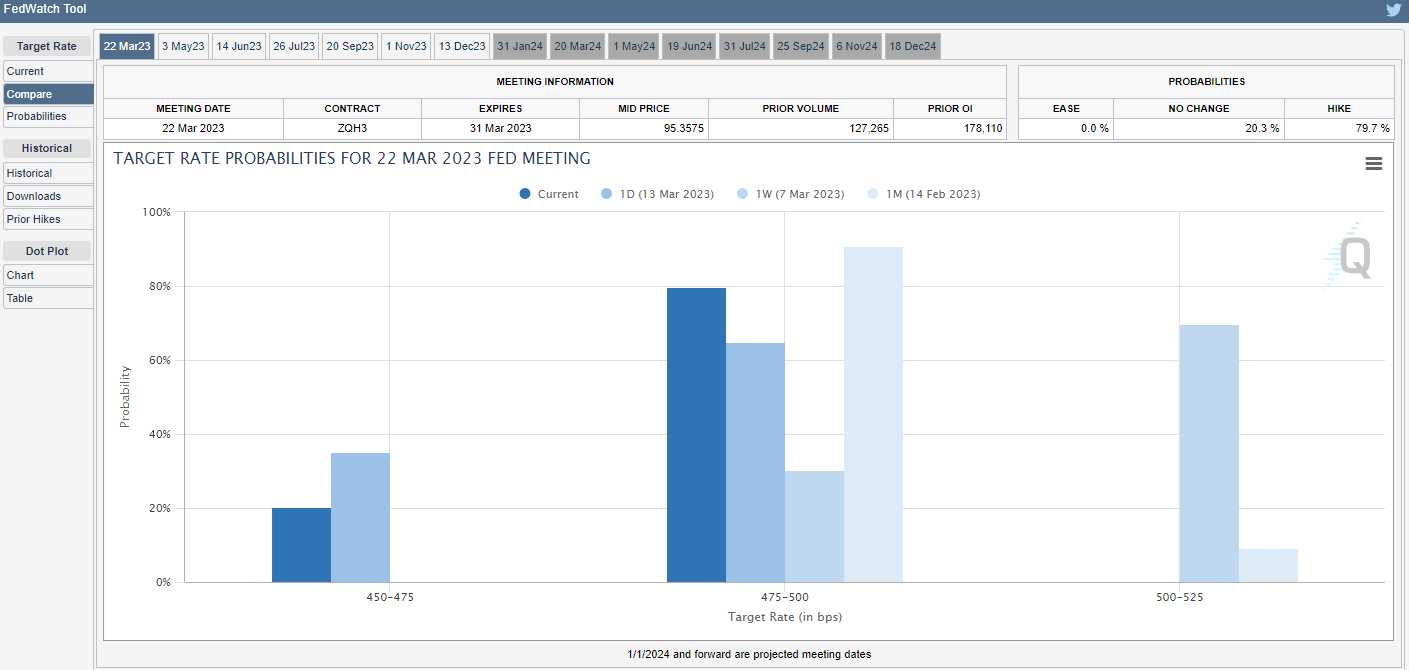

As for its impact on the Fed’s next move…well, we told you the market’s expectations were fickle. Just last week, the market priced in a 70% chance that the Fed would hike 50 bps at its March meeting. But after this week’s events, it’s assigning a 0% probability of that happening. Instead, there’s an 80% chance of a 25 bp hike and a 20% chance the Fed leaves rates unchanged. 🔮

And if you needed any further evidence that nobody knows what’s ahead, just read some of Wall Street analysts’ thoughts. They’re all over the place… 🎯

Lastly, while we’re on the topic of inflation, it’s worth mentioning crude oil prices. Today they closed at their lowest level since December 2021. While that’s good for inflation, it could also mean the market is pricing in lower demand as bank sector turmoil reignites recession fears. 😬

Overall, all of these data points will be factors in the Fed’s decision next week. Right now, the market is betting it’ll back off its aggressive tightening in light of recent events. If so, that would likely be a positive for tech stocks and other long-dated assets, which is why we see the Nasdaq 100 holding up best among all the major U.S. indices.

Whether the market is correct in its assumptions remains to be seen. For now, all we can do is wait and see. 🤷

Company News

AMC Apes Drunk On Liquidity

The last time we discussed AMC Theaters was two weeks ago when its stock fell despite earnings and revenue beating estimates. At the time, we noted that the overhang from an upcoming shareholder vote and concern about the company’s liquidity was keeping a lid on performance. ⚰️

Shares have declined further since then, so let’s discuss how it got here and what happened at today’s shareholder vote.

As we all know, the ‘meme stock’ craze of 2020 and 2021 bought AMC a lifeline by boosting its share price and allowing it to raise fresh capital. It did that several times before shareholders had enough of it. 🛑

So, after shareholders pushed back on the company’s attempts to raise more funding through common stock sales in 2021, it had to find a workaround. In August 2022, it embraced its community’s ‘meme culture’ and decided to issue AMC preferred equity units under the ticker symbol $APE. It then went to shareholders and asked for approval to issue up to 1 billion APE units.

To help win approval from its investor base, the company said it would initially distribute more than 500 million APE units to existing investors through a special dividend. They would each receive one $APE unit for every share of $AMC common stock they owned. And while the company received no funds from that initial distribution, it was enough to win shareholder approval of the new structure, and ultimately it gave executives the financial flexibility they needed. 👍

Unfortunately, once $APE shares began trading, that’s when the problems began. Although both $APE and $AMC shares gave holders the same claim to the economic value created by AMC’s underlying business and had the same number of outstanding shares, their share price was drastically different.

That created a massive arbitrage opportunity, where traders would buy $APE shares and short $AMC shares to capture the spread. That led to a slow and steady decline in both of them. And with both share classes falling significantly, the company became concerned that they could be delisted from the New York Stock Exchange (NYSE) and drastically reduce their investor base/ability to raise funds again. 😬

As a result, the company proposed the following actions to shareholders: 📝

- It would convert existing APE units into AMC common shares, eliminating the market’s arbitrage opportunity but further diluting AMC shares.

- Perform a 10:1 reverse split of AMC common shares, removing its NYSE delisting risk and providing the flexibility to raise more capital via stock in the future.

And that’s what shareholders voted on today. Despite the dilution concerns, roughly 88% of the 978 million votes cast approved both measures. 🗳️

However, there is still some uncertainty the company and its shareholders need to wrestle with until at least April 27th. A Delaware Chancery Court injunction hearing has prevented any new debt-raising action by the company until then. The hearing revolves around a class-action lawsuit that claims AMC circumvented shareholders who were against adding more shares by creating the APE preferred equity units.

Ultimately though, the market seems to believe this case will be settled, and the actions approved by shareholders are likely to move forward. That’s why $AMC shares fell 15% on the day, as the news likely means more dilution is ahead. 😟

As always, anything can happen, and we’ll have to see how this develops in the coming weeks. 👀

Earnings

We Guess That Wasn’t Good?

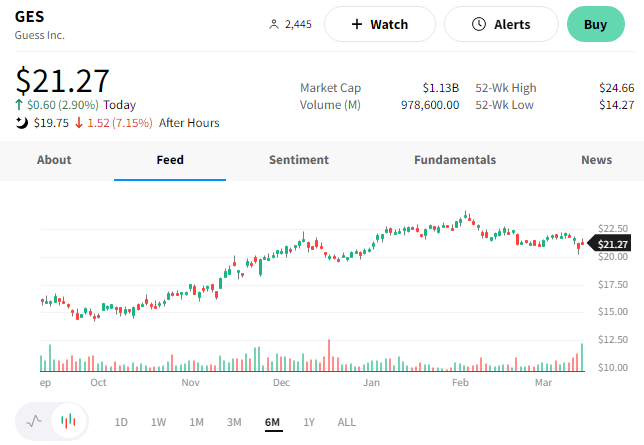

American clothing brand and retailer Guess? reported earnings today that sent shares tumbling. 🔻

Its fourth-quarter adjusted earnings per share of $1.74 on $817.8 million in revenue topped the expected $1.30 and $772 million.

Driving the strength was strong European sales, though currency fluctuations reduced operating profit by $62 million and operating margin by 1.40%. Accessory sales were also a strong point, with handbags, leather goods, travel products, fragrances, jewelry, and eyewear all strong. Its Marciano brand of activewear dresses also performed well. 👜

Ultimately, the company’s holiday-quarter results surpassed even its own expectations. However, executives offered a more cautious outlook for fiscal 2024. ⚠️

The company expects low single-digit revenue growth but solid profit performance and strong cash flow generation. Its full-year earnings per share estimate of $2.45 to $2.80 was well below the $3.41 consensus view. And revenue growth of 1%-3% fell short of the 3.9% expected.

$GES shares were down roughly 7% on the news as investors look ahead to a weaker-than-expected future. 📉

Bullets

Bullets From The Day:

🌐 Dotcom survivor Cvent goes private again in a $4.6 billion deal. The meetings and events management software provider is just one of several public market tech stocks choosing to go private after the recent market rout. It went public via SPAC in late 2021, reaching a peak market cap of $4.7 billion before losing roughly half its value over the next year. Now, Blackstone is swooping in to buy the company, with Vista Equity Partners selling all of its remaining shares and a subsidiary of the Abu Dhabi Investment Authority remaining as a significant minority investor. TechCrunch has more.

✂️ Meta pushes forward with its second round of cuts. Just months after cutting 11,000 employees, Facebook-parent Meta is cutting another 10,000 jobs and scrapping hiring plans for 5,000 open positions. It’s also pulling the plug on lower-priority projects and reducing its layers of middle management as it cuts costs aggressively to offset its slowing revenue growth. Zuckerberg called last year a humbling wake-up call, saying the company should prepare itself for the possibility that this new economic reality will continue for many years. As a result, Meta expects 2023 expenses of $86 to $92 billion, down about $3 billion from its previously forecast range. More from Reuters.

📺 YouTube TV bets that sports fans want even more sports. With interest in sports continuing to rise, as does the content wars around the rights to stream that content. Given that consumers have so many options, streaming platforms are pulling out all the stops to entice viewers to use their platforms. Today, YouTube introduced early access testing for multiview, allowing subscribers to watch up to four different sports programs simultaneously. The company plans to roll the feature out slowly and expand it to other content if successful. The Verge has more.

🤖 Google goes all-in on its AI and Workspace integration. Google and Microsoft are racing to integrate generative AI into their productivity services. Days ahead of Microsoft’s “future of work” event, Google announced it’s bringing various AI-supported functionality to its Workspace, supporting users in writing documents, generating formulas, capturing notes, and doing much more across its suite of products. These new features will roll out rapidly, with trusted users getting access first and providing feedback ahead of their larger roll-out. More from TechCrunch.

✈️ Boeing sells 78 Dreamliner planes to Saudi airlines. After a rough couple of years, demand for wide-body planes increased significantly as travel demand rebounded from its pandemic lows. In its most recent windfall, Boeing received orders from Saudi Arabian Airlines, which ordered 39 planes with the option to buy ten more. And Riyadh Air purchased 39 of Boeing’s largest aircraft models, with the option to buy 33 more. The airlines say this order will support their country’s goal of serving 330 million passengers and attracting 100 million visits by 2030. CNBC has more.

Links

Links That Don’t Suck:

🤖 OpenAI announces GPT-4 – the next generation of its AI language model

🏪 Masatoshi Ito, Japanese billionaire behind the rise of 7-Eleven, dies at 98

🍗 Buffalo Wild Wings sued by Chicago man because their ‘wings’ are breast meat

🛰️ Amazon shows off new satellite internet antennas as it takes on SpaceX’s Starlink

💉 Novo Nordisk to slash U.S. insulin prices by up to 75%, following move by Eli Lilly

🧑✈️ Southwest Airlines vows to increase winter staffing and improve tech after holiday mess

🧑⚕️ How to factor your health into your financial planning, according to a doctor-turned-advisor

⚖️ World’s first robot lawyer is being sued by a law firm – because it ‘does not have a law degree’