As if Credit Suisse hasn’t been a mess for more than a decade, the market is suddenly fixated on its potential failure and the systemic implications of that once again. Nevertheless, let’s recap what you missed in an otherwise busy session. 👀

Today’s issue covers Credit Suisse’s ongoing “crisis,” a slew of economic data, and updates from Adobe and other after-hours earnings movers. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Utilities (+1.36%) led, and energy (-5.31%) lagged. 💚

Internationally, China’s post-lockdown economic data continues to disappoint. Retail sales for January and February matched expectations, while industrial production was 0.2% less than expected. Fixed asset investment rose more than expected, but the real estate sector remains soft despite government efforts to backstop it. Meanwhile, Argentina is dealing with runaway inflation, as it tops 100% for the first time since 1991. 🌏

Apple supplier Foxconn saw profits fall 10% YoY in ’22 and anticipates a decline in consumer electronic demand in ’23. It joins many retailers and others that issued similar, cautious outlooks. 🏭

Kellogg announced plans to split its company into two. Its North American cereal business will be named WK Kellogg Co. Meanwhile, its global snacking, international cereal and noodles, plant-based foods, and North American frozen breakfast business will be named Kellanova. 🥣

And Virgin Orbit announced it’s furloughing nearly all its employees and pausing operations for a week in order to find funding. ⏸️

Other symbols active on the streams included: $TRKA (-12.10%), $HUBC (+18.56%), $AMBI (-12.98%), $FRC (-21.37%), $WAL (+8.30%), $PACW (-12.87%), $AMC (-9.27%), and $AMD (+2.62%). 🔥

Here are the closing prices:

| S&P 500 | 3,892 | -0.70% |

| Nasdaq | 11,434 | +0.05% |

| Russell 2000 | 1,746 | -1.74% |

| Dow Jones | 31,875 | -0.87% |

Company News

No Peace At Credit Suisse

If you’re reading this, you’re old enough to remember the last time Credit Suisse contributed to a meltdown in the market. And trust us, it was not as long ago as you might think. 🤔

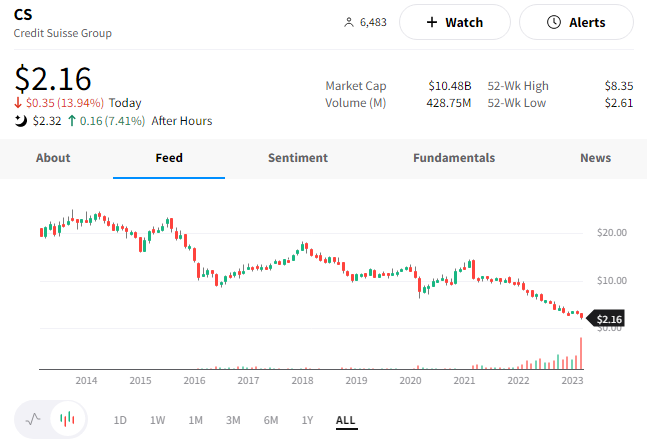

Last September, the Swiss Bank’s shares fell more than 20% on news that it was raising fresh capital for the fourth time in seven years. Then about a week later, a deleted tweet from an ABC Australia reporter started rabid speculation that the bank was on the verge of collapse. And for an entire weekend, everyone became an expert on credit default swaps (CDS), systemic risk in the banking sector, and Credit Suisse.

But once markets opened for trading on Monday morning, both the broader stock market and Credit Suisse shares rose. Crisis averted. 😏

Later that month, shares fell again after executives unveiled significant losses and a three-part turnaround plan. And in February, shares cratered again after the bank reported record annual losses and warned of more to come.

Then, just last week, the bank postponed issuing its annual report after a ‘late call’ from the U.S. Securities & Exchange Commission. The SEC had concerns over how it reported certain events and figures in prior financial statements. Finally, yesterday, the company published its annual report but indicated it found ‘material weaknesses’ in its financial reporting. 📝

That news, plus the recent turmoil in the U.S. banking sector, had Credit Suisse investors on the edge of their seats. And then today’s news happened…

With the amount of trading in the stock, its shareholder base has turned over many times over the years. But recently, it received a boost of confidence when the Saudi National Bank became its largest shareholder. And although that sounds like a great thing, it backfired a bit on the company today.

That’s because the Saudi National Bank said it cannot provide any additional capital because it can’t own more than 10% of the bank. The news sent Credit Suisse shares plummeting about 25% to a fresh all-time low. And at one point, its 5-year credit default swaps (CDS) were pricing in a 38% chance of the bank failing. 😱

Like other bank executives, Credit Suisse CEO Ulrich Koerner tried to calm the market by saying the bank’s liquidity base remained strong and was well above all regulatory requirements. That didn’t have its desired effect.

But what did help late in the day was the Swiss Financial Market Supervisory Authority and the Swiss National Bank finally speaking up. 🗪

They tried to restore confidence by stating that:

- $CS “meets the capital and liquidity requirements imposed on systemically important banks;”

- And the Swiss National Bank would provide additional liquidity if necessary.

Ultimately, $CS shares pared their losses and closed down *just* 13% on the day. They’ve also extended their gains after hours, rising roughly 10%. 📈

It’s too early to tell if the Swiss regulators’ words will help buy the company more time to stage a successful turnaround. But, as we discussed in our previous coverage of the bank, it’s become an increasingly difficult environment for poorly-run businesses to turn around. And that was before this past week when three U.S. banks failed, and a loss of confidence spread through the sector. 😬

As a result, calling this a “Credit Suisse Crisis” appears a bit silly to anyone that’s been paying attention to how many times the company has been on the brink. However, our flippant attitude does not suggest that the market should not care about Credit Suisse’s health at all. After all, it is one of just 30 global financial institutions that the international Financial Stability Board designates as systemically important.

It just seems like Credit Suisse is an easy target amidst the market’s fixation on the banking sector. 🎯

Unfortunately for the bank, that’s the name of the game in financial markets. We’ll just have to wait and see whether or not the current crisis at Credit Suisse is actually a crisis for the broader market and global financial system after all… 🤷

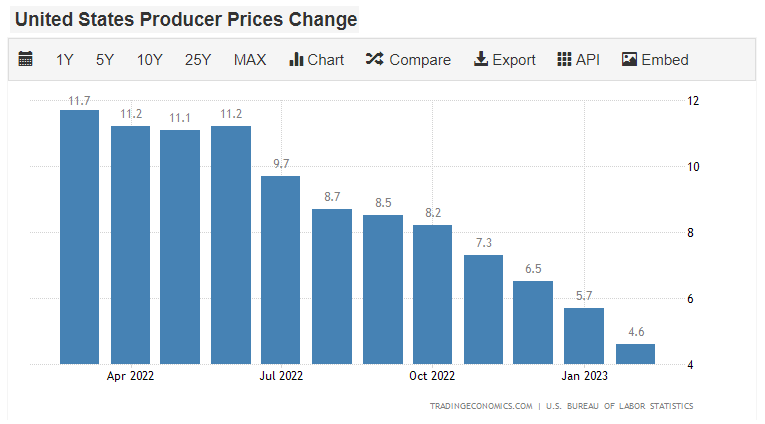

It’s a busy week of economic data, with yesterday’s focus on consumer prices. Today, we got an update on producer prices and much more, so let’s go through it. 📝

The headline producer price index (PPI) fell 0.1% MoM and was up 4.6% YoY. Analysts had expected February’s gain to match January’s at 0.3%. Meanwhile, core producer prices which exclude food and energy, were flat MoM and up 4.4% YoY. The market was expecting a 0.4% MoM gain.

Final demand goods prices fell by 0.2%, while final demand services prices dropped by 0.1%. Driving a good portion of the decline was egg prices finally cracking, falling 36.1% amid supply chain improvements. 🐣

Overall the continued downward progress is a welcome sign for the Federal Reserve. Producer prices tend to lead consumer prices, so hopefully, this means that a further deceleration is ahead. 🤔

As we discussed yesterday with consumer prices, crude oil began another leg lower. Today’s weekly petroleum data from the Energy Information Administration (EIA) showed a surprise crude oil inventory build of 1.6 million barrels. That pressured prices further, with them down six of the last seven days. If prices settle at these lower levels (or continue declining), that will be a tailwind for consumer and producer price inflation readings in the coming months. 🛢️

February retail sales fell by 0.4% MoM, following a revised 3.2% rise in January. After January’s strong rebound in auto sales, a decline of 1.8% in February dragged down the headline number.

Excluding autos, retail sales fell 0.1%. Driving that decline was sales at department stores (-4.0%), furniture stores (-2.5%), and restaurants (-2.2%). On the other hand, the report showed an uptick in spending online and at electronics stores, health and beauty stores, and food retailers. 🛍️

Consumer spending has been easing, particularly on discretionary goods and non-essential purchases. Retailers across the spectrum have offered more cautious outlooks for 2023, citing inflationary pressures, macroeconomic uncertainty, and a weak(er) housing market. If the market volatility continues and this bank sector situation turns into a full-blown crisis, that will likely keep a lid on consumers’ confidence and willingness to spend. 👎

U.S. business inventories fell for the first time in nearly two years in January. The Commerce Department report showed they dropped 0.1% MoM, marking their first decline and the weakest reading since April 2021. Wall Street was expecting that inventories would be unchanged MoM. 📦

This weakness matters because inventories are a critical factor in the calculation of GDP. Last quarter inventories accounted for half of the 2.7% YoY growth in GDP. However, businesses may need to liquidate the excess inventory they accumulated last quarter and order less. That would likely weigh on the first quarter’s GDP print. 🔻

Manufacturing activity remains volatile. The New York Fed’s empire state survey fell well short of the -7.9 reading expected, coming in at -24.6 for March. Driving March’s decline was the New Orders Index (-13.9 MoM), the Shipments Index (-13.5 MoM), and the Number of Employees Index (-3.5 MoM).

One positive aspect of manufacturing activity cooling down is less upward pressure on inflation. The current Prices Paid Index fell by 3.1 points MoM, and expectations for the index six months ahead fell by 18.1 points to the lowest since late 2020. 🏭

The U.S. manufacturing sector is expected to remain volatile. January’s report showed activity in the NY region slipped to its lowest level since the pandemic began, reaffirming its downward trend.

And last and sort of least, let’s touch on housing. The National Association of Home Builders (NAHB) reported its housing market index (HMI) rose from 42 in February to 44 in March. Analysts were expecting a decline to 40. The way this measure is interpreted is that any number below 50 indicates that more builders surveyed view conditions as poor than good. And vice versa. 🏘️

Driving the increase was an uptick in single-family homes from 47 to 49. And the traffic of prospective buyers jumped from 28 to 31. Meanwhile, single-family home sales expectations for the next six months ticked down from 48 to 47. Overall, the unexpected improvement in traffic was the differentiating factor in this month’s report.

Earnings

A Mixed Bag Of Earnings

Despite the economic and banking issues capturing investors’ attention, some earnings reports are worth mentioning.

First up is software giant Adobe, which beat fiscal first-quarter expectations. Its adjusted earnings per share of $3.80 on revenues of $4.66 billion topped the expected $3.68 and $4.62 billion. Its cost-cutting efforts and adjustment of expectations are bearing fruit. As a result, the company raised its fiscal 2023 profit forecast to $15.30-$15.60 per share and $1.7 billion in net new annualized recurring revenue (ARR) from its Digital Media segment. That segment saw revenue grow 9% YoY last quarter, and it’s starting to monetize its recent acquisition of Frame.io. $ADBE shares were up about 5% on the news. 🌤️

Robotic process automation software company UiPath also reported better-than-expected results. Its first-quarter earnings per share of $0.15 and revenues of $308.5 million beat the expected $0.06 and $278.64 million. Its guidance also came in higher than the consensus view. It expects fiscal year 2024 revenue of $1.25-$1.26 billion, while analysts expected $1.21 billion. Overall, executives are optimistic about the company’s position in the current environment. They say companies need to do more with less in a tougher macroeconomic environment, which is where UiPath’s Business Automation Platform and other products help. $PATH shares were up about 13% after hours. 🦾

Insurance software provider Ebix didn’t have as much luck after its first-quarter earnings missed expectations. Its earnings per share of $0.36 were $0.32 short of the consensus estimate. However, revenues of $255.2 million did top the $251.05 million analysts expected. The company experienced the highest negative impact from foreign exchange movements in about five years. Rising interest rates also increased its debt servicing costs and pressured its profits. With its business still about 25% below pre-pandemic operating levels, executives are working with the board and outside advisors to refinance its credit facility. $EBIX shares were down roughly 11% on the day. 👎

Conversational commerce and AI software company LivePerson fell precipitously after missing earnings and revenue estimates. The company’s fourth-quarter loss per share of $0.55 was larger than the $0.33 loss expected. And sales fell 1.1% YoY to $122.4 million, below the expected $126.93 million. The company did make efforts to cut costs last year, reducing them by $80 million on an annualized basis. But investors remain concerned with the lack of revenue growth from the company. $LPSN shares are down over 35% after hours, trading at their lowest since early 2017. 🤖

Last up was cloud computing company PagerDuty, which also topped expectations. Its earnings per share beat by $0.02, and revenues beat by about $2 million. Executives forecasted full fiscal year 2024 earnings of $0.42-$0.50, well above the consensus view of $0.20. However, forecasted revenues of $446-$452 million were shy of the $451.43 million expected. Overall, it seems investors are pleased with the company’s efforts to cut costs and focus on profitability amidst slowing revenue growth. $PD shares were up 11% after hours. ⛈️

Bullets

Bullets From The Day:

🤑 Samsung’s new South Korean semiconductor complex will cost 300 trillion Korean won. Nearly every major country worldwide is investing heavily to cement itself as a leader in semiconductors, displays, batteries, electric vehicles, and other products/services required for a technology-driven future. Today South Korea announced that Samsung Electronics would invest $228 billion in creating the world’s largest semiconductor complex in the country, with the investment spread out over the next two decades. In addition, the government is targeting a 550 trillion won private sector investment in these critical areas by 2026. CNBC has more.

🤝 Federal regulators approve the first major railroad merger in over two decades. After an extensive two-year review by the U.S. Surface Transportation Board, regulators have officially signed off on Canadian Pacific’s $31 billion acquisition of Kansas City Southern. The deal combines the nation’s two smallest players and will create a single-line service linking the United States, Canada, and Mexico. Regulators remain critical of railroads given the recent derailments but say that the combination will foster rail traffic growth and support investment in infrastructure, service quality, and safety. More from Yahoo Finance.

🤩 Attention remains a critical currency in business, as Ryan Reynolds’ backed company is acquired for $1.35 billion. The most successful celebrities in the world tend to be those that leverage their influence/audience into ownership stakes in businesses they start or buy into. Today’s example is the prepaid wireless brand Mint Mobile, in which Ryan Reynolds holds a 25% minority ownership stake. Today, the company announced it’s being acquired by T-Mobile for cash (39%) and stock (61%), with the final price depending on the company’s performance pre and post-closing. In 2020, Aviation Gin which Reynolds was also a part owner of, was acquired by Diageo PLC for $610 million. The Verge has more.

🔋 BMW says its electric rollout will boost its margins and deliveries in 2023. The German automaker reported 10.6 billion euros in EBIT and an 8.6% margin for its automotive segment in 2022, with automotive cash flows of 11.1 billion euros. For 2023, it expects an EBIT margin of 8-10% for its automotive range, with deliveries rising slightly YoY and selling prices remaining stable. Its premium models and fully battery-electric vehicle (BEV) push will drive future growth. The company expects BEVs to account for 15% of its sales in 2023 and grow to above 50% well before 2030. More from CNBC.

📺 Sling TV fires back at YouTube TV’s push into sports with its picture-in-picture mode. Content and streaming platforms continue their push into sports, embracing the strong demand from consumers. But with so many options to watch, they have to compete on experience by rolling out new features. Sling TV announced three features: “side view,” which allows web users to watch games in a small screen overlay; “sports scores,” which is a new custom iOS device widget to capture further screen real estate; and a Sling widget for iOS users so they can access their favorite channels without leaving their home screen. TechCrunch has more.

Links

Links That Don’t Suck:

⚡ Kia’s EV9 electric SUV features three rows of seats and a striking design

⚠️ Pesticides in produce: 2023’s Dirty Dozen and Clean 15 fruits and vegetables

📝 Workers in Illinois can take time off ‘for any reason’ after governor signs new law

✂️ TikTok mulls splitting from ByteDance if proposal with U.S. fails – Bloomberg News

🚗 Honda recalls nearly 500,000 vehicles because front seat belts may not latch properly

🤖 OpenAI co-founder on company’s past approach to openly sharing research: ‘We were wrong’