Growth sectors led the charge today as stock market bulls look to break beyond the tight range we’ve been in since mid-March. Let’s see what you missed. 👀

Today’s issue covers Target and TJX’s view on the consumer, a summary of today’s tech earnings, and why foreign stocks are making waves. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Consumer discretionary (+2.07%) led, and utilities (-0.33%) lagged. 💚

In economic news, U.S. single-family building permits rose 3.1% in April, though overall permits fell 1.5%. Single-family housing starts rose 1.6%, with overall housing starts up 2.2%. It adds to Home Depot’s earnings, painting an overall cautious picture of this year’s housing outlook. 🏚️

Regional Banks rebounded, led by Western Alliance Bancorp, which announced deposits grew more than $2 billion since the end of Q1. 💰

Industrial giant Siemens beat second-quarter forecasts and raised its full-year sales and profit guidance. Its CEO is confident about the second half of 2023, boasting a strong order book and progress on supply chain bottlenecks. 🏭

In crypto news, Tether says it will further back the USDT stablecoin by using a portion of its net profit to buy Bitcoin. Blockchain firm Ripple is acquiring Swiss crypto custody services firm Metaco for $250 million as the Securities and Exchange Commission (SEC) pressure forces more firms overseas. And leading hardware wallet maker, Ledger, announced a new recovery feature that sent crypto enthusiasts into a frenzy. ₿

Other symbols active on the streams included: $XELA (+5.89%), $OMH (-1.26%), $IMMP (+64.78%), $COYA (-1.20%), $GDC (+4.42%), $TRKA (-8.32%), and $TSLA (+4.41%). 🔥

Here are the closing prices:

| S&P 500 | 4,159 | +1.19% |

| Nasdaq | 12,501 | +1.28% |

| Russell 2000 | 1,775 | +2.21% |

| Dow Jones | 33,421 | +1.24% |

Earnings

TGT & TJX Spill The Tea On Consumers

After Home Depot’s lackluster results, all eyes are on other retailers for hints about consumers’ health. Today we got more clues from Target and TJX Companies, so let’s take a look.

First up is big-box retailer Target, which managed to hit its financial targets despite a sales slowdown. 🎯

Adjusted earnings per share (EPS) of $2.05 on revenue of $25.32 billion topped the expected $1.76 and $25.29 billion. Comparable store sales were flat YoY, with shoppers spending less as the quarter went on. Consumers also shopped differently, with digital sales falling 3.4% YoY, as overall shopper traffic edged out a 1% YoY gain.

Discretionary categories posted mid-single-digit to low-double-digit sales declines. Beauty led the consumer staples’ strength, growing by a mid-teens percentage YoY. Food and beverage were next with high single-digit growth. And household essentials rose low single-digits, driven by health and pet items. 🛒

Another positive was that inventory fell 16% YoY, signaling that its heavy discounting may be coming to an end. That and lower freight costs helped push Target’s gross margin up to 26.3%.

With that said, executives stuck with their cautious full-year outlook. They expect comparable sales from a low-single-digit decline to a low-single-digit increase and full-year EPS of $7.75 to $8.75. Although customers are buying fewer discretionary goods, the retailer is luring them in with groceries and everyday essentials to buoy results. ⚠️

$TGT shares were up nearly 3% today as the news was better than investors anticipated. 👍

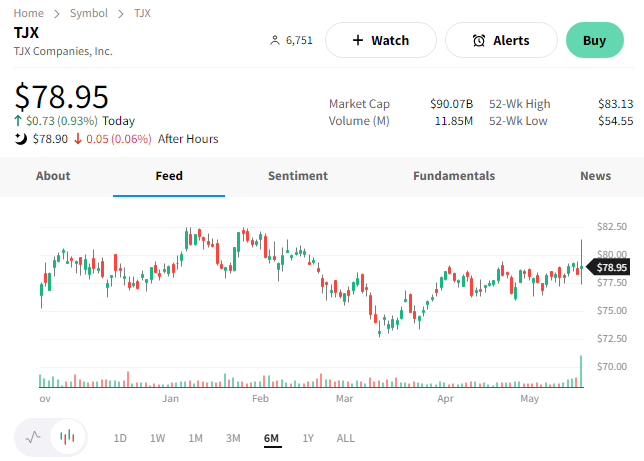

Meanwhile, off-price department store TJX Companies offered a mixed forecast. 🏬

The parent company of TJ Maxx, Marshalls, Home Goods, and other off-pice stores should be a big beneficiary of the current environment. And it was, to a certain extent.

It reported first-quarter earnings per share of $0.76 on revenues of $11.8 billion. That revenue number aligned with expectations, while earnings beat by $0.04. Same-store sales jumped 3%, topping the 2.7% consensus view.

However, the company’s conservative guidance caught some investors off guard. Both its current-quarter and fiscal-year earnings forecast were below expectations. Despite being the right business for the current economic environment, executives remain hesitant to bet on a pickup in consumer spending. 🤔

The mixed messaging initially sent shares of $TJX up 4%, though they closed up 1% on the day. 🔺

Overall, the cautious messaging from retailers continues. While many have gotten their inventory and costs back under control, they’re not anticipating a significant upswing in consumer spending this year. Instead, the base case seems to be moderate declines or flat sales for the foreseeable future. However, the overall economy remains the critical wildcard out of their control. 🤪

We’ll see what Walmart has to add to the conversation when it reports tomorrow before the bell. 👀

Home country bias is a big issue among investors, where investors overexpose themselves to domestic equities in their investment portfolio. This plays out across the spectrum, with active short-term traders and long-term buy-and-hold investors both exhibiting this behavior. 🌎

Luckily for U.S. investors, that bias has worked out pretty well…especially since the financial crisis. However, now and again, foreign stocks make enough noise to get people’s attention. 📢

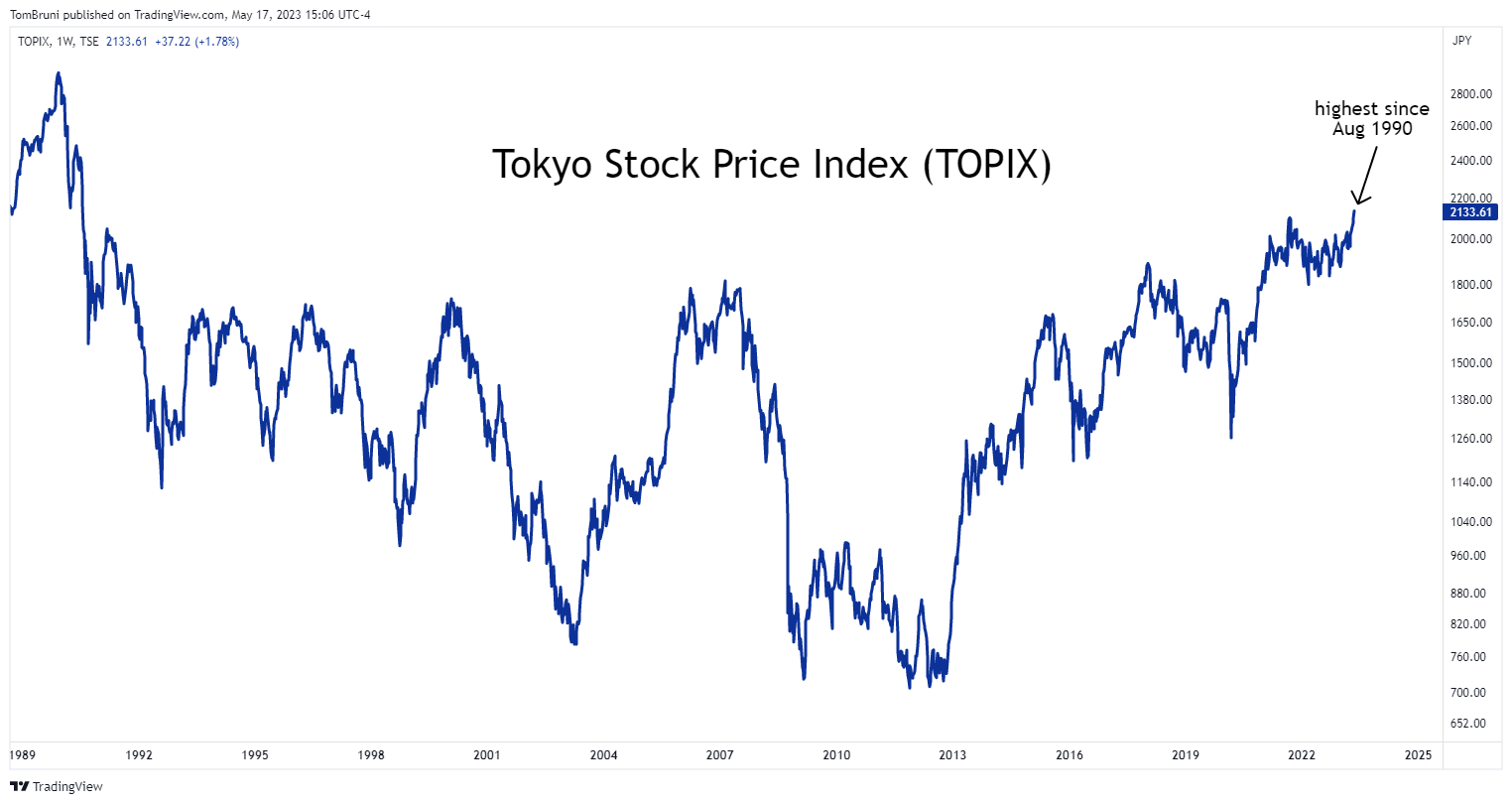

It’s unclear whether now is one of those times more broadly, but investors are beginning to notice Japan’s recent outperformance as its primary index hits nearly 33-year highs. 👀

For those unfamiliar with the country’s stock market, it has two major indexes.

Its Tokyo Stock Price Index (TOPIX) is said to provide the broadest measure of the stocks listed on the Tokyo Stock Exchange. That’s because it is a free-float market-capitalization-weighted index, while the Nikkei 225 is a price-weighted index focused on the largest 225 Japanese stocks. 🔍

We clarify because sometimes their performance differs significantly. Nonetheless, the important part of today’s conversation is that both indexes are hitting new heights.

The TOPIX is back to August 1990 levels. 😮

And the Nikkei 225, although still shy of the highs it made a few months ago, is still sitting at levels not seen since mid-1990. 📈

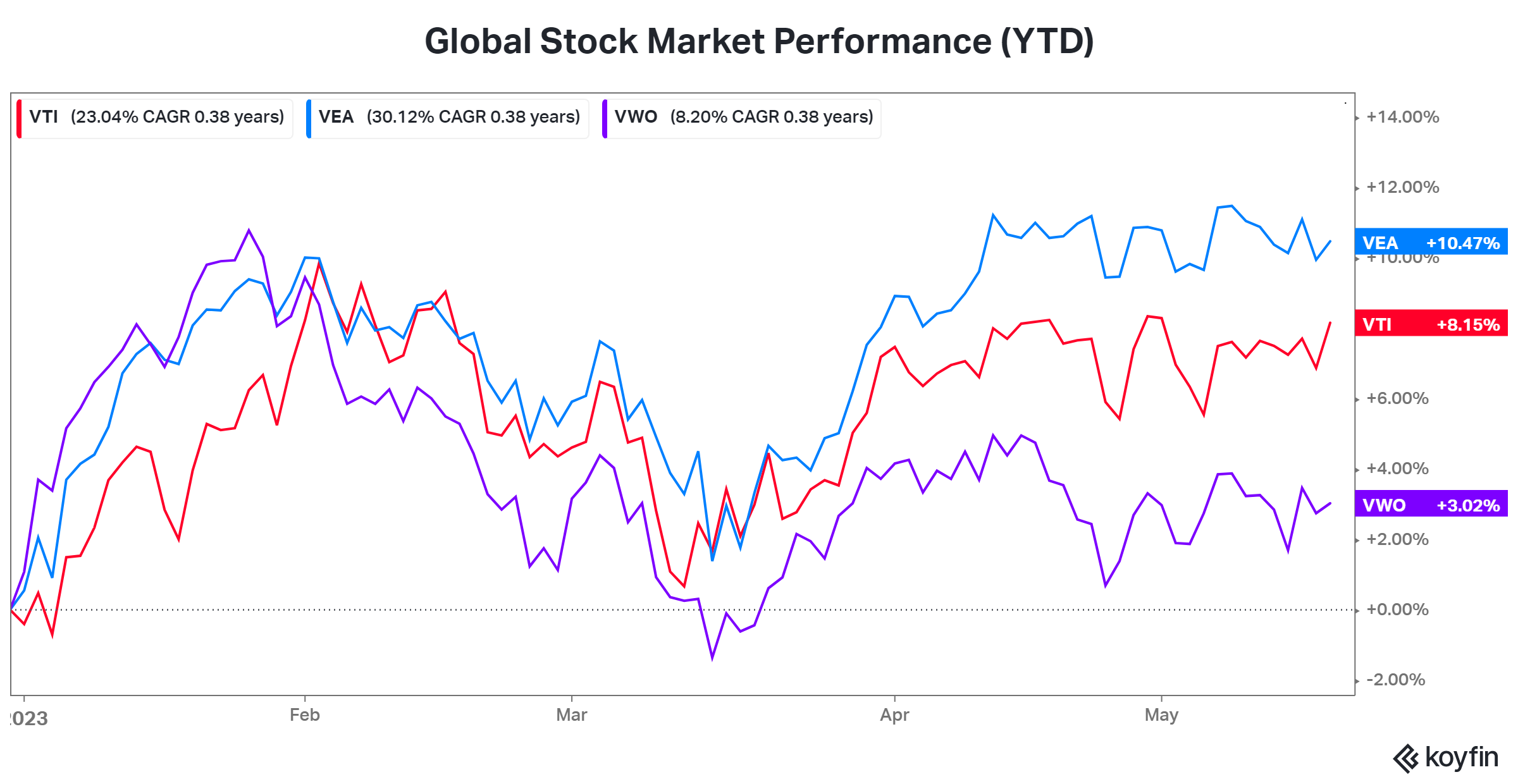

The chart below has ETFs tracking the U.S. stock market ($VTI), developed markets excluding North America ($VEA), and emerging markets ($VWO). 👇

While exposure to China has hurt emerging market stocks, exposure to Japan has helped developed markets outperform the U.S. so far this year, especially since the March bottom.

As we said, this will likely be another blip on investors’ radars this year. Until there’s significant broad-based outperformance from foreign stocks, they’re unlikely to garner much attention.

That said, some retail investors and traders are taking advantage of these overseas trends through ETFs, U.S.-listed ADRs, and other vehicles. Time will tell if their bets on Japan will continue to pay off. As always, we’ll keep you updated as this trend progresses. 👍

Several tech stocks reported today, so let’s see how they did. 👇

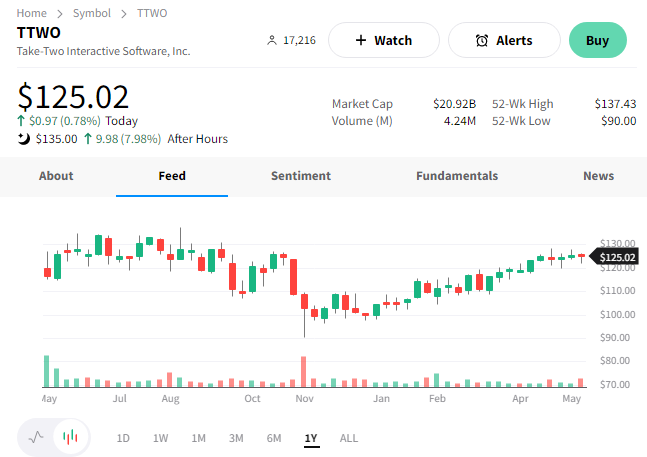

First, we’ll start with Take-Two Interactive, which inspired this section’s title. 📝

The American video game company missed earnings expectations by $0.09, but its revenue of $1.39 billion topped estimates of $1.34 billion. Higher inflation has led consumers to be more selective about spending, primarily benefiting bargain titles and blockbuster games.

And executives expect that to continue. As a result, they now see fiscal 2024 net bookings of $5.45 to $5.55 billion, which was well below the $6.11 consensus view. 📉

With that said, they’re optimistic about fiscal 2025, expecting net bookings of $8 billion and over $1 billion in adjusted unrestricted operating cash flow. They also hinted at further growth in fiscal 2026, which investors took to mean that Grand Theft Auto VI isn’t too far away. Its predecessor is known as “the most financially successful media title of all time,” so progress here is a big win.

Whether the optimism is warranted or not remains to be seen. But as of now, $TTWO shares are trading up 8% after hours to new year-to-date highs. 📈

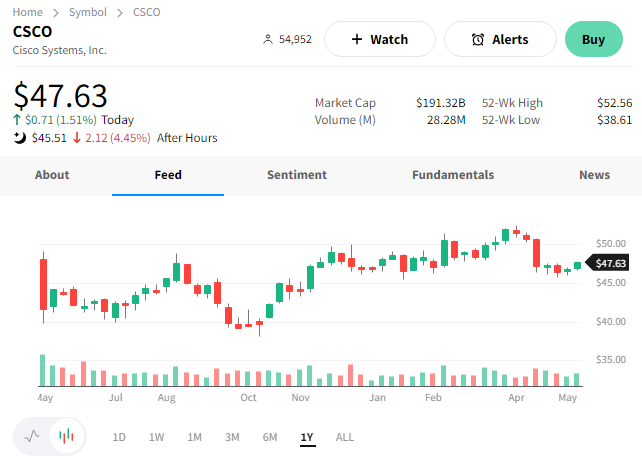

Next up is digital communications company Cisco, which is falling despite topping guidance. 🤔

It reported adjusted earnings per share of $1.00 and revenues of $14.6 billion. Both numbers topped the consensus views of $0.97 and $14.4 billion. Fiscal fourth-quarter guidance also topped expectations, but full-year guidance is where things turned for the worst.

Executives increased their annual profit guidance but did not raise the ceiling on revenue growth for the year as expected. Instead, they anticipate full-year revenue growth of 10% to 10.5%, up from their previous 9% to 10.5% forecast. 👎

Ultimately, investors and analysts remain concerned that delays in its backlogged orders are masking meaningful declines in new orders. Orders declined 23% YoY in the most recent quarter. However, executives say the QoQ numbers are more relevant since the pandemic-era comparables were essentially outliers.

Nonetheless, investors are selling after hours. $CSCO shares are down about 5%. 🔻

Lastly, it’s worth mentioning ServiceNow. $NOW shares soared 5% as the company partnered with Nvidia on generative AI. The cloud computing company will develop customized large language models (LLMs) for data using Nvidia’s software, services, and infrastructure. 🤖

This followed news that ServiceNow would invest $1 billion in its venture-capital arm by 2026 to back enterprise-software startups in AI and automation. Additionally, the company announced its first-ever share repurchase program of $1.5 billion, with the CEO predicting a “$20 billion-plus company in the not-too-distant future.”

Time will tell if he’s right. For now, investors are celebrating the short-term gains caused by the optimism. 🥳

Bullets

Bullets From The Day:

💵 Pfizer sells billions in bonds in the fourth-largest deal ever. The pharmaceutical giant sold $31 billion of debt in the fourth-largest U.S. bond sale ever. It received over $85 billion in orders for its eight-part investment-grade deal, financing its Seagen Inc. purchase. It’s the company’s first bond sale since 2021 and part of a rush of offerings ahead of the potential increase in borrowing costs sparked by the U.S. debt ceiling debate. Notably, the FTC’s crackdown on Amgen’s Horizon Therapeutics acquisition caused Pfizer to add language allowing it to redeem the debt if its proposed acquisition failed. Yahoo Finance has more.

😡 Critics say OpenAI is looking to stifle innovation after gaining its massive head start. Sam Altman called on U.S. lawmakers to regulate artificial intelligence (AI) during his testimony before a U.S. Senate committee on Tuesday. He argued that a new agency should be formed to license AI companies, citing the potential risks associated with the many AI models introduced to the market over the last few months. He suggested a combination of licensing and testing requirements, independent audits, and other measures. However, vocal critics say this is a classic capitalistic move whereby leading companies raise the barrier to entry, creating a monopolistic environment and stifling innovation. More from BBC News.

👪 Uber embraces “family” as it rolls out new products and features. At its annual “Go-Get” event, the company unveiled several initiatives to attract new customers, from teens as young as 13 to families who want to link their accounts. They’re also rolling out a feature allowing users uncomfortable navigating the app to call a telephone number to arrange a ride. Overall, it’s a continuation of its “tentacular strategy,” which creates a closed business loop with each product that feeds customers back into other Uber channels. TechCrunch has more.

◀️ Coinbase CEO raises funds for a new startup trying to reverse aging. Longevity pharma startup NewLimit has raised $40 million in Series A funding after raising $105 million from its co-founders, Coinbase CEO Brian Armstrong and former Google Ventures partner Blake Byers, in 2021. So what are they doing with the money? Essentially, the company is looking to use new epigenetics tools to “reprogram” cells to act younger, with an initial focus on T-Cells. That could increase people’s quality of life as they age but also prevent the development of some diseases. The big question remains whether the company can give reprogrammed cells similar functional performance as actual young cells. More from Axios.

✈️ Virgin Orbit receives a $17 million bid for its aircraft assets. The bankrupt satellite launch company entered into a “stalking horse” agreement with Stratolaunch to sell its aircraft assets for $17 million in cash. This type of agreement is used as a starting bid or minimally accepted offer that other interested bidders must surpass to buy an asset or company. With that said, the agreement does not provide Stratolaunch exclusivity, meaning other parties can bid on the same assets. We’ll learn more about the company’s fate on Friday, May 19, when all bids for its assets are due. Reuters has more.

Links

Links That Don’t Suck:

❌ Use it or lose it: Google says it will delete inactive accounts

📆 Disgraced Theranos CEO Elizabeth Holmes will report to jail on May 30

☀️ China dominates the solar power industry. The EU wants to change that

🍺 Miller Lite downplays ‘woke’ ad following Bud Light Dylan Mulvaney disaster

💰 UBS expects $17 billion hit from Credit Suisse rescue, flags hasty due diligence

👎 Gallup Poll shows a record-low share of Americans say it’s a good time to buy a house

🤖 Point72 founder Steve Cohen joins the list of billionaires bulled up on artificial intelligence (AI)