Stock market gains moderated as U.S. debt ceiling talks stalled, though the major indexes remained positive for the week. Let’s see what else you missed. 👀

Today’s issue covers John Deere dumping on earnings, why Footlocker lost its grip, and more from the day. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Energy (+0.71%) led, and consumer discretionary (-0.86%) lagged. 💚

In economic news, Republicans walked out of today’s debt ceiling talks, claiming that the White House is being unreasonable. Meanwhile, Fed Chair Powell indicated that banking sector stress may mean the rate required to bring down inflation may be lower than it would have otherwise been. And regarding the banking crisis, Treasury Secretary Janet Yellen reportedly told bank CEOs that more mergers might be necessary. 📻

Despite higher interest rates, it was the year’s busiest week of U.S. investment-grade bond issuance. Pfizer raised $31 billion in the fourth-largest U.S. corporate bond issuance ever. 💰

In airline news, the Justice Department won a lawsuit to reverse JetBlue and American Airlines’ northeast U.S. partnership. Meanwhile, American Airlines and its pilots have reached a preliminary agreement for a new labor contract after the union recently authorized a strike. ✈️

Beaten-down drug maker Catalent rebounded 15% after its CEO said during its earnings call that the company “thinks it can sufficiently service customer demand.” As a result, it was the best-performing stock in the S&P 500 today. 💊

Other symbols active on the streams included: $XELA (-22.68%), $FTCH (+14.75%), $PLTR (-0.26%), $NVDA (-1.31%), $MULN (-10.08%), $TRKA (-0.68%), and $TSLA (+1.84%). 🔥

Here are the closing prices:

| S&P 500 | 4,192 | -0.14% |

| Nasdaq | 12,658 | -0.24% |

| Russell 2000 | 1,774 | -0.62% |

| Dow Jones | 33,427 | -0.33% |

Earnings

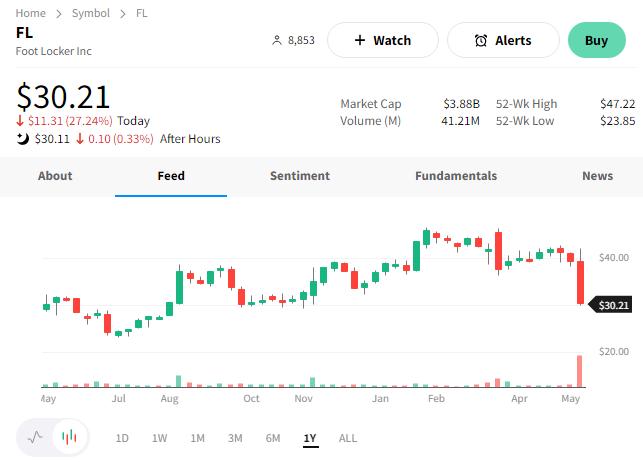

Foot Locker Can’t Get A Grip

Last time we talked about shoe retailer Foot Locker, it was in a precarious position. However, executives were optimistic things were turning the corner. Unfortunately for investors, they were not able to deliver on that optimism during the first quarter.

The company’s adjusted earnings per share (EPS) of $0.70 missed the $0.81 expected. Revenues of $1.93 billion were also below the $1.99 billion expected. 👎

The retailer said it needed to aggressively promote and discount merchandise in order to clear high inventory levels. Retailers far and wide have said discretionary purchases continue to suffer in the current environment. And shoes and clothes certainly fall into that category. 🛍️

Despite the current macroeconomic environment and lower tax refunds, executives had hoped demand would snap back. However, as the quarter went on, it became clear that optimism did not match reality. As a result, executives cut their guidance aggressively. ✂️

Here are their new full-year estimates vs. previous expectations:

- Sales -6.5% to -8% YoY vs. -3.5% to -5.5%

- Comparable sales -7.5% to -9.0% YoY vs. -3.5% to -5.5%

- Non-GAAP earnings of $2 to $2.25 vs. $3.35 to $3.65

- Gross margins of 28.6% to 28.8% vs. 30.8% to 31%

With the many headwinds facing consumers currently, it’s going to be a difficult environment for Foot Locker to perform. It’s expecting to continue the promotional activity to bring in shoppers and reduce inventory. That’s going to weigh on margins and earnings for the foreseeable future. 🔻

Longer-term, the company hopes to continue diversifying its brand mix away from Nike. This quarter that mixes outside of Nike was 35%, up a couple of points since the last year. They’re still pushing to get that number above 40% by 2026. It’s also working to rationalize costs to preserve cash until the environment improves.

However, what’s missing is a clear strategy on how it’s going to boost sales. As a result, $FL shares plummeted 27%, failing to get a grip among investors. 😬

Earnings

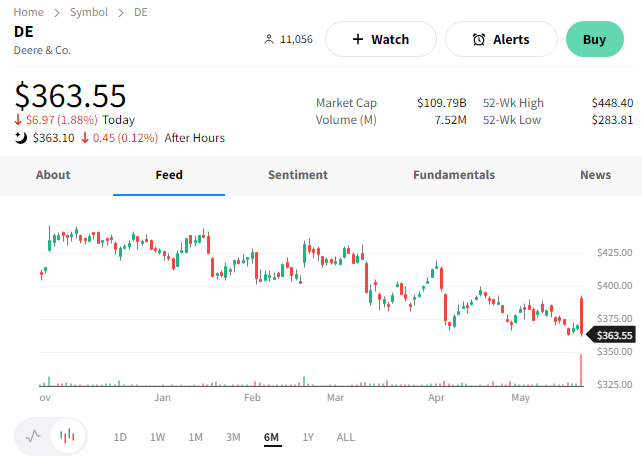

Deere Jumps Then Dumps

We last spoke about Deere & Co. in February, when shares were trading just below all-time highs. Since then, prices have fallen roughly 15%, and today’s results failed to get it back on track.

The world’s largest farming equipment maker reported earnings per share of $9.65 on revenues of $17.39 billion. Both numbers topped the $8.58 and $14.89 billion anticipated by analysts. 💪

Here’s how that 30% YoY revenue growth broke down:

- Production & precision agriculture sales +52.9% YoY to $7.82 billion

- Small agriculture & turf sales +16.1% to $4.15 billion

- Construction & forestry sales +22.9% to $4.11 billion

Executives remain optimistic about its full-year results. They raised guidance for net income from $8.75 to $9.25 billion to $9.25 to $9.50 billion. They also lifted its Small Agriculture & Turf outlook from flat to +5% and its Construction & Forestry from up to 15%. 📈

They referenced favorable market conditions and an improving operating environment in their outlook. The company and other industrial giants have struggled with supply chain issues. However, this quarter many of these companies these conditions remain far from optimal but are improving.

Higher pricing has been a major tailwind for Deere, but as inflation subsides, some analysts are concerned that could weigh on results. Additionally, they noted some investors may think it’ll be hard for things to get better for the company from here. If a major order backlog and record results can’t push the stock up, maybe many of those bullish expectations are already priced in. 🤔

Whether that’s true remains to be seen, but that’s how the market is currently acting. $DE shares initially rose 7% but closed down 2%. 🔻

Bullets

Bullets From The Day:

📝 Microsoft was accused of violating Twitter’s data use policy. Elon Musk’s personal lawyer has reportedly sent the tech giant a letter that accuses it of using Twiter API “for unauthorized uses and purposes.” The letter accuses Microsoft of using more data than it was supposed to and sharing that data with government agencies without permission. This comes weeks after Microsoft declined to use Twitter’s API after the company began charging for it. Ultimately, Elon Musk responded on Twitter, saying, “They trained illegally using Twitter data. Lawsuit time.” Engadget has more.

👨💼 Morgan Stanley CEO to bring in successor within a year. James Gorman plans to step down as chief executive but stay on as executive chairman after thirteen years in the role. The announcement states that the bank’s board has identified three strong successor candidates but did not name them. The largely unexpected decision puts a spotlight on several other long-serving CEOs at the largest U.S. banks. Under Gorman’s reign, Morgan Stanley has turned into a wealth management powerhouse which has helped diversify its exposure to dealmaking activity. More from Reuters.

📱 Instagram unveils a new Twitter clone that’s coming to phones this summer. With the future of Elon Musk’s Twitter remaining uncertain, a number of companies are vying for that audience. One of those is Meta, which is attempting to build the next major microblogging platform. The text-based app will stand alone and include a partial integration with Instagram. Additionally, it will be decentralized and interoperable with Mastodon, which is built on the ActivityPub protocol. It’s expected to be rolled out to a select group of creators for testing this summer. TechCrunch has more.

🎓 New data highlights a big financial gap between college grads and others. A new report finds that Americans without college degrees are more likely to be denied credit than those who finished college. While the government data doesn’t indicate why that’s the case, an older study also found there may be some bias from financial institutions against those without a degree. Overall, college graduates do have more debt than those who didn’t go to college. However, the higher earnings potential may offset that and explain a portion of this potential discrimination. More from Axios.

👍 Twitter’s biggest ad buyer says the platform is no longer “high risk.” The world’s biggest ad agency, GroupM, removed its “high risk” classification and informed its clients that the company is “cautiously optimistic” about Linda Yaccarino’s appointment. It had previously designated the platform as “high risk” last November and warned its clients against buying ads on the platform directly following Elon Musk’s takeover. Reports indicate the group had been waiting for senior leadership to be established and for the level of harmful content on the platform to “return to normalcy” before getting back on board. The Verge has more.

Links

Links That Don’t Suck:

🏟️ Disney is reportedly preparing a standalone ESPN streaming service

🏘️ Existing-home sale prices fall at the sharpest annual pace in a decade

🔺 Lawsuit: iPhone users pay more for DoorDash orders than Android users

👎 Disney stock slumps on Wall Street downgrade citing ‘near-term uncertainties’

🚗 Hyundai and Kia agree to $200 million settlement over TikTok car theft challenge

🚫 Apple reportedly limits internal use of AI-powered tools like ChatGPT and GitHub Copilot