Despite the debt ceiling deal moving to its next stage, equities across the globe continued to pull back. Let’s see what else you missed. 👀

Today’s issue covers Advance Auto Parts’ big breakdown, a crowded day of tech earnings, and what clothing retailers are saying about the consumer. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Utilities (+0.92%) led, and energy (-1.76%) lagged. 💚

In economic news, April’s JOLTs data showed job openings rose by 400k to 10.1 million and the ratio of job openings to available workers jumped to 1.8. The Chicago PMI fell to a sixth-month low of 40.4 in May, marking its ninth straight month in contraction territory. The Dallas Fed services index held steady while price and wage pressures eased. And the debt ceiling bill advanced to the House floor after narrowly clearing the Senate. 🗳️

The Federal Deposit Insurance Corporation’s (FDIC) quarterly report indicated that U.S. bank deposits fell by the most in 39 years during Q1. The Chairman said banks “face significant downside risks from the effects of inflation, rising market interest rates, slower economic growth, and geopolitical uncertainty.” 😬

Overseas, Deutsche Bank is warning of a default wave later in the year, which it expects to peak in mid-2024. And European Central Bank (ECB) Vice-President Luise de Guindos warned financial markets could face a sharp downturn in the event of any further shocks to the global economy. ⚠️

Other symbols active on the streams included: $TOP (-11.19%), $TRKA (-17.56%), $SDA (+120.88%), $CXAI (+9.82%), $TGT (-2.17%), $BUD (-1.95%), and $SOFI (+15.09%). 🔥

Here are the closing prices:

| S&P 500 | 4,180 | -0.61% |

| Nasdaq | 12,935 | -0.63% |

| Russell 2000 | 1,750 | -1.00% |

| Dow Jones | 32,908 | -0.41% |

Earnings

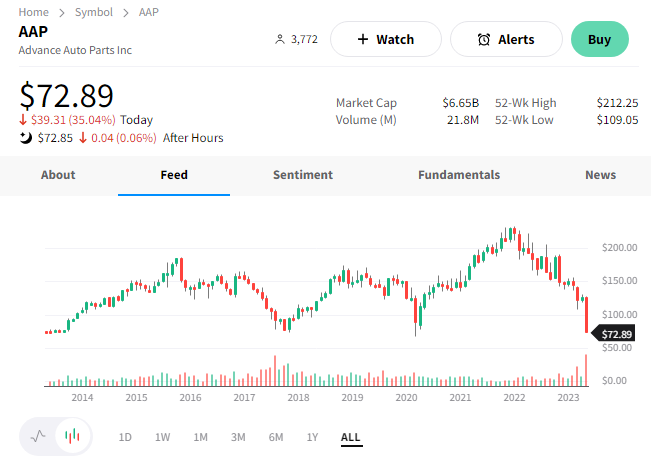

Advance Auto Parts Catches Fire

Advance Auto Parts had a rough day…and that’s putting it lightly. Let’s look at what the auto parts retailer said that caused the worst one-day selloff in its history. 👇

Adjusted earnings per share of $0.72 widely missed the $2.57 expected by analysts. That’s despite revenues of $3.42 billion, only missing estimates by $0.01 billion. Not only did the significant miss cause executives to rethink their full-year guidance, but the board of directors reduced the quarterly dividend from $1.50 to $0.25 per share. ✂️

They now expect full-year adjusted earnings per share of $6.00 to $6.50, down from a previous range of $10.20 to $11.20. That comes as it reduced its sales expectations by a range of just $200 to $300 million, signaling margin troubles. For the foreseeable future, higher-than-expected costs for its professional sales, inflationary pressure, supply chain issues, and unfavorable product mix will continue to pressure results. ⚠️

Analysts believe AAP’s business model has structural issues preventing its operational teams from driving solid results. In a highly competitive space like auto parts, it’s simply not possible to skate by. And it’s clearly losing market share to O’Reilly Automotive and AutoZone, among others.

$AAP shares fell 35% and are near their 2020 and 2017 lows. 📉

Earnings

A Crowded Day Of Tech Earnings

It was a massive day of tech earnings, but we’ll do our best to recap some of the biggest movers.

First up is C3.ai, which failed to live up to the recent hype. The company’s fourth-quarter adjusted loss per share of $0.55 on revenues of $72.4 million topped the $0.13 on $71.3 million in revenue consensus view. However, its fiscal 2024 revenue guidance of $295 to $320 million was shy of analysts’ $317 million estimate. While the results were positive, if your shares are up over 200% this year, you must beat on all metrics to maintain your momentum…, especially in this market. Unfortunately, the company didn’t, so $AI shares are falling 16% after hours following a 9% regular-session decline. 🤖

Next is Salesforce, which beat estimates and raised its full-year earnings guidance. The software giant reported adjusted earnings per share of $1.69 vs. the $1.61 expected. Its revenues of $8.25 billion also topped the $8.18 billion estimate. Like other tech giants, the company has been reining in costs to boost earnings amid slowing revenue growth. As a result, executives raised their fiscal year 2024 revenue forecast to $7.41-$7.43 per share. However, they left their revenue forecast intact. $CRM shares are volatile after hours but down about 5% currently. 🌧️

Then there’s Crowdstrike, which beat estimates but reported slowing YoY revenue growth. The cybersecurity firm reported adjusted earnings per share of $0.57 on revenues of $692.6 million. That compared to $0.51 and $676.4 million anticipated by analysts. Despite revenues growing 42% YoY, investors are concerned about the deceleration from last year’s 61% growth. As did executives’ current quarter revenue guidance of $717.2 to $727.4 million, which was mixed vs. the $698 to $742 million consensus range. $CRWD shares are down 12% after hours. 🔻

And finally, Chewy topped estimates. The online pet retailer’s adjusted earnings per share of $0.05 and revenues of $2.78 billion beat the $0.04 per share loss and $2.73 billion in revenue anticipated. In addition, the company said gross margins were up one percentage point. Meanwhile, net sales per active customer and sales from auto-ship customers reached record highs. $CHWY shares rose 12% after hours. 📦

Earnings

A Clothing Retailer Read

Let’s see how clothing retailers are faring this earnings season. 👚

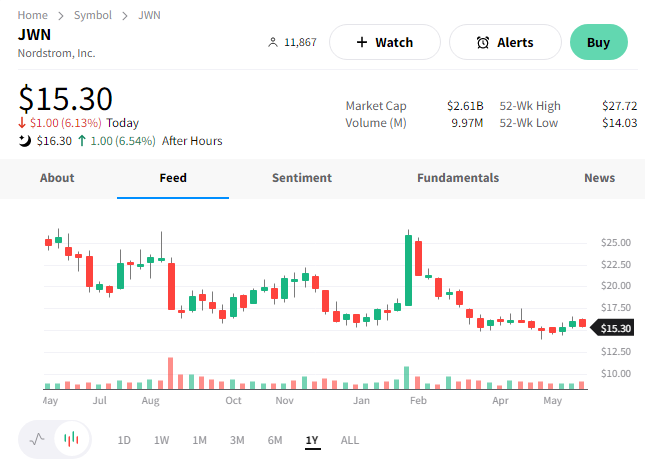

First, we’ll start with Nordstrom, which beat on the top and bottom lines.

The department store’s adjusted earnings per share of $0.07 beat the $0.10 loss anticipated by analysts. Revenues of $3.2 billion also beat the $3.1 billion expected. 🏬

The company saw sales decline YoY across most categories, though activewear, beauty, and men’s apparel were above-average performers. Gross margins also jumped 1.1% YoY as the company pared down its inventory levels. 🛒

Despite the challenging macroeconomic environment, executives remain optimistic due to their higher-end customer base. As a result, they reiterated their fiscal 2023 outlook. They now see revenue declines of 4% to 6% YoY and adjusted earnings per share of $1.80 to $2.20.

Shares of $JWN are up about 7% after hours, offsetting a similar regular session decline. 🤷

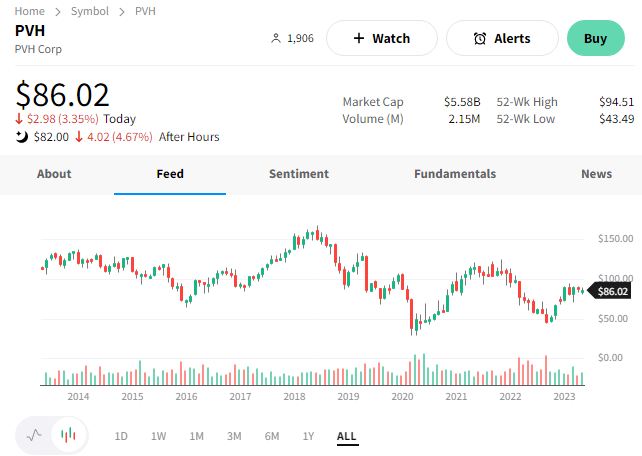

Meanwhile, PVH is extending its losses after hours following mixed results.

The Calvin Klein parent’s adjusted earnings per share of $2.25 on revenues of $2.16 billion beat the anticipated $1.94 and $2.12 billion. The company also reaffirmed its full-year guidance for 3% to 4% revenue growth and adjusted earnings per share of $10.

However, where the issue came in was the company’s rising inventories. That number rose 24% YoY due to what executives said were “abnormally” low levels in the first quarter of 2022, early receipts of inventory, and higher product costs. 📦

Other companies have been reducing inventory aggressively at the expense of their margins. So investors are concerned about potential inventory mismanagement impacting future results here.

$PVH shares are down about 3% after hours. 🔻

Bullets

Bullets From The Day:

💰 FTC levies fine on Amazon over Ring and Alexa privacy concerns. The tech giant will pay $30 million to settle allegations of privacy lapses in its Alexa and Ring divisions. As part of the $5.8 million Ring settlement, the company must delete any customer videos and data collected from an individual’s face before 2018. Meanwhile, its $25 million Alexa settlement will require Amazon to delete inactive child accounts as well as some voice recordings and geolocation information. It will also be prohibited from using that information to train its algorithms. CNBC has more.

🚗 U.S. to require robust automatic emergency braking systems in all new vehicles. The Us Department of Transportation’s (DOT) proposed rule focuses on a “more effective” version of automatic emergency braking (AEB). While roughly 90% of light-duty vehicles today come standard with this technology, the DOT is proposing a more robust version of the technology to stop vehicles traveling at higher speeds, detect vulnerable road users, and improve night safety. It’s a high bar, but one it feels is necessary to keep everyone on the roads safe. More from The Verge.

📈 It wouldn’t be a .com bubble repeat without a surge of domain names. Like every company in the late 90s added .com to their name, the same is beginning to happen in the artificial intelligence (AI) space. Registrations of .ai domain names are up 156% YoY to 174,000, compared to a 27% increase for .com domains over that same period. Maybe this instance of hype will be different than past ones, but it probably won’t be… Axios has more.

📝 U.S. official says noncompete agreements violate U.S. labor law. A U.S. labor board official said requiring workers to sign agreements not to join competing companies is usually illegal in the government’s latest bid to rein in the practice. A 2021 academic study found that 18% of U.S. workers were subject to noncompete agreements, including more than 13% of workers earning less than 40,000 per year. A new rule proposed by the U.S. Federal Trade Commission would ban the practice, though it’s still pending approval. More from Reuters.

🤔 Could Jamie Dimon’s post-retirement life include public office? So what could the CEO of the U.S.’s largest bank do after retiring? The 67-year-old hinted that public office could be in his future, with Dimon saying, “I love my country, and maybe one day I’ll serve my country in one capacity or another.” He’s been the head of JPMorgan since 2005 and has repeatedly joked that he plans to remain CEO for five more years, no matter when asked. And he’s not changing that tune anytime soon, leaving investors and reporters to speculate amongst themselves. Yahoo Finance has more.

Links

Links That Don’t Suck:

🏘️ The COVID home price boom isn’t going bust

😠 Diddy Sues Diageo For Alleged Racist Neglect of His Tequila Brand

🤖 AI poses a threat of ‘extinction event for humanity,’ U.S. official says

🤝 Franklin Templeton to buy Putnam Investments from Great-West Lifeco for $925 million

✂️ Twitter may be worth one-third what Musk paid for it last fall as Fidelity marks down investment

🙃 CEOs got smaller raises. It would still take a typical worker two lifetimes to make their annual pay