Money continues to find a new home through sector rotation, with regional banks rebounding and leading stocks higher. Let’s see what you missed. 👀

Today’s issue covers the SEC’s crypto crackdown spreading to Coinbase, several stocks that are “Thoring” after hours, and the historic golf deal between the PGA Tour and LIV Golf. 📰

Check out today’s heat map:

7 of 11 sectors closed green. Financials (+1.26%) led, and healthcare (-0.83%) lagged. 💚

A regional bank rebound led the charge today, buoying the Russell 2000 small-cap index and equal-weighted S&P 500 index ETF ($RSP). Analysts say insider buying in the industry has hit a three-year high as executives look to shore up confidence in their companies. 🏦

The June IBD/TIPP economic optimism poll showed little improvement after plunging by 12.2% in May, marking its twenty-second consecutive month in negative territory. Meanwhile, industry leaders urged the White House to mediate the labor dispute that’s halted West Coast ports since Friday. 🏭

The Reserve Bank of Australia raised rates by another 25 bps, saying that while inflation is likely past its peak, there are signs that it remains far too persistent. 🔺

Boeing shares fell more than 2% on news that a new defect on its 787 Dreamliners will impact deliveries in the short-term but not its full-year delivery outlook. ✈️

Other symbols active on the streams included: $AAPL (-0.21%), $MVIS (+30.39%), $NVCR (-43.04%), $FFIE (+31.46%), $UVIX (-11.77%), $FRZA (+13.59%), $GTLB (+31.19%), and $HOTH (+78.19%). 🔥

Here are the closing prices:

| S&P 500 | 4,284 | +0.24% |

| Nasdaq | 13,276 | +0.36% |

| Russell 2000 | 1,855 | +2.69% |

| Dow Jones | 33,573 | +0.03% |

The U.S. Securities & Exchange Commission (SEC) isn’t taking a beat after suing the world’s largest cryptocurrency exchange, Binance, yesterday. Let’s see what it’s up to today. 👇

The first piece of news is that it’s now taking aim at the largest U.S.-listed exchange, Coinbase.

It’s charging the company for the unregistered offer and sale of securities in connection with its staking-as-a-service program. It claims that since at least 2019, Coinbase has made billions of dollars unlawfully facilitating the buying and selling of crypto asset securities. More specifically, it intertwines the traditional services of an exchange, broker, and clearing agency without having registered any of those functions with the Commission. 📝

By offering these unregistered services, Coinbase allegedly:

- Provides a marketplace and brings together the orders for securities of multiple buyers and sellers using established, non-discretionary methods under which such orders interact;

- Engages in the business of effecting securities transactions for the accounts of Coinbase customers; and

- Provides facilities for comparison of data respecting the terms of settlement of crypto asset securities transactions, serves as an intermediary in settling transactions in crypto asset securities by Coinbase customers, and acts as a securities depository.

The regulator is asking that the exchange be “permanently restrained and enjoined” from offering the 13 assets listed on its platform that the SEC considers crypto asset securities. 🚫

$COIN shares initially fell as much as 24% in pre-market trading on the news, halving those losses by the close of trade. 🔺

Additionally, the SEC asked for an emergency order to freeze Binance US assets anywhere in the world. The regulator alleges that the company and its founder Changpeng Zhao have a “disregard” for U.S. law. It argues the emergency restraining order is necessary to “prevent the dissipation of available assets for any judgment.” 🥶

Ultimately, the SEC wants to ensure that if and when it wins a case against Binance.US, there’s money to return to customers and levy fines against them. Nobody wants to see another flight of assets experienced at FTX and other defunct crypto firms.

Today’s news shows that Gary Gensler and the SEC are not backing down from the crypto industry. While industry players argue clearer regulatory guidance is the way to foster innovation and discourage foul play, U.S. regulators continue to take an enforcement-led approach. ⚔️

Earnings

These Stocks Are Thoring On Earnings

Earnings season has slowed to a crawl, but let’s quickly summarize some of today’s movers. 👇

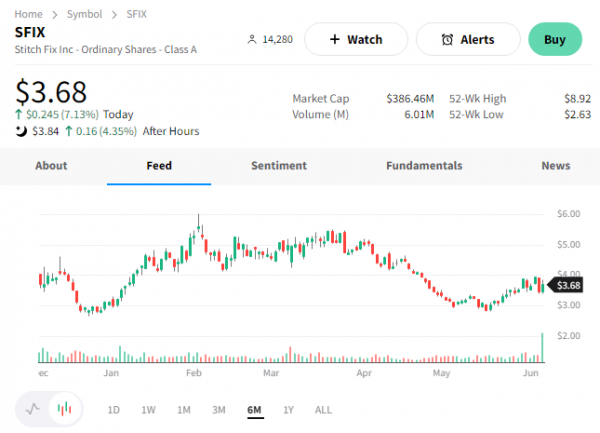

First up is the online personal styling service, StitchFix. Investors continue to look for signs of a turnaround in the stock, which continues to tread water near all-time lows after falling 98% from its pandemic-fueled highs.

Its third-quarter adjusted loss per share of $0.19 on $394.9 million in revenue both topped analyst estimates. Active clients of 3.48 million also beat the 3.45 million expected. However, the company’s fourth-quarter sales forecast of $365 to $375 million fell short of the $379 consensus view. 🔺

Overall, the company remains pressured by the current environment, with all client cohorts spending less than prior years. As a result, it’s focused on cutting costs and is scaling back operations to focus solely on its U.S. business. 🛒

$SFIX shares gained another 4% after hours on the news. 👍

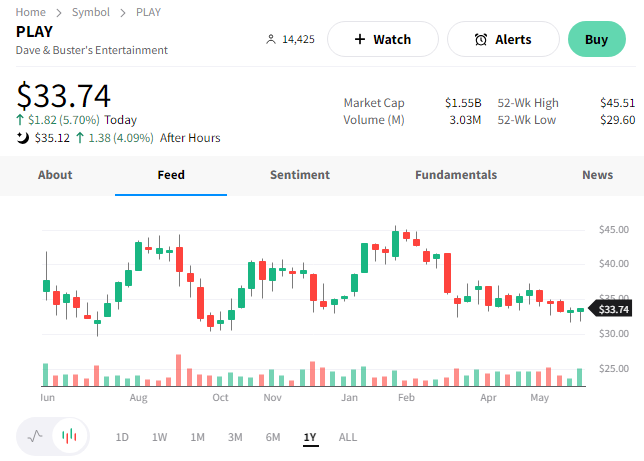

Dave & Buster’s Entertainment reported higher revenue than last quarter, indicating that consumers continue to spend on events and experiences.

The company’s adjusted earnings per share of $1.45 on revenues of $597.3 million topped the $1.26 and $451.1 million estimates. Executives believe in the company’s long-term value proposition, buying back $200 million of common stock in fiscal 2023, reducing outstanding shares by ~12%. 💪

$PLAY shares rose an additional 4% after the bell.

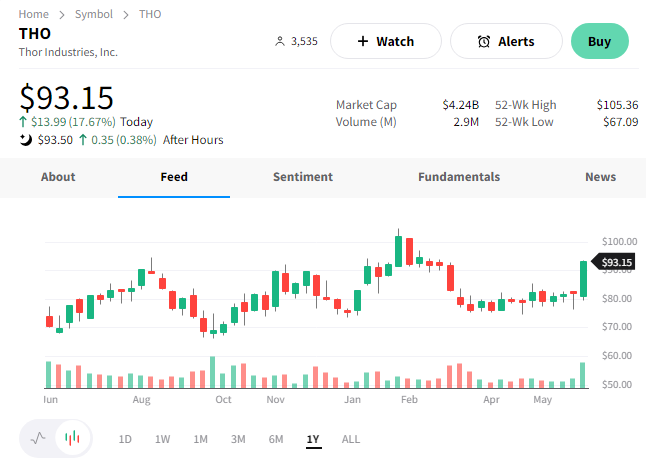

Last up is Thor Industries, which soared today, and inspired this article title. 🤷

The RV maker still sees macroeconomic challenges in the short term, narrowing its full-year guidance. However, its third-quarter results topped estimates, with adjusted earnings per share of $2.24 on revenues of $2.93 billion.

Executives say they’ve “rightsized” inventory and product offerings for current customer preferences. That, combined with cost-cutting, has allowed the company to weather the weak global economic conditions. Higher prices, strong demand, improved inventory availability, and operational initiatives in Europe drove this quarter’s strength. 🌍

The company now anticipates $10.5 to $11 billion in sales, generating adjusted earnings per share of $5.80 to $6.50 in fiscal 2023.

$THO shares jumped 18% on the day. 📈

Company News

Historic Golf Deal Sealed By PGA & LIV

After two years of fighting between them, the PGA Tour has agreed to merge with Saudi-backed rival LIV Golf. While today was a historic day for the sport of golf, whether the deal will be remembered as famous or infamous depends on who you ask.

Let’s lay the groundwork for those unfamiliar with the sport and this story. 👇

LIV Golf is funded by Saudi Arabia’s Public Investment Fund (PIF), which is designed to take the country’s vast oil riches and diversify them into other assets. The country, which has been expanding its footprint aggressively, was looking into the sports world for its next venture. So, it set its eyes on golf about two years ago.

It founded LIV Golf, named after the Roman numeral for the number 54, representing the number of holes its tournaments will have. That’s 18 fewer than a typical PGA event. Anyway, it was in discussions with the U.S. Professional Golfers’ Association of America (PGA) Tour to collaborate in some way, shape, or form. Oh, and the PGA Tour is North America’s leading golf organization registered as a not-for-profit entity.

Despite LIV’s efforts, discussions went nowhere since the PGA and its stakeholders were concerned about where the LIV’s money came from. Saudi Arabia’s human rights record is not good, and arguments remain that its push into sports and other Western parts of culture was an attempt to cover up the country’s issues. 👎

Since no progress was being made, LIV Golf decided to launch its own tournament in 2022 and lure some of golf’s biggest names away from the PGA Tour with massive paychecks. Increased prize money, fewer tournaments per year, and smaller fields with three rounds instead of four in each tournament also incentivized players to switch sides. 🤑

The PGA Tour sued LIV Golf for a variety of things and discouraged players from switching over, with several big names choosing the moral high ground over the mountain of money they were offered. And despite the heavy funding, early indications were that it was failing to gain significant traction with viewers.

However, that all changed today, given the news. The PGA Tour (including the DP World Tour) announced it would merge with LIV Golf, surprising many players who learned of the decision at the same time as the public. 🤯

The two entities will combine their commercial businesses and rights into a new yet-to-be-named-for-profit company. The PIF is reportedly prepared to invest billions of new capital into the entity, which it hopes will unify the sport globally. And lastly, the merger will end all pending litigation between the two as they iron out the final details in the coming weeks.

Ultimately, this is a massive story for sports and business fans alike. Over the last few years, money has flowed aggressively into sports teams, their streaming rights, etc. It’s clear that global consumers love sports, and big business is looking to capitalize on their passion. 🤑

We’ll have to see how this all plays out. But as usual, incentives remain at the core of human decision-making. And money talks…especially when talking about an oil empire’s worth of it. 💰

Bullets

Bullets From The Day:

🧑⚖️ Merck is suing the Biden administration over Medicare drug pricing. The global drugmaker takes issue with Medicare’s new powers to substantially reduce drug prices for seniors under the Inflation Reduction Act. It’s the industry’s first shot in a likely long battle to weaken the program, calling the negotiation program a “sham” and “tantamount to extortion” in its federal court complaint. It’s asking the judge to block the U.S. Health and Human Services department from compelling the drugmaker’s participation in the program. CNBC has more.

🖖 Sequoia is splitting up its U.S., China, and India arms into three entities. The prominent venture firm is looking to separate itself as it navigates the increasingly complex geopolitical landscape. The split will separate its Asia units from the U.S. “mothership” and is expected to go into effect by March next year. In its letter to limited partners, it downplayed the move, citing various reasons, from decentralizing its back-office functions, confusion about the shared Sequoia brand, and portfolio conflicts across entities. More from TechCrunch.

❌ San Francisco’s largest hotel’s owner is walking away from the property. Park Hotels and Resorts said it has stopped paying the $725 million worth of loans on properties in San Francisco as it looks to reduce its presence in the city. Its properties encompass nearly 3,000 rooms, but the continued burden on the company’s operating results and balance sheet is too significant to subsidize any further. The move represents another blow to the city facing talent and capital outflows due to its significant socioeconomic challenges. CNN Business has more.

🥪 Subway is struggling to lure in new U.S. franchisees. As the company continues to prepare itself for sale, it’s having trouble revamping its ownership model in the U.S. Low restaurant profits and outdated stores make it challenging to attract multi-unit operators. Several franchisees reportedly examined the possibility of buying in but passed on the opportunity after seeing how little money each store makes. Low margins and the prospect and making necessary renovations mean more work than many operators are willing to take on. More from Reuters.

📝 Federal Trade Commission continues to stack up child privacy fines. Microsoft is the latest company to pay a fine over improperly using children’s data. The company agreed to pay $20 million to settle allegations that it violated the Children’s Online Privacy Protection Act (COPPA) with the way it stored data on attempted Xbox account signups. It follows the FTC’s $520 million settlement with Fortnite developer Epic Games, with roughly $275 million related to COPPA violations. Globally, regulators have taken a more scrutinizing approach to children’s data, catching many tech giants on the wrong side of the law. The Verge has more.

Links

Links That Don’t Suck:

✂️ Reddit to lay off about 5% of its workforce (90 staff)

📺 70% of HBO Max subs have moved over to rebranded Max service

☀️ New Jersey utilities float solar panels on reservoir, powering water treatment plant

🍟 McDonald’s has a special Grimace birthday meal, new purple berry-flavored shake, coming June 12

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.