Market participants continue to adjust their portfolios as a stellar first half of the year ends, with many still lagging behind big tech’s performance. Let’s see what you missed. 👀

Today’s issue covers Olive Garden owner Darden Restaurants’ dip from all-time highs, Accenture lagging the tech rebound, and a look at precious metals slowly melting lower. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Consumer discretionary (+1.28%) led, & real estate (-1.41%) lagged. 💚

In economic news, initial jobless claims remained unchanged week over week, sitting at a twenty-month high. Existing home sales rose 0.2% MoM but fell 20.4% YoY as the market sits with a historically-low three-month supply. The median price of existing homes sold in May declined by 3.1% YoY to $396,100. Northeast and Midwest prices rose, and South and West regions fell. 🔻

Internationally, the Bank of England surprised the market with a 50 bp rate hike to combat stubbornly-high inflation. Turkey raised interest rates from 8.5% to 15%, reversing the unorthodox policy of keeping rates low while inflation soared. And Brazil’s central bank held rates constant at 13.75% for the seventh consecutive meeting. ⏯️

Overstock shares jumped 17% after its $21.5 million floor price bid won the auction for Bed Bath & Beyond’s digital assets, the brand’s name, and other intellectual property. 🏬

Boeing supplier Spirit AeroSystems fell 9% after announcing that worker strikes will cause it to suspend production at its Kansas factory. Boeing shares also fell 3% on the news. ❌

Car-insurance fintech firm Root soared for the second straight day on reports that it’s received an acquisition offer of $19.34 per share from Embedded Insurance. 🚗

Online UK supermarket Ocado’s shares jumped 32% on rumors that Amazon is interested in making a takeover bid for the company. 🛒

In crypto news, the International Monetary Fund (IMF) stated that banning crypto “may not be effective in the long run,” stating that Central Bank Digital Currencies (CBCDs) and other crypto assets have attractive use cases in certain regions of the world like Latin America. ₿

Other symbols active on the streams included: $MULN (-10.63%), $SPCE (-6.83%), $TRKA (-3.97%), $AGLE (+328.67%), $PIXY (+51.52%), $LCFY (+6.86%), $GRNQ (+16.84%), and $BTC.X (+0.44%). 🔥

Here are the closing prices:

| S&P 500 | 4,382 | +0.37% |

| Nasdaq | 13,631 | +0.95% |

| Russell 2000 | 1,848 | -0.80% |

| Dow Jones | 33,947 | -0.01% |

Earnings

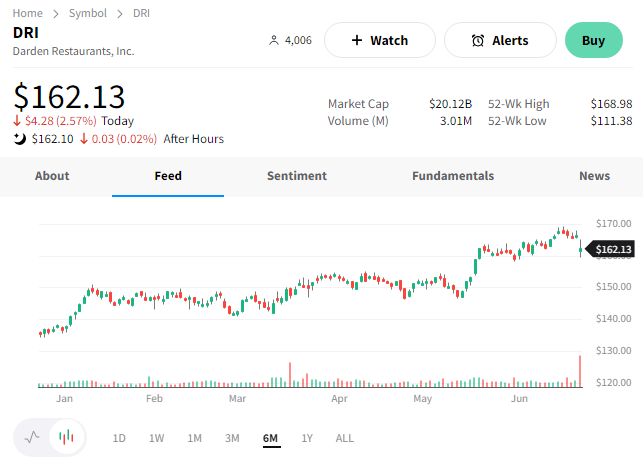

Darden Dips From All-Time Highs

Unlimited breadsticks and salad were not enough to keep consumers returning to Olive Garden’s parent company at the rate Wall Street expected. Let’s break down how the company’s brands performed in the current environment and what executives say about the future. 👇

First, Darden Restaurants reported adjusted earnings per share of $2.58 on $2.77 billion in revenues. Those earnings topped expectations by $0.04, while revenue was in line.

Net sales rose 6.4% YoY, while same-store sales rose 4% YoY. Leading the charge was LongHorn Steakhouse, which saw 7.1% same-store sales growth, topping the 4.9% expected. 🔺

However, Olive Garden, which makes up about half of the company’s sales, reported 4.4% growth, missing expectations by 0.6%. And its fine dining segment, including The Capital Grille and Eddie V’s, saw same-store sales decline 1.9% YoY. The company anticipates softer fine-dining sales will continue through the first fiscal quarter. 📉

Executives blamed high comps from last year for this quarter’s softer-than-expected numbers. They anticipate traffic will stabilize on a YoY basis after the fiscal first quarter, as trends settle down from post-pandemic peaks and establish new normal levels.

Looking ahead, executives forecasted $8.55 to $8.85 adjusted earnings per share for fiscal 2024, straddling the consensus view of $8.79. They also anticipate $11.5 to $11.6 billion in sales and same-store sales growth of 2.5% to 3.5%. 👎

On the costs front, they anticipate 3% to 4% total inflation, which they will offset by raising menu prices by 3.5% to 4%. And they’re looking at $550 to $600 million in capital expenditures (CAPEX) in the coming fiscal year.

While executives downplayed the impact of the macroeconomic uncertainty and sticky inflation, investors are worried about the demand side of the equation. 😟

If most restaurants and food companies continue raising prices to offset rising costs, how will that affect the volume of consumers? We’ve already seen many consumers trading down as inflation bites their wallets, and the Olive Garden same-store sales confirm that to some degree.

We’ll have to wait and see. But for now, $DRI shares are pulling back slightly from the all-time highs set last week. 🔻

Earnings

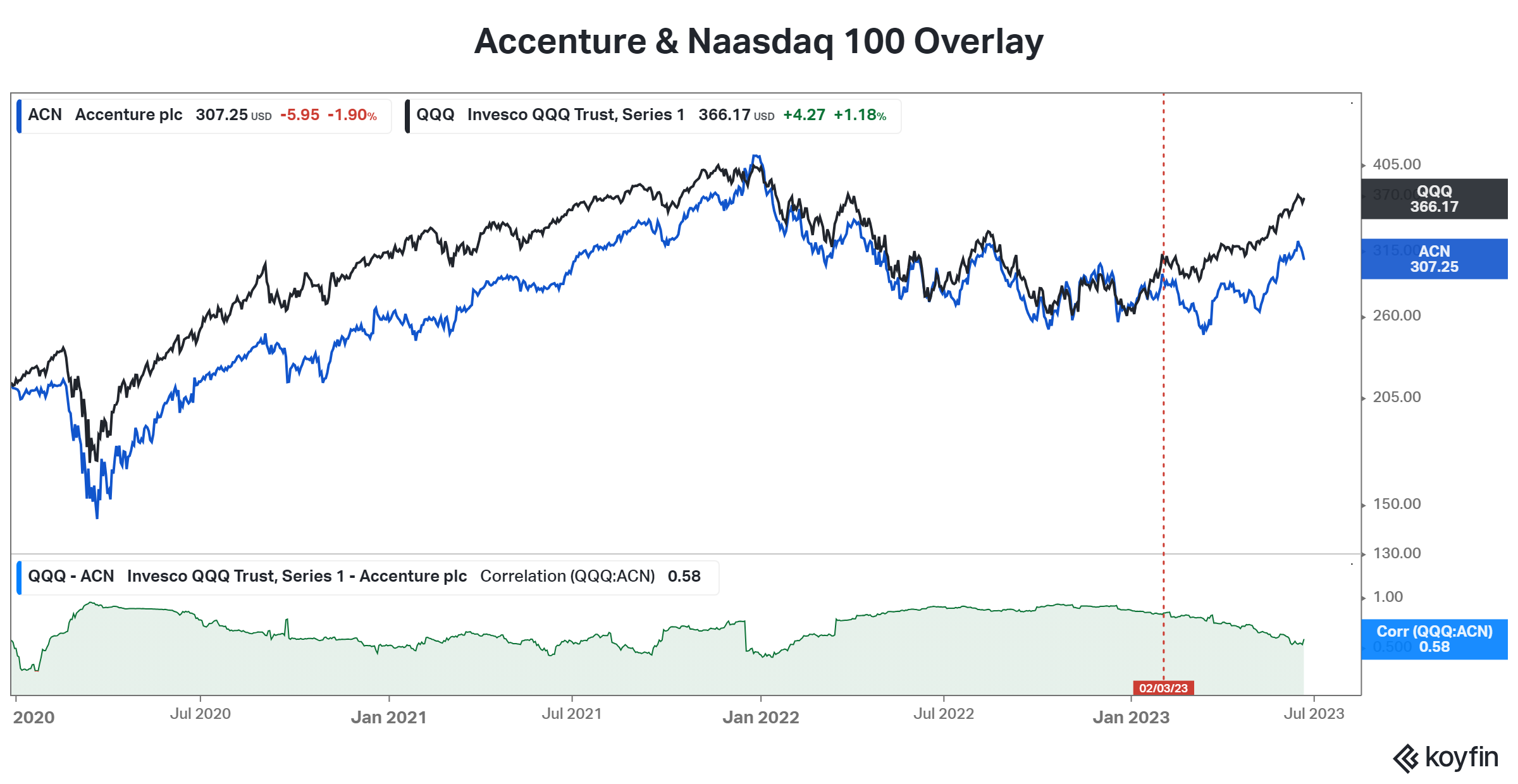

Accenture Lags The Tech Rebound

Technology consulting firm Accenture is falling again today despite better-than-expected quarterly results. ☹️

Its adjusted third-quarter earnings per share of $3.19 came on $16.56 billion in revenue. Those topped the $3.01 and $16.49 billion expected. However, its outlook is where things fell apart.

Executives lowered their fiscal 2023 revenue growth range from 8%-10% to 8%-9%. They also anticipate current-quarter revenue of $15.75 to $16.35 billion, which trailed the $16.35 billion consensus estimate.

They blamed weakness in the tech, media, and communication industries, where revenue fell 8% YoY in the recent quarter. The company’s largest market, North America, also saw revenue growth slow to a three-year low of 2%. 🔻

Unfortunately, artificial intelligence (AI) won’t give the company a boost anytime soon. Accenture CEO Julie Sweet said she doesn’t expect generative AI to be a significant growth driver next year. Instead, the firm is focused on companies finishing their migrations to the cloud, as there’s so much digital transformation work left to do in the market. 🤖

Clearly, investors are concerned about a continued slowdown in tech spending. However…what’s interesting is the divergence that’s formed between $ACN shares and the tech-heavy Nasdaq 100 ETF $QQQ.

Below is an overlay chart showing a strong positive correlation since early 2020. However, that relationship broke down in February and has since seen Accenture lag the broader tech sector. Part of that could be explained by the largest five or ten tech stocks pulling the Nasdaq 100 higher.

Nonetheless, it’s an interesting relationship to keep an eye on as it begs whether the market is too optimistic about tech as a whole. Or if Accenture and other service providers to the industry are being too cautious. We’ll have to wait and see. 🤷

Commodities

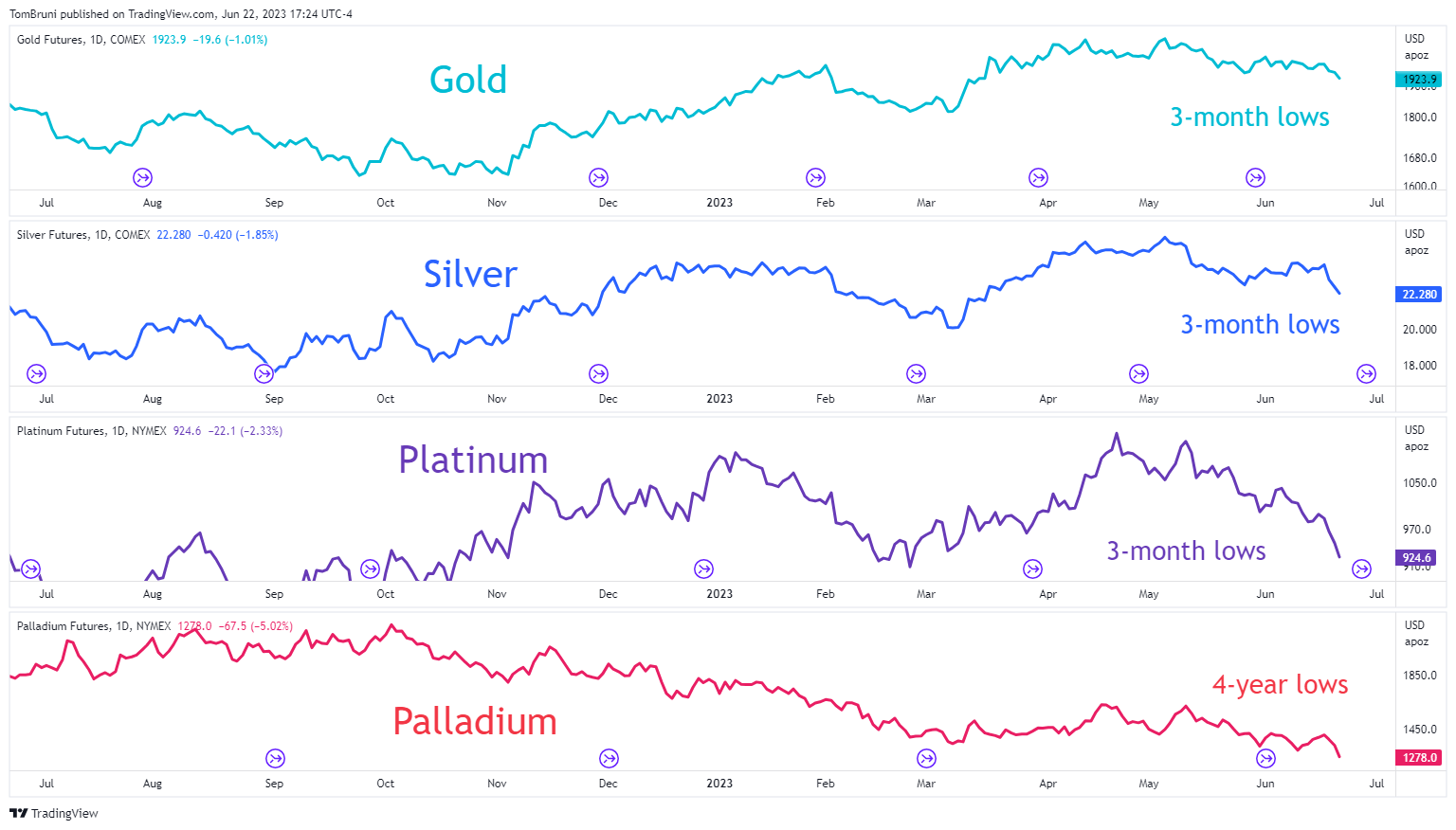

Precious Metals Slowly Melt Lower

With the stock market catching its breath before a new earnings season begins, we’ve been trying to highlight other market trends. And right now, one of those is in the precious metals section of the commodities space. 👀

Gold, silver, platinum, and palladium are all considered precious metals for those unfamiliar. These metals are rare, naturally occurring metallic chemical elements of high economic value…hence the name. *cue the Gollum “my precious” meme.*

While these are all important for economic purposes…making their way into technology, consumer goods like jewelry, and elsewhere, they’re not like base metals copper, nickel, aluminum, etc., that primarily serve an industrial need. 💍

In the investment world, they’re often included in people’s portfolios as an “inflation” or “end of the world” hedge. As a real asset, the theory is that these physical goods of high value should go up in value during times of economic uncertainty or high inflation. That theory, while logical, doesn’t always hold up when looking at the data. However, it’s still a core investment pitched to investors, professional and retail alike. 🪙

So why are we talking about precious metals today? Some investors in the community have recently highlighted the slowly declining price action over the last few weeks.

Below is an overlay chart of gold, silver, platinum, and palladium. As we can see, gold has held up the best but is still hitting three-month lows, along with silver and platinum. Meanwhile, palladium made fresh four-year lows this week. 👇

Now this doesn’t necessarily imply that prices will continue lower. But with inflation coming down and a lot of the economic uncertainty being removed from the market recently, it’s not surprising to see these tangible assets start to move lower. 🔻

The current backdrop is causing many investors to rethink where this group could be heading in the short to medium term. As such, this chart will undoubtedly be on investors’ radars as we head into the second half of 2023.

As always, we’ll keep you updated on how this short-term trend develops. But for now, traders in the community are bracing for a test of those March lows. 😬

Bullets

Bullets From The Day:

💰 Vice Media is set to be acquired by a big-name consortium. A group of the struggling media company’s lenders will acquire it out of Chapter 11 bankruptcy for $225 million. The group led by Fortress Investment Group, Soros Fund Management, and Monroe Capital beat out multiple offers, ultimately canceling today’s auction for the company. The consortium beat out competitor GoDigital, which said its bid was significantly higher. It also included a plan with real, renewed leadership, expertise, and investment to create a profitable Vice within a year. Deadline has more.

🤖 AWS launches $100 million generative AI funding program. Amazon Web Services will already benefit bigly from the artificial intelligence (AI) race, as demand for their services will undoubtedly rise alongside its competitors. However, it’s looking to grab more of the AI pie by creating the AWS Generative AI Innovation Center. The program will use $100 million to connect AWS-affiliated stakeholders to accelerate enterprise innovation and success with generative AI. The head of this initiative clarified the money will specifically fund “people, technology, and processes” around generative AI…which is still vague. Ultimately we’ll have to wait and see. More from TechCrunch.

💳 Robinhood eyes the credit card business with a $95 million acquisition. The retail brokerage continues to build itself out as a full-service brokerage, pivoting away from its original transaction-based business model. Today it announced the acquisition of X1, which offers an income-based credit card with rewards and has raised $62 million in funding since its 2020 inception. It adds to its portfolio of consumer-focused products, expanding its interchange fees from its current debit card offering into the credit card business. X1’s co-founders will oversee the new business for Robinhood. Yahoo Finance has more.

👩💼 TikTok’s losing its chief operating officer (COO). After five years in the position, V. Pappas informed staff today that they will no longer work as COO of the company, saying they believe the “time is right to move on and refocus.” Pappas was effectively the U.S. face of the company, making announcements and speaking about its upcoming strategy and programming. However, CEO Shou Zi Chew began taking a more public role as TikTok faced pressure from Western governments to cut ties with its Chinese parent company over data privacy concerns. More from The Verge.

🔋 Ford receives a $9.2 billion loan from the U.S. government to boost battery production. The automaker will receive the single largest loan in the history of the Department of Energy’s (DOE) Loan Program Office. It will use the funds to build three new battery factories in collaboration with SK Innovation, generating 129 GWh of battery cells annually. These projects will play a critical role in the company scaling its EV business, which it hopes will produce two million vehicles annually by 2026. It also reiterates the government’s commitment to supporting and rewarding U.S.-based initiatives. Electrek has more.

Links That Don’t Suck:

🛬 FedEx to shut down 29 more aircraft as demand shrinks

🥋 Mark Zuckerberg is ready to fight Elon Musk in a cage match

🛸 Lean green flying machines take wing in Paris, heralding transport revolution

📻 Pilot, crew of Titan submersible believed to be dead, expedition company says

📧 SEC fines JPMorgan subsidiary for deleting 47 million emails, some related to subpoenas

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.