U.S. 30-year yields jumped to new year-to-date highs as cyclical stocks like Caterpillar rose on earnings. Meme stocks continue to run, causing many to question if the market’s rally is overdone. Let’s see what else you missed. 👀

Today’s issue covers the meme stock mania, the tale of travel stocks, and Caterpillar breaking out to all-time highs. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Industrials (+0.33%) led, and utilities (-1.24%) lagged. 💚

The U.S. JOLTs report showed that job openings fell to 9.58 million in June, with 1.6 per available worker. Layoffs fell marginally, and quits fell by a notable 300,000 as the thawing of a historically strong labor market slowly continues. Meanwhile, the ISM manufacturing index remained in contraction territory for the ninth straight month. 🔻

Internationally, the Reserve Bank of Australia held interest rates at 4.1% for the second month but did not take more tightening off the table. And speaking of interest rates, the U.S.’s credit rating was downgraded to AA+ from AAA by Fitch, sending the stock market lower after hours. ⏯️

Nikola shares jumped 17% after the electric-vehicle maker announced a deal to sell trucks to J.B. Hunt Transport Services and won a $16.3 million grant to support seven hydrogen refueling stations under its Hyla brand. ⚡

TG Therapeutics shares plummeted 50% after the biopharmaceutical company’s earnings and revenue fell short of expectations. Analysts had expected better results from the first full reporting period since the FDA approved its multiple sclerosis treatment Briumvi. 💊

ZoomInfo Technologies dropped 27% to fresh all-time lows after the software and data company cut its full-year earnings and revenue outlook. ✂️

And IPG Photonics and Zebra Technologies both fell 17% after reporting worse-than-anticipated quarterly results. 📉

Other symbols active on the streams included: $NIO (-4.38%), $MULN (-0.46%), $PLTR (+0.76%), $LKNCY (+13.24%), $SOFI (-9.61%), $MANU (-8.57%), $TTOO (+6.78%), and $SNMP (+36.99%). 🔥

Here are the closing prices:

| S&P 500 | 4,577 | -0.27% |

| Nasdaq | 14,284 | -0.43% |

| Russell 2000 | 1,994 | -0.45% |

| Dow Jones | 35,631 | +0.20% |

Earnings

All Eyes On AMD As CAT Jumps

While investors remain focused on the technology sector, industrials and other cyclical stocks continue to break out. The big question remains whether the economy will perform as the consensus “soft landing” view believes. But the market is certainly positioning itself as if it will. 🤔

Check out the popular long-term treasury ETF $TLT hitting fresh year-to-date lows today. Although the Fed Fund Futures market still isn’t pricing in another hike before the end of the year, the rest of the bond market seems to be getting comfortable with the fact that rates may need to head higher (and stay there longer).

After nine months of consolidating, some traders believe this chart signals the start of U.S. interest rates next leg higher. 📈

Meanwhile, industrial giant Caterpillar ($CAT) soared 9% to all-time highs following earnings. 🐛

The company topped expectations, reporting adjusted earnings per share of $5.55 on revenues of $17.3 billion. Analysts had expected $4.57 per share on $16.5 billion in revenues. Executives saw strength across all three of their construction, mining, and energy-related businesses, with profit margins improving from 13.8% to 21.3% YoY. 🔺

For as much as the headlines say investors are anticipating a recession and a slowing economy, they’re certainly not investing like that. Today’s breakout in Caterpillar is certainly putting the recent strength in cyclical stocks back on everyone’s radars.

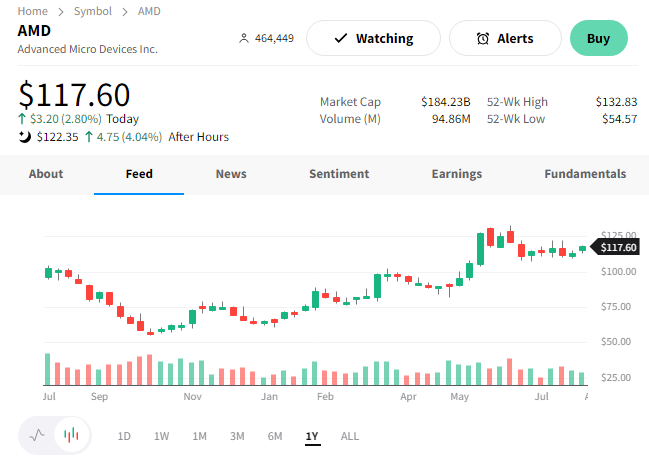

And over in technology land, Advanced Micro Devices reported slightly better results. 👍

The semiconductor company reported adjusted earnings per share of $0.58, topping estimates by $0.01. Revenues of $5.36 billion also exceeded the $5.30 billion consensus view.

With client PC business, data-center, and gaming business units revenue all down YoY, the company is looking ahead to artificial intelligence (AI) opportunities. Similar to its peers, the focus on higher-end chips remains as the PC and gaming market supply vs. demand dynamics rebalance. 🤖

$AMD shares rose above 4% after the bell.

Stocks

Meme Stock Mania Continues

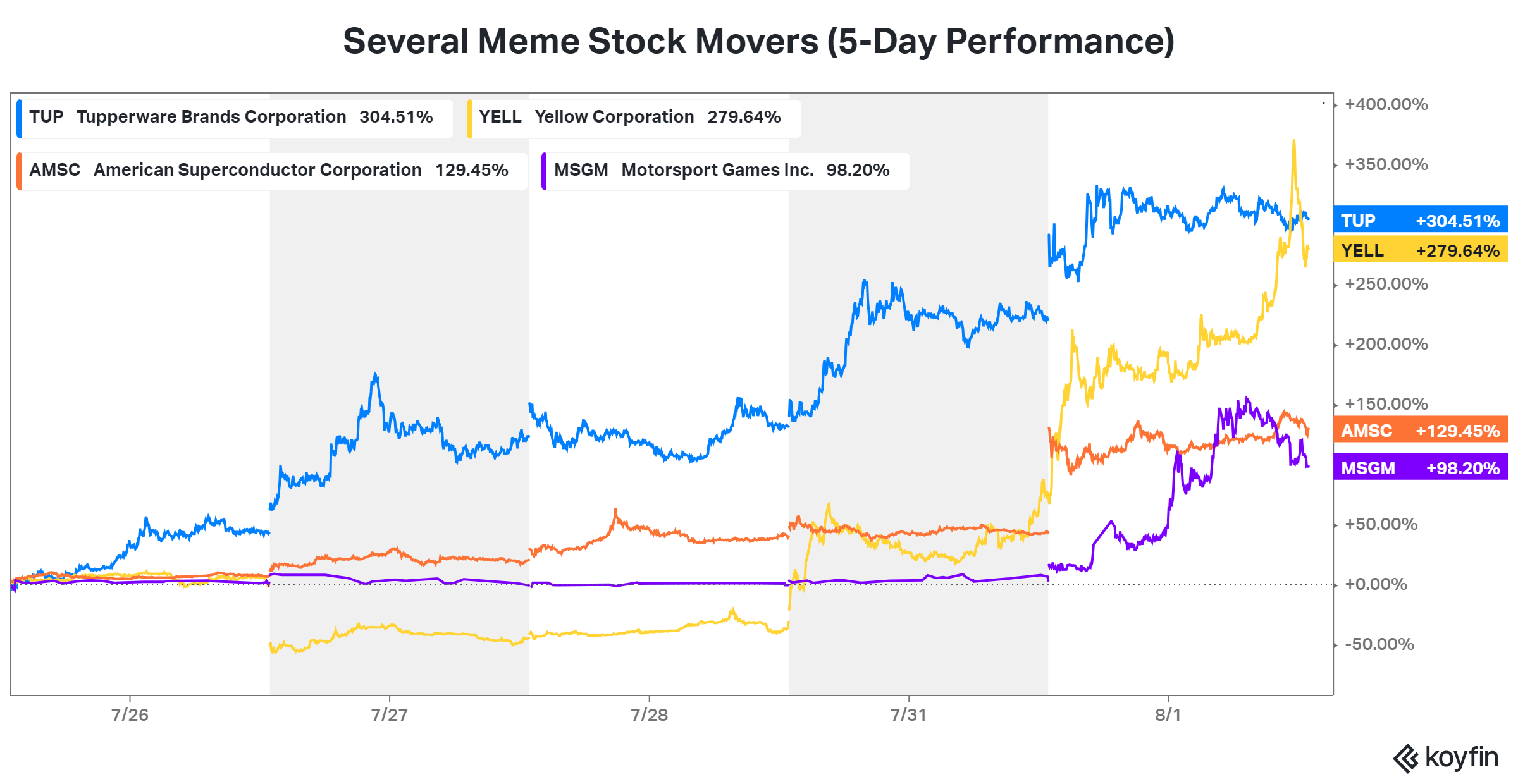

After nine months of rallying, it’s safe to say that animal spirits are back. And with that bullish sentiment comes speculative fervor taking place in several names. 🐂

Most notable is Tupperware Brands, which has rallied nearly 900% from its lows set two weeks ago. The stock is squeezing on seemingly no news, and it’s still unclear when the company plans to file its delayed annual and quarterly reports. And yet, with short interest above 20% of its outstanding float, a short-covering rally is underway.

Similarly, other names are following suit. Like the 99-year-old trucking company Yellow Corporation, which just filed for bankruptcy protection and shut down its operations. And others, like American Superconductor Corporation and Motorsport Games Inc., recently joined the party. 📈

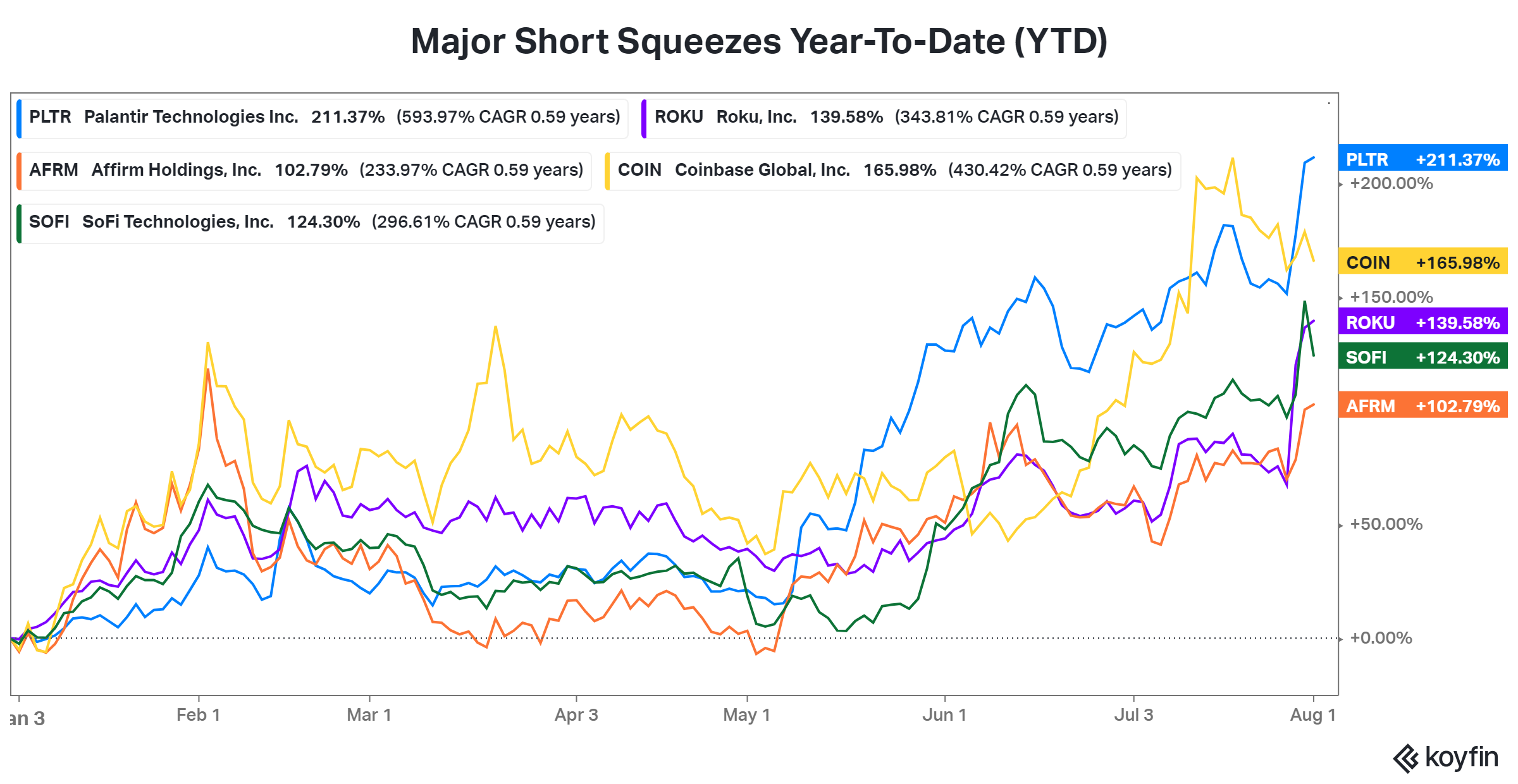

In addition to this, there have been continuing short squeezes in many beaten-down growth stocks. Some names include Palantir, Affirm, SoFi, and Coinbase, which investors apparently got too negative on late last year. 😮

The classic meme-stock playbook is the same as it has always been: Traders identify a somewhat well-known or iconic brand that’s got a lot of people betting against it ahead of a catalyst. And once prices get going, the trend feeds on itself because traders thrive on volatility. When that stock stops heading in the right direction, they move on to the next. ⏭️

Everyone’s question now is when it will end. Some are pointing to today’s mainstream coverage by Jim Cramer as a sign that the Tupperware rally could be coming to an end. Others suggest it will simply add more fuel to the fire. 🤷

Memesters: tonight it's all you: Tupperware!

— Jim Cramer (@jimcramer) August 1, 2023

I get Tupperware.. but Yellow? give me a break

— Jim Cramer (@jimcramer) August 1, 2023

The craziness will end eventually; it always does. But for now, meme stocks be memeing. 🙃

Earnings

The Tale Of Travel Stocks

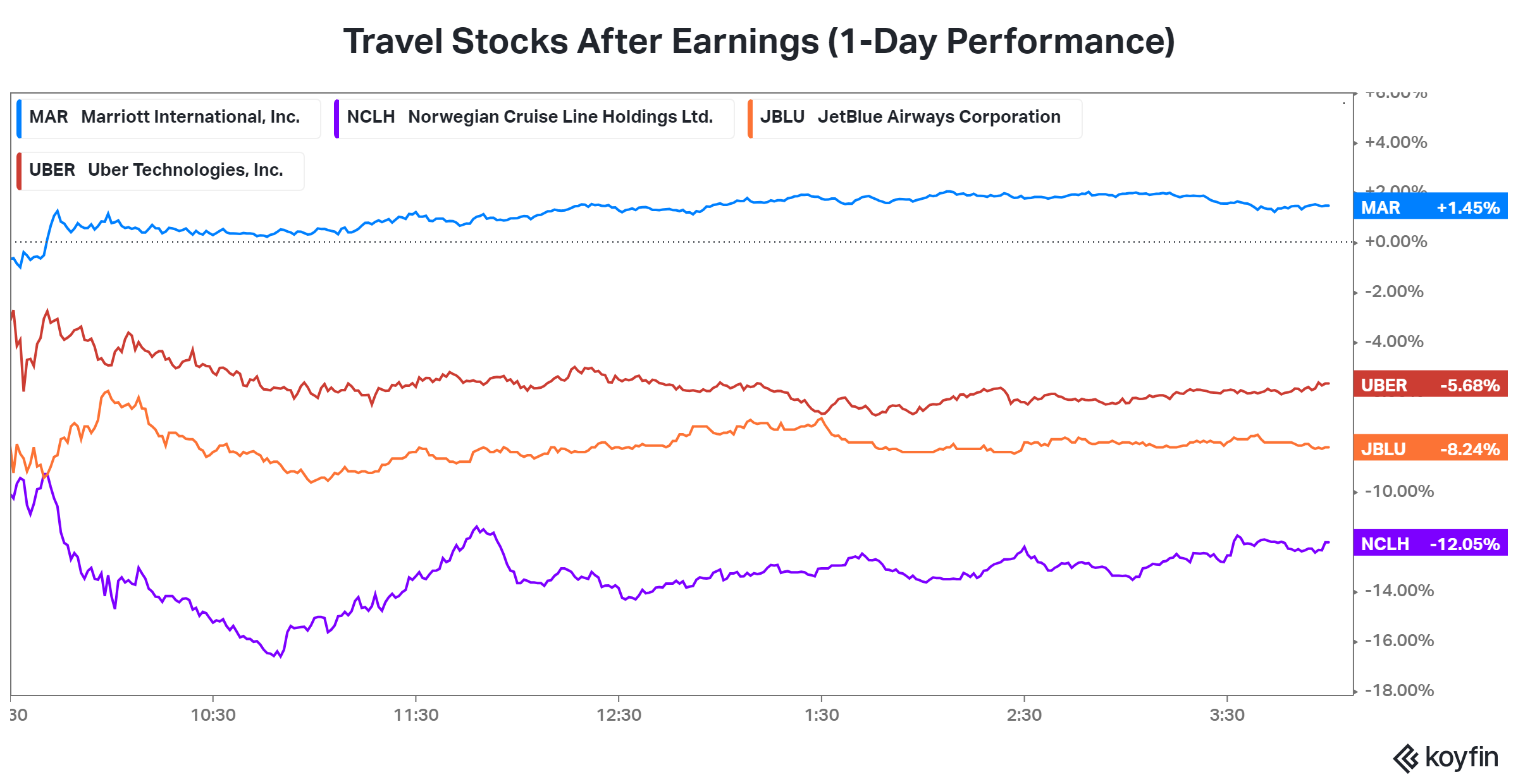

It remains a mixed bag for travel stocks this earnings season, with several big players reporting today. Let’s recap a few. 👇

JetBlue Airways fell 8% after saying it doesn’t expect to post a profit during the third quarter, cutting its full-year earnings guidance from $0.70-$1.00 to $0.05-$0.40. Its second-quarter earnings and revenue were essentially in line with expectations and at the top of the company’s previous guidance. ✈️

Consumers shifting their leisure travel from domestic to international weighed on its results, as well as company-specific issues like ending its Northeast partnership with American Airlines.

Norwegian Cruise Lines faced a similar issue, delivering strong second-quarter results but whiffing with its third-quarter guidance. The cruise operator now expects $0.70 per share in earnings, missing the $0.80 consensus estimate in what’s typically its strongest period of the year. 🚢

Uber shares initially popped, then dropped after its second-quarter earnings report. Revenues of $9.23 billion missed expectations by $0.10 billion. Notably, the company earned its first GAAP profit of $0.18 vs. the expected $0.01 per share loss. However, when looking under the surface, nearly all of that was due to a $385 million pre-tax benefit from unrealized equity investment gains. 🚗

Mobility gross bookings again topped delivery, and the company’s freight business remains challenging amid weak goods demand.

Marriott International had the best day, with shares rising to new all-time highs after earnings. Its second-quarter results topped expectations due to international strength, causing the hotel operator to raise its full-year outlook. 🏨

Overall, many of these travel stocks have rallied sharply this year, raising the bar for what investors expect from their businesses. Investors’ primary concern remains how much better these businesses can perform, especially given concerns consumer spending will eventually wane. Time will tell. 🤷

Bullets

Bullets From The Day:

🪧 Walmart plans in-store advertising as it chases higher-margin businesses. The big box retailer’s shoppers may soon see more third-party ads on screens in self-checkout lanes and TV aisles, hear sports over the store’s radio, and be able to sample items at demo stations. It’s interesting because retailers have a unique opportunity to offer targeted ads but don’t want to do so at the expense of annoying their shoppers. CNBC has more.

🛒 Overstock revives Bed Bath & Beyond brand. Less than two days after its remaining brick-and-mortar stores shuttered, the Bed Bath & Beyond brand is back online. Overstock.com has officially transformed itself after buying the bankrupt brand name and website for $21.5 million, as the company bets the move could help drive traffic to its online store. While the name will survive online, CEO Jonathan Johnson says physical stores will not be returning. More from Axios.

🧑⚕️ Amazon adds video telemedicine to its virtual clinic offering. The retailer adds the service in all 50 states as it delves further into the care delivery business. Virtual care exploded in popularity during the COVID-19 pandemic but has remained a convenient way to check in with a doctor or deal with minor health issues that don’t require an office visit. Overall, Amazon’s program looks to remove barriers and help treat people with everyday health concerns affordably. ABC News has more.

🤖 Meta’s launching AI ‘personas’ across all of its apps. The company says its artificial intelligence (AI)-powered characters could provide features like search or recommendations as users interact with their products. The launch could help boost engagement with its services and display Meta’s AI capabilities as it competes with OpenAI, Bard, and other competitors. More from TheVerge.

🍔 World’s biggest individual YouTuber runs into issues with his burger brand. Jimmy “MrBeast” Donaldson, known for his philanthropy and giveaway content, is going after the company behind his fast food chain, MrBeast Burger. He claims that Virtual Dining Concepts is hurting his brand and reputation by serving a subpar product out of its ghost kitchens. From a business perspective, it highlights one of the many challenges of content creators using their likeness to expand into other products and services. BBC News has more.

Links

Links That Don’t Suck:

🚫 What you need to know about the incandescent light bulb ban

🎢 $10M gravy-themed coaster planned for Holiday World & Splashin’ Safari

❌ Judge rejects motion to dismiss Terraform case, disagrees with Ripple decision

🍩 Everyone’s a winner: Krispy Kreme offers free doughnuts for losing lottery tickets