After nine months of rallying, it’s safe to say that animal spirits are back. And with that bullish sentiment comes speculative fervor taking place in several names. 🐂

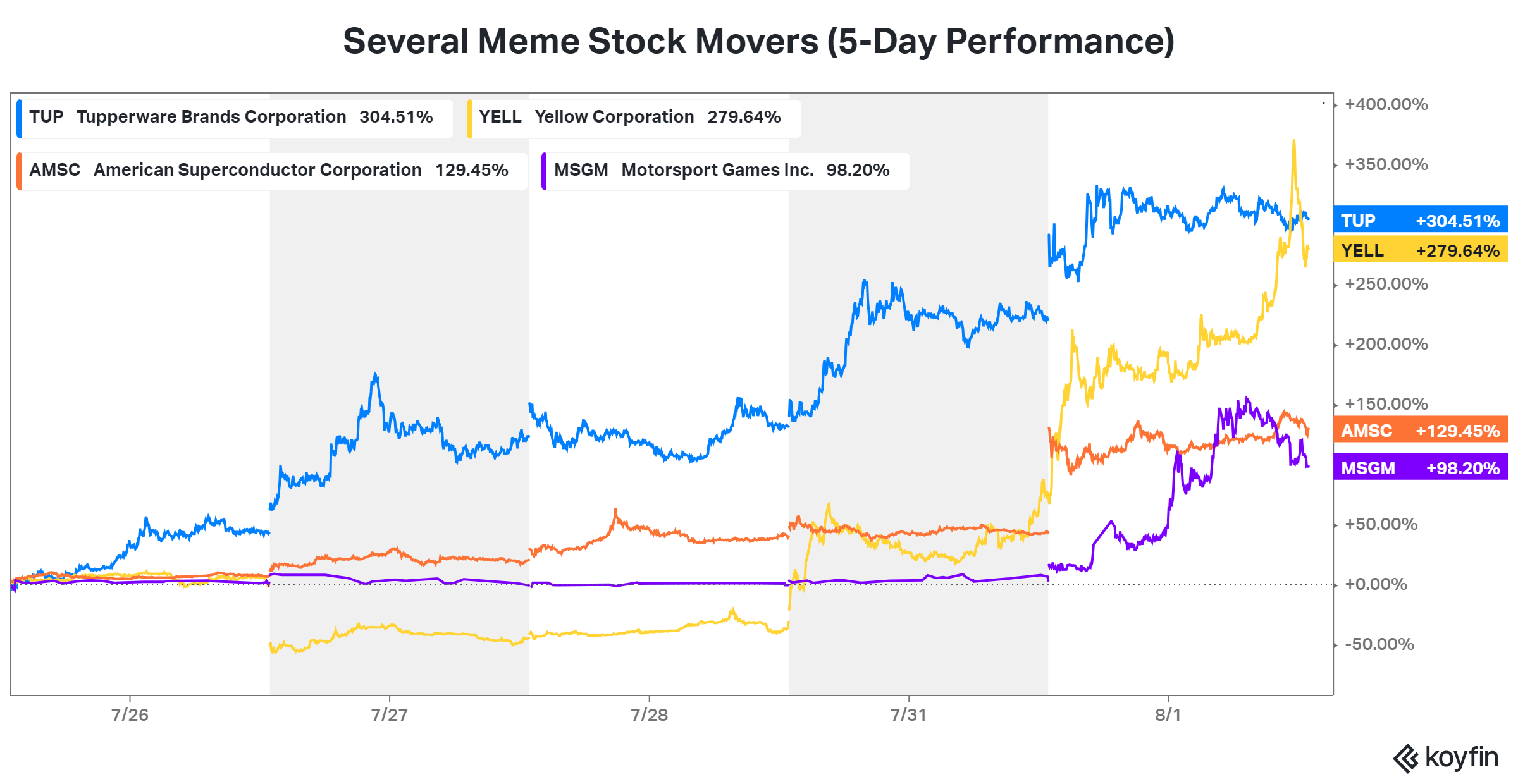

Most notable is Tupperware Brands, which has rallied nearly 900% from its lows set two weeks ago. The stock is squeezing on seemingly no news, and it’s still unclear when the company plans to file its delayed annual and quarterly reports. And yet, with short interest above 20% of its outstanding float, a short-covering rally is underway.

Similarly, other names are following suit. Like the 99-year-old trucking company Yellow Corporation, which just filed for bankruptcy protection and shut down its operations. And others, like American Superconductor Corporation and Motorsport Games Inc., recently joined the party. 📈

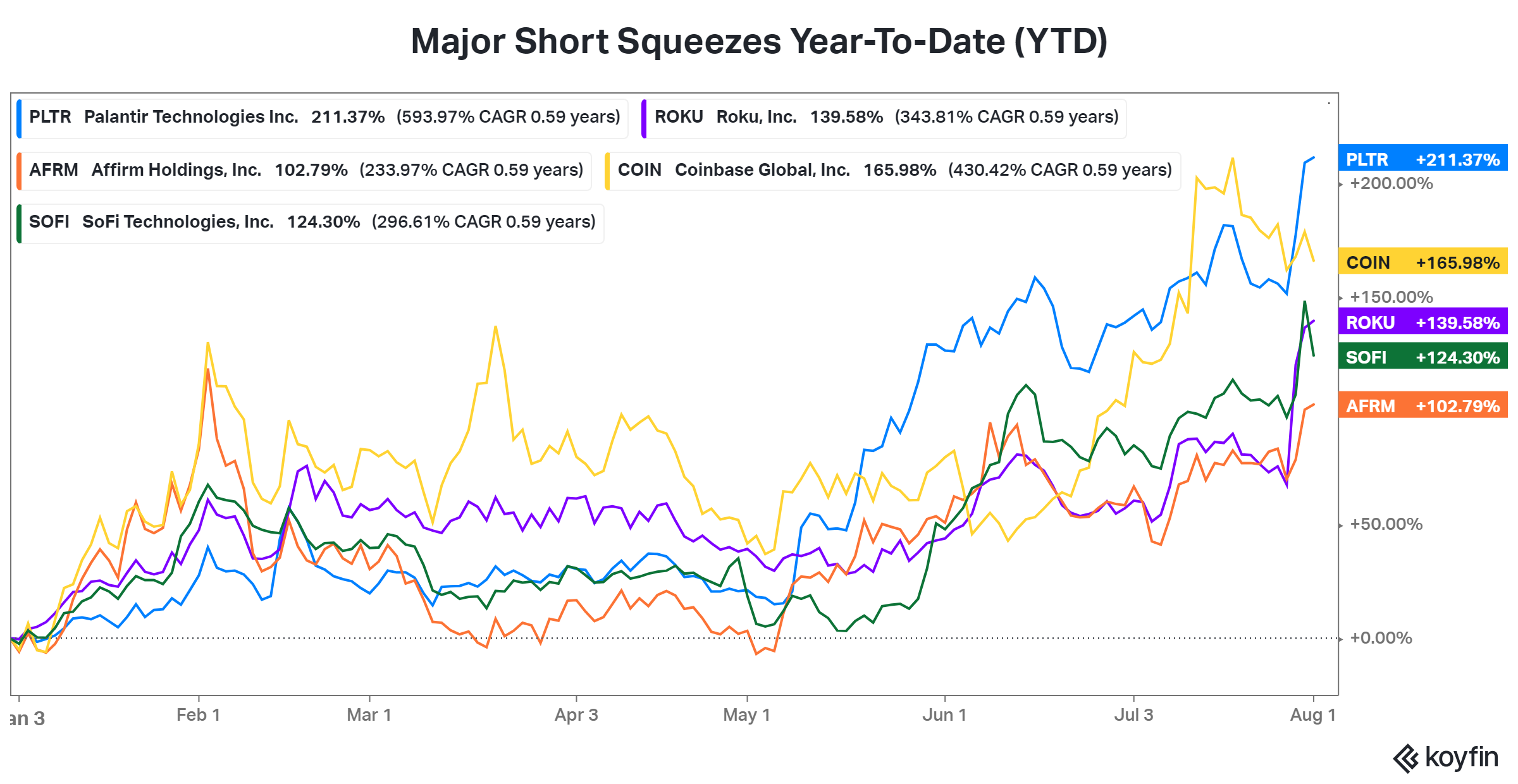

In addition to this, there have been continuing short squeezes in many beaten-down growth stocks. Some names include Palantir, Affirm, SoFi, and Coinbase, which investors apparently got too negative on late last year. 😮

The classic meme-stock playbook is the same as it has always been: Traders identify a somewhat well-known or iconic brand that’s got a lot of people betting against it ahead of a catalyst. And once prices get going, the trend feeds on itself because traders thrive on volatility. When that stock stops heading in the right direction, they move on to the next. ⏭️

Everyone’s question now is when it will end. Some are pointing to today’s mainstream coverage by Jim Cramer as a sign that the Tupperware rally could be coming to an end. Others suggest it will simply add more fuel to the fire. 🤷

Memesters: tonight it's all you: Tupperware!

— Jim Cramer (@jimcramer) August 1, 2023

I get Tupperware.. but Yellow? give me a break

— Jim Cramer (@jimcramer) August 1, 2023

The craziness will end eventually; it always does. But for now, meme stocks be memeing. 🙃