It was a throwback day in the market, with the original meme stocks and COVID players back in the news for various reasons. Meanwhile, the major indices continued their slow drip lower as investors prep their portfolios for year-end. Let’s see what else you missed. 👀

Today’s issue covers the “original” meme stocks back in the news, restaurant stocks’ potential warning about consumers, and a COVID darling needing new tricks. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Utilities (+0.18%) led, and technology (-1.08%) lagged. 💚

ISM services PMI jumped to 54.5 in August, showing resilience in the services sector of the economy. Mortgage demand fell to a 27-year low as thirty-year mortgage rates remain comfortably above 7%. And the Bank of Canada left interest rates at 5% as it continues to monitor inflation’s descent. 🏭

After warning about higher fuel costs, airlines came under pressure today, as prices have jumped about 30% since early July. Southwest Airlines narrowed its revenue outlook for this quarter as international travel continues to outweigh domestic travel. 🛬

Apple shares fell 4% on news that China banned iPhone use for government officials at work. While it may seem like a small segment of the company’s market, fears are the government could introduce further restrictions as it reduces reliance on overseas technologies. 📵

Roku shares popped 3% after announcing it will lay off another 10% of its employees, reduce the use of some office facilities, and remove certain content from the platform to cut costs. ✂️

Dominion Energy is selling several of its natural gas distribution companies to Enbridge for $9.4 billion, causing both stocks to extend their recent declines. 💰

Shares of unmanned aircraft systems company AeroVironment soared 21% after its fiscal first-quarter earnings and revenues topped expectations. 😮

WeWork shares fell to new all-time lows despite its CEO saying the company is ‘here to stay’ and renegotiating most of its real estate leases. 🏢

Other symbols active on the streams: $AI (+0.15%), $TTOO (-13.04%), $MULN (-8.12%), $CHPT (-14.26%), $EZGO (-82.95%), $CGC (+17.27%), $NVOS (-0.68%), and $GNS (-14.88%). 🔥

Here are the closing prices:

| S&P 500 | 4,465 | -0.70% |

| Nasdaq | 13,872 | -1.06% |

| Russell 2000 | 1,874 | -0.33% |

| Dow Jones | 34,443 | -0.57% |

Company News

Original “Meme Stocks” Back In News

Almost as if we had taken a time machine back two years, AMC, Gamestop, and Bed Bath & Beyond popped back up in the news today. But not for great reasons. 🙃

First, we’ll start with AMC Entertainment. Last week, the company completed three efforts to pave the way for issuing new shares of stock: a 10-for-1 reverse split, converting $APE units into $AMC shares, and paying out a shareholder lawsuit settlement. And it’s wasting no time getting started.

Just three weeks after getting court approvals to complete all of those actions, the company filed a new prospectus to sell up to 40 million shares of common stock. 💰

The filing said the proceeds will be used to improve liquidity and refinance and repay loans. With $9.5 billion of debt and lease obligations and business operations that are still below pre-pandemic levels, the company has little choice but to raise funds by diluting shareholders further. 🤷

Given investors have experienced significant losses investing in the company, its filing cautioned them against buying new shares. Bolded font in the risk factors section states, “…Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.” ⚠️

Although largely expected, the news still sent $AMC shares down sharply on the day. Shares closed down 37% at new all-time lows. 📉

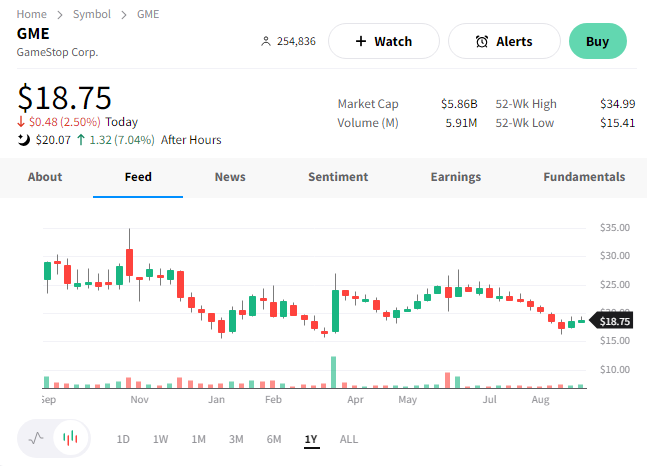

Meanwhile, GameStop experienced a wild after-hours session following its second-quarter results. An adjusted loss per share of $0.03 and revenue of $1.16 billion topped the $0.14 loss on $1.14 billion in revenues expected. 🎮

Driving the strength was a “significant software release” that helped drive software and collectible sales to 49% of total revenue during the quarter. However, the company didn’t provide any additional color on that and did not hold a conference call.

While investors are happy to see sales stabilizing and costs continuing to come down, questions remain about the company’s ability to drive sales growth. It can only cut costs so far, so eventually, it will need to grow sales to deliver earnings growth. But, its shift towards a more online model has been slow, with many leadership transitions in the process. 🐌

After an initial pop of 12%, $GME shares are up 7% after hours as investors process the news. 📈

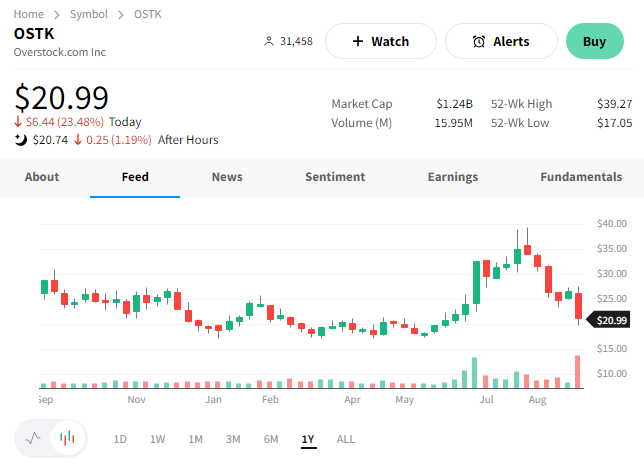

And Overstock.com’s attempt to revive the online portion of Bed Bath & Beyond’s business is off to a rough start. 😬

The company said sales have seen a mid-teen percentage YoY decline so far in Q3. That also includes a low double-digit percentage decline since its new website launched on August 1st. However, executives remain optimistic and say the company’s top-line performance is improving steadily.

$OSTK shares fell 24% on the news as investors remain wary of the longer-term strategy. 😰

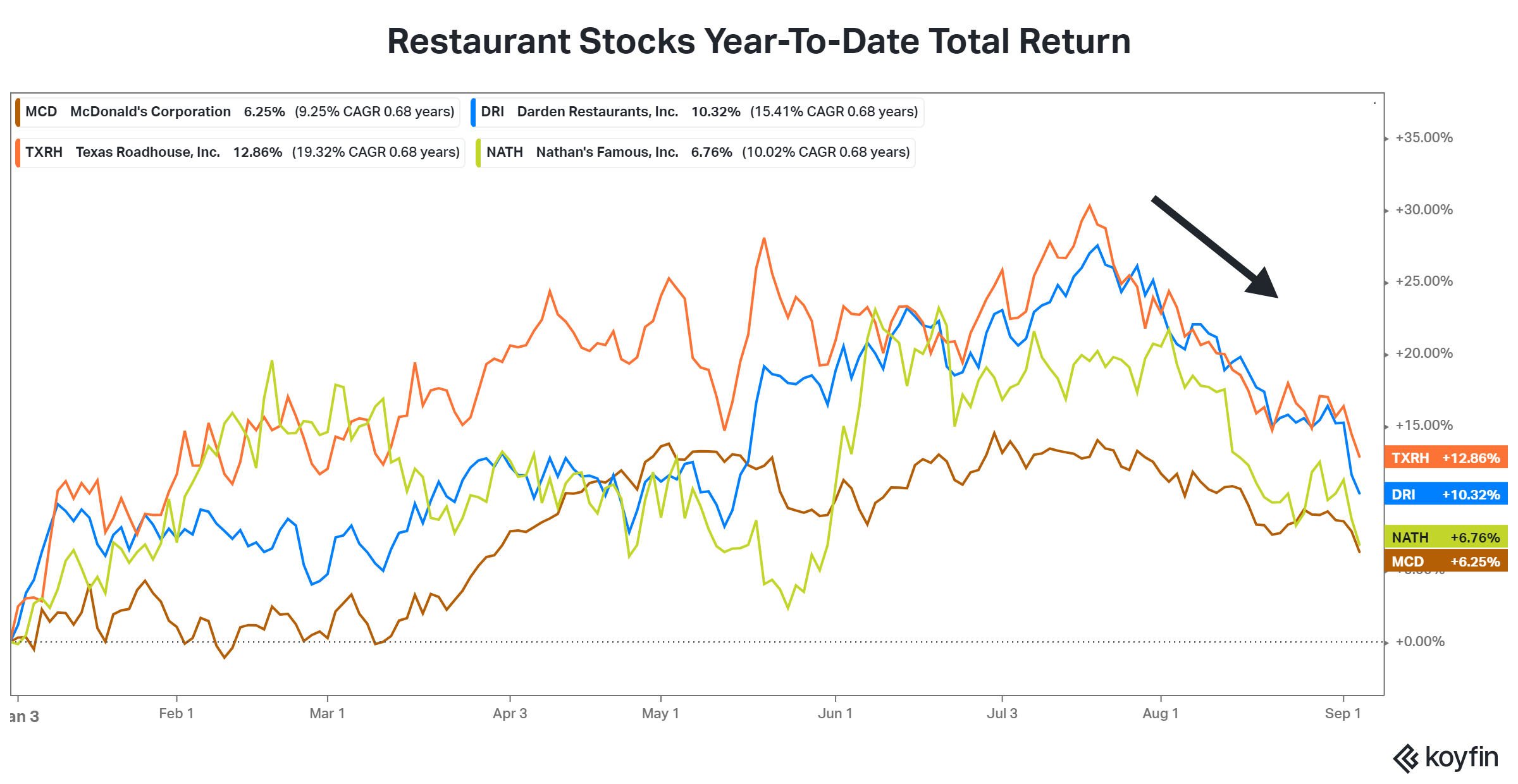

Restaurants have outperformed the rest of the retail space for the last couple of years. Driving that strength was consumers getting out of their houses, shifting their discretionary spending from goods to experiences as they “revenge spent” their way back into the world. 💸

But now, as the job market weakens and student loan repayments begin, some analysts expect consumer spending to be impacted. That could hurt discretionary sectors across the board, especially if inflation remains elevated.

What does that mean for the restaurant industry? After significant outperformance from the group, one Wall Street analyst suggests it could be headed for rougher times ahead. ⚠️

Technician Carter Worth was on CNBC yesterday discussing the restaurant industry breaking down from a technical perspective. He pointed out that many prominent restaurant names like McDonald’s, Darden Restaurants, Texas Roadhouse, and others had peaked during the summer (July) and are now breaking their uptrend. 😰

He believes that the group’s relative underperformance is just beginning and that more weakness is likely ahead.

While Carter didn’t discuss the fundamentals potentially causing this move, it would make sense that the market is pricing in a slowdown at these companies as consumers’ discretionary income gets rebalanced. Wage growth is slowing, student loan bills are returning, and record-high prices for shelter and automobiles are placing significant pressure on people’s wallets. And when it’s time to cut back, unnecessary restaurant spending could be among the first budget items to go. ❌

We’ll have to wait and see if that’s the case. But for now, restaurant stocks are trading cautiously.

Company News

COVID Darling Needs New Tricks

Biotech giant Moderna exploded to the forefront of investors’ minds during the COVID-19 pandemic, playing a pivotal role in bringing the mRNA vaccine to life so quickly. 💉

Its role in the pandemic helped propel its market capitalization from under $10 billion in 2019 to nearly $200 billion at its peak. But as the U.S. and other countries moved past the pandemic’s peak and into a more normalized environment, it’s struggled to maintain that valuation.

Since peaking in 2021, its valuation has tumbled 80% to roughly $40 billion as investors look towards its next act. And nothing makes that more apparent than the stock’s reaction to news about the company’s updated COVID-19 vaccine for new variants of the virus. 🧫

Today, the company said its new vaccine generated a strong immune response against a highly mutated omicron variant, BA.2.86. Yet the stock barely budged on the news, instead continuing its recent decline. While this is good news from a scientific perspective, it’s unlikely to drive the significant growth investors are looking for. Thus, the market’s response was lackluster. 👎

For now, traders and investors are focused on the clear downtrend the stock remains stuck in. After breaking to multi-year lows in August, prices recently retested broken support near $117 and are now continuing lower. The stock’s 63-day moving average (in purple) also indicates its quarterly price trend remains lower.

Hopes are the company can use its mRNA technology to create vaccines and treatments for other significant diseases. But without a clear catalyst to change things, many are looking elsewhere for opportunities. As such, sellers remain in control for now. 🤷

Bullets

Bullets From The Day:

🏗️ Chinese property market remains volatile as Evergrande Group soars. The property developer’s shares jumped 70%, helping buoy Country Garden Holdings, Logan Group, and others in the industry. It comes after Country Garden narrowly avoided default on its dollar-denominated bonds by making $22.5 million in coupon payments. With that said, the payments were originally due in August but submitted hours before the 30-day grace period expired. The industry stress continues, but a shimmer of good news was enough to spark a rally. CNBC has more.

🔌 Startup looks to turn residential water heaters into “virtual power plants.” After spending nine years as a partner with Google Ventures and another three as California’s chief technology innovation officer, Rick Klau has co-founded a business looking to revolutionize the hot water heater. Unlike residential solar power, this idea wouldn’t create energy but allow utilities to better prepare for demand. At the same time, consumers would offset most of the cost of upgrading from gas to electric water heaters. More from Axios.

🗓️ Truth Social merger partner gets an extension to avoid liquidation. Digital World Acquisition Corp. (DWAC), the SPAC seeking to merge with former President Donald Trump’s media company, received another year to pull off its merger. Roughly 72% of stockholders approved the one-year extension, nearly two years after the SPAC deal was initially agreed on, drawing scrutiny from regulators and prosecutors alike. It’s the second approved extension, with the first last September. CNN Business has more.

🤝 Google tentatively settles U.S. antitrust probe over Play Store. The U.S. tech giant has tentatively settled with the alliance of attorneys general that filed a lawsuit in 2021 alleging it of abusing its dominance on Android app distribution through the Google Play store. Today, Bloomberg reported that the matter has been referred to a judge, who can confirm the settlement and cancel the courtroom battle. However, it’s worth noting that game developer Epic Games was not included in the proposed deal, with its trial set to begin November 6th. More from Engadget.

🖥️ YouTube is experimenting with less frequent but longer ads. The video-sharing and social media website is testing a new format that puts longer ads in the middle of the content rather than scattering them throughout the entire video. For now, this change is primarily being tested on its main app on connected TVs. Additionally, it’s experimenting with a more straightforward ad countdown timer to replace the current “video will play after ads” message. The Verge has more.

Links

Links That Don’t Suck:

📈 Start your FREE trial of Benzinga Pro today for fast news before major stock price spikes!*

🍺 Bill Gates made a nearly $100 million bet on Bud Light

👁️ Autism may be identified early with eye-tracking device, studies show

🎢 Disney’s wildest ride: Iger, Chapek and the making of an epic succession mess

🤑 Elon Musk borrowed $1 billion from SpaceX in same month of Twitter deal, The WSJ reports

🚗 U.S. steps toward forcing recall of 52 million air bag inflators that can explode and hurl shrapnel

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.