Earnings proved to be the catalyst bears needed to take out the market’s last remaining leaders, big tech. Weakness in the largest stocks pulled the major indexes lower while pockets of the market, like financials and real estate, tried to stabilize. Let’s see what else you missed. 👀

Today’s issue covers Amazon’s third-quarter earnings results, Siemens Energy seeking government support, and why some traders are looking for a small-cap bounce. 📰

Here’s today’s heat map:

3 of 11 sectors closed green. Real estate (+2.11%) led, & communication services (-2.18%) lagged. 💚

U.S. third-quarter GDP expanded at an annualized rate of 4.9%, driven by strength in consumer spending as a tight labor market keeps money in people’s wallets. Meanwhile, U.S. pending home sales stayed near record lows in September, down 13% YoY as low inventory and affordability keep the market suppressed. 🔺

Internationally, the European Central Bank ended its streak of ten consecutive hikes by holding rates steady at 4%, joining its developed market peers who have paused. And Turkey’s central bank raised rates from 30% to 35% as inflation rages on and its currency tumbles sharply. ⏯️

United Parcel Service fell 6% to a new 52-week low after beating on earnings, missing on revenues, and cutting its full-year revenue guidance. The transportation giant followed its peers in citing global economic uncertainty as the primary reason for continued weakness in volumes and pricing. For now, it continues to focus on cost-cutting, preparing for an uninspiring holiday season. 📦

Toymakers continue to struggle as investors worry about a recession’s impact on already lackluster discretionary goods spending. Hasbro fell 12% after both earnings and revenue missed expectations. Meanwhile, Mattel dipped 8% despite easily beating analyst estimates, driven by Barbie sales growing 16% YoY and Hot Wheels rising 22%. 📦

Altria fell 8% to nearly three-year lows after reporting declining revenue, blaming competition from illegal e-vapor products. Domestic cigarette shipment volume fell 11.6% YoY as the industry continues to face structural declines in demand. 🚬

Home appliance giant Whirpool saw shares go down the drain today, falling 16% to three-year lows after its full-year earnings guidance came in 1% below expectations. And Align Technologies plummeted 25% after its earnings and revenue missed expectations, with the medical device company also giving weak current-quarter guidance. ✂️

Other symbols active on the streams: $SOFI (-2.54%), $CPRX (+3.78%), $MULN (+19.70%), $DXCM (+11.26%), $ENPH (+1.94%), $CMG (+0.06%), and $INTC (+4.87%). 🔥

Here are the closing prices:

| S&P 500 | 4,137 | -1.18% |

| Nasdaq | 12,596 | -1.76% |

| Russell 2000 | 1,657 | +0.34% |

| Dow Jones | 32,784 | -0.76% |

Earnings

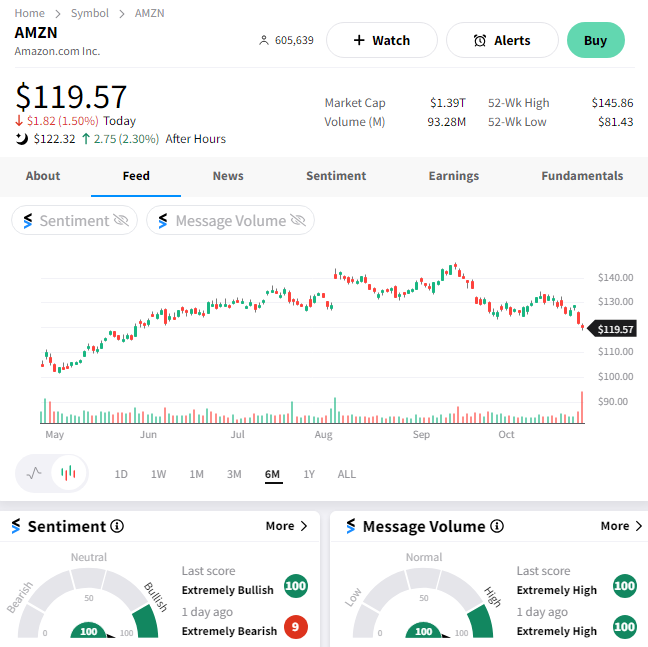

Amazon Delivers Cloud Miss

Amazon is the latest tech giant to report earnings, flailing wildly after the bell as investors digested mixed third-quarter results. 👀

The company’s adjusted earnings per share of $0.94 topped the $0.58 expected, as did revenues of $143.1 billion ($141.4 expected). Advertising was a bright spot, with revenues of $12.1 billion vs. estimates of $11.6 billion.

However, Amazon Web Services revenue of $23.1 billion missed expectations by $0.10 billion. Although the segment widened its operating profit margin, 12% revenue growth lagged Microsoft Azure’s 29% and Google Cloud’s 22%. Analysts are concerned the slowing revenue growth could signal market share loss to its largest competitors. 🔻

When asked by reporters whether the unit’s growth had bottomed in the current quarter, Amazon’s CFO responded, “I wouldn’t quite characterize it that way.” While its customers’ appetite for cloud services remains robust, there are several headwinds facing the entire sector right now. That could mean new work being pushed out to future quarters as companies navigate the economic uncertainty. However, during the earnings call, he “talked up” recent cloud business deal flow that should support fourth-quarter numbers. So, investors received mixed signals at best here. 🤷

The recovery in its core e-commerce business continued, with revenues rising 7% YoY vs. 4% last quarter. Promotional events like “Prime Day,” its “biggest ever” sale, were needed to spur consumer demand in the current environment. Although sales rose 13% YoY in the third quarter, executives’ forecast for fourth-quarter sales of $160 to $167 billion indicates roughly 10% growth. The midpoint of that range is also below analyst expectations of $166.6 billion. 👎

Additionally, Amazon remains focused on cost optimization as it navigates the slower growth environment. It’s laid off 27,000 employees over the last year, also closing down many of its unprofitable initiatives. ✂️

Given Amazon had sold off over the last few days, it was able to take the slowing cloud growth in stride. With that said, it’s clear that investors are focused primarily on that segment of the business, given e-commerce is expected to remain challenged, and advertising is still a smaller segment.

$AMZN shares are up 2% after the bell, offsetting regular-session losses. 🔺

Company News

Siemens Seeks Support

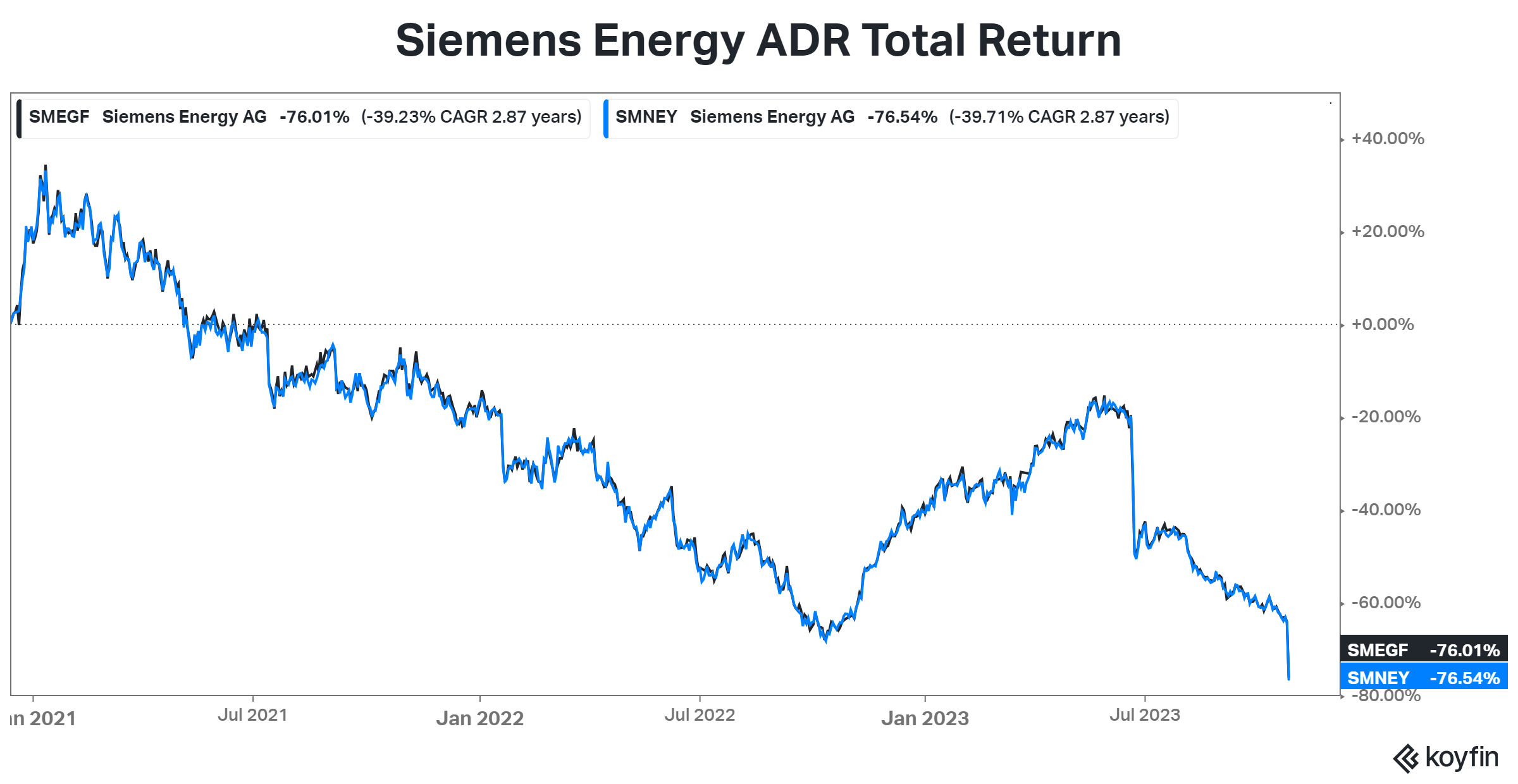

Roughly four months after we last discussed Siemens Energy, the company is back in the news. 📰

Before getting into today’s news, the energy giant made headlines in June after scrapping its profit forecast and warning that major setbacks at its wind turbine subsidiary (Siemens Gamesa) could last years. That sent shares tumbling 37% in about two days, also pressuring Siemens AG, which owns about 35% of the company.

Now, the stock has fallen another 35% after requesting guarantees from the government to continue its long-term projects. 🆘

Its statement said, “Considering this requirement, the Executive Board is evaluating various measures to strengthen the balance sheet of Siemens Energy and is in preliminary talks with different stakeholders, including banking partners and the German government, to ensure access to an increasing volume of guarantees necessary to facilitate the anticipated strong growth.”

Reports indicated that the company is looking for 15 billion euros in guarantees, but executives did not comment on the exact details. The market was a bit confused, however, since executives said they expect fiscal 2023 results to align with previous guidance. 🤔

The overall lack of clarity sent investors scrambling as the constant surprises erode confidence in management’s ability to turn this struggling ship around. The market will certainly receive more clarity during its fourth-quarter results on November 15th, but for now, it’s left to wonder about what new headwinds might emerge.

Both American Depositary Receipts (ADRs) tracking the stock fell to their lowest levels ever. 📉

Stocks

Small-Caps Attempt To Dig In

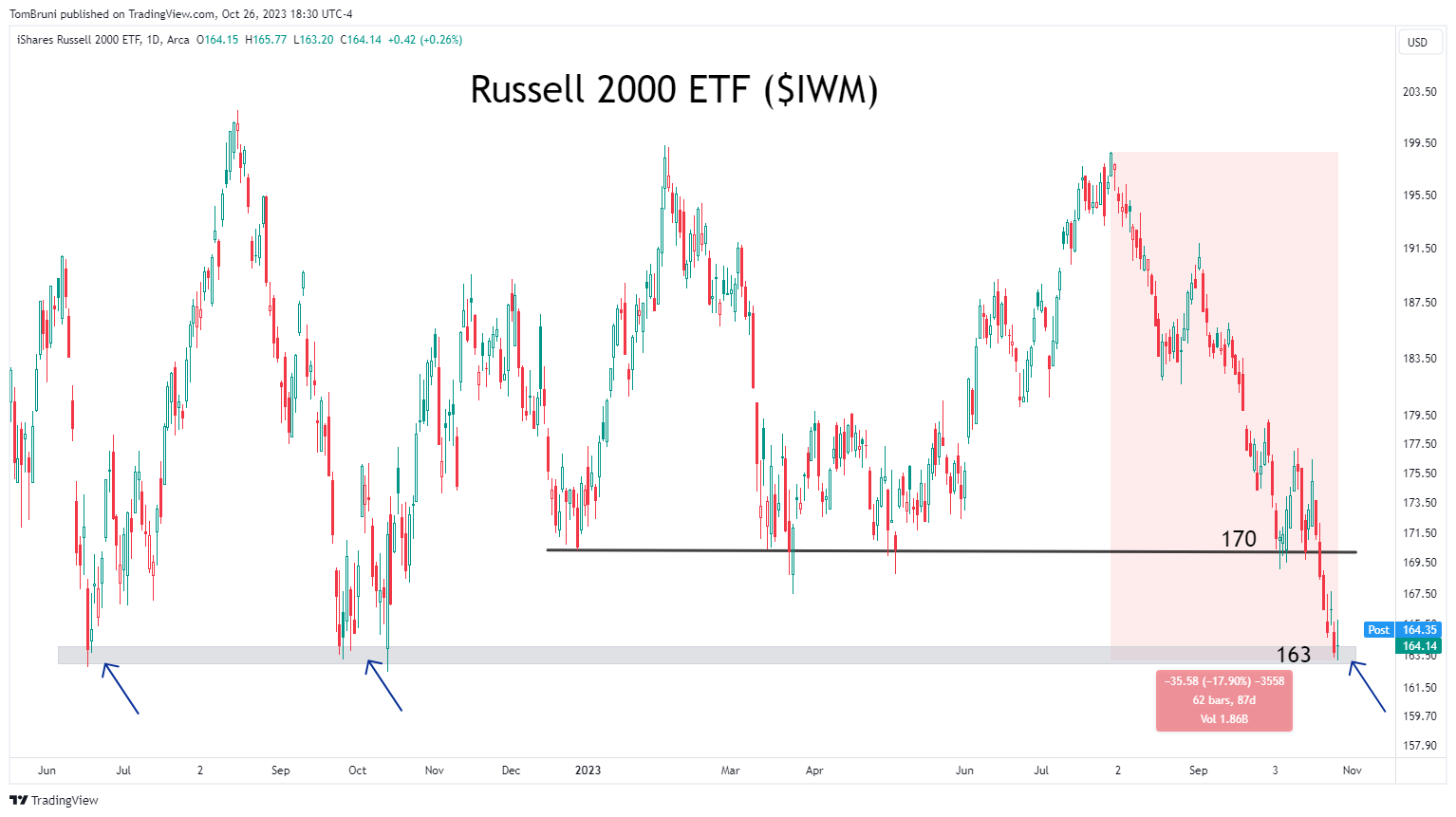

Last week, we looked at where technical analysts are looking for buyers to emerge in the S&P 500. A similar chart emerged in the small-cap Russell 2000, so let’s review. 📝

As we’ve discussed, small and micro-cap stocks have been significant laggards for years. That said, some technical analysts are making the case for this group to lead a short-term stock market bounce.

The thesis essentially looks at the last 15 months of price action, which has been a choppy mess. When prices reach the top of their range around 200, sellers emerge, and prices reverse. And when they get toward the bottom of their range around 163, buyers appear, and prices reverse. 📊

Well, we’re back down to that level now. Since the index has fallen 18% over the last three months, some argue it’s overly extended and could see a bounce. Others say that the fundamental headwinds are too strong and that big tech’s wreck will pull the entire market lower. 🐂⚔️🐻

As usual, we’ll have to wait and see. But that’s what technical analysts in the community are watching in the coming trading sessions. 🤷

Bullets

Bullets From The Day:

🤖 Microsoft reorganizes Xbox and marketing teams to support AI and gaming push. The changes come less than two weeks after its acquisition of Activision Blizzard officially closed. Its CEO says the company is doubling down on its Gaming business, planning to announce which games are coming to Xbox Game Pass in the coming months. Meanwhile, it’s also heavily integrating artificial intelligence (AI) into Windows, Office apps, Bing, and other products as another core growth driver. The Verge has more.

📉 X usage plummets in Musk’s first year. According to new data, app downloads fell roughly 38% globally between October 2022 and September 2023, with U.S. downloads falling 57% during the same period. Average time spent daily per user fell 2% YoY in the third quarter, with sessions falling 4%. Churn rose 30% YoY as of September, with web traffic down 7% globally and 11.6% in the U.S. for the first nine months of 2023. Besides engaging users, it’s also struggling to keep brands on board, with its U.S. ad business falling 60% YoY as of September. More from Axios.

🦺 U.K.’s controversial Online Safety Bill officially becomes law. The bill, which aims to make the country ‘the safest place in the world to be online,’ is now law after years in the making. It introduces new obligations for how tech firms should design, operate, and moderate their platforms. Enforcement of these new rules is expected to be rolled out in three phases to give companies ample time to comply. However, concerns remain about the rules’ reach and impact on privacy, with encrypted messaging apps at the center of the conversation. The Verge has more.

🕵️♂️ OpenAI forms new team to study ‘catastrophic’ AI risks. The company, with significant backing from Microsoft and other tech giants, has advocated for regulating the artificial intelligence (AI) space, citing various risks. It’s taking things a step further, creating a ‘Preparedness’ team, which will be responsible for tracking, forecasting, and protecting against the dangers of future AI systems. While some risk categories are more far-fetched than others, it listed chemical, biological, radiological, and nuclear threats as areas of top concern. TechCrunch has more.

📺 Investors get updates on major streamers’ subscribers. NBCUniversal’s flagship streaming platform, Peacock, added 4 million subscribers during the last quarter and narrowed its loss to $565 million. Comcast Corp. president Mike Cavanagh reiterated the focus of using Peacock to anchor its transition to the streaming space from legacy linear TV Networks. As such, investors were happy to see revenues growing and overall spending shrinking, with the company now expecting “peak losses” of $2.8 billion vs. previous estimates of $3 billion. The Hollywood Reporter has more.

Links

Links That Don’t Suck:

🥄 McDonald’s is getting rid of McFlurry spoons

💼 Morgan Stanley’s Ted Pick to take helm as CEO from James Gorman

🤫 SEC’s Gensler won’t say what’s next with Bitcoin ETFs after Grayscale loss

📫 U.S. Postal Service touts crackdown on postal crime with hundreds of arrests

🆘 I need my 401(K) money now: More Americans are raiding retirement funds for emergencies

🤔 Businesses across the country picked names meant to outsmart Google search. Does it work?