This year, we’ve written a lot about a general trend impacting the stock market. That being, the larger the company, the better it has performed. 💪

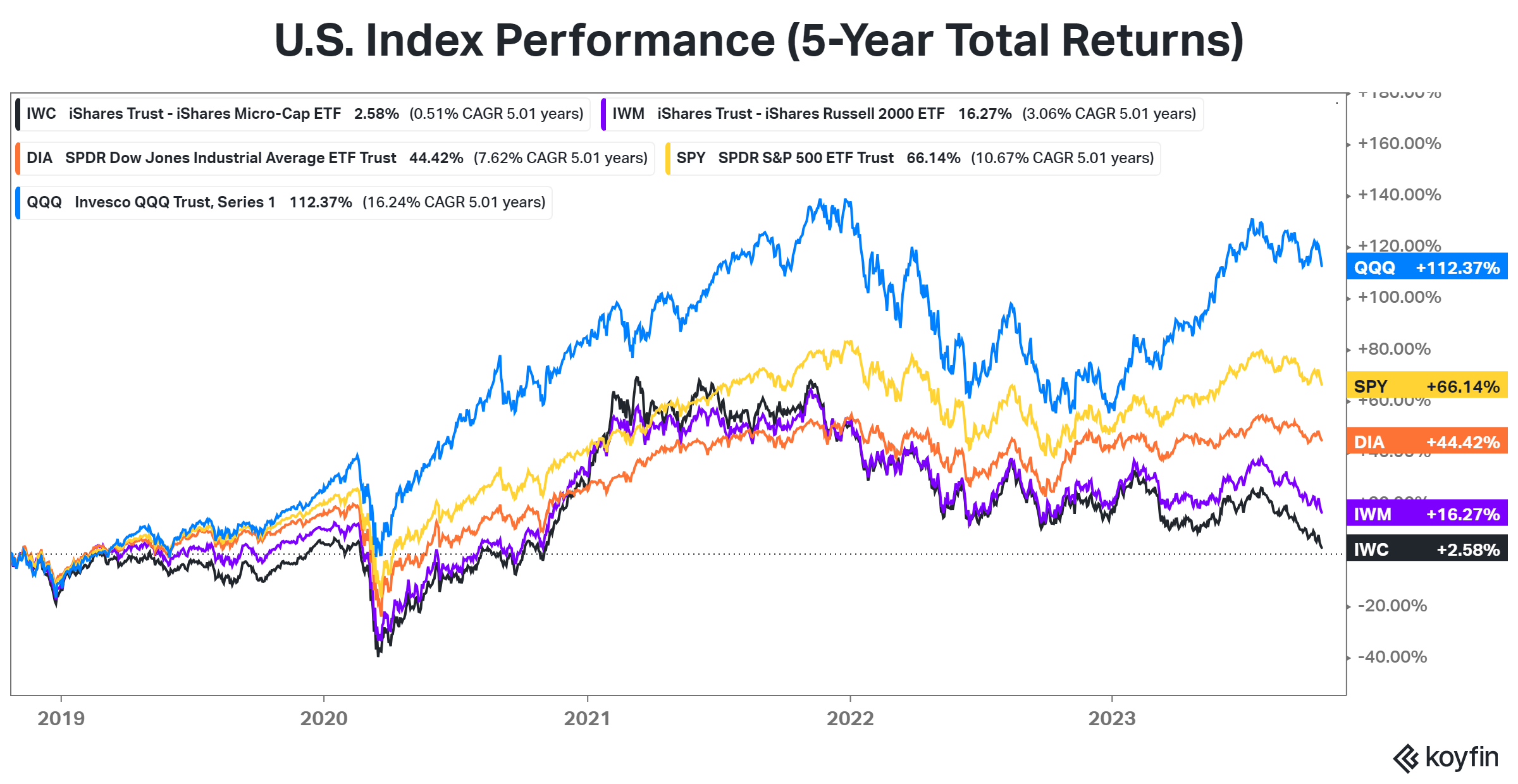

As we can see from the chart below, the Nasdaq 100 and S&P 500 have led gains over the last five years. That’s primarily because mega-cap technology stocks, now dubbed “the magnificent seven” but previously known as FAANG or FANMAG, have driven a large portion of the gains. Meanwhile, the “riskier” small and micro-cap companies have struggled to progress.

That trend continued this week, catching many investors’ attention because five-year returns in the micro-cap ETF $IWC neared the flatline. So not only did this market segment underperform during stocks’ rally, but it’s now leading to the downside. 📉

This flies in the face of conventional market wisdom that says “higher risk” assets like small and micro-cap stocks should offer a “higher potential return.” Instead, investors have been punished for taking additional on risk, leading to a decline in overall risk appetite in the stock market. 🙃

With high interest rates and a slowing global economy, the environment for these smaller businesses is only getting harder. As a result, investors continue to flock to larger companies with robust balance sheets and lots of cash from their operations, allowing them to ride out any economic weakness more easily.

And it’s not the only segment of the market to come “full circle,” either. Many high-flying sectors from the pandemic are back to their pre-pandemic levels (or worse, below them). We’re not quite sure what the takeaway here is. Other than that, investing is hard. And as always, investors need to be selective in what trends they participate in and how they participate in them. 🤷