The bulls are attempting to stem October’s decline before the month ends but are still hesitant to put on risk ahead of Wednesday’s Federal Reserve interest rate decision and commentary. Let’s see what else you missed. 👀

Today’s issue covers SoFi slumping after reporting results, Chegging in on Pinterest, and several stocks moving big ON earnings. 📰

Here’s today’s heat map:

11 of 11 sectors closed green. Communication services (+2.06%) led, & real estate (+0.31%) lagged. 💚

Union strikes continue to make progress for workers. General Motors is the last of the “Big Three” automakers to reach a tentative deal with the United Auto Workers (UAW) union, coming days after Stellantis and Ford reached agreements. Meanwhile, the Great Lakes shipping artery will start to function again after Canadian workers reached a deal with St. Lawrence Seaway Management. 🤝

Western Digital jumped 7% after announcing that it will separate its hard drive and flash memory businesses via a spinoff. The company acquired flash memory manufacturer SanDisk for $19 billion in 2016, with this separation essentially reversing that merger in the second half of 2024. ✂️

Icahn Enterprises remains on the ropes, hitting 19-year lows ahead of its third-quarter earnings release on Friday before the opening bell. Its downtrend began earlier this year when Hindenburg Research published a short-selling report on the company, accusing it of overstating its value and paying an unsustainable dividend. 📉

McDonald’s shares popped after its earnings and revenue topped expectations, with a roughly 10% price increase in 2023 helping drive the results. The fast-food chain is seeing continued pressure on lower-income consumers ($45,000/yr & under) but is gaining share with middle and high-income as they trade down to cheaper dining options. 🍟

Commercial real estate REIT, Realty Income Corp., agreed to acquire Spirit Realty Capital for $5.3 billion in an all-stock transaction. This will further diversify its tenant base at a time when commercial real estate remains under pressure. 🏢

And HSBC shares fell 2% despite its after-tax profit surging 235% YoY and the bank announcing a $3 billion share buyback. 🏦

Other symbols active on the streams: $TSLA (-4.79%), $AMC (+8.85%), $FSR (-8.77%), $RVPH (+46.40%), $CHRS (+14.02%), $ICU (-1.96%), $VYNE (+23.39%), and $BTC.X (+0.28%). 🔥

Here are the closing prices:

| S&P 500 | 4,167 | +1.20% |

| Nasdaq | 12,789 | +1.16% |

| Russell 2000 | 1,647 | +0.63% |

| Dow Jones | 32,929 | +1.58% |

Earnings

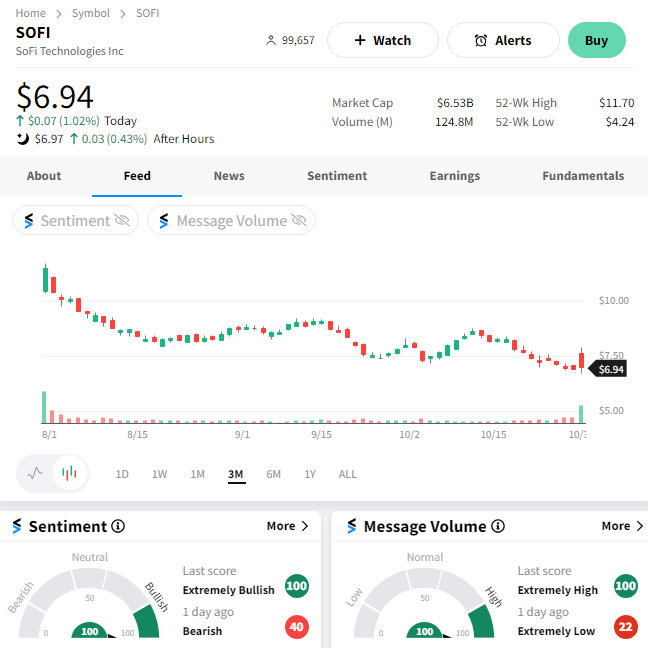

SoFi Slumps After Results

Popular fintech giant SoFi Technologies posted stronger-than-expected results and lifted its forecast. However, that wasn’t enough for the stock to hold onto early gains. Let’s dive into the numbers. 👇

The company’s revenues rose about 27% YoY to $537 million, topping expectations of $518 million. Student-loan originations rose 101% YoY to $919.3 million, with volume reaching its highest since the first quarter of 2022. Personal-loan originations also rose 38% YoY to $3.9 billion, while home-loan originations rose 64% to $355.7 million. 📊

Total new members were up 47% YoY to 6.9 million, with new product additions up 45% YoY to 10.4 million. As for deposits, they grew 23% YoY to $15.7 billion, with over 90% of SoFi Money deposits coming from direct deposit members. 💵

Its efforts to attract and retain new money appear to be working, with more than half of newly funded SoFi Money accounts setting up direct deposit by the end of their first month. That “stickier” money drives debit transaction volume and strong cross-buy trends with its lending and other financial services products. And with FDIC insurance of up to $2 million, nearly 98% of deposits were fully insured at quarter-end.

Its third-quarter net loss grew to $0.29 per share vs. the $0.08 loss per share analysts anticipated. However, it said that if it excluded the impact of non-cash impairment charges, that loss would have been only $0.03 per share. Management reiterated its confidence in achieving positive GAAP net income in the fourth quarter. And adjusted EBITDA of $98 million was its highest ever, topping the $65 million analysts expected. 🤑

Overall, executives remained optimistic about balancing growth, investment, and profitability. They lifted their full-year adjusted net revenue guidance range to $2.045-$2.065 billion, topping estimates of $2.026 billion. Their forecasted $386-$396 million in full-year adjusted EBITDA exceeded analyst estimates of $344 million.

Despite that, investors’ concerns boil down to a few key themes. The first is that the current environment for banks is a challenging one, as higher interest rates have both positives and negatives. The second major concern is that some analysts don’t believe the company will achieve its GAAP profitability targets and generate the cash needed to fund its growth. Since the company is still in investment mode, that means it may have to take on higher-interest debt. 🏦

Lastly, some on Wall Street don’t believe the online banking model is a viable one long-term. For now, the company is focused primarily on “wealthy” consumers earning over $100,000 per year. But, concerns are that it could limit its ability to grow market share. And if it needs to expand that course group of customers down the income spectrum, they’ll be playing a very different (and potentially more difficult) ball game.

As always, we’ll have to wait and see who is right. But for now, that’s why the stock’s valuation remains suppressed despite seemingly strong results. 🤷

$SOFI shares were up as much as 15% but faded throughout the day to close slightly green. 🔺

Earnings

Moving ON Earnings

Several stocks moved bigly today after reporting results, so let’s recap. 👇

We’ll start with ON Semiconductor, which helped inspire the title of this post. Although its third-quarter results topped expectations, its forecast for fourth-quarter EPS of $1.13-$1.27 and revenues of $1.95-$2.05 billion both missed by a wide margin. Macroeconomic pressures such as weaker demand for vehicles pressured the stock, with analysts saying the cyclical nature of the company’s business is taking hold again. $ON shares plummeted 22% on the day. 📊

Lattice Semiconductor experienced similar results, narrowly beating current-quarter expectations but providing a soft outlook. It forecasted $166-$186 million in revenues, well below analyst estimates of $195.7 million. The company, which makes low-power programmable chips, faces pressure in several of its core markets, including communications, computing, consumer, and automotive. Its record cash generation and share repurchase program were not enough to offset the macroeconomic concerns. $LSCC shares dropped 17% on the day. 🏭

Health sciences company Revvity missed third-quarter estimates and cut its fiscal 2023 outlook. It earned $1.18 per share in earnings on revenues of $670.7 million compared with estimates of $1.19 and $695.4 million. Executives blamed an increasingly challenging end-market environment, with pharma and biotech customers pulling back and leading to a 1.6% revenue decline in its life sciences business. Looking ahead, new fiscal 2023 earnings of $4.53-$4.57 and revenues of $2.72-$2.74 came in below analyst estimates. $RVTY shares fell 16% on the day. 🧑⚕️

In a rare win for the solar industry, JinkoSolar delivered better-than-expected results. The company’s third-quarter earnings of $2.53 per share on $4.36 billion in revenue beat estimates, with gross profit doubling YoY and margin expanding from 15.7% to 19.3%. It also announced promising news about its solar-cell technologies, saying its 182 mm high-efficiency N-type monocrystalline silicon solar cell reached a conversion efficiency of 26.79%. That represented a new record for the specifications. $JKS shares shined 14% on the day. 🌞

Less-than-truckload transportation company XPO jumped after its third-quarter earnings and revenue beat expectations. Its adjusted earnings per share of $0.88 on revenues of $1.98 billion compared with estimates of $0.63 and $1.93 billion. Executives say the strong results came from volume and pricing gains, as well as improved labor productivity. The company is benefitting from competitor Yellow Corporation’s bankruptcy, which left a capacity gap in the industry and drove market share gains for the remaining players. $XPO shares soared 15% on the day. 🚚

Earnings

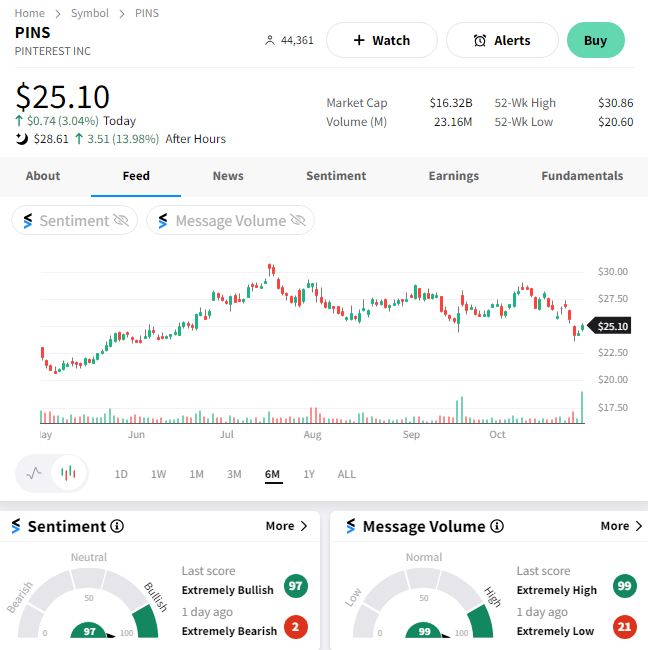

Chegging In On Pinterest

Today, we’re checking in on two popular stocks that often have difficulty around earnings: Pinterest and Chegg. Let’s see how they did. 👀

First, we’ll start with image sharing and social media site Pinterest, which topped third-quarter estimates. Its adjusted earnings per share of $0.28 on revenues of $763.2 million beat the $0.20 and $743.5 million anticipated by analysts. 🔺

Global monthly active users also saw substantial gains, rising 8% YoY to 482 million vs. the 473 million expected. Meanwhile, average revenue per user (ARPU) of $1.61 beat estimates by $0.02. The company also managed to keep expenses in check, rising just 2% to $768.2 million. It’s anticipating fourth-quarter 2023 non-GAAP operating expenses will fall 9%-13% YoY. 📊

The company continues to lean into its differentiators as a visual search, discovery, and shopping platform, delivering stronger results for advertisers. It anticipates its position in the market will continue yielding results, seeing fourth-quarter revenue growth of 11%-13% YoY vs. 11.3% estimates.

Overall, shareholders were happy that advertising on the platform is holding up well despite several industry headwinds weighing on competitors. $PINS shares rose 14% today. 📈

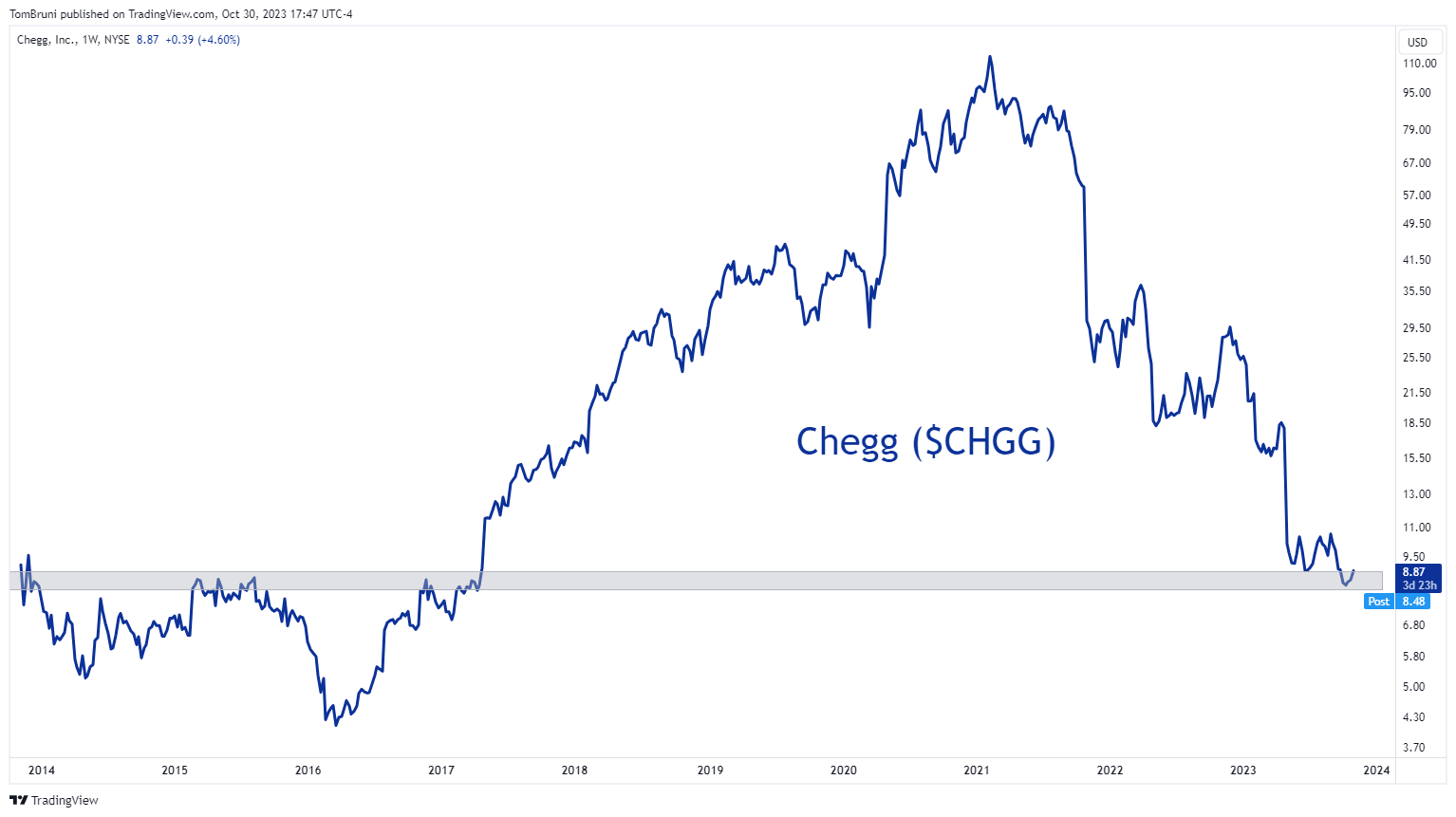

Meanwhile, American education technology company Chegg once again failed to impress. The stock experienced a sharp decline in late 2021 and early 2022 as the “pandemic-era” growth it experienced slowed significantly. It also dropped heavily earlier this year after it warned that Chat-GPT and other generative AI tools materially impacted its market share. 🤖

Most recently, the stock has been on investors’ radars as it looks to stabilize at its post-IPO price in the high single digits. However, overall concerns remain despite the company posting better-than-expected third-quarter results (and meeting guidance).

The company’s service subscribers fell roughly 8% YoY to 4.4 million, with free cash flow down 83% QoQ to $9.37 million. Investors remain skeptical that the company can transform itself into the hyper-personalized, on-demand tool that its customers expect in today’s day and age.

$CHGG shares fell nearly 5% after hours, eliminating their regular-session gains. ⏪

Bullets

Bullets From The Day:

🧑⚖️ Evergrande shares hit all-time lows as court adjourns winding-up hearing. The Chinese property giant fell over 20% to new lows after a Hong Kong judge delayed the court hearing to address a winding-up petition against the company. Evergrande must now develop a revised restructuring proposal before Dec. 4th, when the court will make a final decision. CNBC has more.

🛒 Omnicon extends eCommerce/retail media reach with Flywheel acquisition. Flywheel helps merchants sell their products more efficiently on marketplaces like Walmart, Amazon, and Alibaba, serving more than 4,500 brands currently. The marketing communications firm says the net cash purchase of $835 million will allow it to expand its footprint in the digital commerce and retail media sectors. With retail media and eCommerce sales continuing to grow, this should put the company at the center of two structural trends. More from PYMNTS.com.

📱 Facebook and Instagram launch paid ad-free subscription. Meta is launching the service to address concerns from European Union regulators, offering users an ad-free experience for 9.99 euros per month on the web or 12.99 euros on iOS and Android. By making users choose between paying for the service to remove ad targeting or using the service for free but consenting to its data collection practices, the company will have more clearly met privacy requirements set by the Digital Markets Act, GDPR, and others. The Verge has more.

📊 Consumers’ post-pandemic wage picture remains murky. A new analysis from the Hamilton Project at the Brookings Institution says that American workers’ overall real wage gains depend on various factors. There’s no straightforward way of measuring pay for workers, so they looked at four different pay measures and adjusted them for inflation using the consumer price index and personal consumption expenditures price index. When using the first measure of inflation, wage gains looked minimal (or fell) but looked better when using the second measure. Axios has more.

🧬 23andMe extends its collaboration with pharmaceutical giant GSK. The two companies have extended their partnership with a non-exclusive data licensing agreement that allows GSK to use 23andMe’s database for drug target discovery and other research for one year. It includes a $20 million upfront payment, as well as access to their analysis of the data. The anonymized DNA database is highly sought after by healthcare companies, given it’s only rivaled by Ancestry.com and the Chinese government. Investing.com has more.

Links

Links That Don’t Suck:

📺 Tracking the premium tier price of the big streaming services

🏀 NBA announces new partnership with Kim Kardashian’s SKIMS

🍬 For the second Halloween in a row, U.S. candy inflation hits double digits

🚉 ‘Super commuting’ is on the rise — and that spells big trouble for mid-size cities

💵 FTX creditor claims breach the 50c mark as buyers see light at the end of the tunnel

🛰️ Pentagon awards $1.3 billion in contracts to Northrop Grumman and York for 100 satellites