It was a volatile day in the market, as the “triple witching” resulted in over $5 trillion in options expiring and the major indexes rebalancing. With that said, the stock market indexes closed out another week of gains as we head into slower holiday sessions. Let’s see what you missed. 👀

Today’s issue covers Darden dipping despite an earnings beat, the U.S. yield curve inversion deepening, and another exciting week of Stocktwits’ trading competitions. 📰

Here’s today’s heat map:

2 of 11 sectors closed green. Technology (+0.53%) led, & utilities (-1.77%) lagged. 💚

New York Fed President John Williams looked to rein in some of the market’s rate cut optimism by saying on CNBC’s Squawk Box, “We aren’t really talking about rate cuts right now. We’re very focused on the question in front of us, which, as chair Powell said…is, have we gotten monetary policy to a sufficiently restrictive stance in order to ensure the inflation comes back down to 2%?” ⏸️

The Empire State Manufacturing Survey showed that optimism is still subdued, with the diffusion index for general business conditions falling from 9.1 in November to -14.5 in December. Meanwhile, November’s factory production numbers rebounded 0.3%, driven by a 7.1% jump in motor-vehicle production as United Auto Workers (UAW) employees returned to the job. 🏭

December’s S&P Global PMI showed U.S. business activity picked up due to rising orders and worker demand as financial conditions loosened. The December ISM Report also forecasted that economic improvement will continue in 2024. 👍

Overseas, Chinese stocks rebounded marginally after the government introduced new economic stimulus measures, with traders betting more is ahead given the retail sales weakness. 💰

Scholastic shares fell 12% after the publisher and distributor of children’s revenues fell 4% YoY due to challenges in the retail market. And e-signature company DocuSign rose 12% on news it’s exploring a sale to either private equity or other technology firms. 📝

Other symbols active on the streams: $COST (+4.45%), $ZIM (+17.99%), $GNS (+28.30%), $VRCA (+61.97%), $XPEV (-7.54%), $VFS (+13.54%), $HNT.X (+31.95%), & $BONK.X (+51.56%). 🔥

Here are the closing prices:

| S&P 500 | 4,719 | -0.01% |

| Nasdaq | 14,814 | +0.35% |

| Russell 2000 | 1,985 | -0.77% |

| Dow Jones | 37,305 | +0.15% |

Earnings

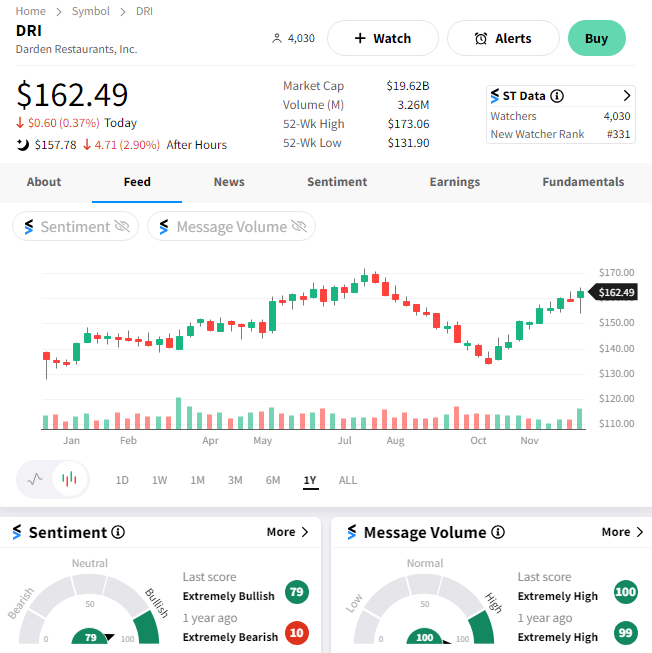

Darden Dips Despite Earnings Beat

Olive Garden parent Darden Restaurants had a rough July-October after weakness in its flagship brand led to a sales miss and disappointing 2024 guidance. However, today’s second-quarter results gave investors renewed hope that it’s getting back on track. 🤔

The company’s adjusted earnings per share of $1.84 topped the expected $1.74. Revenues were shy of expectations, coming in at $2.73 vs. $2.74 billion. Sales jumped 9.7% YoY, boosted by including Ruth’s Chris Steak House locations following its acquisition. 📈

Total same-restaurant sales rose 2.8% YoY, with Olive Garden sales up 4.1% YoY and LongHorn Steakhouse up 4.9% YoY. However, fine dining sales lagged for another quarter, falling 1.7% YoY.

Executives remain confident in their strategy to profitably grow market share, outperforming the industry in most closely-followed metrics. As such, they raised their full-year fiscal 2024 outlook for adjusted earnings per share from $8.55-$8.85 to $8.75-$8.90. They also expect total inflation of 3.0% to 3.50% and same-restaurant sales growth of 2.5% to 3.0%. 💸

The company also bought the dip in its stock, repurchasing 1.2 million shares for $181 million. It still has $328 million remaining under its current $1 billion repurchase authorization.

$DRI shares were down marginally on the day but have recovered most of their July-October decline from all-time highs. 👍

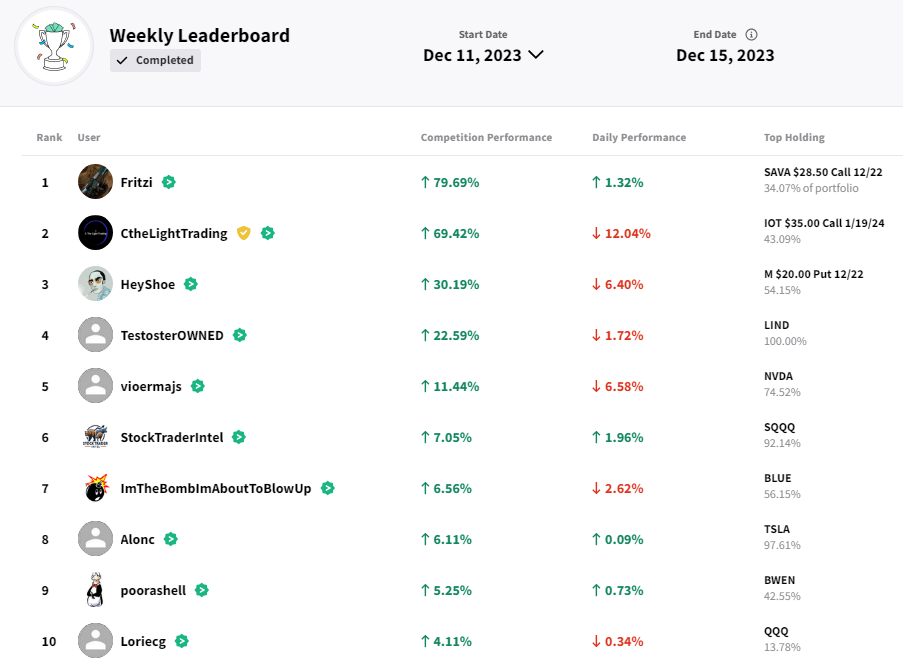

Stocktwits’ third week of trading competitions ended today, so let’s recap how it went. 👇

This week’s competition was a tight one, with CtheLightTrading snagging the second spot for the third consecutive week. HeyShoe also took the third spot where he sat in week one. Clearly, the two of them are in contention for that top spot, so we’ll keep an eye on them in future weeks. 👀

But, they were unable to knock Fritzi off the top spot, with his bullish bets on the tech sector and broader market paying off. Congrats to him on a nearly 80% gain, and extra kudos for posting all of his trades in real time on his stream. 🤩

We’ll have to wait and see how next week’s competition shakes out; make sure to join or follow along before things get started on Monday!

Economy

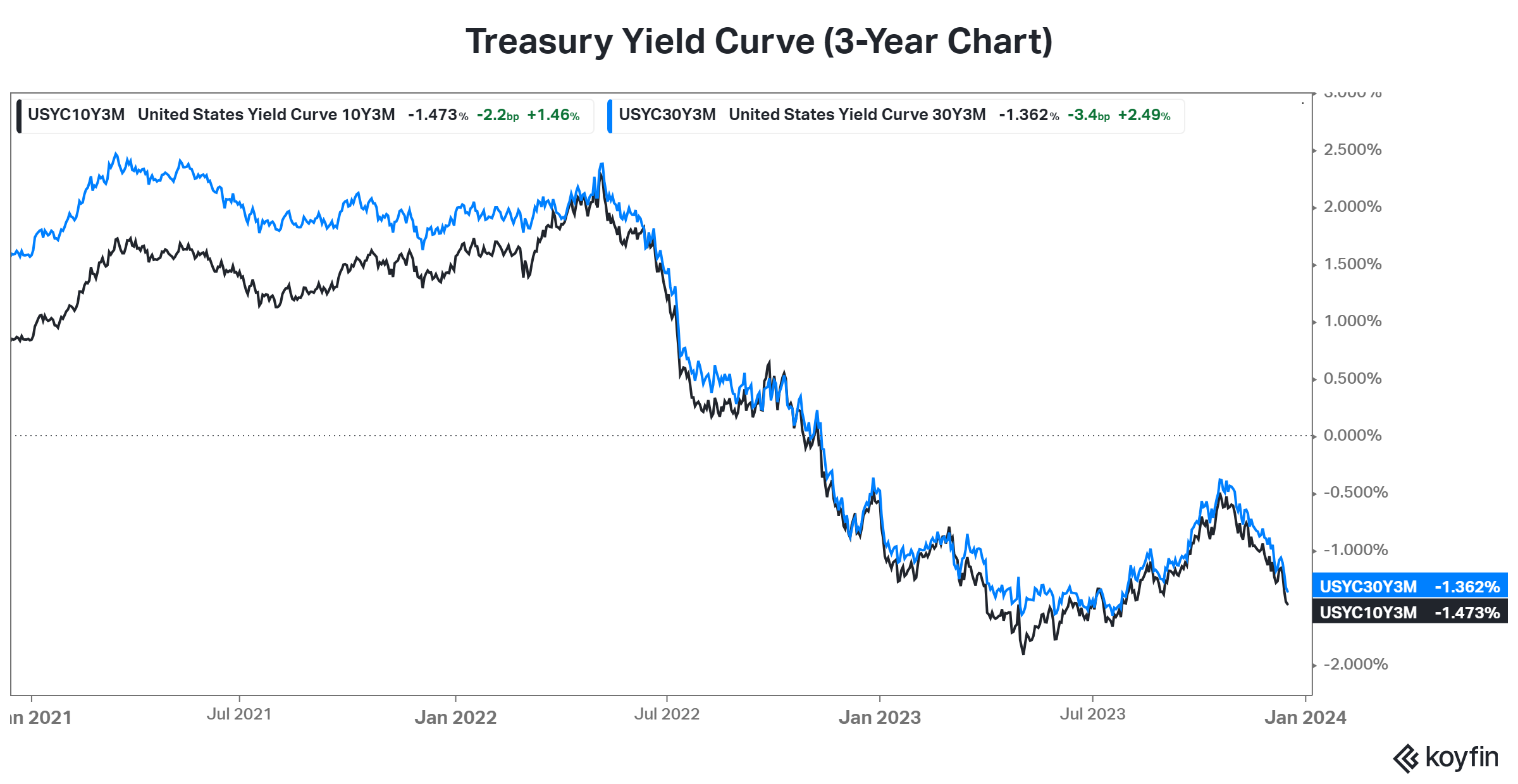

Yield Curve Inversion Deepens

It’s been about a year since the yield curve popped onto investors’ radars, with us discussing it in October and November of 2022. ◀️

As discussed in our posts, a yield curve inversion is not a perfect indicator of a recession, but it has a pretty good track record. That’s because when short-term rates are above long-term rates, investors believe growth (i.e., inflation) will be higher in the short term than the longer term. As such, they demand a higher yield to hold short-term bonds than long-term ones.

So why is this back on our radar today? Despite the bond market’s epic rebound since late October, long-term yields have fallen faster than short-term ones. As a result, the yield curve’s inversion has deepened and is approaching the lows it set earlier in the year. 📉

So, while the stock market, crypto, and other risk assets continue to party on the prospect of lower nominal interest rates, some analysts say the yield curve suggests we’re not out of the woods yet. However, they admit there doesn’t seem to be a clear catalyst to push the economy into recession and cause the Fed to cut short-term interest rates aggressively. 🤔

In the past, major economic shocks like the financial crisis, a global pandemic, or other overlooked risks were why the economy tipped into recession. Inverted yield curves leave the economy in a vulnerable position but are not in and of themselves the reason for a downturn to begin. In other words, the conditions are set for an economic downturn, but those conditions need a spark to get things going. 🔥

And so far, analysts are unclear what that spark (or risk) will be. We’ll have to wait and see what 2024 brings us. As we saw with 2023 (and every other year to be honest), the market and economy have a habit of surprising us all… 🤷

Bullets

Bullets From The Day:

🤝 Ukraine is a step closer to joining the EU. The country got a green light to start sped-up talks on joining the European Union (EU). While it’s a significant short-term boost for the company and a clear message to Russia’s Vladimir Putin, it could be years before the country actually becomes an EU member. Joining the EU is seen as a path to wealth and stability. Still, EU officials said talks couldn’t officially begin until the country addressed multiple issues like corruption and lobbying concerns, among others. AP News has more.

📈 Corporate debt defaults have risen all year. U.S. companies’ debt default rates have been historically low since 2021 but have ticked up all year to reach their historical average of 4.1%. While defaults often go hand-in-hand with bankruptcy, only about half of the 89 U.S. defaults involved bankruptcy this year. The other half was referred to as “distressed exchanges,” where the lender agrees to a deal in which it won’t be paid back in full, but it gets something in return, like a higher priority spot on the company’s capital structure. More from Axios.

⛽ Ethanol industry gets a significant win with low-emission aviation fuel tax credits. The Biden administration will recognize a methodology favored by the ethanol industry in guidance to companies looking to claim tax credits for sustainable aviation fuel (SAF), representing a major win for the U.S. corn lobby. The push comes as the global aviation industry, which accounts for about 2% of global energy-related carbon dioxide emissions, tries to decarbonize by any means necessary. That includes using cleaner fuel sources like ethanol. MSN has more.

💸 Will the $6 trillion in money market funds help fuel a 2024 stock market rally? Investors hoarded cash this year, taking advantage of higher interest rates at the expense of missing out on massive gains in the stock market. Rumors are that FOMO could fuel further stock market gains in 2024 as investors look to play catchup. However, an important part of this conversation is that much of these funds haven’t come from the stock or bond markets. Instead, they’re coming from traditional bank accounts and products with a lower yield and are simply consumers shifting their assets into higher-yielding products. So, the tailwind for stocks may not be as significant as expected. More from Reuters.

✂️ GM announces new layoffs as it ends certain vehicle production. The company is discontinuing production of Chevrolet Bolt and Chevrolet Camaro models, impacting 945 workers at one plant and 369 at another. This comes as the automaker looks to retool one facility to build electric trucks, with it coming back online in late 2025. It’s been a long week of cuts for General Motors as it looks to appease investors with additional cost cuts to offset higher wages from the United Auto Workers (UAW) union deal and a $10 billion buyback program. CNBC has more.

Links

Links That Don’t Suck:

❄️ Level up your investing during IBD’s 12 Days of Holiday Deals and unlock a new offer every day.*

💊 First postpartum depression pill now available in the U.S., drugmakers say

☕ Greek-yogurt maker Chobani buys coffee company La Colombe for $900 million

⚠️ Jensen Huang expresses worry about Nvidia employees showing complacency: report

🥑 WeightWatchers launches program for weight-loss drug users after Oprah confirms GLP-1 use

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.