The U.S. stock market indexes closed the week mixed as bulls and bears battled over sticky inflation data and the future of AI-related sectors like semiconductors. Let’s see what you missed. 👀

Today’s issue covers why today was definitely “a” top in one chip stock, investors eyeing PHAT profits in biotech stocks, and an energy chart worth watching. 📰

Here’s today’s heat map:

3 of 11 sectors closed green. Materials (+0.52%) led, & communication services (-1.52%) lagged. 💚

Producer prices ticked up more than anticipated in January, causing stocks to temporarily tumble on fears that rate cut odds will be pushed out further. With inflation’s downward progress stalling across many developed countries, central banks remain in no rush to loosen conditions. 🔺

Michigan consumer sentiment rose marginally to a 31-month high in February, driven by slowing inflation and a strong labor market. The White House’s National Economic Advisor touted that consumer sentiment has risen by 30% in three months, its fastest increase in 30 years. 🙂

U.S. housing starts fell 14.8% MoM in January, its sharpest drop since April 2020, as snow and frigid temperatures pushed back plans. Permits fell just 1.5% MoM and are still 8.6% above last year’s levels, given the continued demand for new construction. 🏘️

Nike shares fell after announcing it will cut another 2% of its workforce to offset weak demand. Meanwhile, restaurant software maker Toast is laying off 10% of its workforce amid slow growth. ✂️

Other symbols active on the streams: $ICU (+24.73%), $VKTX (+13.66%), $OCGN (+27.23-%), $LUNR (+9.25%), $TOP (+6.40%), $HTOO (+90.00%), $HOLO (+114.06%), & $SOUN (+1.35%). 🔥

Here are the closing prices:

| S&P 500 | 5,006 | -0.48% |

| Nasdaq | 15,776 | -0.82% |

| Russell 2000 | 2,033 | -1.39% |

| Dow Jones | 38,628 | -0.37% |

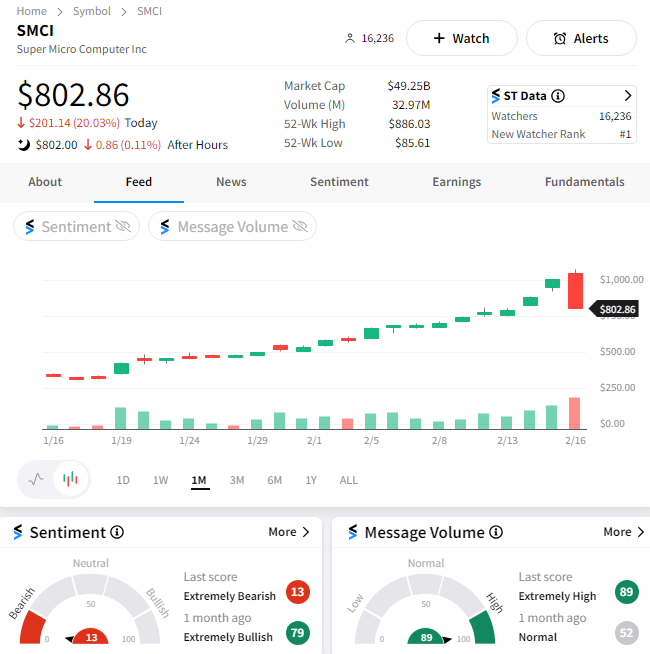

We don’t want to say CNBC caused the top in Super Micro Computer Inc., but they definitely pushed sentiment over the edge. 🤪

Mania’s are hard to time, but most market participants agree that today was “a” top in the stock. What we all fail to agree on is whether it was “the” permanent top. Let’s see how it played out. 👇

SMCI shares rose to nearly $1,100 in pre-market trading but sold off at the open and throughout the day. The stock traded in a $300 price range and closed down 20% from yesterday’s highs, erasing two full days of gains in the process.

Clearly, the short-term momentum has shifted. So, with traders moving to the sidelines, at what price do investors become interested in buying the dip? We’ll have to wait and see in the days ahead, but many expect the chip volatility to continue since Nvidia earnings are on deck next Wednesday. 😬

With semiconductors cooling off, technical analysts are keeping an eye on this trendline in the Nasdaq 100 ETF. This “line in the sand” has supported the market throughout 2024 and as far back as November, so traders are watching it closely to see if that continues.

Bulls argue that as long as prices are above this trendline, they’re buying the dip because the trend remains intact. On the other hand, bears say that the more times a level of support is tested, the more likely it is to break. ⚔️

As of today’s close, we’re right at this trendline, so the pressure is on bulls to reassert their dominance and scare the bears off again. This inflection point will set the tone for the tech-heavy index in the short term as we head into another important earnings week.

We’ll see what happens on Tuesday when the U.S. markets reopen. Until then, if you want more content on AI and a potential market top, check out the Trends With Friends podcast below! 🍿

Stocktwits Presents “Trends With Friends”

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and special guest Jim O’Shaughnessy discuss:

- Markets: Why JC thinks anyone who can count should be bearish on this market 🐻

- Artificial Intelligence: How AI impacts the stock market and fuels speculation 🤑

- Life: The importance of exercising self-control in the face of technological advances 🫨

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

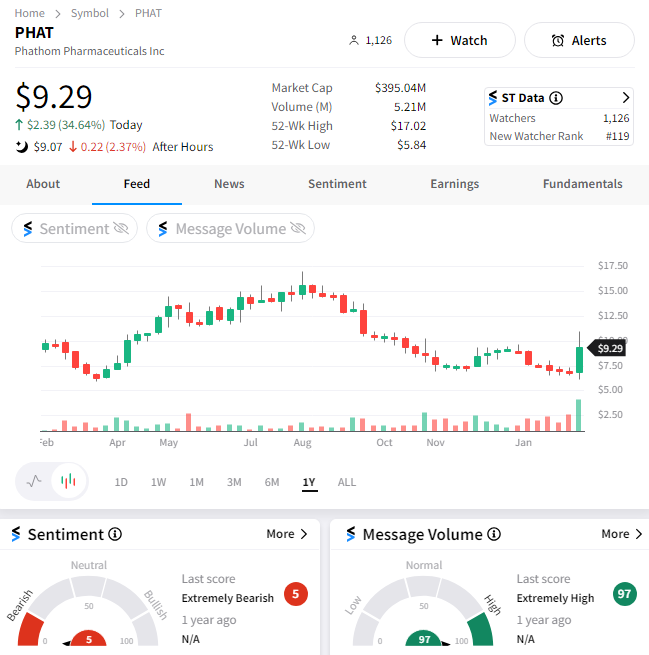

As we’ve been highlighting for a long time, investors and traders continue to seek opportunities in the micro and small-cap healthcare space in hopes of a buyout.

With the most prominent players sitting on tons of cash and needing their next growth driver, it seems like there’s a new company being acquired every day. 🤑

That’s why stocks like Phathom Pharma can rise sharply on seemingly no news. 🤷

However, investors who prefer a more diversified approach to the biotech sector are finding opportunities in ETFs like XBI. 🧺

Stocktwits user Christopher Brecher shared the chart below showing the S&P Biotech ETF pushing toward the top of a two-year trading range. He points out that a successful breakout through the mid-90s would target the mid-120s over the medium to long term, representing 30% upside.

With the market indexes and healthcare sector ETF $XLV hitting all-time highs, bulls say now is the time for $XBI and other laggards to play catchup. Time will tell if they’re correct, but the healthcare sector and its many industries are a key focus area for investors and traders right now. 🕵️♂️

Stocktwits Spotlight:

Stickier-than-expected inflation reports this week have investors thinking about energy prices again. And while natural gas prices seemingly go down every day, the rest of the energy complex is seemingly staging a turnaround. 🤔

Stocktwits user Upsidetrader shared the chart above showing crude oil has slowly been gaining traction since mid-December. Prices had failed to break through the 79-80 range in the past, but if they can crack that level, there could be further upside towards the low 90s in the coming quarters.

Strength in the energy sector would renew upward pressure on producer and consumer prices, threatening the market’s hope for a May or June rate cut. It’s still early in the game, but it looks like energy bulls are setting up for a run here while the rest of the market is focused on tech. 🥵

If you like chart-driven market analysis and swing trade ideas like this, follow Upsidetrader on Stocktwits for more! 👀

Bullets

Bullets From The Day:

🤺 Pay TV distributors are fighting against the industry’s new sports joint venture. Comcast, Charter, DirecTV, and other pay TV distributors are facing uncertain terms over whether they’ll be able to offer customers the same skinny sports bundle as the joint venture Disney, Warner Bros. Discovery, and Fox recently unveiled. They’ve begun to push back on the venture, claiming the new bundle will lead to further cable TV cancellations, and are anxious to find a strategic role in a seemingly inevitable situation. CNBC has more.

👍 SEC clears Trump’s social media deal. The Securities and Exchange Commission (SEC) allowed the former president’s media and technology company to merge with a blank-check acquisition vehicle in an agreement that currently values Truth Social at as much as $10 billion. Despite its much smaller operations and user base, that would be about half the valuation of Elon Musk’s X. Once the deal closes, Trump will own between 58.10% to 69.40% of the combined company but may have to divest his stake based on how his bid for president goes. More from Reuters.

📺 Comcast and Paramount are considering a streaming partnership. With Paramount Plus and Peacock working overtime to court subscribers in a competitive streaming market, they’re concluding that they may have to team up if they’re going to thrive (or simply survive). With Disney, ESPN, Fox, and Warner Bros. Discovery working together to create a new shared service focused on sports, partnerships have clearly become a major growth driver in the space as consumers look for simplified offerings at competitive prices. The Verge has more.

🪫 Electric vehicle startup Faraday Future’s payment problems continue. The struggling EV maker previously sold its Los Angeles headquarters in 2019 to shore up cash and has been leasing it back from Rexford Industrial. However, a lawsuit filed this week indicates that the startup missed its January and February lease payments, as well as maintenance fees and taxes amounting to just under $1 million. Faraday Future reported just $8.5 million in cash at the end of September 2023 and is also under investigation by the SEC. More from TechCrunch.

📝 Amazon’s the latest to argue the U.S. labor board is unconstitutional. The tech giant has joined rocket maker SpaceX and grocery chain Trader Joe’s in claiming that a U.S. labor agency’s in-house enforcement proceedings violate the U.S. Constitution. Its filing with the National Labor Relations Board (NLRB) outlines its plans to argue that the agency’s unique structure violates the company’s right to a jury trial. The filing comes as Amazon faces a pending case of illegally retaliating against workers at a warehouse in the NYC borough of Staten Island. Reuters has more.

Link

Links That Don’t Suck:

❤️ Want to build a portfolio you love? Then get 3 months of IBD Digital + Print for just $15!*

🙃 SEC fines VanEck $1.75M over ETF finfluencer promotion

☕ Starbucks has a new accessible store design. Take a look inside

🌿 The EU’s tough new moderation rules are about to cover a lot more of the internet

🛍️ What will retail look like in five years? Top industry executives share their predictions

🎫 A $36 million Mega Millions ticket was sold at a Florida grocery store. No one claimed it

🏡 ‘The least affordable housing market in recent memory’: Why now is a great time to rent

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.