The U.S. stock market remains on rocky footing, with hawkish FOMC minutes and concern about tech valuations outweighing semiconductor optimism. With Nvidia’s results beating expectations, we’ll see if bulls can retake control of the market indexes tomorrow. Let’s see what you missed. 👀

Today’s issue covers Nvidia delivering bears another blow, renewable stocks lacking a charge, and more from the day. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

9 of 11 sectors closed green. Energy (+1.88%) led, & technology (-0.63%) lagged. 💚

While the entire market was focused on Nvidia, January’s Federal Open Market Committee (FOMC) meeting minutes came out midday. They reiterated that Fed officials remain cautious about lowering rates too quickly and would prefer to wait until their battle against inflation is won before acting. ⚠️

Buzzfeed shares have more than doubled after hours following an announcement that the media company will sell entertainment brand Complex for $108.60 million to live stream shopping platform NTWRK. While the sale will give the struggling company much-needed cash, it purchased Complex for $300 million in 2021. As a result, it’s cutting more jobs to further curb losses. ✂️

Other symbols active on the streams: $LUNR (-15.20%), $BABA (+3.34%), $TDOC (-23.67%), $BOIL (+24.04%), $IOVA (+31.09-%), $EBS (+78.29%), $RAPT (+48.18%), & $JASMY.X (+38.24%). 🔥

Here are the closing prices:

| S&P 500 | 4,982 | +0.13% |

| Nasdaq | 15,581 | -0.32% |

| Russell 2000 | 1,995 | -0.47% |

| Dow Jones | 38,612 | +0.13% |

Earnings

Nvidia Delivers Bears Another Blow

With it being Nvidia day and all, let’s recap the semiconductor giant’s earnings and reaction. 👇

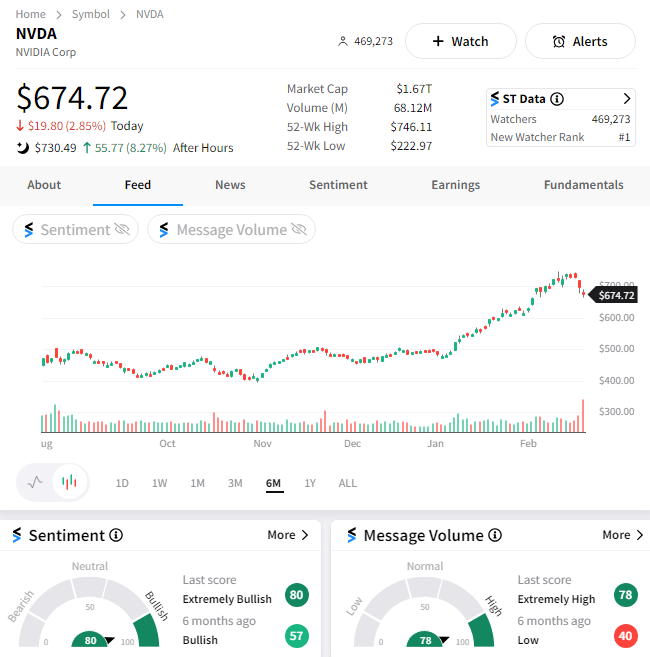

Before the print, we noted that Nvidia had only seen a downside surprise in earnings vs. expectations three times in the last ten years. However, with analyst estimates high and bullish sentiment roaring into the print, bears thought the contrarian view might have paid off.

Instead, we got more of the same action, with Nvidia delivering results that topped estimates. 🌠

Adjusted earnings per share of $5.16 on revenues of $22.10 billion topped the $4.64 and $20.62 billion anticipated. Its revenue guidance for the current quarter also beat, coming in at $24 billion vs. the $22.17 billion consensus forecast.

With Nvidia’s total revenue up 265% YoY, many investors are concerned the company may not be able to keep this pace of growth up forever. 😬

CEO Jensen Huang addressed those fears, saying, “Fundamentally, the conditions are excellent for continued growth in 2025 and beyond.” Demand for the company’s high-end chips will remain high due to generative AI reaching a “tipping point” and the industry shifting away from central processors to Nvidia’s accelerators.

On that note, data center revenues were up 409% YoY to $18.40 billion, with more than half of that from large cloud providers. Meanwhile, its gaming business rebounded, rising 56% YoY to $2.87 billion as the post-pandemic glut continues to clear in the market. ⛅

With tight supply and high demand keeping prices high and boosting margins, the company has the wind at its back in the current environment. When that will shift is unclear, but executives and investors alike don’t appear to be worried about that in the short to medium term. We’re all having too much fun to think about that…right? 😜

Given the options market implied a 10% move and shares are up 8% after the bell, option holders will likely feel some pain in the morning. However, the market remains optimistic overall, with the Stocktwits community sitting in “extremely bullish” territory as I write this. We’ll have to wait and see if bears take another shot tomorrow or if bulls use this momentum to push to new highs. 🤷

This Week’s Can’t-Miss Event:

Real Vision is thrilled to share Crypto Gathering 2024: Don’t F*ck This Up Edition with Stocktwits.

It’s taking place online on February 22 and 23 and is completely free to attend!

Attendees will hear from a star-studded lineup, including Beeple, Raoul Pal, OSF, Austin Federa, and many more.

They’ve curated a special content watch list just for Stocktwits’ audience, so reserve your seat now!

Earnings

Renewable Stocks Lack A Charge

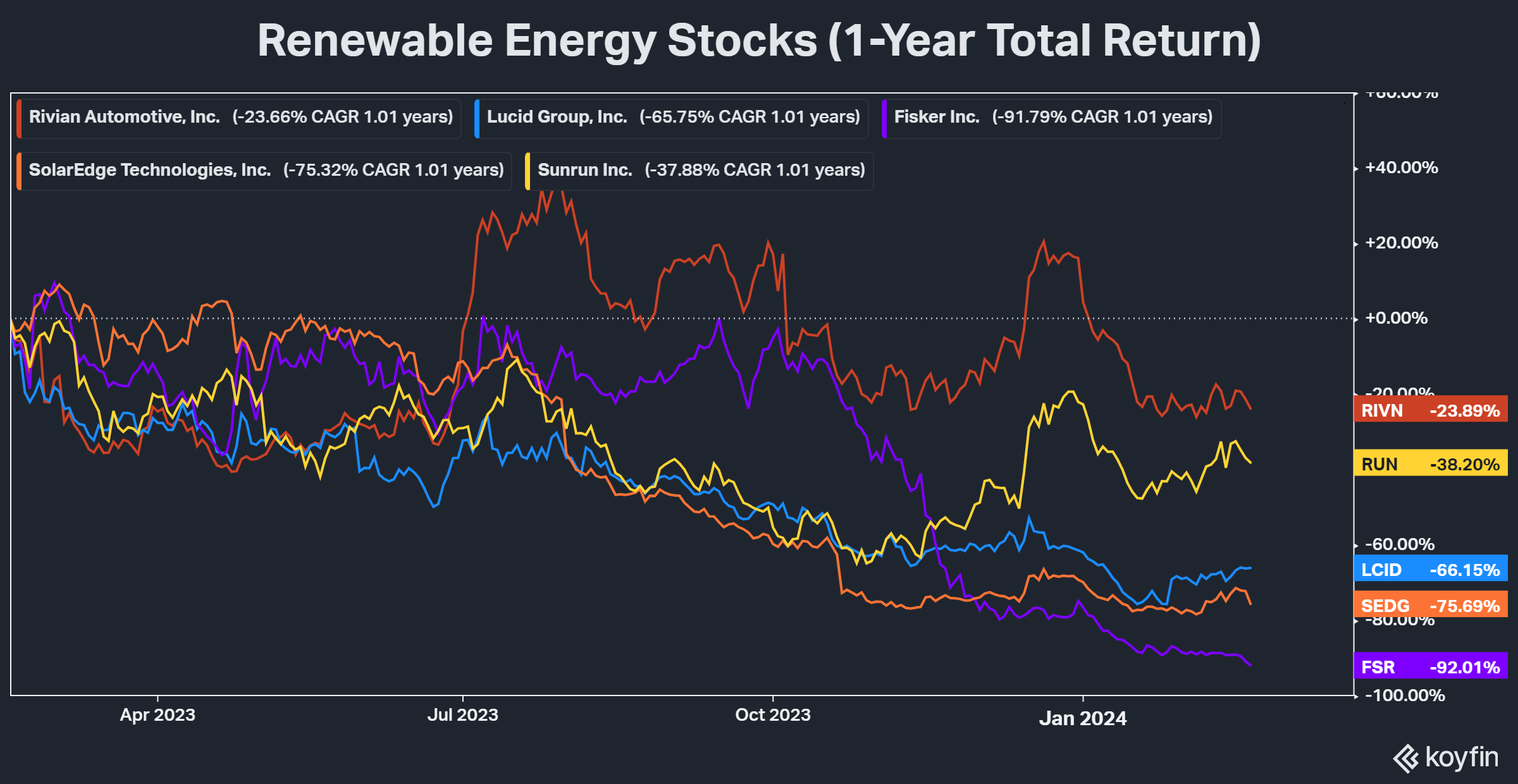

The current market environment has not been kind to renewable energy stocks like electric vehicle makers or solar manufacturers. And that trend continued today with lackluster earnings results. 👎

Rivian kicked it off by saying that it’s laying off 10% of its workforce due to EV pricing pressures. Although it built and shipped more than double the vehicles it did in 2022, its 2023 losses still totaled more than $5.40 billion. 🪫

Lucid Motors didn’t fare much better, now predicting it will build just 9,000 EVs in 2024. That’s down from previous estimates of 90,000… It’s no big deal, just an extra zero on there. Its 2023 financial results showed the company lost $2.80 billion as it slashed prices to stoke demand.

SolarEdge tumbled sharply after issuing weaker-than-expected first-quarter guidance yesterday. Weak is putting it lightly, with management forecasting less than half of what Wall Street had anticipated. Elevated interest rates have depressed residential solar market demand, leaving the company (and its competitors) with a large inventory backlog to work through. ⛈️

SunRun followed suit today, with its revenues also missing expectations amid slumping demand. Its CEO and management feel confident that installations will grow considerably from current levels, but the market isn’t buying that narrative just yet.

For solar and electric vehicle stocks, it’s all about the numbers. Until demand stabilizes and these companies give investors confidence that further dilution isn’t coming, they will likely remain in a downward spiral. 😵💫

Here’s a peek at the stocks mentioned and their 1-year total return. It’s not a great look in a market environment where most sectors and industry groups have charged higher with the bulls. 🤷

In Case You Missed It…

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and chart wizard Ivanhoff every week on “Momentum Monday.”

In this week’s episode, the group discusses:

- SMCI’s potential blowoff top & what it means for semiconductors ☠️

- Coinbase and Robinhood reporting record profits 💸

- The “bigger picture” trends impacting the broader market 📊

- Top picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

Stocktwits Spotlight:

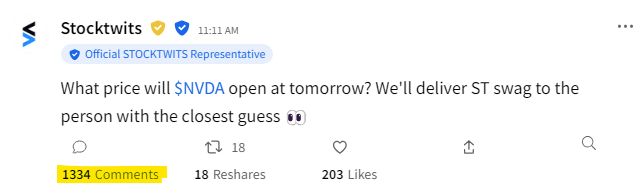

Today’s spotlight goes out to the entire Stocktwits community, who know how to turn earnings into a major event. We posed a question asking what price Nvidia shares will open at tomorrow morning…and you all certainly delivered, with more than 1,300 predictions and counting. 🤯

If you’re not following the @Stocktwits account on Stocktwits, Twitter, and Instagram, you’re missing out on the action.

Luckily for you, there’s still time to get in your prediction by tomorrow morning and win some swag! So go follow us and get your guess in. 🎯

We’ll see you there! 👀

Bullets

Bullets From The Day:

🍖 Beyond Meat banks its future on a new version of its “meat.” The company is launching a new iteration of its burger in grocery stores this spring, touting it as an even healthier version amid criticism of its products being processed and full of chemicals. Sales have fallen 30% over the last two years, with its market capitalization down from over $14 billion to under $500 million, as it struggles to find product-market fit. CNBC has more.

🤑 Reddit bets big on power users participating in its IPO. The social media giant plans to sell a chunk of its initial public offering (IPO) shares to its users, earmarking roughly 75,000 shares for when it goes public next month. The users will be given an opportunity to buy shares at the IPO price before it starts trading, which is typically reserved for the underwriters and wealthy or well-connected investors. With the IPO market still on shaky footing, we’ll have to see if its bet on users helps drive goodwill and demand for the stock. More from Reuters.

🤖 Google’s Gemini AI has clearly missed the mark. Although generative AI has a history of amplifying racial and gender stereotypes, Google’s attempts to subvert them are causing problems as well. The company has apologized for what it describes as “inaccuracies in some historical image generation depictions” generated by its Gemini AI tool, saying that its attempts at creating a “wide range” of results missed the mark. The Verge has more.

🧪 A potential watershed moment for cancer therapies has arrived. A new class of cancer treatments that harness the body’s immune system to fight tumors is being hailed as the biggest thing in oncology since CAR-T’s revelation of cell therapy more than a decade ago. CAR-T is not yet approved for solid tumors, which make up about 90% of cancer types. However, the new therapy class “tumor-infiltrating lymphocytes” (TIL) uses immune cells from a patient’s tumor to mount a long-lasting defense. More from Axios.

❌ Opposition to the Capital One-Discover deal continues to grow. Democrat Congresswoman Maxine Waters is the latest lawmaker to oppose the proposed acquisition and is joining her colleagues in asking regulators to block the deal. According to analysts, combining the two companies would create the biggest credit card issuer with around $250 billion in card balances and a market share of 22%. While the market is optimistic the deal will get done, it’ll face significant opposition on its way. Reuters has more.

Link

Links That Don’t Suck:

👋 New features, powerful upgrades and a new name… MarketSmith becomes MarketSurge on March 4th!*

₿ VanEck’s Bitcoin ETF records 2,200% volume surge in a day

📡 London’s famed BT Tower sold to U.S. hotel group for $347 million

🍕 KFC rolls out Chizza — a fried chicken and pizza hybrid — nationwide

🛫 Boeing removes head of 737 Max program in wake of safety incidents

🤪 ChatGPT goes temporarily “insane” with unexpected outputs, spooking users

🚀 Private Varda Space capsule returns to Earth with space-grown antiviral drug aboard

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.