The speculative nature of the current market environment came to a head this afternoon as Bitcoin soared past $60,000 before quickly coming back down. With stocks finally taking a breather, traders are on watch for a potential shift in the market’s short-term momentum. Let’s see what you missed. 👀

Today’s issue covers Bitcoin blasting TF off, the path of least rizz-istance in Bumble, and why there’s snow rest for the wicked in two retail favorites. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

7 of 11 sectors closed green. Real estate (+1.28%) led, & communications (-0.68%) lagged. 💚

The U.S. economy’s fourth-quarter growth estimate ticked down to a 3.20% annual pace despite consumer spending being revised upward to 3.00%. The personal-consumption expenditure (PEC) indicator also ticked up to 1.80%, creating more angst about upcoming inflation readings. 🔺

Beyond Meat continued its rally but ended the day well off yesterday’s post-market highs. Investors are likely becoming more skeptical of management’s forecast that gross margins will improve by 20 points this year, though the short-term momentum remains intact for the short-squeeze crowd. 🫠

Fintech favorite Lemonade fell 28% after forecasting disappointing guidance for the first quarter and full fiscal year, overshadowing its adjusted EBITDA and revenue beat in the fourth quarter. Meanwhile, Duolingo soared 21% after the language platform’s key metrics beat expectations and management provided upbeat guidance. 📊

Vaccine makers continue to struggle in the post-pandemic world, with Novavax plummeting 27% after revenue and earnings missed expectations. Management also expects full-year 2024 sales to be flat or lower YoY. 💉

AI stocks are in focus again after C3.ai posted a smaller-than-expected loss and beat revenue expectations. Access management company Okta also popped 25% after posting a double beat and offering revenue guidance above estimates. 🤖

Other symbols active on the streams: $IONQ (-11.63%), $BIDU (-8.05%), $LUNR (-12.30%), $SOUN (-7.58%), $CLSK (-13.45%), $VKTX (+11.11%), $PRST (-30.26%), & $DOGE.X (+20.58%). 🔥

Here are the closing prices:

| S&P 500 | 5,070 | -0.17% |

| Nasdaq | 15,948 | -0.55% |

| Russell 2000 | 2,040 | -0.77% |

| Dow Jones | 38,949 | -0.06% |

Crypto

Bitcoin Blasts TF Off

Alright, now we know this is primarily an equity-focused newsletter. But speculation in the market has been building extensively through the last few months, and there’s no better vehicle to visualize that than one with no intrinsic value. 😆

Ok, you had to let us get one joke in there. After all, we just said what we were all thinking but wouldn’t say out loud. Let’s dive into some wild stats. 👇

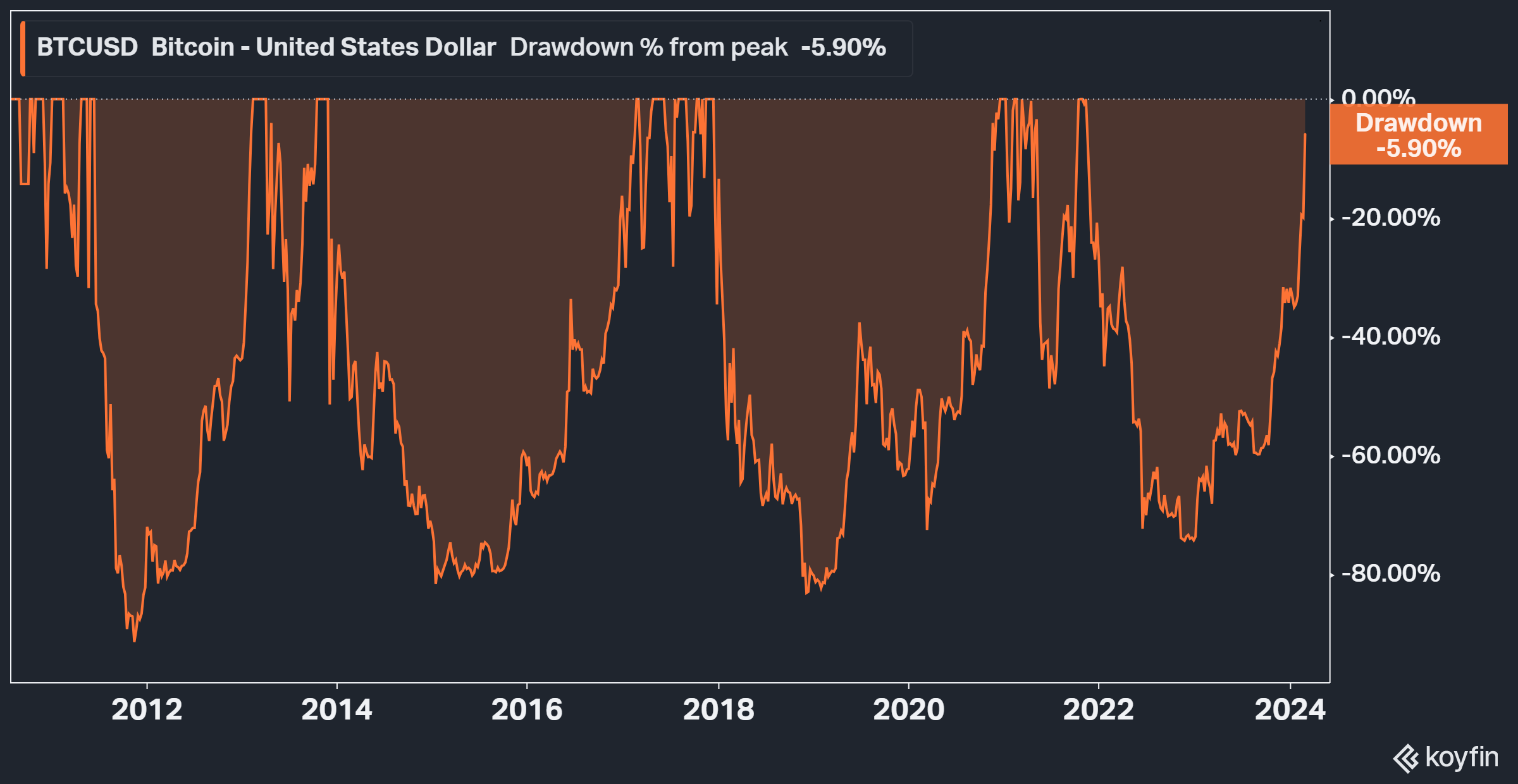

Regardless of what you think about Bitcoin and cryptocurrency in general, the market is speaking. The historical drawdown chart below shows that prices are now just a stone’s throw away from all-time highs less than 15 months after a 75% decline. And nothing gets bulls more excited than all-time highs. 🤩

I like to joke that when we’re in a crypto bear market, everyone in the space is “building.” And when we’re in a bull market, everyone in the space is tweeting every uptick in Bitcoin’s prices in real time. That’s essentially what we’ve gotten back to over the last few months, with it all coming to a head this week.

The FOMO that’s building is palpable; you can feel it online, and especially in the price action. Below is a 1-minute Bitcoin chart showing prices soaring past $60,000 this morning before quickly reversing and wiping out $95 billion of value in 30 minutes. While the market has recovered most of that decline since, the point is trading activity in crypto is back in a big way. 📈

In fact, activity got so crazy today that crypto exchange Coinbase effectively broke, showing users a “glitch” that indicated they had a zero balance in their account and prevented them from trading. Last time we checked, exchanges didn’t experience significant interruptions unless there was massive activity all at once. 🫨

Bloomberg also reported that Bitcoin ETF trading volumes hit a new record at $7.69 billion just today. Equity market crypto-proxies like Microstrategy also set new trading volume records, and exchanges like Robinhood continuing to rise alongside crypto prices. 📊

And speaking of retail brokerages, U.S. investing platform Webull announced it is going public through a SPAC Deal while the market is still hot. It’s hoping the recent resurgence in animal spirits can help it enter public markets since it missed the boat back in 2021/2022. 💸

Whether this is a symptom of a healthy bull market or a sign of significant froth remains to be seen. But what’s clear is that everyone wants their piece of the pie and is saying, “count me in” by grabbing exposure as quickly as possible. 🪙

P.S. If you want extensive coverage of the crypto market, make sure you’re subscribed to our crypto-focused newsletter, The Litepaper. ₿

Earnings

Bumble’s Path Of Least Rizz-istance

Dating apps are a tricky business in the post-pandemic world, with investors continuing to swipe left on Bumble after its latest earnings report. 📰

The company behind dating apps Bumble, Badoo, and Fruitz said a slowdown in user spending caused it to miss first-quart revenue expectations. As a result, new CEO Lidiane Jones’ first move is to cut 350 roles, costing $20 to $25 million in one-time charges over the first two quarters. ✂️

Competitor Match Group has been looking to “rizz up” the younger generations with heavy marketing spend but has had limited success. Meanwhile, Bumble said it’s focused on reigniting ARPU growth in the mature U.S. market, relaunching its eponymous app and revamping its premium plus offering. And in terms of user growth, it’s eying global market expansion.

Nonetheless, the changes will take time to show results. The company expects just 8% to 11% annual revenue growth this year, well below estimates of 13.30%. Overall, the weak fundamental backdrop and the company’s inability to get a handle on revenue growth leaves it no choice but to lean down and preserve its cash. 🔻

As for the stock, technical analysts like to use the word “path of least resistance” when discussing a stock’s trend. In the case of Bumble, it’s safe to say the path of least “rizz-istance” is clearly lower, with the stock down more than 85% since coming public and hitting new all-time lows today. While its app is failing to attract a younger audience, its stock is failing to attract investors. 👎

Earnings

Snow Rest For The Wicked

Earnings season is a tough time for investors in several retail favorites, including Snowflake and AMC Entertainment. Let’s quickly see how they fared during their most recent quarters. 👇

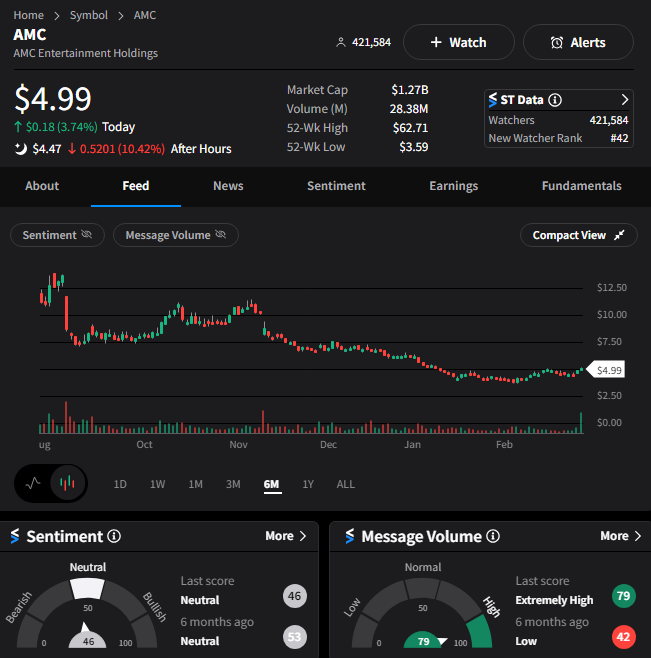

We’ll start with everyone’s favorite movie theatre chain, AMC Entertainment. The company beat earnings and revenue expectations during the fourth quarter, but the stock is still falling after hours.

That’s likely because CEO Adam Aaron said that “literally all” of the increase in fourth-quarter revenue was driven by Taylor Swift and Beyonce’s films. Total attendance grew 4.70% YoY to 51.90 million, yet the company reported a net loss and negative free cash flow. ☹️

With two consecutive quarters of blockbuster movies failing to produce cash from operations, investors are rightfully worried about further dilution. It also signals that much of the company’s success will depend on Hollywood producing blowout films every quarter if it has any chance at a sustained turnaround. 😬

After all, the company raised $865 million in cash from equity offerings in 2023 and paid off just $448.10 million in debt. With its debt and finance leases totaling $4.60 billion at the end of the quarter, the company will need cash eventually. And with it not coming from operations, the only other place it can come from is asset (or equity) sales.

Ultimately, the company has revenue and profitability problems. Until it can generate free cash flow from its core movie business, the risk of further dilution will be a major overhang for the stock. The bull vs. bear debate is raging on Stocktwits, with sentiment currently sitting in neutral territory.

Meanwhile, $AMC shares are down about 10% after the bell. ⚔️

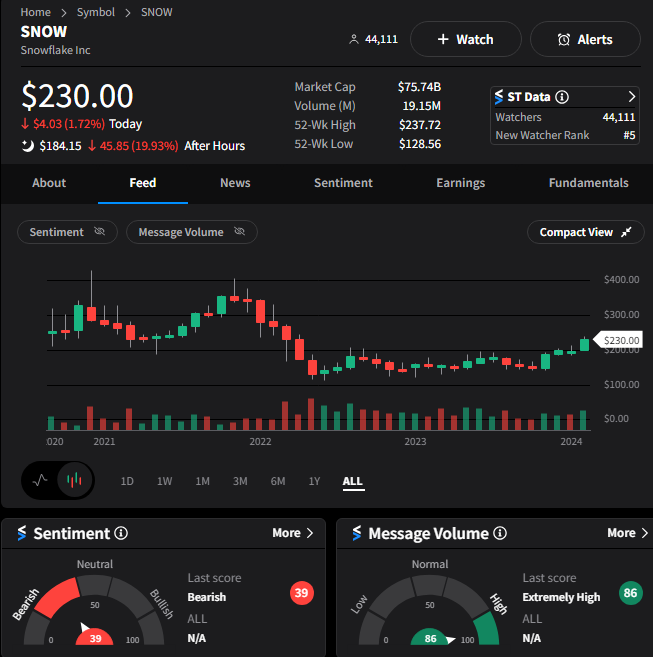

Next up is cloud company Snowflake. The main story here is the surprise change in CEO it announced. CEO Frank Slootman has retired effective immediately and will be replaced by the company’s senior vice president of AI, Sridhar Ramaswamy. 👨💼

The transition and a weaker-than-anticipated revenue outlook will undoubtedly take the market some time to digest. As a result, $SNOW shares plummeted 20% after the bell, with the Stocktwits community seemingly bearish on the stock following the news. 🐻

Bullets

Bullets From The Day:

🍏 Tim Cook cools market angst by saying Apple will “break new ground” on GenAI this year. The consumer tech giant’s CEO hopes to quell some concerns after pulling the plug on its decade-long electric vehicle yesterday and shifting resources to artificial intelligence (AI). It’s been the slowest among big tech to ramp up its investment in generative AI, but it seems to be making more external promises about what consumers (and the market) can expect from it in the year ahead. TechCrunch has more.

🗞️ More news publishers join in suing OpenAI and Microsoft for copyright infringement. The publications claim that the generative AI company intentionally removed important copyright information from training data, including author, title, and other identifiable information. The Intercept, Raw Story, and AlterNet filed separate lawsuits, each taking a unique approach to challenging the widespread use of copyrighted works in AI training models. More from The Verge.

❌ More layoffs hit the gaming industry as EA joins in. The video game company will lay off 5% of its global workforce, with management telling staff they’re sunsetting games and moving away from developing future licensed IP that it believes may not be successful. EA CEO said the company is streamlining its operations to deliver deeper, more connected experiences for fans everywhere and that cuts will support EA’s strategic priorities and growth initiatives. As for the future focus, owned IP, sports, and massive online communities were highlighted. CNBC has more.

Link

Links That Don’t Suck:

😎 New features, powerful upgrades and a new name… MarketSmith becomes MarketSurge on March 4th!*

🦺 FAA gives Boeing 90 days to come with plan to fix safety problems

🍔 Wendy’s, burned by CEO comment, vows no price surges for burgers

🏚️ Troubled Chinese property developer Country Garden faces liquidation petition

📺 Disney and Mukesh Ambani create new India media giant with 750 million viewers

🧑⚖️ Supreme Court will hear Trump presidential immunity claim in election interference case

📝 Read Google CEO Sundar Pichai’s memo to employees about the company’s Gemini AI screwup

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.