The first-week post-FTX collapse has not yielded many major moves. So unless something drastic happens between the end of market hours and tonight, crypto looks like it will close this week very close to where it closed last week.

Flat as flat can be. But a lot can change after hours – and the weekends are notorious for crazy swings.

On deck for today, we look at why Solana ($SOL.X) has fallen more than its peers, Nexo’s ($NEXO.X) crazy survival story, an insane amount of money for a Telegram handle, and updates to the top 10 market cap staking rewards.

Algorand ($ALGO.X) took the lead today, gaining a nice +7.32%. Overall, a fairly good showing by crypto. Despite Bitcoin ($BTC.X) closing in the red (barely), the Altcoin Market Cap and Total Market Cap edged out a small win for the day.

Here’s how the rest of the market looked at the end of the trading day:

| Algorand (ALGO) |

$0.29

|

7.32% |

| Litecoin (LTC) | $62.34 | 2.47% |

| Binance Coin (BNB) | $0272.89 | 1.65% |

| Monero (XMR) |

$133.22

|

1.25% |

| Tron (TRX) |

$0.05

|

1.21% |

| Bitcoin Cash (BCH) | $104.28 | 0.90% |

| Uniswap (UNI) | $5.81 | 0.77% |

| Ethereum (ETH) | $1,207 | 0.31% |

| Bitcoin (BTC) | $16,632 | -0.15% |

| Polygon (MATIC) |

$0.87

|

-0.19% |

| Altcoin Market Cap |

$468 Billion

|

0.52% |

| Total Market Cap | $788 Billion | 0.23% |

Nearly everything about Dogecoin ($DOGE.X) that comes up in the news is silly to unbelievable. No one in their right mind would have thought that Dogecoin would be one of the highest market cap and stalwart cryptocurrencies to exist 3 or 4 years ago. But here it is.

Did you know you can buy and sell usernames on Telegram? It can be done through Fragment (unless you live in the US). Someone paid almost $550,000 for the @doge Telegram handle. It is the 8th largest sale according to Fragment.

@casino is just above @doge, with @auto the most expensive Telegram name sold – at roughly $1.43 million. 😐

Crypto lender Nexo ($NEXO.X) is like the Minnesota Vikings of crypto this year (also, they both have purple in their logos). This has got to be a combination of fate and good work because someone there is probably getting a bonus this year.

The first bullet Nexo dodged was its offer to buy BlockFi ($BLOCKFI.P) this past Summer. Nexo was willing to partner with FTX on acquiring BlockFi – but BlockFi decided to go it alone with FTX’s bid. The total value of Nexo’s offer was roughly $850 million.

The second bullet – and Hollywood couldn’t write a better script for this – is the FTX bullet that almost hit them along with everyone else. We have to go back to this November 8 Tweet from Nexo’s Twitter:

.@Nexo has $0 net exposure to FTX/Alameda.

As a conservative institution with stringent risk controls @Nexo has safeguarded *all* funds by withdrawing its entire balances from the exchange over the past few days, as evidenced by on-chain data:https://t.co/py8fzBDKbP

1/— Nexo (@Nexo) November 8, 2022

Again, either Nexo has a guardian angel, or someone at Nexo smelled the stink coming from FTX before it was too late because, between November 1 and November 8, Nexo withdrew nearly $220 million from their FTX accounts. Literally hours before FTX shut down all withdrawals.

Genius or miraculous? You be the judge.

Nexo is one of the only ‘big’ crypto lending platforms that has been able to stay stable and grow after the collapse of Three Arrows Capital/Voyager/Celcius. If you didn’t read our interview with them, read it here. 👼

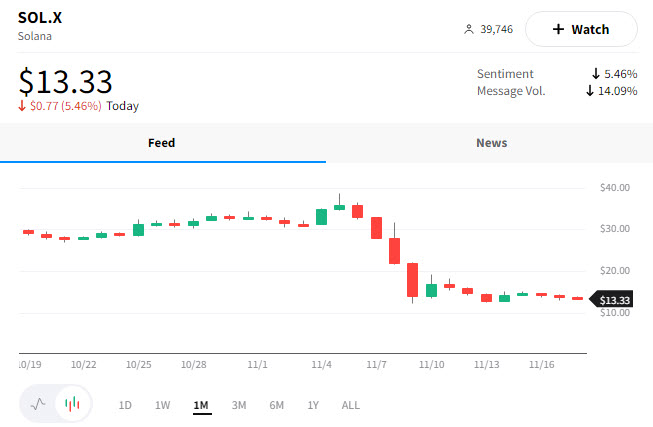

If there’s one major market cap cryptocurrency that’s suffered the most after FTX’s collapse, it’s Solana ($SOL.X).

So why is Solana getting hit more than its peers? Because of this guy:

It’s no secret that Sam Bankman-Fried (SBF) and FTX had a close relationship with Solana – heck, FTX held nearly $1 billion in SOL before declaring bankruptcy. The largest single asset owned by FTX ((according to the Solana Foundation’s blog post) is/was $2.2 billion of the Solana-based liquidity hub Serum ($SRM.X).

Serum, according to TheStreet, “… is one of the foundations of the Solana DeFi infrastructure, as it is the protocol and ecosystem that brings high speed and low transaction cost to Solana DeFi. It implements an on-chain central limit order book and matching engine, allowing to share liquidity and to offer powerful trading features to institutional and retail investors.”

What are SBF’s ties to Solana and Serum? SBF created Serum.

Anything that guy touched, people want to get rid of. The resulting FUD from FTX and SBF’s fall saw Solana fall -60% last week with little to no recovery this week.

The unfortunate collateral damage is the other projects in Solana’s ecosystem: almost none had/have any exposure to FTX. 😵

All The Big News – December 2, 2022

Accusation That FTX Misused Customer Funds Presents a ‘Prison’ Problem, Says Crypto Legal Expert Jeremy Hogan From The Daily Hodl

U.S. Trustee asks bankruptcy court to appoint FTX trustee From The Block

FTX Japan drafts plan to return client funds From Cointelegraph

Sam Bankman-Fried’s still sorry, but now he says his memory isn’t great From The Block

The table below is the current (November 18, 2022) staking yield rates of the top ten cryptocurrencies by their market cap. Not all cryptocurrencies have a staking mechanism on their networks, so, for example, you don’t see Bitcoin ($BTC.X) listed.

Staked % is what percent of the total supply of that cryptocurrency is currently used to earn staking rewards. Sometimes called ‘Locked Up.’

The Lock-Up Period is how long crypto must stay staked before you can withdraw it and/or any rewards earned.

Nominal Yields are the rewards listed, whereas Real Yield is the expected return when factoring in other costs, factors, or changes like inflation rates (not listed).

It should also be noted that calculations and factors for Real Yields can vary substantially from one week to the next. Additionally, the Nominal Yield may have an expected range but is not guaranteed. For example, Polkadot’s ($DOT.X) Nominal Yield is advertised/listed between 8% to 14%.

Another factor to consider is that the rewards are not in US Dollars but in token/crypto your stake. Staking Cardano ($ADA.X) rewards you in ADA and so forth.

This table is updated weekly.

| Crypto | Staked % | Lock-Up Period | Nominal Yield % | Real Yield % |

|---|---|---|---|---|

| Ethereum (ETH) | 13% | 12+ months | 6.9 % (+0.1) | 5.9% (+2.4) |

| Cardano (ADA) | 71% | None | 3.8% | 1.7% |

|

Solana (SOL)

|

77%

|

2 Days |

7.2%

|

1.6%

|

|

Polygon (MATIC)

|

33.7% (-0.5)

|

9 to 10 Days

|

5.2% (+0.1)

|

3.4% (+0.1)

|

| Polkadot (DOT) | 50.4% (-1.1) | 28 Days | 15.1% (+1.1) | 7.2% (+0.2) |

|

Tron (TRX)

|

46.2% (-0.4)

|

N/A

|

4.1% (+0.2)

|

2.1%

|

|

Cosmos (ATOM)

|

62.1% (-3.3) |

21 Days

|

20%

|

6.8% (+0.8)

|

|

Near (NEAR)

|

46.8% (+0.7)

|

36 hours |

10.4% (-0.1)

|

5.3% (-0.1)

|

|

Flow (FLOW)

|

53.5%

|

7 Days | 9.3% | 4.1% |

|

Elrond (EGLD)

|

60% (+0.7%)

|

N/A

|

8.8% (-0.1) |

3.3% (-0.1)

|

Source: staked.us/yields

Ethereum ($ETH.X), Near ($NEAR.X), and Elgron ($EGLD.X) both recorded an increase in stakers week over week.

Cosmos ($ATOM.X) saw the biggest drop of -3.3 percentage points week over week, but its real yield increased from 6% to 6.8%.

Ethereum’s real yield gained 2.4 points and was the biggest gainer for real yields week over week.

Last we wrote about keeping an eye on Cardano’s change in staking percentage as an early warning indicator of a change in sentiment among stakers. So far, they appear undeterred.

Considering Solana’s ($SOL.X) epic collapse of nearly -60% last week, the lack of any changes to its staking percentage or yields seems odd – but that’s what the data shows. 🔢

Bullets

Bullets From The Day:

💵 Binance.US is rumored to be in the running for another bid on Voyager ($VGX.X). Other prior bidders like CrossTower are also resubmitting proposals for Voyager. FTX had won the initial bid, but thankfully, for customers with assets still stuck on Voyager, nothing was transferred to FTX before the latter’s recent collapse. Read more from The Block

⁉️ Crypto.com’s CEO Kris Marszalek spoke with Andrew Sorkin of CNBC’s Squawk Box about further dangers to cryptocurrencies amid FTX’s collapse. Marszalek voiced his concerns that the industry may be pushed back a couple of years. He also expressed concerns that if the liquidity crunch continues, many exchanges may have to delist illiquid altcoins from their exchanges to protect consumers. Watch the full CNBC interview here

😵 According to a recent tweet by on-chain analysis firm, Glassnode, long-term hodlers of Bitcoin ($BTC.X) are “… currently experiencing acute financial stress, holding an average of -33% in unrealized losses.” However, at the same time, those unrealized losses have not turned the longer-term hodlers into sellers. Long-term hodlers of Ethereum ($ETH.X) and Ripple ($XRP.X) also show continued resilience in this market. Full story from Beincrypto

Links That Don’t Suck:

😬 Here’s what Joe Rogan found ‘weird’ about the FTX exchange meltdown

↙️ Top Crypto Analyst Says Historical Bottoming Signal for Bitcoin (BTC) Just Started Flashing

🤾 Jump Crypto says no plans to shut down, quashing rumors

🩳 Big Short Investor Michael Burry Sees This Asset Rising Amid FTX Contagion

🔟 Study: World’s top 10 most metaverse-ready countries revealed

🐻 How Uniswap [UNI] is emerging victorious in the current bear market

🇨🇳 China’s state blockchain infrastructure Xinghuo BIF partners Malaysian MyEG to fuel global push

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: