“Be fearful when others are greedy and greedy when others are fearful.”

That above quote is sometimes attributed to the great investor Warren Buffet. While Buffet has never been a fan of crypto, there are plenty of big-money whales out there that are. We will look at what the big players are doing and thinking post-FTX collapse.

We’ve also updated the FTX mega-thread with new updates. And if you’ve ever wondered what the heck exchange tokens (like CRO or FTT) are, check out our Crypto 101 article today.

Lot’s of choppy trading and price action this week in the crypto space, and it looks like that will continue. All of the primary assets we track are in the red, with Litecoin ($LTC.X) doing better than the rest.

Ethereum ($ETH.X) and Ethereum Classic ($ETC.X) are both sitting at the bottom, lagging behind their peers. And while today was another red day, Wednesday’s close was still above Monday’s close – we’ll see if that lasts though.

Here’s how the rest of the market looked at the end of the trading day:

| Litecoin (LTC) |

$57.37

|

-1.04% |

| Solana (SOL) | $14.07 | -1.47% |

| Shiba Inu (SHIB) | $0.00000906 | -2.05% |

| Bitcoin (BTC) |

$16,498

|

-2.25% |

| Cardano (ADA) |

$0.33

|

-2.61% |

| Dogecoin (DOGE) | $0.08 | -2.78% |

| Avalanche (AVAX) | $13.06 | -3.12% |

| Ethereum Classic (ETC) |

$19.87

|

-3.31% |

| Stellar (XLM) |

$0.09

|

-3.69% |

| Ethereum (ETH) |

$1,202

|

-3.94% |

| Altcoin Market Cap |

$467 Billion

|

-2.34% |

| Total Market Cap | $785 Billion | -2.36% |

Crypto

What Is Big Money Doing?

No matter how long you’ve been in the cryptocurrency space, no news or event has been more bearish than the collapse of FTX. Maybe there’s some recency bias from your author’s perspective, but neither Mt. Gox, the 2018 bear market, nor the Covid Crash felt as ugly as crypto does now in late 2022. 2022, in general, has, thus far, been the worst year from a ‘bad news’ perspective.

Fear, Uncertainty, and Doubt (FUD) is massive. $10s of billions is seemingly wiped out, and millions of creditors are affected. Institutions and individual investors have been equally hit by 2022’s nightmare of one collapse after another. But what are the ‘whales’ doing? What is Big Money up to? What are the institutions, the major fund managers, the top dogs – what are they doing during this crypto-pocalypse.

They’re practicing an old Wall Street phrase often quoted by Warren Buffet: “fearful when others are greedy and greedy when others are fearful.”

Is Ark Invest’s ($ARKK) Cathy Wood worried about FTX’s collapse on Bitcoin ($BTC.X)? If she is, she has an odd way of showing it. Ark picked up 315,259 shares of Grayscale’s GBTC ($GBTC) on Monday. Why not Bitcoin itself? No idea, but it might be because GBTC is trading at a 40% discount to the Bitcoin it’s holding.

What about one-time major crypto hater turned major crypto bull Shark Tank’s, Kevin O’Leary? Mr. Wonderful was a paid spokesperson for FTX and told Market Insider that his investment in FTX, “I’m writing that all down to zero.” He even tried to round up other investors to help bail out FTX – but when regulators started circling, he backed out.

Is he done with crypto? Nope. He’s still in it and transferred his assets to the Canadian crypto exchange WonderFi.

What about the great VC billionaire Tim Draper? He is famous for his 2018 prediction of Bitcoin hitting $250,000 by the end of 2022 or early 2023. Does he still feel that way after the FTX crypto contagion? In an interview with Cointelegraph, Draper said, “No change in the price prediction. Still $250,000 by early next year.”

Regarding FTX’s collapse, Draper continued saying, “FTX was centralized, reliant on a single founder,” the billionaire investor stated, referring to FTX creator and former CEO Sam Bankman-Fried. “When a currency is centralized — a central bank for instance — it has a single point of failure, and can also be manipulated.”

Taking a more optimistic approach, Draper made a case for FTX’s collapse as being bullish for Bitcoin:

“I think this fiasco is going to bring on a lot more Bitcoin maximalists. Note that your money is not secure in a centralized system, whether crypto or fiat.” 🧠

Just when you think you’ve tackled the cryptocurrency universe, something new always seems to pop up. One of the newer creations in crypto is the rise and use of Exchange Tokens. You might have heard of a few of them: Cryptom.com’s Cronos ($CRO.X), Binance’s Binance Coin ($BNB.X), and the now infamous FTX’s token, $FTT.X.

Exchange tokens are really nothing more than a type of cryptocurrency known as a utility token. They can be bought and sold just like Bitcoin ($BTC.X) or Ethereum ($ETH.X) – but they have the added benefit of doing something if you’re using it on the native crypto exchange.

So what do exchange tokens do? That depends on the token. But in a nutshell, exchange tokens are mostly used as an incentive for users to keep using the same exchange with some type of utility or benefit, like decreased trading fees. Let’s look at two of the biggest exchange tokens.

Crypto.com’s Cronos

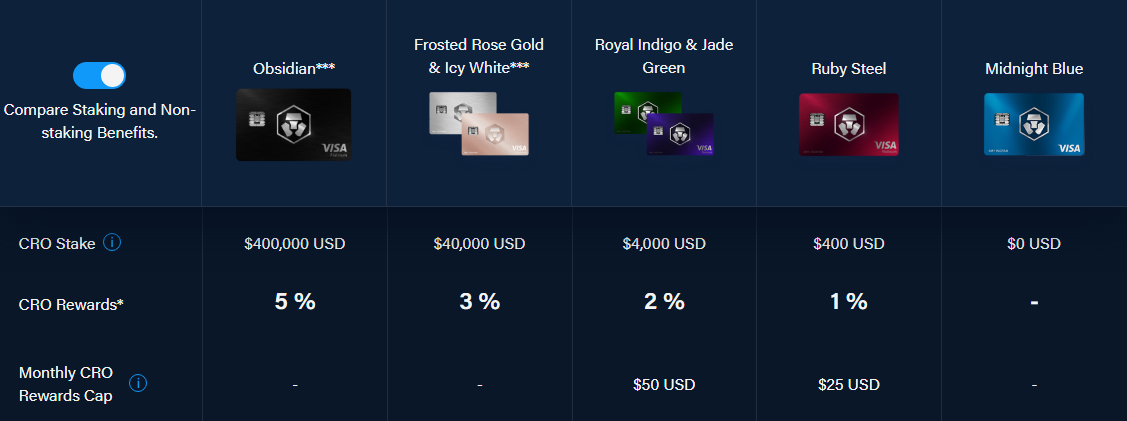

Easily one of the most popular and most traded exchange tokens is Crypto.com’s Cronos (CRO). Hodlers of CRO have certain benefits depending on the amount of CRO they choose to stake (deposit for a certain amount of time).

Crypto.com has its own debit card that anyone who uses Crypto.com can get, but if you want all the fancy bells, whistles, and benefits, you’ll have to pony up some CRO and stake it. And when I say pony up some cash we mean several ponies, stud horses, hay, and stables:

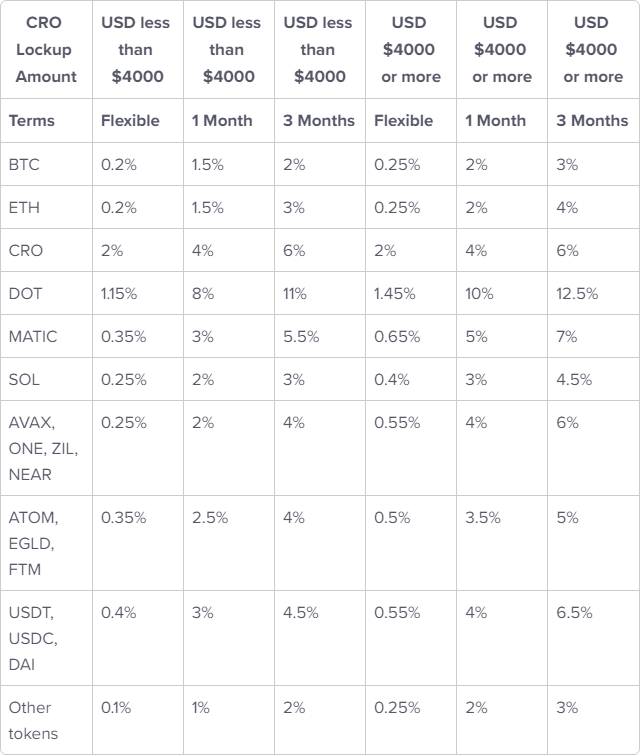

In addition to the debit cards offered, Crypto.com has a feature called Earn, which allows you to earn interest on certain cryptocurrencies and stablecoins. As with the debit cards, the interest rate varies depending on how much CRO you have staked and how long you choose to stake:

However, you should know that many of the cryptocurrencies CRO offers in their Earn program yield less than staking the asset natively.

For example, Polkadot ($DOT.X) has a nominal return between 8% and 14% – but Crypto.com will only pay you, at max, 12.5%, and you have to commit quite a bit of CRO to pay for the privilege of earning less than you could just staking on your own.

Binance’s BNB

Binance’s BNB token is an entirely different beast than CRO. BNB is the native token used on Binance’s blockchain/ecosystem, BNB Chain.

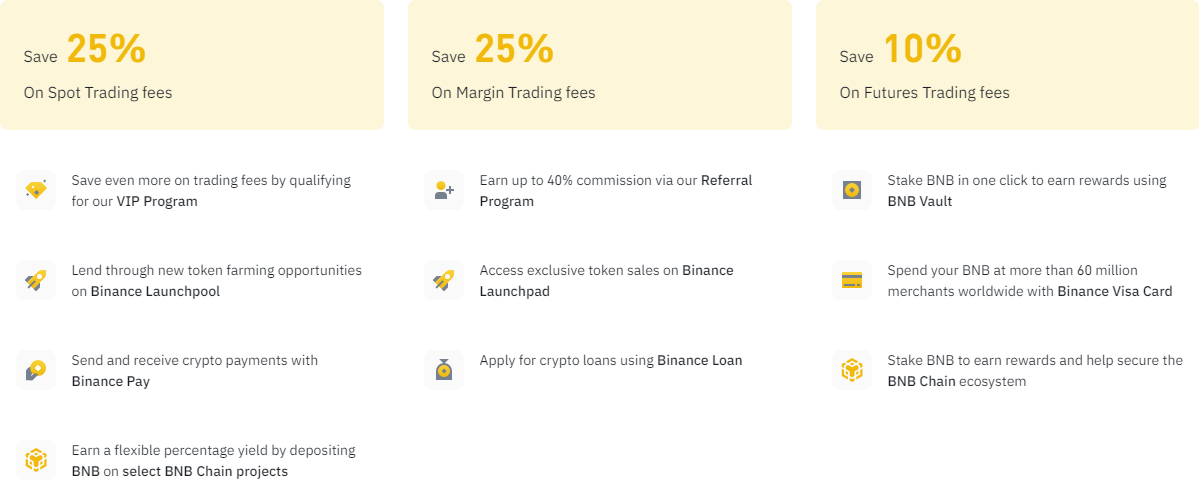

For traders, BNB can be used to save on trading fees, margin fees, and future trading fees.

BNB also has an interesting Burn mechanic (BNB is removed from circulation, like burning physical currency) to help stabilize the price and supply of BNB. Read more about Binance’s burn here.

While BNB might seem very limited compared to CRO, the use cases and focus differ. The primary focus of the BNB token is to ‘power’ the ever-expanding BNB Chain.

Does Binance offer staking like Crypto.com? Yes – but Binance leaves out the requirement of staking BNB to get Binance’s full range of staking benefits.

While CRO And BNB are just two examples of exchange-based tokens, you can see that while similar, they also have some big differences. So be sure to do that thing called due diligence and read the fine print.

Risks

Cryptocurrencies are arguably the riskiest of risk-on-type assets. At the time of writing this article (November 2022), 2022 has been one of the ugliest years for the cryptocurrency industry. Participants have seen entities like Terra ($LUNA.X), Voyager ($VG.X), Celsius ($CEL.X), and now FTX ($FTT.X) go bankrupt due to negligence, fraud, or both.

A common theme with the four entities listed above is this: they all have/had their own exchange token.

Unlike an instrument like Bitcoin, Ethereum, or Cardano ($ADA.X), most exchange tokens’ value is contingent upon the exchange’s success as a business. Exceptions would be exchange tokens that are also smart contract platforms like BNB.

When an exchange fails like Celsius or FTX, customers may be S.O.L. when it comes to getting anything of value back from those tokens. Assets like Bitcoin retain their value, but it’s unlikely that a failed exchange token like FTT will be of value to anyone anymore.

Are exchange tokens like CRO in the clear? Not by a long shot. Exchanges can make big changes to their incentives with little to no warning, causing massive shocks in the token’s value. In May 2022, Crypto.com significantly changed the staking rewards and benefits of staking CRO. CRO swiftly lost over 30% of its value.

Additionally, exchange tokens on Nexo ($NEXO.X) and Zoom ($ZOOM.X) eliminated all staking rewards for US customers in response to the SEC’s massive fine against BlockFi ($BLOCK.P). While neither of those exchanges suffered as significant a drop as CRO, the benefit of staking and holding NEXO or ZOOM was significantly reduced.

While exchange tokens have very enticing benefits, recent history should be a big reminder to make sure everyone does their own due diligence and researches where they put their money very, very carefully.

If something looks or sounds too good to be true, it often is. 👩🎓

All The Big News – December 2, 2022

Accusation That FTX Misused Customer Funds Presents a ‘Prison’ Problem, Says Crypto Legal Expert Jeremy Hogan From The Daily Hodl

U.S. Trustee asks bankruptcy court to appoint FTX trustee From The Block

FTX Japan drafts plan to return client funds From Cointelegraph

Sam Bankman-Fried’s still sorry, but now he says his memory isn’t great From The Block

Bullets

Bullets From The Day:

👔 Sony ($SONY) continues to push further into the NFT and metaverse space. Sony published a patent application for a system that tracks digital assets in video games. Many gamers have asked how and what vertical in-game assets will be managed or tracked – well, Sony just figured that out and has a (pending) patent on it. Specifically, the NFTs and game assets Sony is targeting is unique items associated with celebrities, e-sports winners, teams, and streamers. Full story from Decrypt

😱 USD Coin’s ($USDC.X) parent company Circle ($CIRCLE.P), filed an amended S-4 registration highlighting a miscalculation in the amount of USDC in circulation. Circle reported a decline of $8.3 billion in USDC circulation between June 30, 2022, and September 30, 2022 – $3 billion of which was due to Binance. Binance recently auto-converted nearly all USD-backed stablecoins (excluding Tether ($USDT.X)) stablecoins on its platform(s) to their stablecoin, BUSD ($BUSDX.X) in September. Read more from Cointelegraph

😬 In Monday’s Litepaper, we shared an update here in the Bullets section regarding Terra co-founder Daniel Shin. South Korean authorities recently summoned him as part of an investigation into his role in potential fraud. This situation escalated today with the Seoul Southern District Prosecutor’s Office raiding Shin’s payment technology company, Chai Corporation. Chai Corporation (had a partnership with Terra) and Shin are accused of using customers’ personal information in launching Shin’s payment service. The Block has the full story

Links

Links That Don’t Suck:

😬 Crypto stablecoin issuer Circle adds Apple Pay support

👬 US Congressman Says ‘Crypto Bros’ Preventing Legislation by Flooding Washington With Lobbying Money

💠 Polkadot (DOT) Active Accounts Number Jumps by 300% in Two Weeks

🌇 Citadel CEO on FTX debacle: ‘The turf war by American regulators has got to end’

🧵 Nexo resolves real-time audit outage laying insolvency rumors to rest

🧱 Cardano’s First Node Release After Vasil Gains Traction, Here’s What to Know

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: