It’s hard to believe we were just talking about hitting $40k on Monday, and now Bitcoin has hit and exceeded $44k, and the Altcoin Market Cap regained the $700 million level. 👍

Performance in crypto today is a mixed bag all around. Cryptos that have already made some big moves have paused, while the laggards look like they’re setting up for their own big moves.

We’re kicking off today’s Litepaper with a Technically Speaking segment; we’re zooming in on altcoins that look poised for significant action: Compound, Decred, Ontology, Monero, and Optimism.

Also on deck: Cathie Wood’s Coinbase and GBTC trades and Coinbase’s new way to transfer cash.

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $43,966 | -0.52% |

| Ethereum (ETH) | $2,257 | -1.57% |

| Total Market Cap | $1.562 Trillion | -0.27% |

| Altcoin Market Cap | $703 Billion | -0.07% |

| Avalanche (AVAX) – Biggest Winner |

$26.87

|

9.45% |

| Stacks (STX)- Biggest Loser | $1.05 | -11.04% |

As the title of today’s Litepaper says, today’s Technically Speaking is all about looking at the charts of altcoins that are poised for their own big move or have yet to follow the rest of the market.

Note: all of the altcoins discussed have a market cap of at least $100 million.

Want to know more about the Ichimoku Kinko Hyo system? Check out our Do You Ichimoku 101 article here.

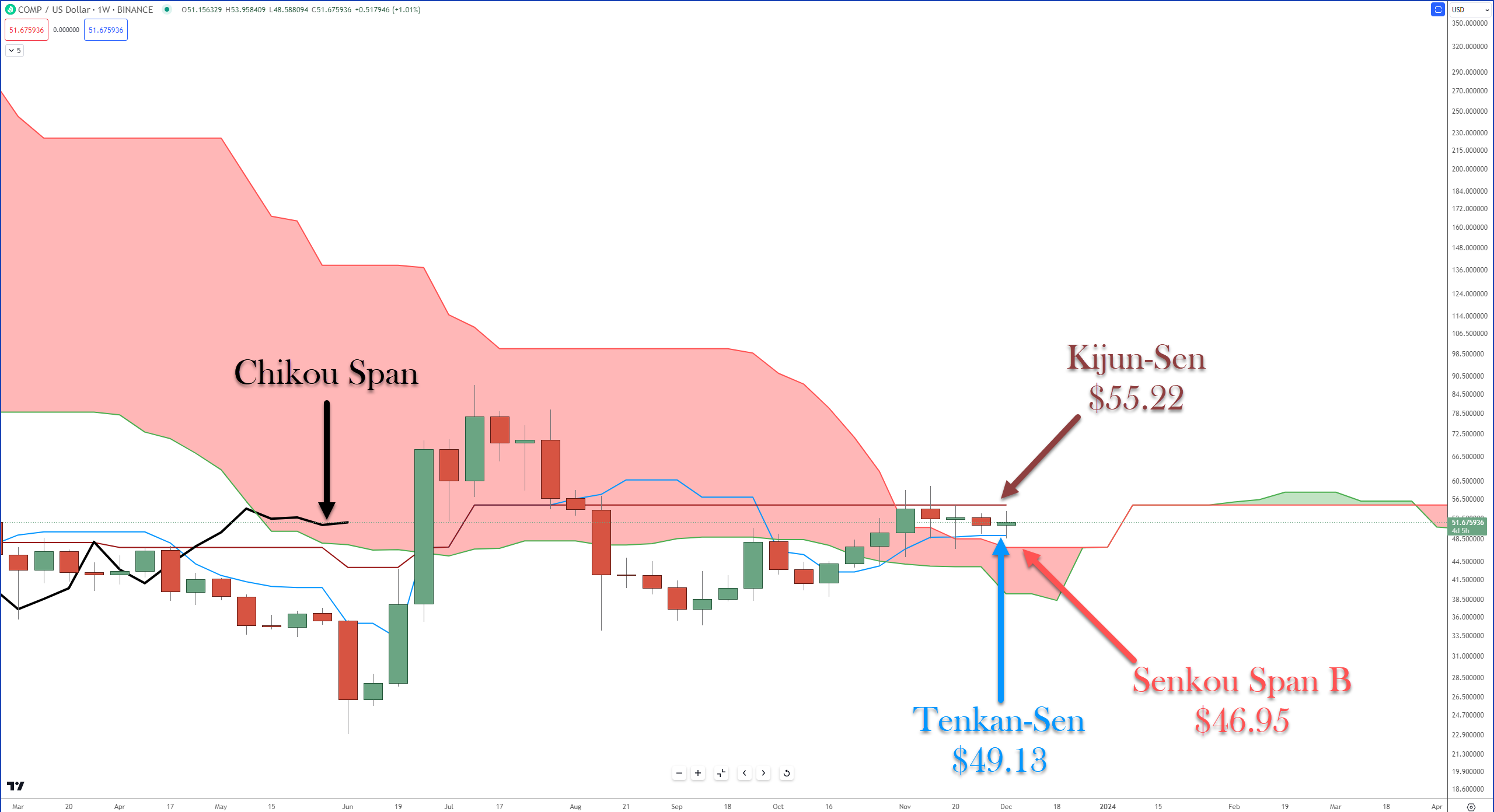

Compound

$COMP has been stuck in between its weekly Tenkan-Sen and Kijun-Sen for the past five weeks. And when you look at the Kijun-Sen, it’s not hard to understand why.

The Kijun-Sen is hella flat, and it has been the same price level for an insane twenty-one weeks. The move bulls want to see is a weekly close above the Kijun-Sen ($55.22).

Decred

Whether you look at $DCR‘s performance on a daily, weekly, or monthly timeframe, it’s clear this guy is lagging the broader market, big time.

Hell, this thing is still trading where was in June of this year and it’s one of the only $200+ million market cap crypto’s to not be above its weekly Kijun-Sen or inside/above the weekly Cloud.

For Ichimoku traders and analysts, the kind of weekly close they’re looking for as a sign that Decred is going to play catchup with everyone else is a weekly close that puts the Chikou Span above the candlestick bodies and in open space.

A weekly close at or above $16.19 would fulfill all those needs.

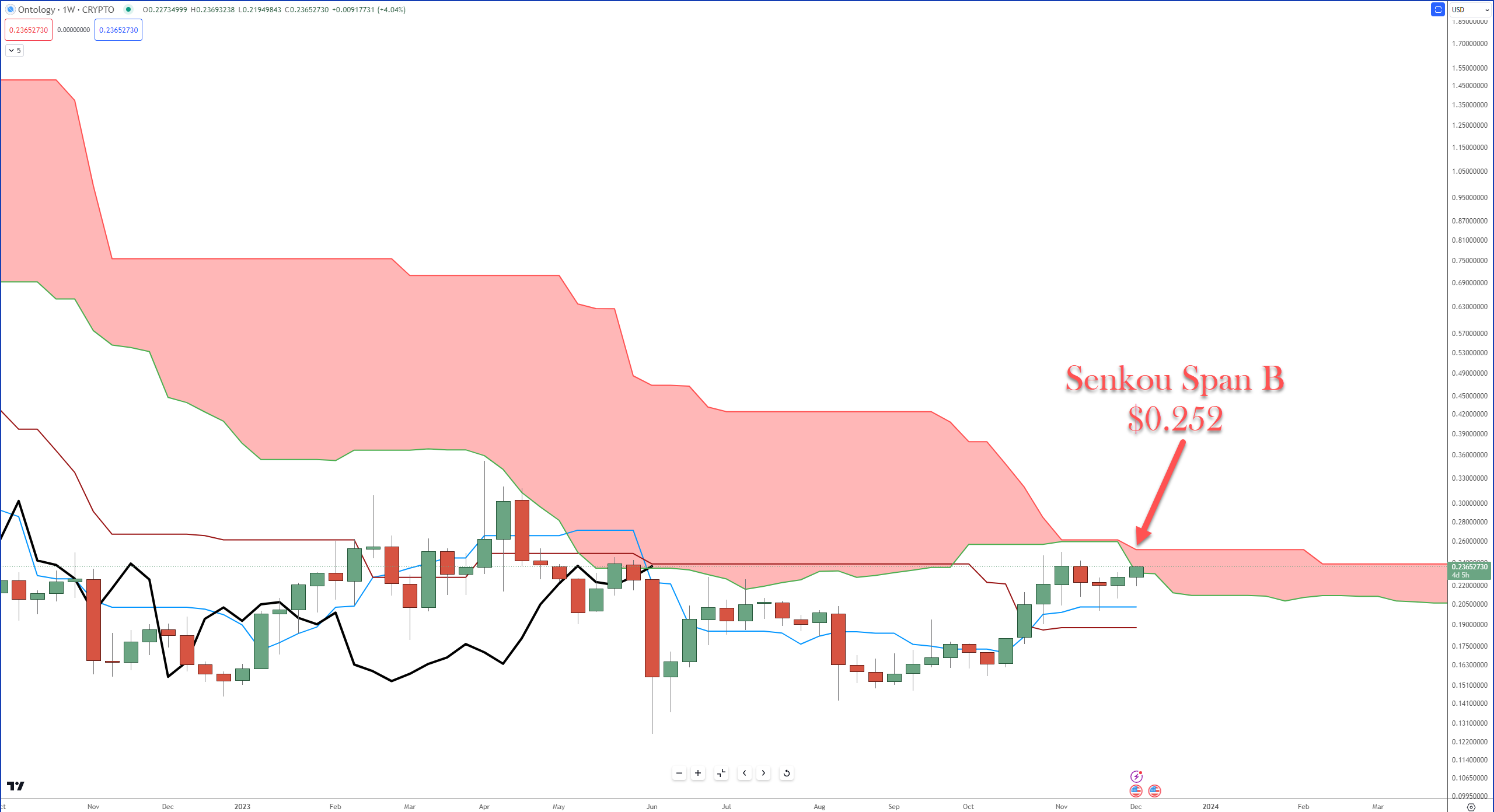

Ontology

Let’s look at the daily and weekly charts for this bad boy – starting with the daily.

There’s only one thing missing on the daily chart to confirm that $ONT is positioned for another run higher, and that’s the Chikou Span above the bodies of the candlesticks. A daily close at or above $0.237 would fulfill that requirement.

Now, on to the weekly.

The final weekly resistance level for Ontology is, naturally, the strongest level of support/resistance within the Ichimoku Kinko Hyo system: Senkou Span B.

A close above Senkou Span B ($0.252) would confirm the first Ideal Bullish Ichimoku Breakout since February 2021 – almost three years ago!

Monero

There’s not a lot to talk about when it comes to $XMR‘s daily or weekly charts. The Privacy Coin index is hands down of the worst performing indices of 2023, and Monero, as the biggest of the privacy focused cryptos, represents that index’s performance well.

That isn’t to say Monero has been trending lower or is a big loser – it’s not! It’s just stuck and hasn’t moved much. With the exception of a little rally in late January 2023 and the FTX dip in November 2022, Monero’s been trading between the $140 and $170 range ever since August 2022.

One good sign on the daily chart is the development of an inverse head and shoulders pattern, so keep an eye on XMR over the next few days to see how it responds to this pattern.

Especially if it closes above the neckline around $173.

Optimism

I’ll keep this one short and sweet. $OP‘s daily chart has a very similar setup to Ontology’s.

Bulls are just waiting for a daily close that positions the Chikou Span back into open space – which will occur if the daily can close above $1.86.

Speaking of Coinbase, this is from their blog: With Coinbase Wallet, sending money is now as easy as sending a text. 📲

Gone are the days of wrestling with bank account numbers and routing details. Coinbase Wallet lets you send money globally with just a link, shared via your favorite messaging and social apps like WhatsApp, iMessage, Telegram, Facebook, Snapchat, TikTok, Instagram, or even good old email. And the cherry on top? It’s instant and free of fees.

$COIN is stretching its arms across 170 countries, supporting local fiat onramps in over 130. This is a game-changer, especially for those in high-inflation economies whom the traditional financial system has sidelined. With popular local payment methods integrated, Coinbase is bringing stable currencies like the US Dollar to the global stage.

Fee-Free Transactions

According to their blog, you can receive money from any crypto exchange or self-custody wallet, buy $USDC sans Coinbase fees, and send USDC globally without fees on networks like Arbitrum, Avax, Base, Optimism, and Polygon. Plus, you can send payments in thousands of coins, including fee-free USDC, through Coinbase Wallet messaging.

Simplified Experience for Beginners

For those new to the crypto world, Coinbase Wallet introduces a simple mode. This feature strips down to the basics – buying, sending, receiving, and storing digital assets – making it a breeze for beginners.

It sounds like Coinbase wants a money and payment revolution in your pocket, making money transfers easier, cheaper, faster, and without borders. 💸

Bullets

Bullets From The Day:

🔐IBM and Ripple’s Secure Crypto Storage: IIBM is stepping into the web3 space with its Hyper Protect Offline Signing Orchestrator, offering a secure crypto storage solution. This move, attracting Ripple-backed Metaco, aims to provide a safer environment for institutional investors, especially after the FTX collapse and other high-profile crypto failures. IBM’s venture into crypto and Bitcoin’s bullish market trends could significantly boost its stock value and reputation in the web3 industry.

📈 Pando’s U.S. Bitcoin ETF Ambitions: Swiss asset manager Pando is making moves in the U.S. financial market, filing for a spot Bitcoin ETF with the CBOE. Already experienced in the European crypto ETP market, Pando’s entry into the U.S. could be a game-changer. Amidst this, Bitcoin’s price has soared, reflecting market optimism for the potential approval of a U.S. spot Bitcoin ETF, with experts predicting a high likelihood of approval by early next year.

🚨 SEC’s Bitcoin ETF Scrutiny and ‘Kill Switch’ Concerns: The SEC is closely working with Bitcoin ETF applicants, with a spotlight on BlackRock’s updated application. A potential ‘kill switch’ in the filing has sparked debates, suggesting severe consequences if Bitcoin is classified as a security. This move mirrors concerns raised in the XRP and Ripple Labs case, highlighting the SEC’s cautious approach to Bitcoin’s classification and its impact on the market.

🐳 Ethereum Whale Resurfaces: An early Ethereum whale, dormant for five years, has transferred nearly $90 million worth of ETH to Kraken. This move comes amidst other significant transfers, including Celsius Network’s transactions to various platforms. With Ethereum’s price showing positive momentum, this activity could indicate a shift in market dynamics or a strategic move by long-term holders.

Links

Links That Don’t Suck

↗️ Futures traders lose over $160 million in a week as Bitcoin rises

🤩 Rockstar devs react to Grand Theft Auto 6 trailer leak: ‘This f***ing sucks’

🥊 Canada gang charged for smuggling weed in maple syrup barrels for crypto

🗣️ Google updates Bard chatbot with ‘Gemini’ A.I. as it chases ChatGPT

💵 Digital assets defy traditional market trends amid signs of economic slowdown

Say Hello

💻 Questions? Comments? Email Jon at jmorgan@stocktwits.com 💻