Selling in the technology sector finally found Apple, knocking the market darling from its #1 spot down to #2 on the list of the world’s largest companies. 2️⃣

The stock fell 2.69% today, officially closing in bear market territory, meaning its share price has officially fallen more than 20% (on a closing basis) from former highs. 🐻

This matters to market participants for two main reasons:

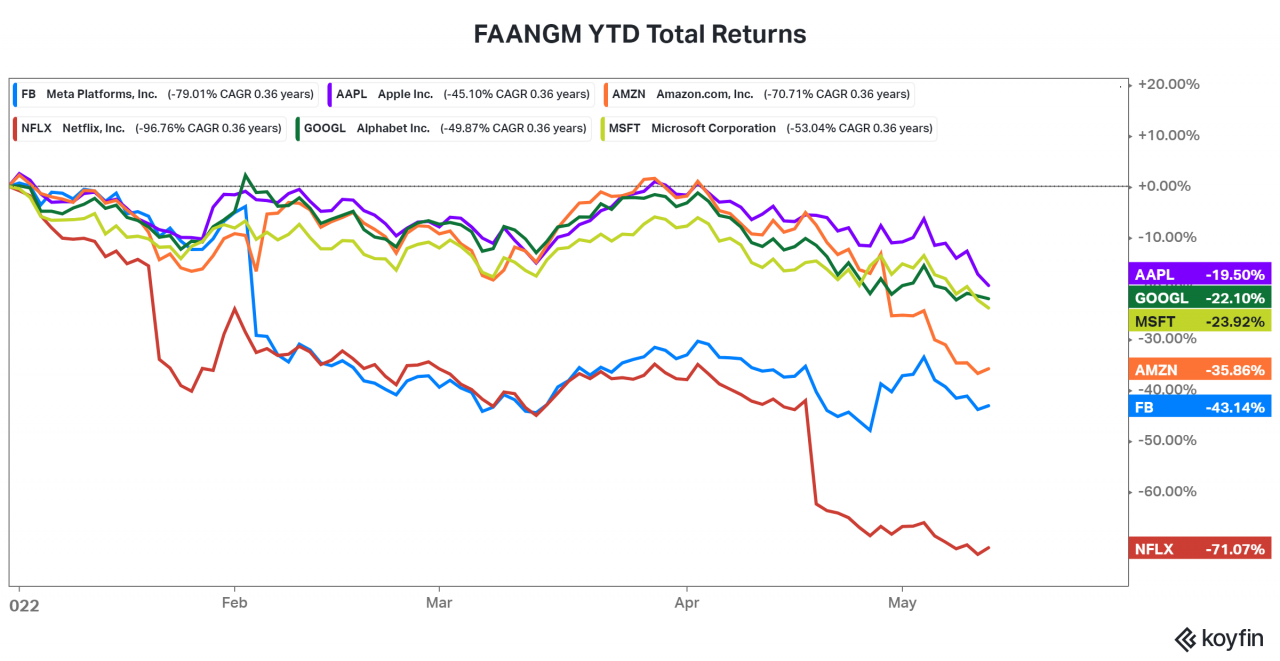

First off, this is the last of the market generals to fall. The company joins Facebook, Amazon, Netflix, Google, and Microsoft, which have already experienced significant declines. 📉

From a contrarian perspective, some market participants are viewing this as a potential sign that the broader weakness in the market may be inching closer to an end. ⌛

Much of the heavy selling over the last year has been in the most speculative/growth-focused areas of the market (SPACs, unprofitable tech companies, high-flying IPOs, etc.)

But as mega-cap tech names that were previously considered to be safe havens are now also getting hit, could things be headed too far on the downside? 🤔

On the flip side is the second reason why Apple’s weakness matters. ⚖️

Simply put, Apple is the largest U.S. company, and therefore it has a massive weight in all of the major indexes.

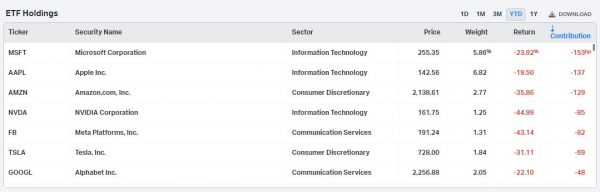

Apple has a 6.82% weight in the S&P 500, meaning today’s decline of 2.69% was responsible for -0.19% of the index’s performance today.

And if we take a look at the year-to-date performance of the S&P 500 ETF, the largest negative contributors to the index are all technology stocks, with Apple being the second-worst contributor behind Microsoft:

So the bearish argument is clear. 💡 It’s going to be incredibly difficult for the broader market indexes to find a bottom until Apple and its mega-cap peers stop going down. That’s just how portfolio math works.

Regardless of which side of the fence you fall on, Apple is going to remain in focus for investors in the days/weeks ahead. 👀

Check out the Apple stream to read conversations about $AAPL & share your thoughts!