The rally over the last two days has gotten a lot of people excited on Wall Street, specifically some technical analysts. 👀

The reason is that there was an improvement in the “breadth” of the market.

Market breadth analysis measures the health of the stocks that comprise the overall market indexes. The S&P 500 is a market-cap-weighted index, so breadth analysis looks to understand how well (or poorly) the 500 stocks within it are performing. 🔍

One of the most commonly used measures is the New Highs – New Lows Percentage Index. When the index we’re analyzing is in an uptrend or bull market, we generally want to see more stocks making new highs than new lows. However, in typically see the opposite in a bear market: more stocks make new lows than new highs.

Sometimes there can be divergences in the performance of an index vs. its constituents which analysts use as a contrarian indicator.

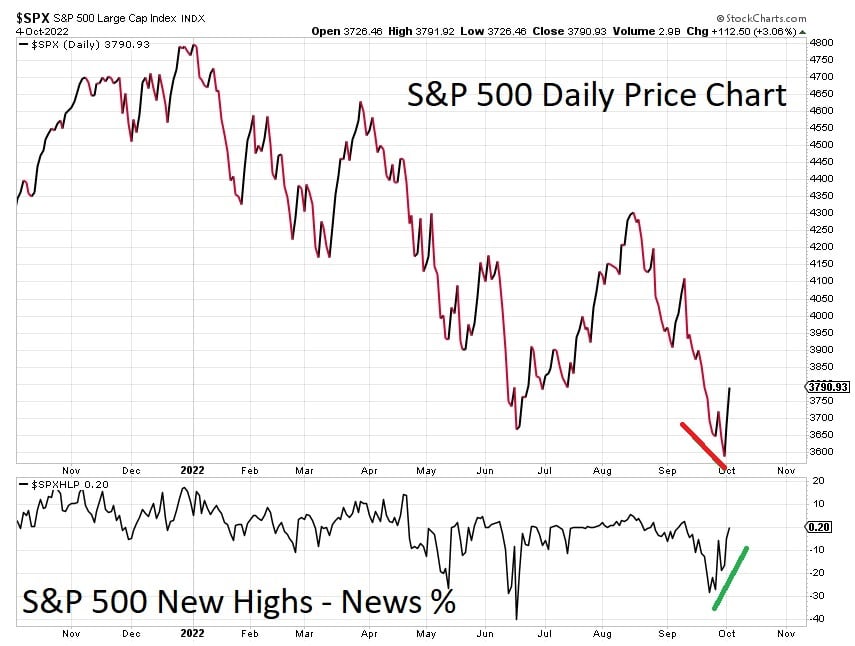

Let’s look at today’s example: Last week, the S&P 500 index made new lows in price, yet the New Highs – New Lows Percentage Index made a higher low. In other words, fewer stocks made new lows along with the index.

Technical analysts view this as a potentially bullish sign, particularly given the stock market’s strength over the last two days. They suggest that an improvement in market breadth is signaling the market could be undergoing a trend change. This thesis, however, is only valid if prices can stay above their recent lows along with the New High – New Low Percentage Index.

Breadth is a much broader topic that deserves a longer post, but we wanted to put out a quick explainer for those unfamiliar with the concept.

As always, we’ll have to wait and see how this develops in the days/weeks ahead. In the meantime, join the $SPY stream and share your thoughts on this theory. 💭