Chinese stocks are again on the rocks after a tumultuous end to the week-long National Congress of the Chinese Communist Party. This event occurs every five years and is the public venue for top-level leadership changes in the CCP and the formal event for changes to the Party’s Constitution.

In other words, it’s a big event. And this year did not disappoint. Or, actually, it did since prices are falling big time. But you know what we mean…

The main thing that people were focused on was former President Hu Jintao’s dramatic escorted exit from the event’s closing ceremony. This sparked much speculation about what’s happening and shows that President Xi Jinping is solidifying his power in the party and hold on the country.

On top of that, analysts and investors had expected more economic reforms to be pushed through at this party. However, that did not happen, leaving many worried about the country’s economy and ability to continue growing. Additionally, it delayed the release of several key economic indicators last week, which added to the uncertainty.

Overall, the political uncertainty and concern over the country’s economy have added to the sentiment that China’s market is “uninvestable,” or at least very risky.

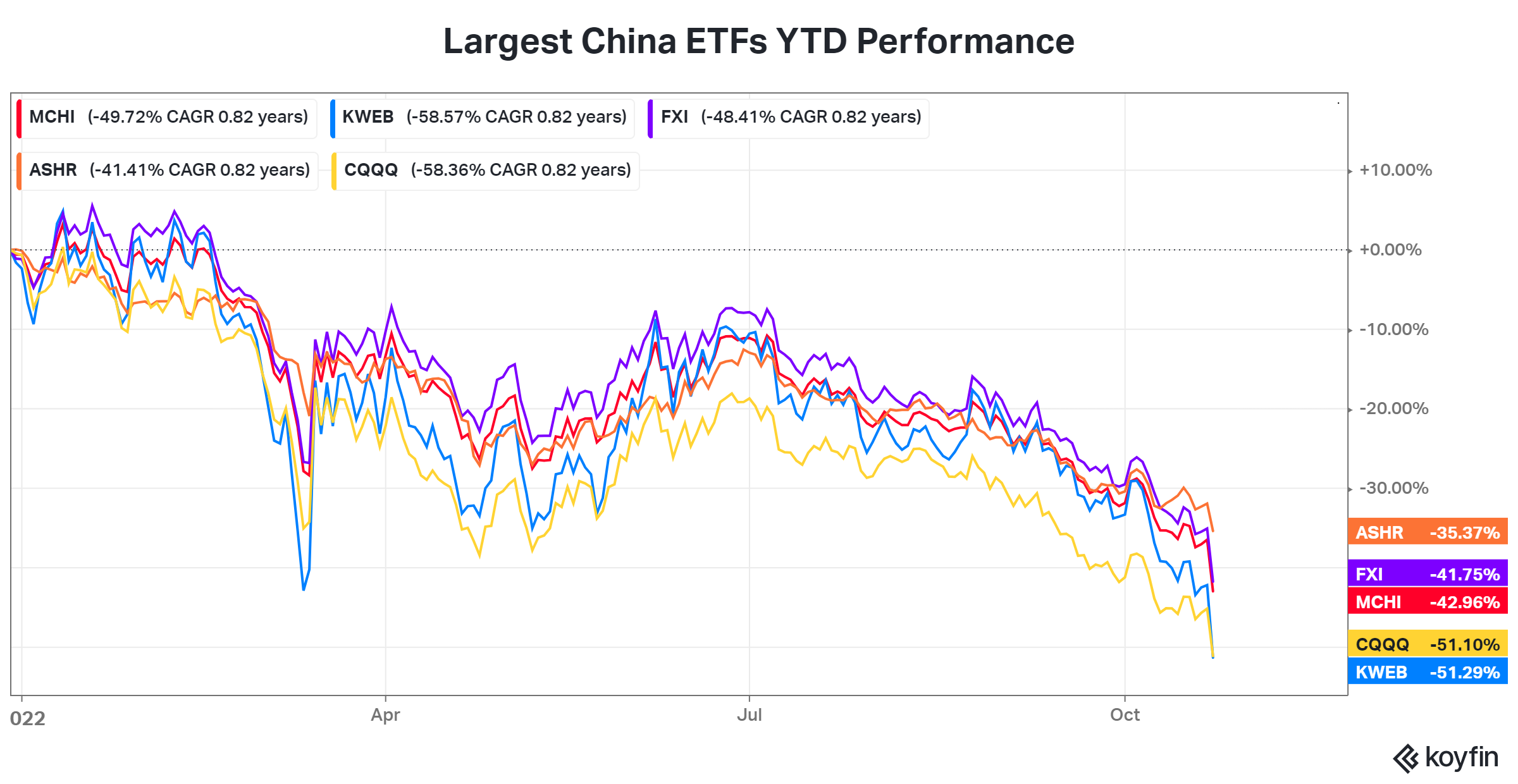

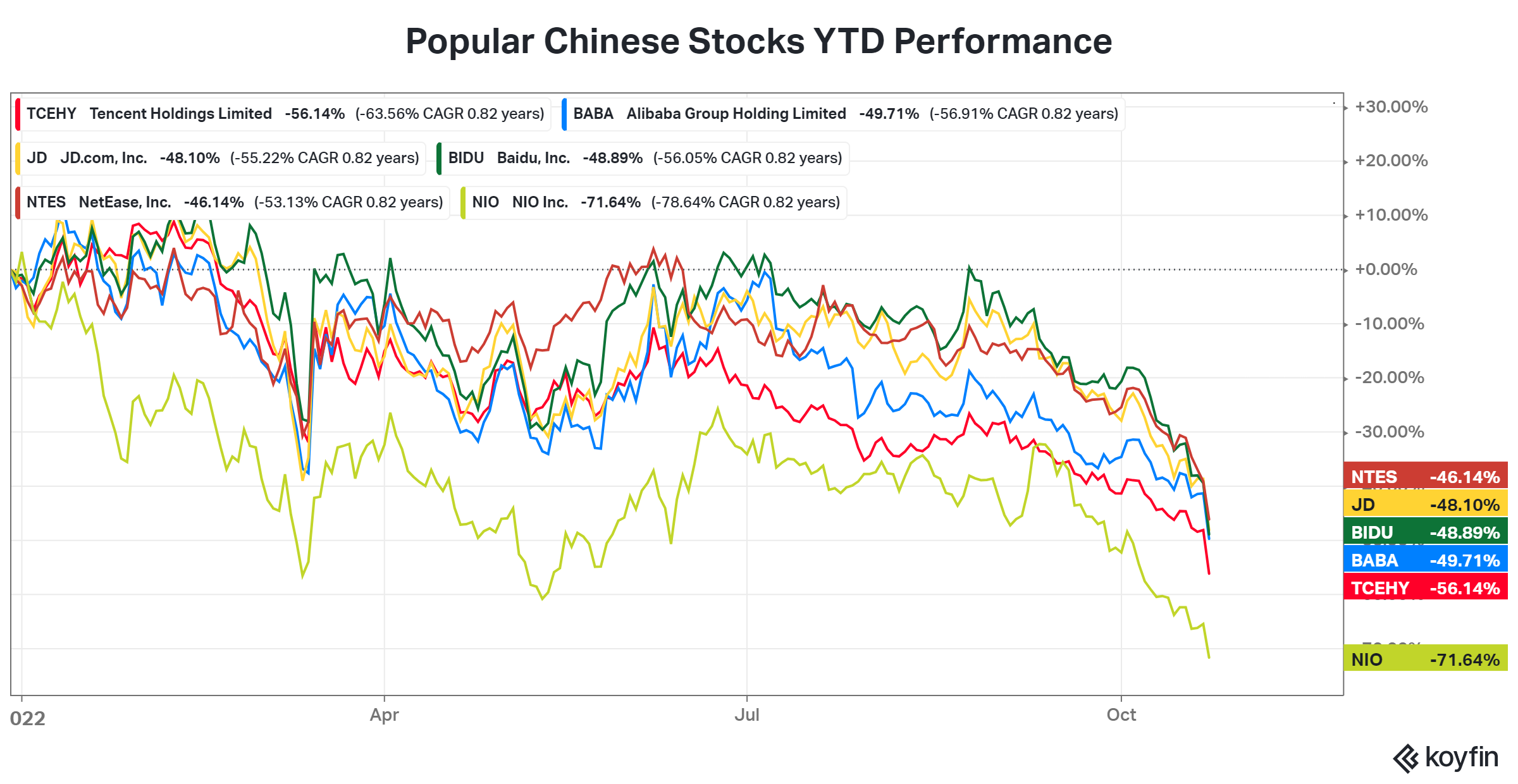

The uncertainty sent Hong Kong’s Hang Seng Index down 6.63% to its lowest level since April 2009. Many of the popular U.S.-listed ETFs and American Depository Receipts (ADR) were down sharply at the open, many of them hitting fresh all-time lows or other long-term lows.

Here is a year-to-date chart of several of the largest China-focused ETFs by assets under management (AUM):

And here’s a year-to-date chart of several popular Chinese stocks:

How this all shakes out remains to be seen. But this topic and asset class will likely remain in focus for some time until the markets get more clarity about what’s going on in the country.

As always, we’ll keep you updated the best that we can. 📝