This week we received earnings reports from several former growth darlings. And most of their stocks’ reactions were absolutely dismal.

So before we send you off to enjoy your weekend, we wanted to share some of the worst charts from the week. Just in case you forgot what type of environment we’re in for broken growth stocks. 🙃

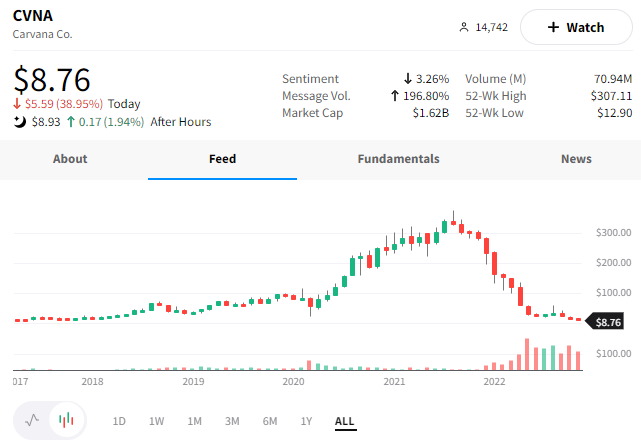

First, let’s start with a quick joke. What do you call a stock that’s down 97.68%? A stock that was down 96.19% but fell another 39%. More formally, it’s known as Carvana.

$CVNA shares suffered their worst day ever after it missed already lowered top and bottom-line expectations. Additionally, Morgan Stanley gave up on trying to cover the stock…pulling its rating and price target altogether. A 98% drop in 15 months has to be a record of some sort. Big yikes.😬

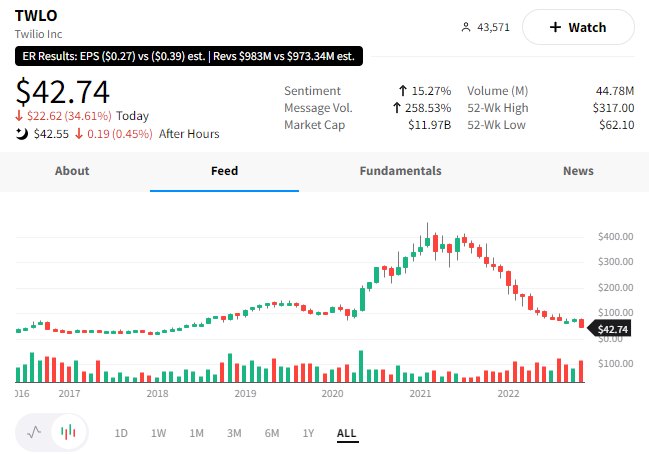

$TWLO shares crashed 35% after issuing weaker-than-expected guidance.

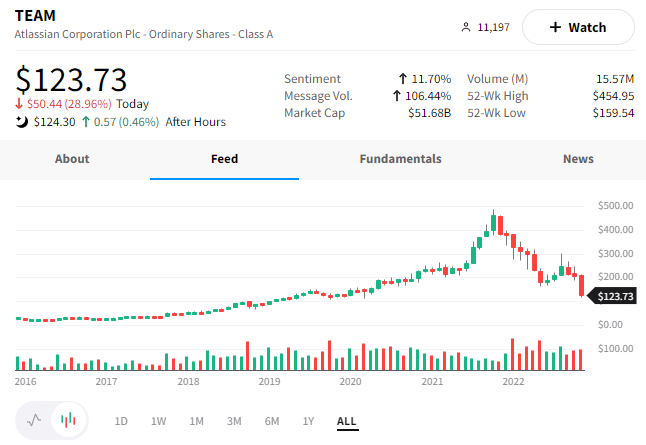

$TEAM shares fell 29% after revenue missed expectations and the software maker issued a disappointing forecast.

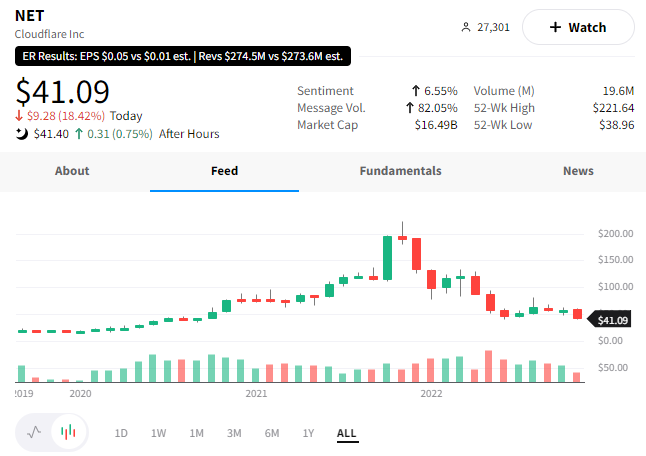

$NET shares dropped 18% despite beating earnings and revenue expectations. Once again, forward guidance was key and clearly did not appease investors.

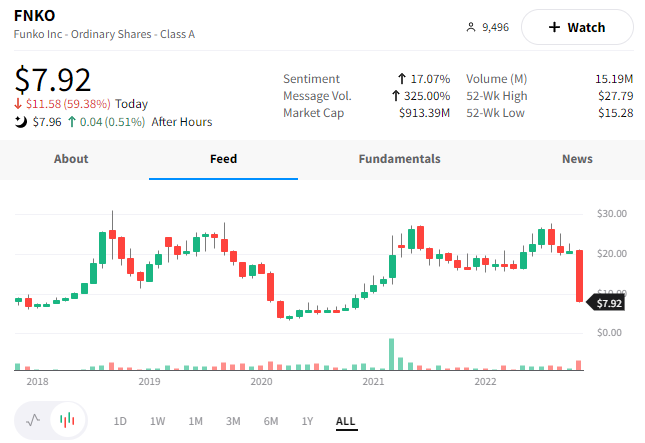

While not a tech stock, we can’t exclude this disaster of a chart…

$FNKO investors were left saying “what the Funko” happened, as shares dove more than 60%. The toy company missed earnings and slashed its outlook, indicating no growth in the coming quarters. Much like its customers, the company’s investors did not play around…opting to aggressively offload shares on the news. 👎