Yup. You read the headline correctly. Fidelity is getting ready to take the metaverse by storm. ⚡

A bundle of trademark applications (97727409, 97727473, and 97727439) were filed with the U.S. Patent and Trademark Office last week.

The patents highlight an online marketplace for digital goods and media – primarily NFTs – and a virtual environment to give financial advice in cryptocurrencies, crypto exchange services, and virtual real estate.

If it sounds weird that America’s largest provider of 401k accounts is getting into the metaverse, it sounded just as weird back in 2018 when they made a similar announcement.

At the height (or the low) of the 2018 bear market in cryptocurrencies, Fidelity announced a huge step into the crypto space for hedge funds and other institutions.

Fidelity didn’t just become the first major finance player to hodl Bitcoin in custody in 2018; they went all in by offering trades across multiple cryptocurrency exchanges for clients. 🤯

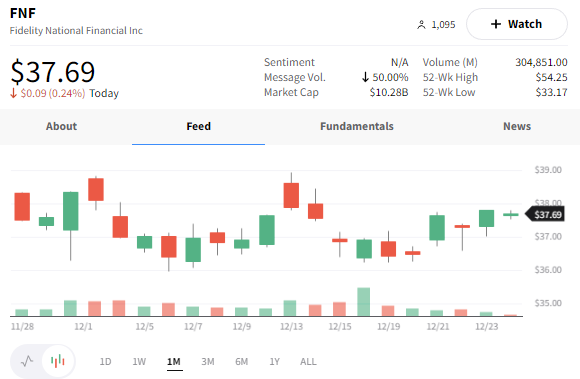

At the time of writing, Fidelity is trading mostly flat for the day, avoiding many of the red seen by its peers and the broader market.