The Volatility Index, or VIX, is a popular indicator to measure “fear” in the market. And it just hit a 15-month low, popping up on many radars. 📝

First off, the VIX is based on the implied volatility of S&P 500 Index options. Using near-term expiration dates, it generates a 30-day forward projection of volatility. As a result, investors use the VIX to measure the level of “risk” or “Fear” the market is feeling. 📝

While the VIX is not a tradeable index, there are futures contracts that track it. However, the most common way for retail investors to gain exposure to the VIX is through several exchange-traded funds (ETFs) and exchange-traded notes (ETNs).

Over the last few years, focus on the index has been diminished, as the popularization of options trading (specifically short-term options) impacts how it behaves. For example, rather than investors using monthly options to hedge their portfolios or make directional bets, many have begun to use weekly or daily options. Some argue that reduces the index’s value. 📆

With that said, many still use the VIX as a measure of the underlying fear or complacency in the market.

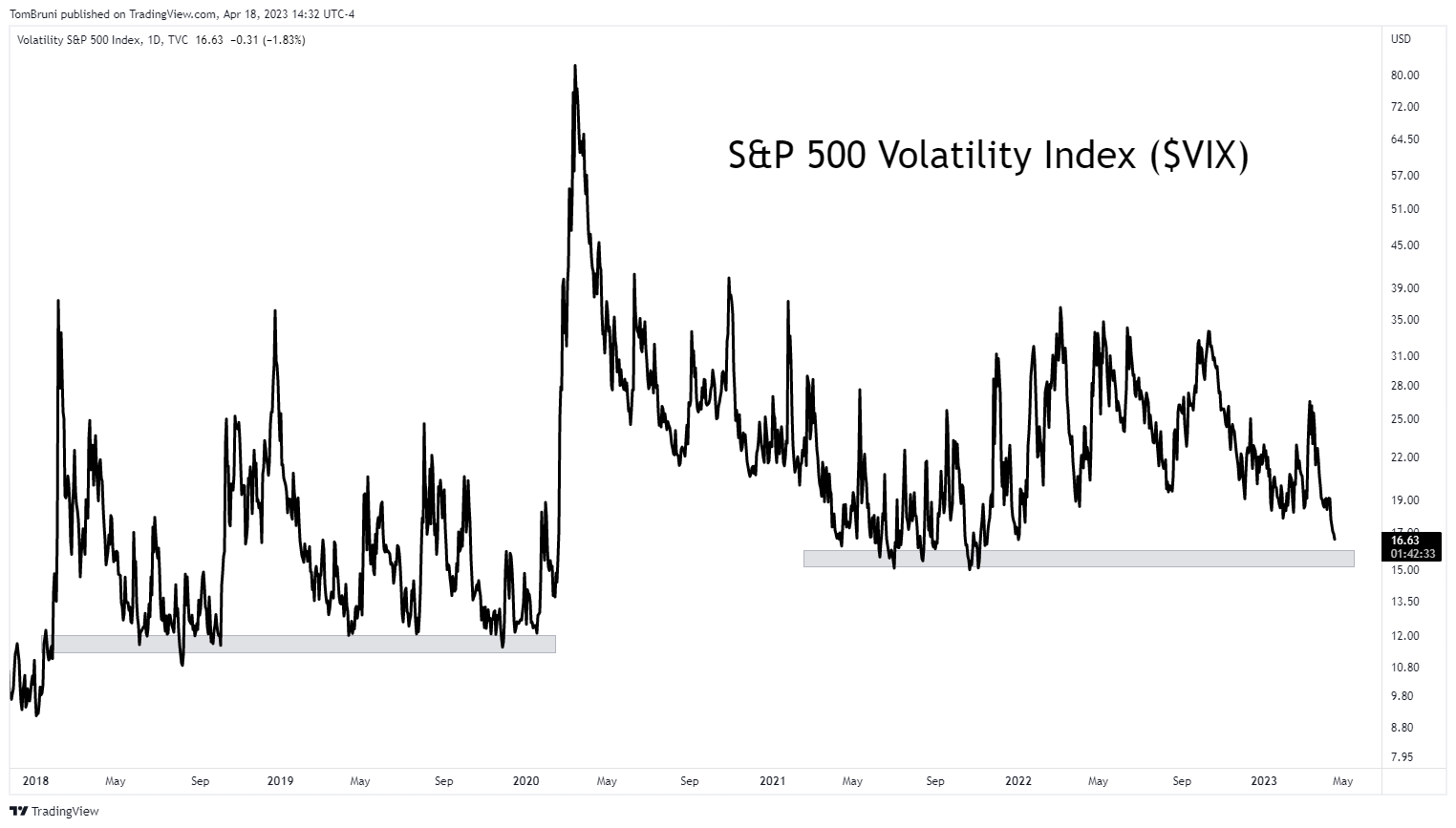

Since early 2022 we’ve been in a higher-volatility regime, with the VIX bouncing between the high teens and the mid-thirties. Now, with the index drifting towards the mid-teens, many market participants are wondering whether this means the market is settling into a new, lower-volatility regime. Time will tell…but for now, investors appear “cool as a cucumber.” 🤷