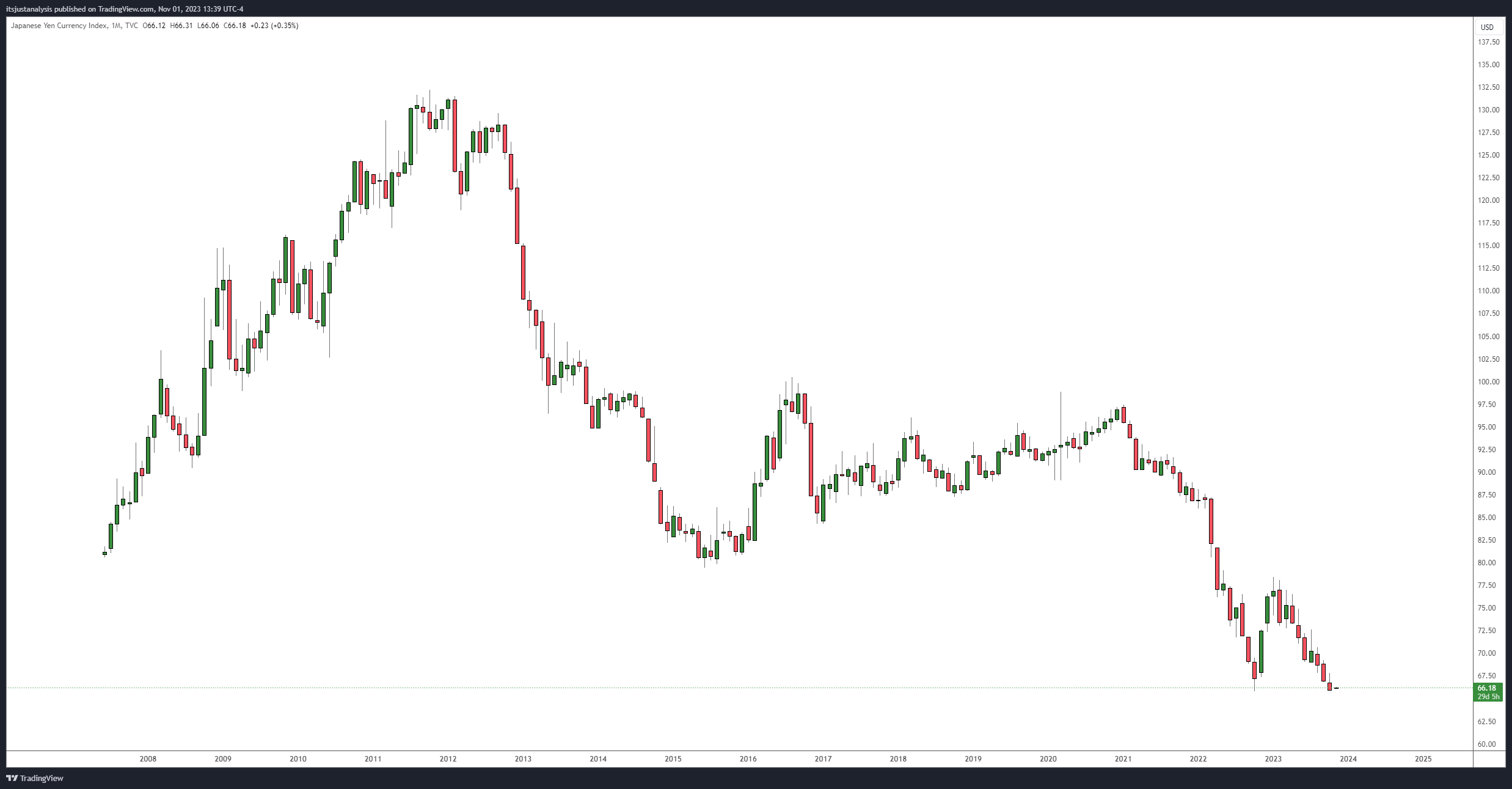

With all eyes on bonds, eyes should also be on currencies, and one of the scariest-looking charts out there is most definitely the Yen Index (JXY). 👀

When October came to an end, the lowest daily, weekly, and monthly close in the JXY’s history occurred. 😲

Why are traders and investors nervous? Unlike the USD and Euro currencies, which are considered clean floats, the Yen is considered a dirty float – meaning the government/central bank intervenes.

And talking heads from Japan’s Prime Minister to the big wigs at the Ministry of Finance and Bank of Japan have all basically said, “F*ck around, find out.” Multiple times. Warning everyone.

The last time Japan’s Ministry of Finance and Bank of Japan intervened was late October 2022, and the Yen rallied nearly +19% into mid-January 2023. At the same time that occurred, the $SPY moved as much as +12.43% and the $QQQ up +10.70%.

Buffet Loves Japan

And Warren Buffet is in love with Japan right now. In the words of Charlie Munger, the decision to invest billions into Japan “…was like having God just opening a chest and just pouring money into it.” 💰

Berkshire Hathaway veered off its usual U.S.-centric course, striking investment gold in Japan. Diving into Japan’s low-interest-rate waters, Berkshire borrowed Yen cheaply to invest in dividend-rich trading houses, turning a $6 billion stake into a whopping $17 billion.

Buffett himself praised the undervalued nature of Japan’s markets at Berkshire’s annual meeting, aligning perfectly with their long-term strategy. ♟️