Advertisement|Remove ads.

NVIDIA Stock Rallies To Record High After Dow Entry, Retail Sentiment Cools From Peak Levels

NVIDIA Corp. ($NVDA) hit a new all-time high on Friday after joining the Dow Jones Industrial Average ($DJIA), replacing chipmaker Intel ($INTC).

The artificial intelligence behemoth hit $149.76 for the first-time ever, on a split-adjusted basis, cementing its position as the world’s most valuable company after overtaking Apple ($AAPL) on Monday.

This climb extends NVIDIA’s five-day rally, fueled by high expectations for reduced corporate taxes and potential deregulation in AI and energy following Republican candidate Donald Trump’s 2024 U.S. election win.

While joining the Dow boosts NVIDIA’s profile, it may not lead to substantial additional buying, as relatively few funds track the Dow compared to other indices.

According to Dow Jones Market Data, stocks added to the index typically experience only modest gains or even slight declines on their first day, with the last 20 additions averaging a 0.3% loss.

Meanwhile, Nvidia supplier Taiwan Semiconductor Manufacturing ($TSM) reported its October sales hit a record high. The company’s revenue for October rose 29% year-on-year (YoY) to $9.79 billion.

Both TSMC and NVIDIA are ramping up production capacity to meet skyrocketing demand for AI chips, with TSMC doubling its advanced packaging capability, known as CoWoS, essential for NVIDIA’s high-performance AI processors.

In leadership news, NVIDIA appointed Ellen Ochoa, former NASA Johnson Space Center director, to its board on Thursday after the bell.

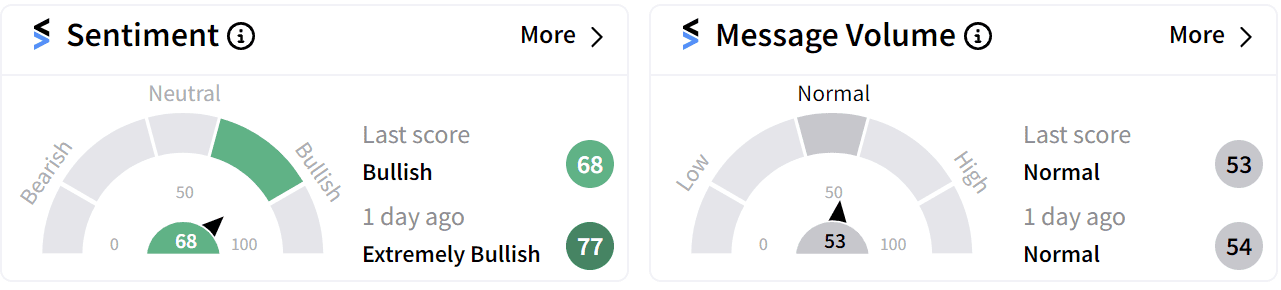

Retail sentiment on Stocktwits for NVIDIA, while still optimistic, dipped slightly into the ‘bullish’ (68/100) territory as the day’s gains leveled off, reflecting some cautious optimism among retail investors.

NVIDIA is set to report its third-quarter earnings on Nov. 20 with Wall Street expected earnings per share (EPS) of $0.74 on revenue of $32.97 billion. The company has beaten estimates for the last four consecutive quarters.

The stock has more than quadrupled this year with gains of 206% so far.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190030422_jpg_015a76718e.webp)