Advertisement|Remove ads.

NVIDIA Overtakes Apple As The World’s Most Valuable Company After A Month-Long Chase, Bolsters Retail Optimism

With an over 2% surge in its stock on Monday, NVIDIA Corp. ($NVDA) has overtaken Apple Inc. ($AAPL) to become the world’s most valuable company, with a market capitalization of $3.39 trillion.

Apple, whose shares fell nearly 1% in mid-day trading, now boasts a market cap of $3.35 trillion, according to Stocktwits data.

The two companies remained closely matched throughout October, following NVIDIA's six-day winning streak that was spurred by the announcement of a $6.6 billion funding round for OpenAI.

Retail sentiment toward NVIDIA was further bolstered by strong spending from major tech firms and its impending inclusion in the Dow Jones Industrial Average ($DJIA).

NVIDIA will replace Intel ($INTC) in the Dow later this week, a decision made by S&P Dow Jones Indices to better reflect the semiconductor sector.

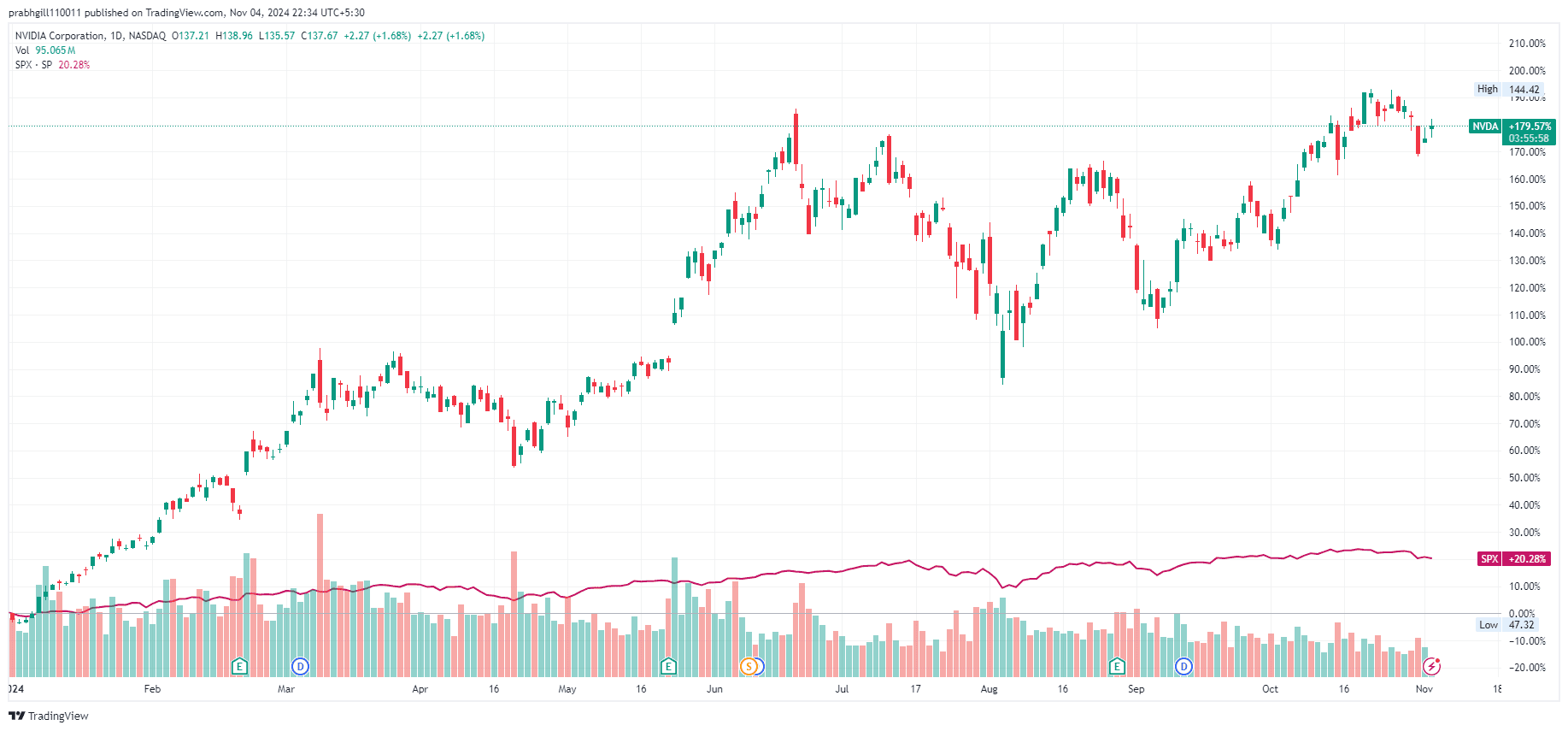

The company’s stock has more than doubled this year, gaining nearly 180% in 2024, dwarfing the S&P 500’s ($SPY) gains.

NVIDIA is scheduled to report its third-quarter earnings on Nov. 20. Wall Street anticipates earnings per share (EPS) of $0.74 and revenue to come in at $32.97 billion.

Nearly 60 analysts give the stock a buy-equivalent rating with a median price target of $150, according to data from finchat.io.

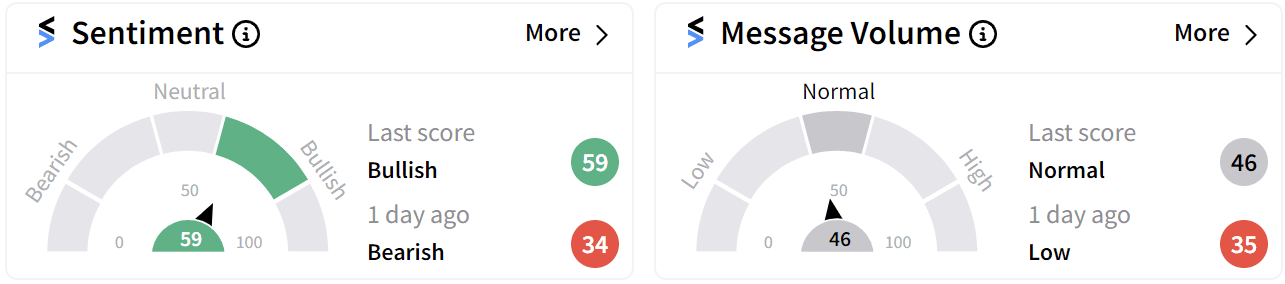

Retail sentiment around NVIDIA on Stocktwits has flipped to ‘bullish’ (59/100) with an uptick in message volume to ‘normal’ (46/100).

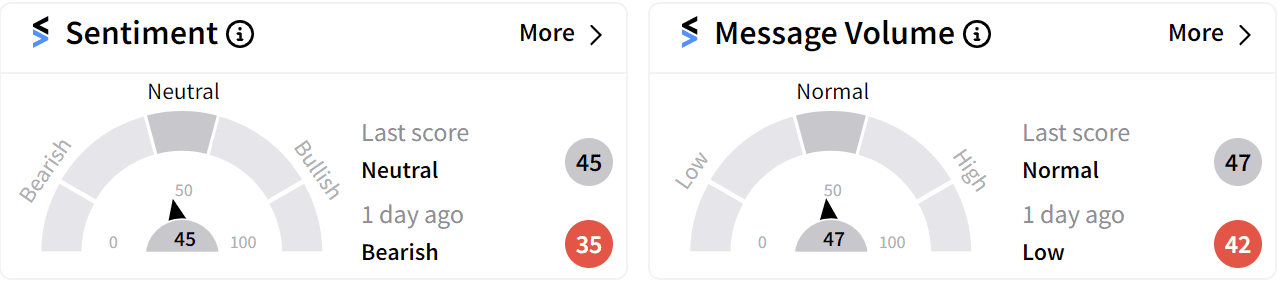

Retail sentiment around Apple has improved marginally into the ‘neutral’ (45/100) territory with an uptick in message volume to ‘normal’ (47/100).

The dip in its shares comes after Berkshire Hathaway ($BRK.A) ($BRK.B) disclosed it sold about 100 million, or 25%, of its Apple shares in the third quarter. Its fourth-quarter results also did not impress Wall Street despite beating estimates.

Analysts’ downgrades have further weighed on the stock, following surveys suggesting that iPhone 16 production may fall short of expectations in the upcoming quarters. Brokerages have also cited concerns that the new iPhone SE could divert customers from Apple's premium iPhone models.

Apple’s stock has gained 20% in 2024 so far.

For updates and corrections email newsroom@stocktwits.com.

Read more: Apple’s Q4 Beat Does Not Impress Wall Street As Stock Dips In Premarket

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)