Advertisement|Remove ads.

ARK Invest Slows Trading Spree But Can’t Quit Coinbase

- Buying activity followed Coinbase’s announcement of stock trading and prediction markets

- ARK funds posted modest after-hours gains following recent declines.

- Retail sentiment on Stocktwits around ARK ETFs remained largely bearish despite fresh inflows.

Cathie Wood’s ARK Invest slowed the pace of new purchases on Thursday, but continued to add to its position in Coinbase Global (COIN), indicating ongoing conviction in the crypto exchange following its latest product expansion.

COIN’s stock gained more than 3% in pre-market trade, trading at around $246.85. On Stocktwits, retail sentiment around the crypto exchange improved to ‘neutral’ from ‘bearish’ territory over the past day, while chatter remained at ‘high’ levels.

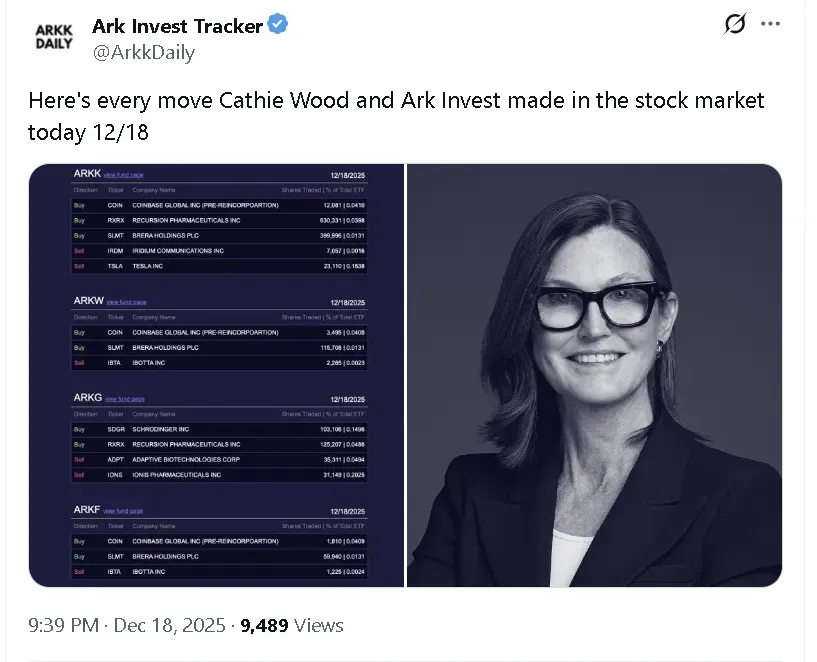

Across its actively managed ETFs, data showed ARK added more than 17,000 shares of Coinbase. The ARK Innovation ETF (ARKK) purchased just over 12,000 shares, while the ARK Next Generation Internet ETF (ARKW) added roughly 3,500 shares and the ARK Fintech Innovation ETF (ARKF) bought about 1,810 shares, according to daily trading disclosures.

Coinbase Remains A Core ARK Holding, Even At A Loss

Thursday’s purchases followed another round of Coinbase buying in the prior session, extending a multi-day accumulation trend across ARK’s flagship funds. Earlier in the week, ARK added 16,795 Coinbase shares to ARKK, 4,879 shares to ARKW, and 2,524 shares to ARKF.

Ark Invest reported holding approximately 2.4 million shares of Coinbase in its latest 13F filing. At current market prices, the position is valued near $592 million, representing a roughly $216 million drop from its last reported value.

ARKK gained 1.3% in pre-market trade. Retail sentiment around the fund trended in ‘bearish’ territory over the past day, with chatter at ‘low’ levels. ARKW rose 0.96%, with retail sentiment improving to ‘neutral’ from ‘bearish’ territory over the past day as chatter remained at ‘normal ‘levels.

ARKF was up over 1%, with retail sentiment around the fund trending in ‘bearish’ territory over the past day, with chatter at ‘low’ levels.

Stock Trading On Coinbase

The increased exposure comes shortly after Coinbase announced plans to introduce stock trading on its platform during its ‘System Update’ product event, marking a notable expansion beyond its crypto-only roots.

Coinbase also revealed a partnership with Kalshi to power prediction markets on its platform, a move that mirrors a similar initiative launched earlier this year by Robinhood Markets Inc. (HOOD). The expansion places Coinbase more directly into competition with retail brokerages that already offer both equity trading and event-based contracts.

Read also: MSTR, BMNR Rise After BOJ Rate Decision Results In Bitcoin, Ethereum Rebound

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_thiel_OG_jpg_9d74d987ca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)