Advertisement|Remove ads.

Five Cryptocurrencies That Beat The Broader Market In A Volatile 2025

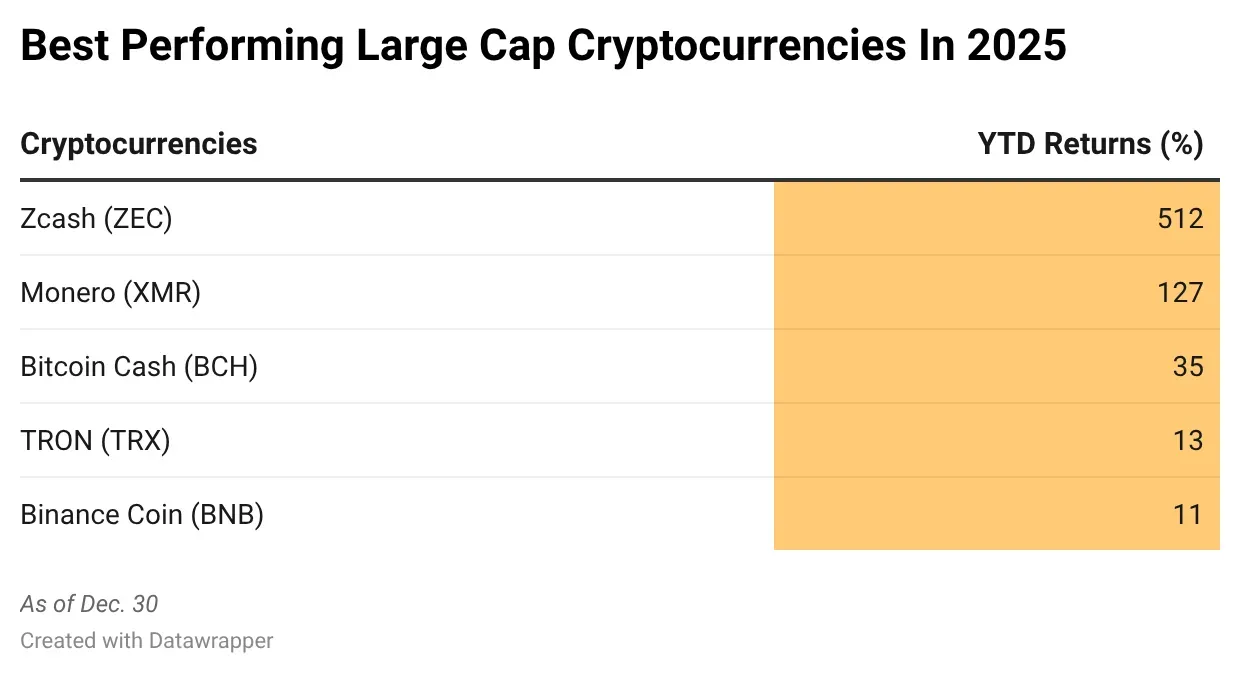

As the year 2025 draws to a close, a number of cryptocurrencies have outperformed the broader market, including Bitcoin and Ethereum, with standout performances and ecosystem growth.

In fact, during a turbulent year for many assets marked by volatility and macro uncertainty, these five — ZCash (ZEC), Monero (XMR), Bitcoin Cash (BCH), Binance Coin (BNB), and Tron (TRX) — posted notable gains or relative outperformance within their respective segments, supported by key fundamental catalysts behind their rallies.

In comparison, Ethereum fell 10.9%, and Bitcoin declined 5.1% till Dec. 30.

1. ZCash (ZEC)

ZCash was one of the year's largest overperformers as renewed interest in privacy-focused assets began to pick up again in 2025. According to coverage from Cointelegraph, demand for financial privacy returned to the spotlight late in the year after being muted for most of the year. The dramatic rise briefly propelled ZEC into the top ranks of the most sought-after assets on Coinbase, even ahead of Bitcoin and XRP in trading volume in mid-November.

The run-up, combined with a post-halving supply squeeze and an upgrade that increased shielded transaction use, propelled outsized percentage gains relative to most major tokens.

Many observers also linked the rally to the interplay of supply factors following the 2024 halving and changes in on-chain usage metrics, such as the growth of the shielded balance on the network. ZEC’s repricing was thus linked to renewed market speculation about privacy-focused use cases, ending the several-year period of obscurity.

2. Monero

Monero also delivered a strong performance within the privacy coin category, capitalizing on the rotation of funds into anonymity-focused cryptocurrencies during the year. Although gains in value varied with broader market trends, Cointelegraph noted that funds were rotating into privacy-focused projects such as XMR amid rising scrutiny in parts of the crypto sector. The trend toward privacy-focused offerings further strengthened XMR's market niche as traders and long-term investors grew interested in non-mainstream cryptocurrencies.

At the same time, on-chain interest in XMR, as well as technical momentum, were other factors that helped it remain strong relative to many other large altcoins in the market. Even when regulatory pressure weighed on parts of the privacy-coin sector, Monero’s investor base remained strong, as it offered a feature of default obfuscated transactions by design.

3. Bitcoin Cash (BCH)

Bitcoin Cash has surprised market participants in 2025, beating most Layer-1s on a relative performance basis, except in the privacy and ecosystem tiers. According to a Cointelegraph report, BCH has been one of the best-performing Layer 1 assets overall, logging close to 40% growth in 2025 alone. This has been remarkable given that most Layer-1 assets experienced token unlocks and developer treasury sales, both of which are significant factors affecting price.

The simple peer-to-peer transaction value also supported the prices and low-cost transfer advantage, a narrative often cited by market participants that lured traders interested in basic cryptocurrency functionality rather than DeFi stories. The altcoin market performed poorly overall, but this helped BCH post consistent gains.

4. Tron

Tron's performance in 2025 relied more on organic growth than on hot price surges. According to a Cointelegraph report, Tron has emerged as one of the leading settlement channels for the popular stablecoin USDT, handling a significant share of stablecoin transaction activity across the crypto market. The primary use of TRX not only validated its utility as a low-cost platform but also as a high-throughput network.

Regular transaction volumes and network adoption for stablecoin flows helped maintain interest in TRX, despite other crypto markets recording mixed trends. Its development as a key hub for dollar-linked transactions emerged as an exciting narrative for traders and developers alike interested in blockchain scalability solutions.

5. BNB

BNB, the native token of the Binance ecosystem, performed quite well relative to many large-cap tokens as trading volumes and network usage remained robust through 2025. According to CoinDesk, BNB reached over $870 in December, outperforming a number of crypto majors on continued volume support. That performance captured not just speculative upside but also continued utility as the fee token for one of the world's largest crypto ecosystems, bolstering its resilience.

Activity across Binance’s trading ecosystem helped extend BNB's relative strength, especially in a year marked by rotating capital flows and cautious macro sentiment. This relative strength distinguished BNB from many peers as crypto markets started to reevaluate large caps.

Also See: What Is Asset Allocation In Investing?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)