Advertisement|Remove ads.

Bitcoin Holds Near $114K Ahead of Fed Rate Decision — SOL, XRP Edge Higher

- Bitcoin edged lower, while altcoins were mixed ahead of the Federal Reserve’s meeting on Wednesday.

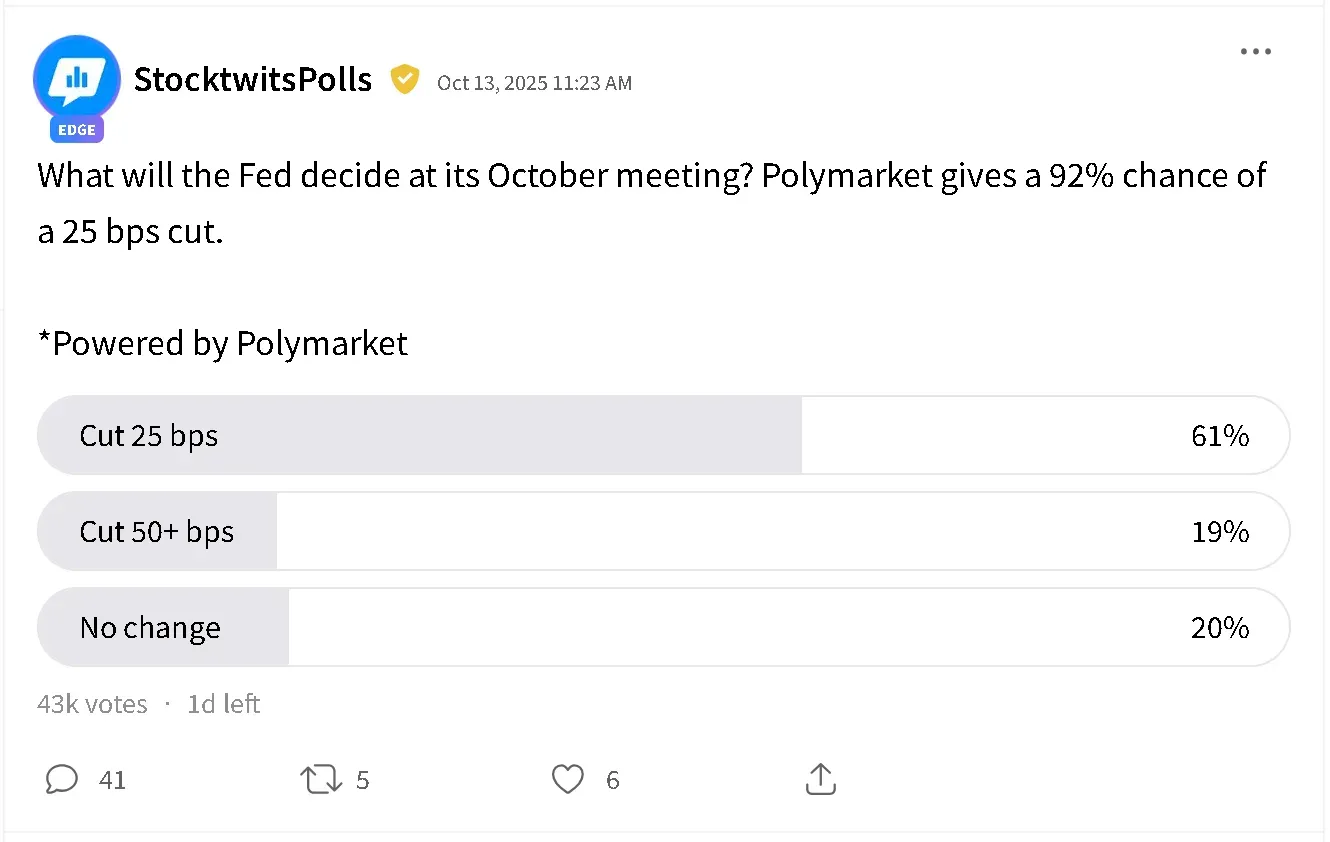

- Most retail traders polled on Stocktwits expect the Federal Reserve to cut rates, with 61% expecting a 25-basis-point reduction.

- XRP led altcoin gains after CryptoQuant said Evernorth Holdings, an XRP digital asset treasury, had acquired 388 billion tokens – about 95% of its target.

Bitcoin (BTC) edged lower in early morning trade on Tuesday, while the rest of the cryptocurrency was mixed ahead of the Federal Reserve’s rate cut decision on Wednesday.

Bitcoin’s price fell 0.8% in the last 24 hours to trade at around $114,500. On Stocktwits, retail sentiment around the apex cryptocurrency fell to ‘bearish’ from ‘neutral’ territory over the past day.

Meanwhile, Ethereum (ETH), the leading altcoin, fell around 1.3% in the last 24 hours. Ethereum’s price traded at around $4,100 in early morning trade, with retail sentiment around the altcoin dipping to ‘neutral’ from ‘bullish’ territory over the past day.

Traders See Near-Certainty of Fed Rate Cut

According to the CME FedWatch Tool, traders have assigned a 97.8% probability that the Fed will cut rates by 25 basis points (bps) at its upcoming meeting, after last week’s softer-than-expected inflation data.

Retail traders on Stocktwits also showed similar expectations. According to an ongoing platform poll, 61% of retail traders expect the Fed to cut rates by 25 bps, another 19% expected a 50 point cut, and only 20% believe rates will remain unchanged.

Solana, XRP Buck Market Decline

The only major tokens trading higher were Solana (SOL) and Ripple’s XRP (XRP). Solana’s price rose 0.3%, while XRP’s price gained 1.7% after on-chain analytics firm CryptoQuant reported that Evernorth Holdings, expected to become the largest XRP-backed digital asset treasury (DAT), has already acquired 388 billion tokens, or about 95% of its target. It said the firm’s average purchase price of roughly $2.44 could mark a key level for XRP’s future price action.

Evernorth, which plans to go public through a merger with Armada Acquisition Corp. III (AACI), said it will list on Nasdaq upon completion of the deal.

Altcoins, Equities Track Crypto Market Losses

The overall cryptocurrency market dipped 0.4% in the last 24 hours, with a market capitalization of around $3.95 trillion. Cardano (ADA) led losses among altcoins. ADA’s price fell 1.7% in the last 24 hours, with retail sentiment on Stocktwits falling to ‘neutral’ from ‘bullish’ territory over the past day. It was followed by Binance Coin (BNB), which fell 1.5% and meme token Dogecoin (DOGE), which dipped 1.3%.

Coinglass data showed that liquidations stood at $269 million in the last 24 hours. Around $191 million came from long bets — traders who expected the price to rise – while the other $77 million came from short positions.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, edged 0.6% lower in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) fell 1/15%. Crypto-exchange Coinbase (COIN) dipped around 0.12%.

Read also: Why Did Galaxy Digital Stock Fall After Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)