Advertisement|Remove ads.

Bitcoin’s Market Cap Drop From All Time Highs Now Exceeds The GDP Of These 5 Countries

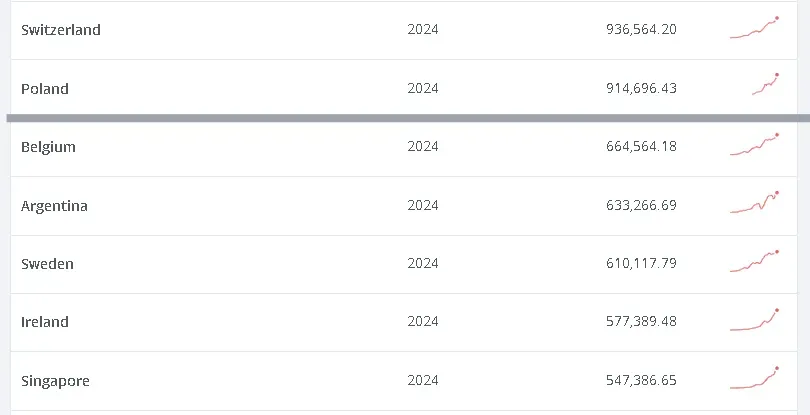

- The value erased is larger than the GDPs of countries such as Belgium, Sweden, Ireland, Argentina, and Singapore.

- Stocktwits data showed retail sentiment slipping to ‘extremely bearish’ while message volume jumped to ‘extremely high’ over the past day.

- Standard Chartered’s Kendrick Geoffrey said current metrics signal a repeat of earlier downturns rather than a structural shift.

Bitcoin’s (BTC) market capitalization has plunged by more than $830 billion from its all-time high of $2.49 trillion, recorded when the cryptocurrency’s price topped $126,000 in early October.

The drastic drop in its value is more than the GDPs of countries like Belgium, Argentina, Sweden, Ireland, and Singapore. For example, Belgium’s GDP stood at roughly $664 billion in 2024, while Sweden’s GDP was around $610 billion, according to World Bank data.

BTC was among the top trending tickers on Stocktwits. Bitcoin’s price traded at around $84,500 in midday trade on Friday after falling 4% in the last 24 hours. Retail sentiment around the apex cryptocurrency fell to ‘extremely bearish’ from ‘bearish’ territory over the past day as chatter increased to ‘extremely high’ from ‘high’ levels.

Where Is Bitcoin’s Price Headed Next?

Kendrick Geoffrey, the global head of digital assets at Standard Chartered, believes the recent sell-off is nothing more than a third iteration of past sell-offs in the crypto market. “A number of other metrics have collapsed to absolute zero levels, such as MSTR’s mNAV which is now at 1.0,” he said in an email to Stocktwits. “I think this is enough to signify the sell-off is over and to eventually disprove those who think the halving cycle remains valid.”

Analysts and industry figures have offered mixed predictions for Bitcoin’s next move. BitMEX co-founder Arthur Hayes suggested that BTC may be nearing a market bottom on Friday, though he cautioned that a further dip to $80,000 could occur before recovery. He said the next catalyst for Bitcoin’s price to rise again would be the central bank printing money after the stock market dips.

JPMorgan raised concerns on Thursday that it could face exclusion from major equity indices as the January MSCI decision approaches. While executive chairman Michael Saylor brushed off those concerns, stating that index inclusion “doesn’t define” Strategy (MSTR), the stock edged 0.8% lower in midday trade, recouping from deeper losses earlier in the session.

Read also: Bitcoin ETFs Hit Record Monthly Outflows In November – Average Investor Now in the Red, Says Analyst

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)