Advertisement|Remove ads.

Bitcoin Selloff Sparks $1.1 Billion In Crypto Liquidations While ETH, XRP Top Altcoin Losses – CZ Says It’s Not ‘The End Of Time’

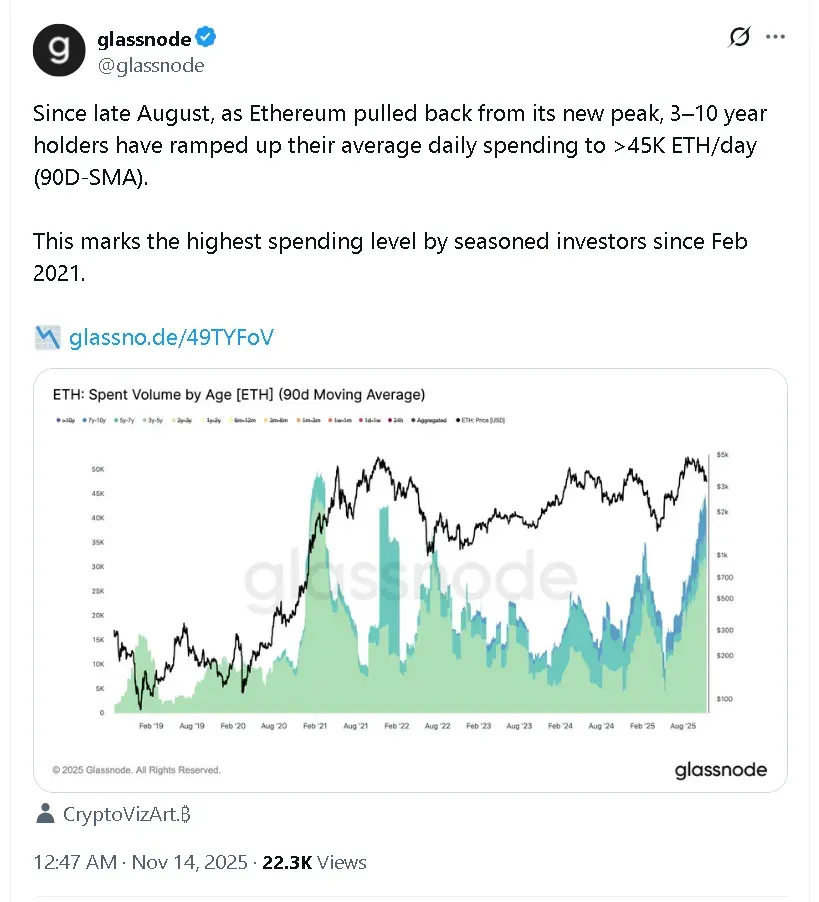

- Glassnode flagged increased selling from long-term holders, consistent with late-cycle patterns.

- Bitcoin and Ethereum both saw retail sentiment on Stocktwits turn ‘bearish’ over the past day.

- Bitcoin and Ethereum spot ETFs recorded significant outflows.

Ethereum (ETH) and Ripple’s native token (XRP) led losses in early morning trade on Friday after more than $1.1 billion in cryptocurrency bets were liquidated as Bitcoin’s (BTC) price dropped to under $96,000.

CoinGlass data showed that long positions accounted for roughly $978 million of the liquidations, compared with about $131 million in shorts. Nearly $510 million leveraged bets on Bitcoin were liquidated, followed by $275 million in Ethereum.

While several analysts warned that conditions point to a potential market downturn, Binance founder and former CEO Changpeng ‘CZ’ Zhao said the pullback is not the “end of time,” in a post on X. Gold bull Peter Schiff responded, stating that while it may not be the end of time, it is the “end of Bitcoin.”

Long Liquidations Drive Market Slide

Ethereum’s price fell more than 9% to $3,187 – a four-month low – in the last 24 hours. On Stocktwits, retail sentiment around the altcoin trended in ‘bearish’ territory over the past day.

On-chain analysis firm Glassnode noted data showing long-term Ethereum holders have started moving more of their coins. Since late August, when Ethereum fell from its recent high, investors who have held ETH for 3 to 10 years have increased the amount they’re spending or selling to more than 45,000 ETH per day on average – the highest level of activity from these long-standing holders since February 2021.

Bitcoin’s price fell to under $96,000, with retail sentiment dropping to ‘bearish’ from ‘neutral’ territory over the past day, even as chatter rose to ‘high’ from ‘normal’ levels.

Glassnode also said the rise in Bitcoin selling from older, long-term holders fits typical late-cycle behavior. Their spending has doubled since July, increasing from roughly 12,500 BTC a day to about 26,500 BTC a day. The firm added that demand for downside protection is rising, with spikes in the 25-delta skew continuing to align with short-term market lows and signaling heavier short positioning.

Broader Market Pressure Hits Altcoins And ETFs

XRP, Solana (SOL), and Cardano (ADA) dropped more than 8% in the last 24 hours. XRP’s price was trading at around $2.29, but retail sentiment on Stocktwits trended in ‘bullish’ territory amid ‘high’ levels of chatter over the past day.

Solana’s price hit $142 with retail sentiment in the ‘bearish’ zone. Meanwhile, Cardano’s price traded at $0.51, with retail sentiment dipping to ‘bearish’ from ‘neutral’ over the past day.

Meme token Dogecoin (DOGE) fell 7% in the last 24 hours, followed by Binance Coin (BNB), which slid 5% and Tron (TRX), which dipped 1.7%.

Bitcoin spot exchange-traded funds (ETFs) saw $896.86 million in outflows on Thursday. Ethereum spot ETF outflows stood at $259.72 million. Solana (SOL) spot ETFs, however, continued to see positive inflows despite price weakness - albeit at lower volumes. They saw inflows totalling $1.49 million.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, fell more than 3% in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) dipped nearly 2%. Crypto-exchange Coinbase (COIN) was down 3.2%.

Read also: MSTR Stock Falls 7% Pre-Market After Strategy Moves Over 47,000 BTC – But Michael Saylor Says ‘HODL’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)