Advertisement|Remove ads.

Cathie Wood’s ARK Adds Bullish Shares After Peter Thiel–Backed Crypto Exchange Jumps 16%

- Ark Invest began buying the dip in crypto stocks last week but has since narrowed its focus.

- Last week, the Peter Thiel-backed crypto exchange reported a $108 million quarterly profit, reversing a year-ago loss.

- Ark has repeatedly accumulated Bullish across multiple funds since its August 2025 IPO.

Peter Thiel-backed Bullish (BLSH) edged 0.94% lower after hours following a gain of over 16% in the regular sessions, leading gains among crypto-linked equities on Monday, and Cathie Wood’s Ark Invest picked up another handful of shares.

Ark Invest added another 57,000 shares of BLSH on Monday across its ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). The crypto exchange recently swung to a $108 million quarterly profit, and the stock surged by double digits on Monday alongside the recovery in Bitcoin’s (BTC) price. The fresh buy follows earlier multi‑million‑dollar Bullish purchases after its August 2025 IPO.

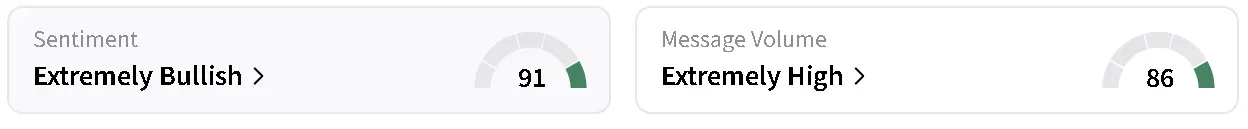

On Stocktwits, retail sentiment around BLSH’s stock remained in ‘extremely bullish’ territory over the past day, with chatter at ‘extremely high’ levels.

Wood’s fund started buying the dip in crypto stocks last week, doubling down on nearly every name in its portfolio, including Robinhood (HOOD), Coinbase (COIN), and Bitmine Immersion Technologies (BMNR). That buying has since slowed, but the firm has continued to add Bullish, even after Monday’s sharp move upwards. Despite the recent rebound, BLSH’s stock remains about 66% below its IPO debut price of more than $95.

Ark Doubles Down On Bullish Bet

Ark Invest doesn’t seem to be just chasing the stock’s 16% pop – it seems to be averaging into a crypto exchange that has flipped from a $116 million loss to a $108 million profit in a year.

Since listing on the NYSE at $37 a share, Ark has repeatedly bought Bullish during both periods of weakness and strength, including prior single-day purchases valued between $8 million and $12 million last week. Recent disclosures show Ark accumulating hundreds of thousands of shares across ARKK, ARKW, and ARKF, pushing its total exposure to Bullish well into the nine-figure range.

Bullish reported net income of about $108 million in its fourth quarter (Q4) earnings last week, reversing a roughly $116 million loss from the third quarter. Executives said the turnaround was driven by a surge in trading activity, with volumes rising to approximately $179.6 billion during the quarter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261087084_jpg_9cdd1d104f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)