Advertisement|Remove ads.

Cathie Wood Warns Bitcoin Investors Are ‘Selling First, And Asking Questions Later’ As Market Uncertainty Skyrockets

- In her new Ark Invest video, Cathie Wood said many Bitcoin investors panic during market drops and “sell first, ask questions later.”

- She stated she does not understand why gold is doing better than Bitcoin, since Bitcoin has a fixed supply.

- Wood added that Bitcoin’s long-term trend is still strong and reminded that it acted as a safe place during the regional bank crisis.

Ark Invest CEO/CIO Cathie Wood said on Saturday that Bitcoin (BTC) investors tend to “sell first and ask questions later” during periods of heavy market volatility.

On Saturday, in an Ark Invest video, Wood said recent risk-off trading has pushed Bitcoin lower as investors react quickly instead of focusing on long-term fundamentals.

Wood explained that broad market selling has affected multiple sectors, including technology and crypto. “You know, sell now, ask questions later,” she added, pointing to algorithm-driven trading as a key factor behind the sharp moves in the overall trading scenario within the market.

She acknowledged that gold has outperformed Bitcoin (BTC) recently and that many investors are turning to gold for safety. However, she does not fully understand that stance. “Now we don’t understand that,” she said, explaining that “gold supply growth is, we believe, accelerating.” She argued that Bitcoin is different from gold since it has a fixed supply, due to which its “supply growth cannot accelerate.”

Bitcoin As A Crisis Hedge

Wood reminded viewers that Bitcoin acted as a “refuge for those who were very scared” during the regional bank crisis. At the time, some investors turned to Bitcoin because they were worried about risks in the traditional banking system.

Bitcoin (BTC) traded around $68,966.57, up by 4.3% in the past 24 hours. On Stocktwits, the retail sentiment around Bitcoin remained in the ‘neutral’ territory, with chatter falling from ‘normal’ to ‘low’ levels over the past day.

Despite the recent weakness, she added that Bitcoin’s broader uptrend remains intact. “I don’t think it will be broken now,” she said, referring to Bitcoin’s broader uptrend. However, she added a note of caution, saying it “could be famous last words.”

Market Fear Lifts Gold First, Bitcoin Follows Later?

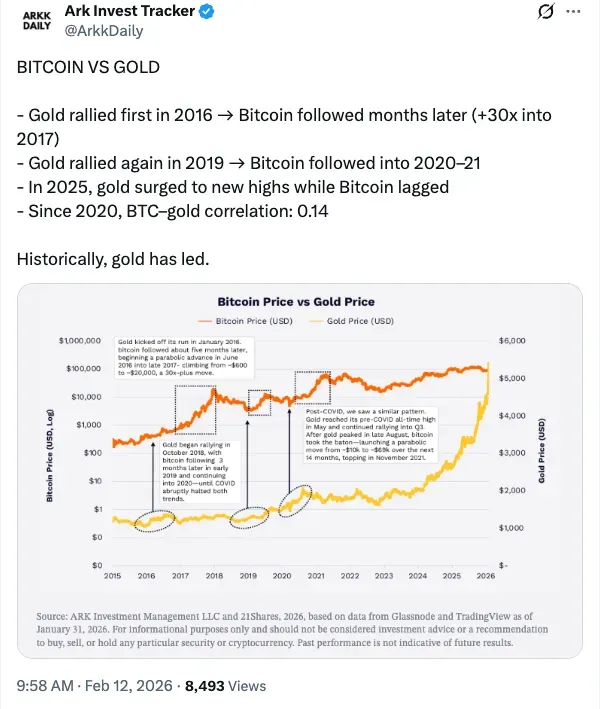

On Thursday, Ark Invest had posted a comparison of Bitcoin and gold performance, which showed that gold had recently outperformed Bitcoin, as investors have been choosing traditional safe assets during market uncertainty.

However, the reports showed that in past cycles, gold often moved higher first when fear increased. After that, Bitcoin tended to follow as confidence slowly returned and investors were willing to take more risk again.

Adding to this, Wood said periods like this could feel uncomfortable for investors. Yet, she described volatility as a normal part of long-term market cycles, adding that such phases have often created opportunities in the past.

Read also: Truth Social Files New Bitcoin, Ether, And Cronos ETF Filings Despite SEC Delays

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)