Advertisement|Remove ads.

US Crypto Czar Clarifies Trump’s Mention of XRP, Solana, Cardano Wasn’t An Endorsement, Just A Nod To Their Market Cap

White House AI and crypto czar David Sacks sought to temper speculation surrounding President Trump’s recent remarks on digital assets, clarifying that his mention of Ripple’s XRP, Solana (SOL), and Cardano (ADA) was not an official endorsement but rather a reflection of their market capitalization.

Speaking on Bloomberg Television on Friday, Sacks explained that Trump’s reference to the tokens was incidental.

“I think the President just gave five examples of cryptocurrencies in his post. Those five have to be the largest by market cap,” Sacks said.

“I think people are reading into that a little bit too much. The bottom line is, I think that what we've announced here is consistent with what the President has always said about the space,” he added.

The clarification dampened enthusiasm in the market, with Cardano sliding 5.6% over the past 24 hours, XRP down 4.5%, and SOL slipping 0.4% during U.S. afternoon trading, according to CoinGecko data.

Bitcoin (BTC) also lost ground, falling to $87,800 and erasing its early gains.

This followed an earlier sell-off as Trump doused market expectations after saying that the U.S. strategic crypto reserve would include Bitcoin, Ether, XRP, Solana, and Cardano.

Instead, he announced the creation of a Bitcoin Strategic Reserve on Thursday, which would initially only include Bitcoin and later add other digital assets seized by the government. He did not mention any taxpayer-funded acquisitions of altcoins such as XRP, Solana, or Cardano.

However, CoinGecko data suggests Sacks’ claim about market cap rankings wasn’t entirely accurate.

Excluding the two largest stablecoins – Tether’s USDT and Circle’s USDC – the five largest cryptocurrencies by market capitalization are Bitcoin, Ethereum, XRP, Binance’s BNB, and Solana.

Dogecoin ranks sixth, with Cardano just behind it.

Sacks' claim also contradicts Treasury Secretary Scott Bessent's comments that the reserve would start with Bitcoin but left the door open for other assets.

“Seized crypto assets would go into the reserve first, then we'll see the way forward for more acquisitions,” he said. “And we're starting with Bitcoin, but it's an overall crypto reserve.”

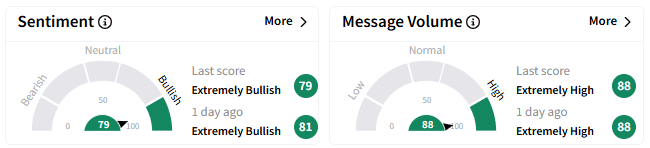

Despite the pullback, retail sentiment around Cardano's token on Stocktwits remained in the ‘extremely bullish’ range, accompanied by ‘extremely high’ levels of chatter.

Cardano’s price has gained 13.5% over the past year.

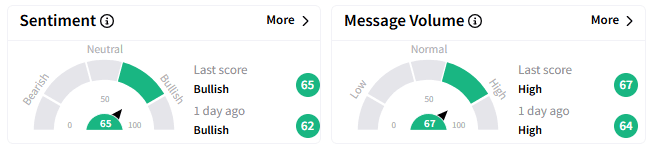

Retail sentiment on Stocktwits around XRP’s token seemed less shaken, inching higher into the ‘bullish’ territory, accompanied by ‘high’ levels of chatter.

The token has surged nearly 300% over the past year, making it the best-performing of the three.

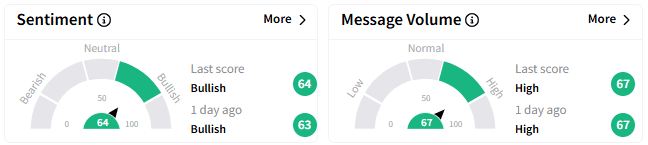

Retail sentiment around Solana’s token was also bullish, accompanied by ‘high’ levels of chatter.

However, its price remains down 1.3% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)