Advertisement|Remove ads.

Retail Traders Are Buying The Crypto Dip — But Not Bitcoin

Bitcoin’s (BTC) price consolidation has historically triggered capital rotation into altcoins, and this time appears no different.

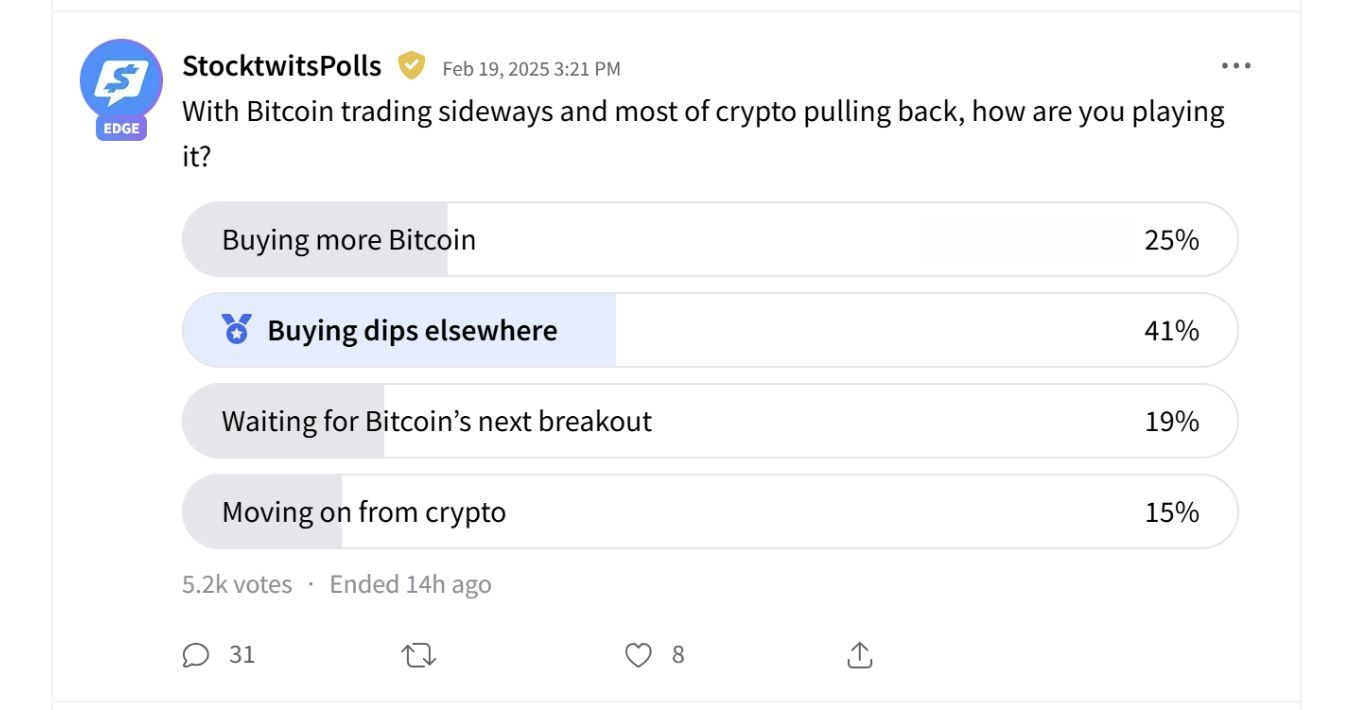

A recent Stocktwits poll found that 41% of traders are buying dips in altcoins, while only 25% are adding to Bitcoin.

The data reinforces a familiar trend in crypto markets – when Bitcoin consolidates, speculative capital often moves into riskier assets.

This dynamic has played out in past market cycles, such as in early 2021, when Bitcoin’s rangebound trading coincided with a surge in altcoins.

With BTC struggling to break higher, investors are again looking for opportunities elsewhere, favoring projects they believe have room for outsized gains.

Recent price action suggests this trend may unfold again, with tokens like Ripple’s XRP (XRP), Solana (SOL), and meme coins drawing significant interest, according to Stocktwits data.

In a post on X, CEO and Founder of CryptoQuant Ki Young Ju, stated that altcoin season has officially begun.

However, the Altcoin Season Index, with a score of 37 out of 100, reflects that the market isn’t quite there yet.

While 19% of traders are waiting for Bitcoin’s next breakout before making moves, another 15% are stepping away from crypto entirely.

This divide highlights the growing challenge for Bitcoin – without a clear near-term catalyst, some investors may lose interest and shift capital into other speculative sectors.

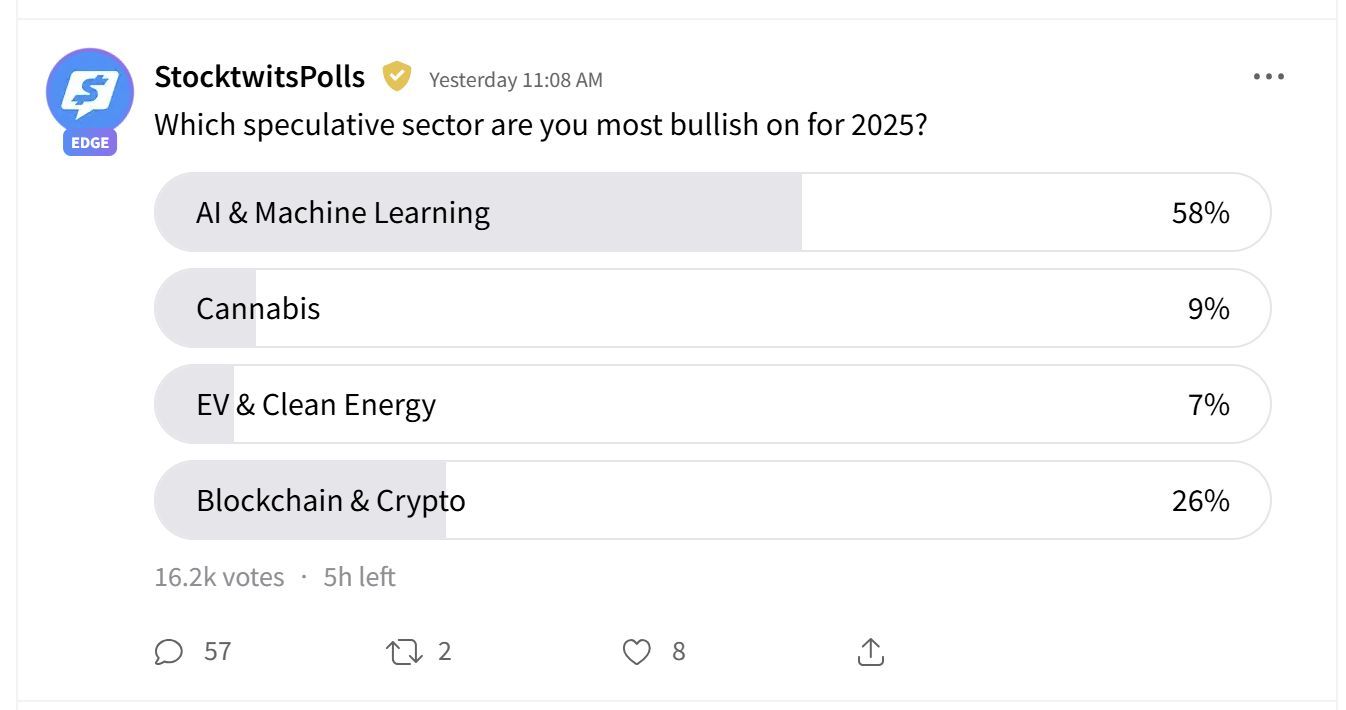

In another poll, traders indicated a stronger preference for artificial intelligence (AI) and machine learning (ML) stocks over blockchain-related investments, though crypto remains the second-most favored speculative asset class.

The market’s next major catalyst could dictate whether altcoins sustain their appeal or if traders return to Bitcoin as a safer bet.

With the SEC weighing new crypto ETF approvals and macroeconomic forces shaping risk sentiment, all eyes remain on BTC’s next significant price move.

Bitcoin (BTC) is currently up 2% on the day, trading above $99,000. However, it remains 9.1% below its all-time high of $108,786, reached just before Donald Trump’s presidential inauguration.

Over the past month, Bitcoin has declined by 5.6%, despite expectations that Trump’s pro-crypto stance could serve as a bullish catalyst.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Altcoins XRP, LTC Gains Outpace Bitcoin As Crypto Market Awaits Release Of FOMC Minutes

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)