Advertisement|Remove ads.

Litecoin Leads Monthly Gains, Outperforming Crypto Majors As ETF Speculation Fuels Retail Optimism

Litecoin (LTC) is leading monthly gains among major cryptocurrencies, rising over 5% by Friday afternoon U.S. market hours to trade around $134 as speculation builds around a potential spot Litecoin exchange-traded fund (ETF).

Litecoin is the only cryptocurrency among the top 20 by market capitalization to post monthly gains, up by over 13%. The gains come at a time when the broader crypto market is struggling.

Bitcoin (BTC) has declined 6.5% over the past month, while Ether (ETH) has fallen 17.6%. Solana (SOL) saw the steepest losses among large-cap cryptocurrencies, dropping 32.8% in the same period.

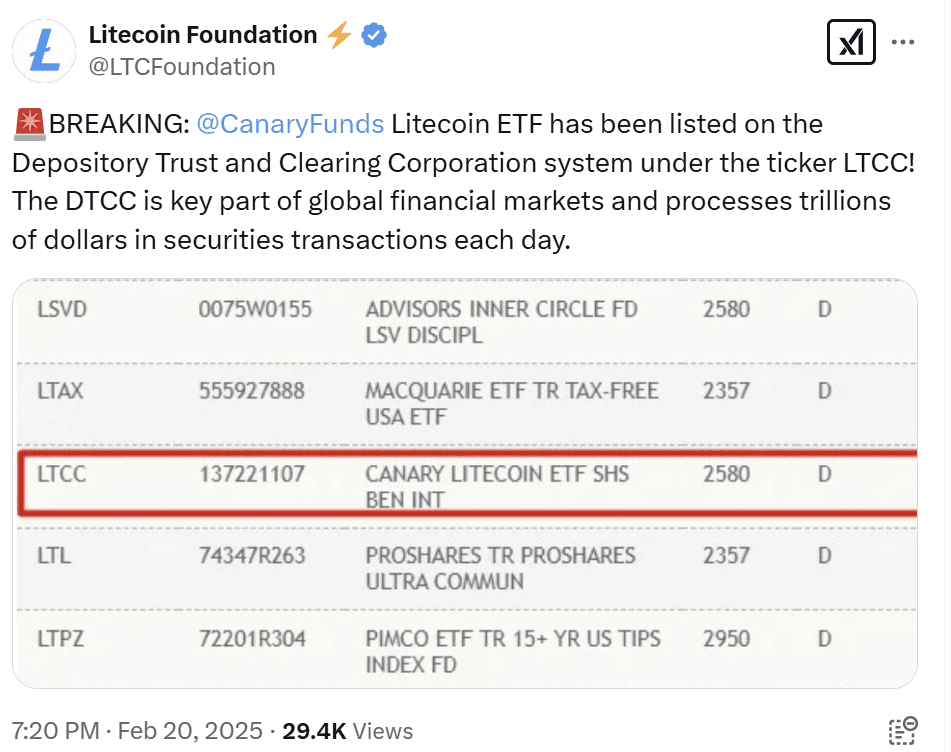

Friday’s surge in LTC prices comes as Canary Capital’s Litecoin ETF was spotted on the Depository Trust and Clearing Corporation (DTCC) system under the ticker LTCC on Thursday – a “key preparatory” step before potential approval, according to the Litecoin Foundation.

This comes after the Securities and Exchange Commission (SEC) posted an acknowledgment of a rule change to list the CoinShares spot Litecoin ETF on the Nasdaq earlier this week.

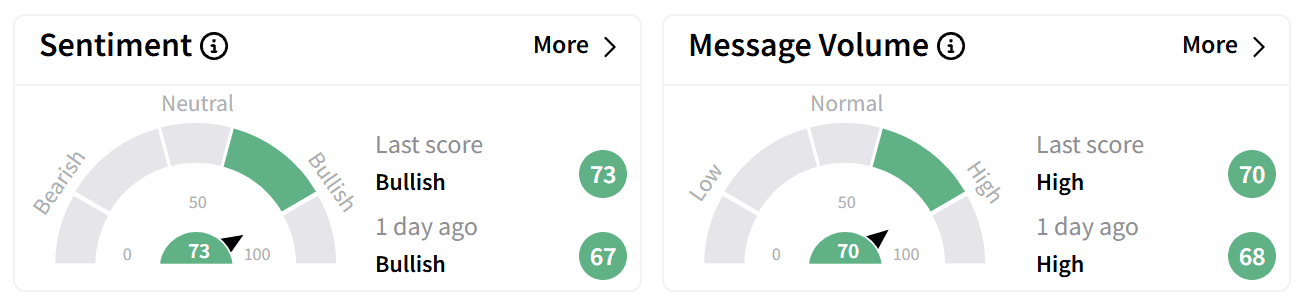

On Stocktwits, retail sentiment around Litecoin trended higher into the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

The sentiment and chatter seem fueled by optimism about Litecoin’s pending ETF.

Litecoin’s price has nearly doubled over the past year, but whether the cryptocurrency can maintain this momentum remains to be seen.

According to crypto research platform Santiment’s latest report, speculation around Litecoin’s ETF drove the token’s market capitalization 46% higher between Feb. 2 and Feb. 19, which it attributed the rise in part to increased network activity.

The company's analysis shows that daily transactions on the Litecoin network have reached $9.6 billion over the past week.

“There is clear growing excitement around a potential Litecoin ETF, 13 months after Bitcoin's first ETFs were approved by the SEC,” said the report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Retail Traders Are Buying The Crypto Dip — But Not Bitcoin

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221559942_jpg_36e309967d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237997221_jpg_4dc389547a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2258412162_jpg_8f6a6237d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ocular_therapeutix_jpg_e5ff9ff87d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trip_Advisor_jpg_c5134f02d2.webp)