Advertisement|Remove ads.

Lummis Revives BITCOIN Act, Laying Groundwork for Trump’s BTC Strategic Reserve — Retail Sentiment Split

Bitcoin (BTC) stabilized above $83,000 after dipping below $78,000 late Sunday, recovering alongside the broader markets.

The rebound coincides with U.S. Senator Cynthia Lummis’ reintroduction of the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act – a bill that proposes the U.S. government acquire one million Bitcoin over five years – an investment currently valued at around $80 billion.

The legislation aligns with President Donald Trump’s executive order to establish a Strategic Bitcoin Reserve, which aims to address national debt and bolster the economy.

Under Lummis's proposed plan, the purchases would be funded through Federal Reserve earnings and gold certificates, and the BTC holdings would be locked for at least 20 years.

The BITCOIN Act has already garnered support from five Republican co-sponsors, including Senators Jim Justice, Tommy Tuberville, Roger Marshall, Marsha Blackburn, and Bernie Moreno.

Representative Nick Begich is set to introduce a companion bill in the House on Tuesday.

The proposal mandates the U.S. Treasury Secretary to establish a decentralized network of secure Bitcoin storage facilities nationwide, with large BTC reserves held in cold wallets.

The Treasury would issue new gold-backed certificates to the Federal Reserve at current market prices, using the proceeds to finance Bitcoin acquisitions.

Provisions in the bill restrict any Treasury Secretary from selling more than 10% of the Bitcoin reserve within a two-year window.

However, this potential for eventual liquidation contrasts with the White House’s stance.

Last week, following Trump’s executive order to create a Strategic Bitcoin Reserve, senior White House officials indicated that the digital asset should be held indefinitely to generate "long-term value."

The administration has also insisted that any future acquisitions remain budget-neutral – an approach Lummis’ bill does not follow.

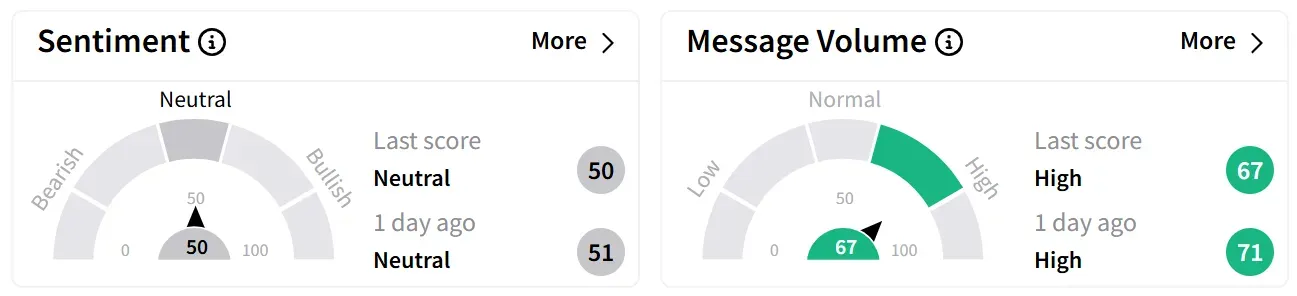

Retail sentiment around Bitcoin’s token ticked lower within ‘neutral’ territory, despite ‘high’ levels of chatter.

Some users pointed out the irony of Bitcoin advocates pushing for institutional adoption and now expressing concerns about market manipulation.

Others warned that downside risks persist despite the positive regulatory developments.

Bitcoin has fallen more than 15% over the past year and is currently trading 23% below its January all-time high of nearly $109,000.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: SEC Hits Pause On XRP, Solana, Litecoin, Dogecoin ETFs — Retail Backs Ripple But Skeptical On Others

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)