Advertisement|Remove ads.

MSTR Options Exposure Dwarfs Tesla, Nvidia, Meta – Michael Saylor Says Bitcoin Makes The Stock ‘Interesting’

- MSTR’s options interest to market capitalization ratio far exceeds derivatives exposure seen at Tesla, Meta, Nvidia, and Alphabet.

- A large January 2 options expiry could heighten short-term volatility.

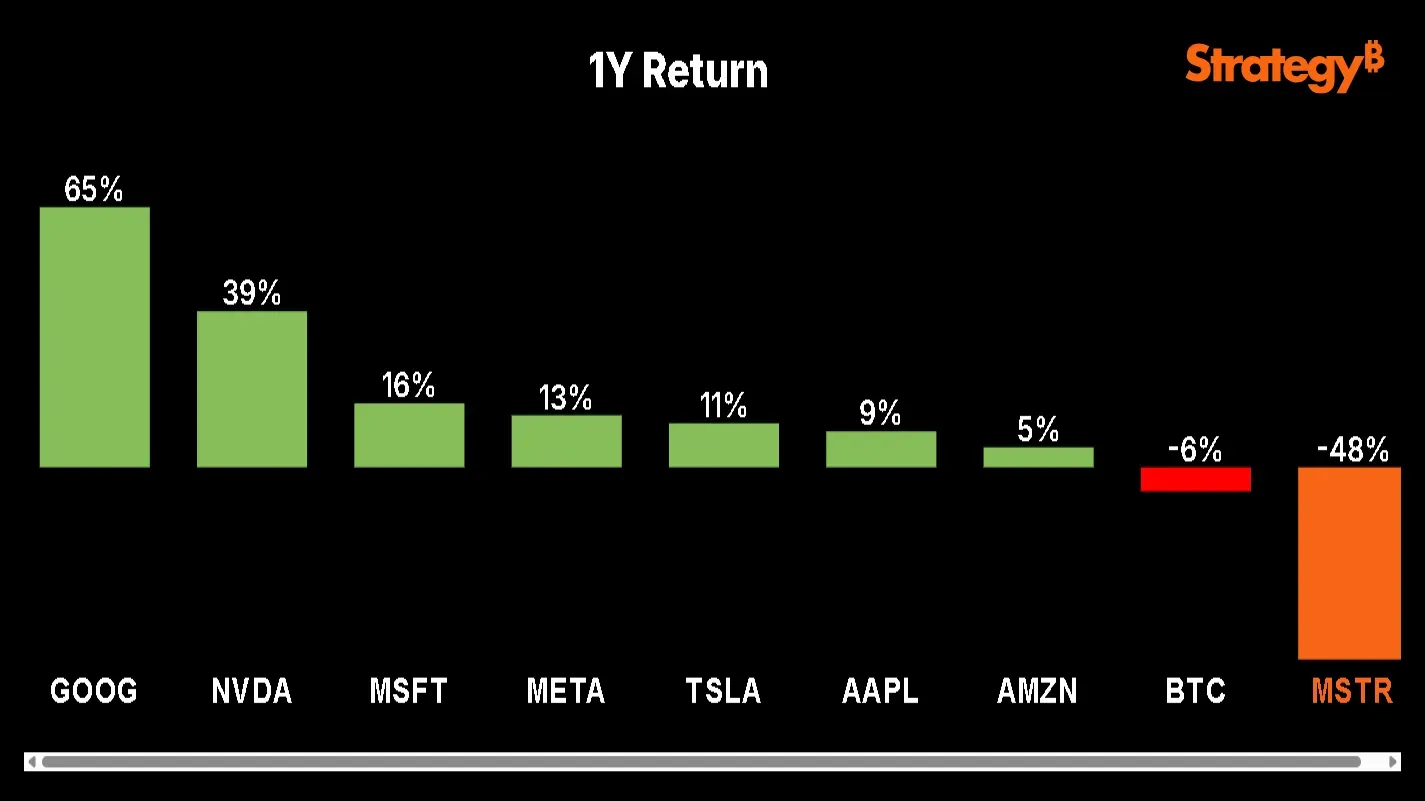

- While options activity on MSTR's stock is higher than its mega-cap peers, its returns over the past year have lagged behind.

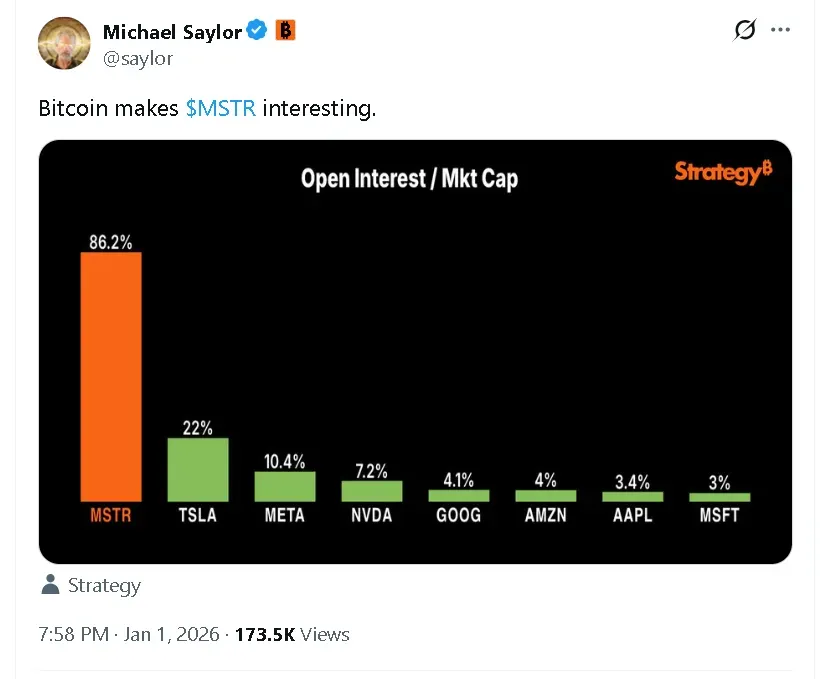

Strategy (MSTR) executive chairman Michael Saylor said Thursday that Bitcoin (BTC) is what makes the stock “interesting,” pointing to options activity that now rivals the company’s market capitalization and exceeds that of mega-cap peers including Tesla (TSLA), Meta Platforms (META), Nvidia (NVDA), Alphabet (GOOG/GOOGL) and others.

MSTR’s stock was trading flat in after-hours trade after dipping 2.35% on the last trading session of 2025. On Stocktwits, retail sentiment around the company remained in ‘bearish’ territory over the past day as chatter dipped to ‘low’ from ‘normal’ levels. Meanwhile's Bitcoin remained range-bound entering the new year. BTC's price rose 1.4% in the last 24 hours to around $88,600 but retail sentiment around the apex cryptocurrency remained in 'bearish' territory over the past day.

Strategy’s Options Market Signals Elevated Risk Appetite

According to Saylor’s post on X, open interest around MSTR is around 86.2% of its market value, meaning option open interest is almost as large as the company’s entire market cap.

By comparison, options open interest at large technology companies remains far lower relative to their market capitalizations. According to Saylor’s post, Tesla’s ratio sits near 22%, while Meta’s is about 10.4%. Nvidia’s open interest is roughly 7.2%, followed by Alphabet at around 4.1%. Amazon (AMZN), Apple (AAPL) and Microsoft (MSFT) each post ratios below 5%.

While options activity on MSTR's stock is higher than its mega-cap peers, its returns over the past year have lagged behind. MSTR's stock has fallen nearly 50% over the past year, while Google's stock has gained 65%, Nvidia's stock is up 39% and even Meta's stock gained 13%.

TSLA’s stock rose 11% over the past year was the second highest trending ticker on Stocktwits at the time of writing, despite limited price action after-hours. Retail sentiment around the stock trended in ‘bearish’ territory over the past day, according to platform data.

Shares of Nvidia, Google, Amazon, Apple, Microsoft and Meta were also trading flat in after-hours trade on Thursday night, with retail sentiment trending in ‘bearish’ territory over the past day.

MSTR Trades Like a Bitcoin Proxy

The large gap between Strategy and its mega-cap peers indicates how the stock is uniquely positioned in public markets. Since adopting Bitcoin as its primary digital treasury asset in 2020, Strategy has increasingly traded more like a high-beta proxy for the the cryptocurrency.

Strategy’s market capitalization currently stands near $48.3 billion. With roughly 446,000 options contracts, mostly calls, set to expire on January 2,, according to data from OptionsCharts.io.

Preferred Stock Yield Adds Another Layer

Saylor’s comments follow Strategy’s announcement that its Series A Perpetual Stretch Preferred Stock (STRC) will pay an 11% annualized dividend beginning in January, distributed monthly.

The variable-rate preferred offering was introduced in late July at a 9% yield and has since stepped higher as market conditions triggered rate adjustments. The dividend rose to 10% in September, 10.25% in October, 10.75% in December, and now 11% for January 2026.

Strategy raises the rate by 25 basis points (bps) when the five-day volume-weighted average price falls below $99, with larger increases if it drops further. The mechanism is designed to support the preferred stock’s price near its $100 par value while continuing to fund Bitcoin accumulation.

Read also: Crypto Markets Drift Into Year-End With Bitcoin, Ethereum Range-Bound

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)