Advertisement|Remove ads.

Sui, XRP Shine Even As Crypto Investment Funds See Record $2.9B Outflows – Retail Sentiment Rebounds

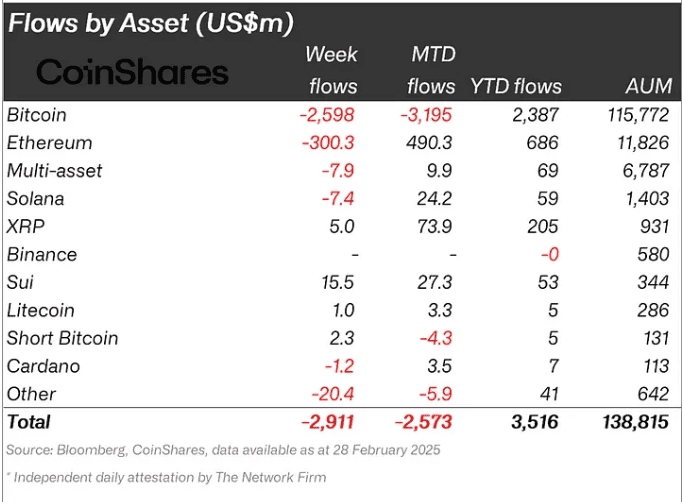

Digital asset investment products saw an unprecedented $2.9 billion in outflows last week, marking the largest weekly exodus on record and extending a three-week losing streak to $3.8 billion, according to a report by CoinShares.

Despite the mass withdrawals, Sui (SUI) and XRP emerged as the best performers, bucking the broader trend with inflows of $15.5 million and $5 million, respectively.

Sui climbed 8.4%, while XRP rose 17% during U.S. pre-market hours on Monday as the broader crypto market rallied to U.S. President Donald Trump’s proposal for a “crypto strategic reserve,” which would include XRP, Cardano (ADA), and Solana (SOL), in addition to Bitcoin (BTC), Ethereum (ETH).

The CoinShares report attributed the record outflows to a confluence of factors, including the recent Bybit hack, a more hawkish Federal Reserve, and profit-taking after a 19-week inflow streak that saw $29 billion pour into crypto funds.

“These elements likely led to a mix of profit-taking and weakened sentiment toward the asset class,” it said.

Bitcoin bore the brunt of the sell-off, accounting for $2.59 billion in outflows. Ethereum wasn’t spared either, posting a record weekly outflow of $300 million.

Solana and Toncoin also faced selling pressure, with outflows of $7.4 million and $22.6 million, respectively.

Sui’s price has experienced sharp swings over the past two weeks. The token broke above its 200-day simple moving average (SMA) following Trump’s crypto reserve announcement but has since retreated, hovering just above the key technical level.

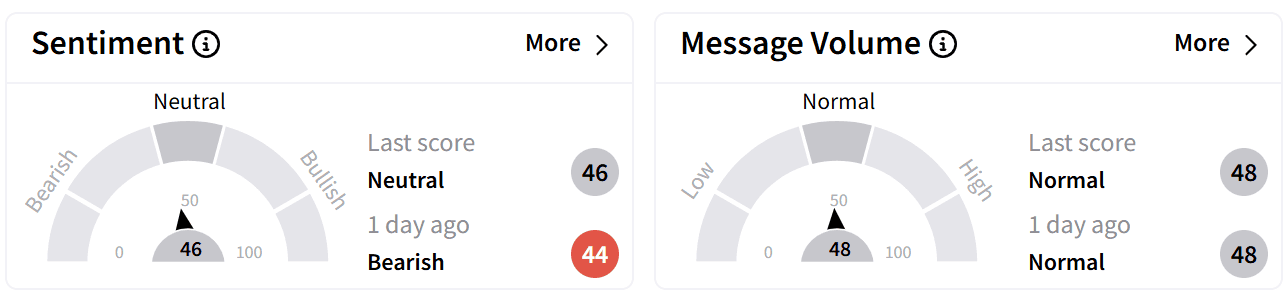

Retail sentiment on Stocktwits around Sui’s token improved to ‘neutral’ from ‘bearish’ a day ago.

Users on the platform celebrated the cryptocurrency’s rally over the weekend.

XRP also saw a sharp price reaction, surging 25% to $3 before retracing to $2.60 after Trump’s announcement.

Ripple’s native token remains around 19% below its January high of $3.2 but remains above its 200-day SMA, a critical support level.

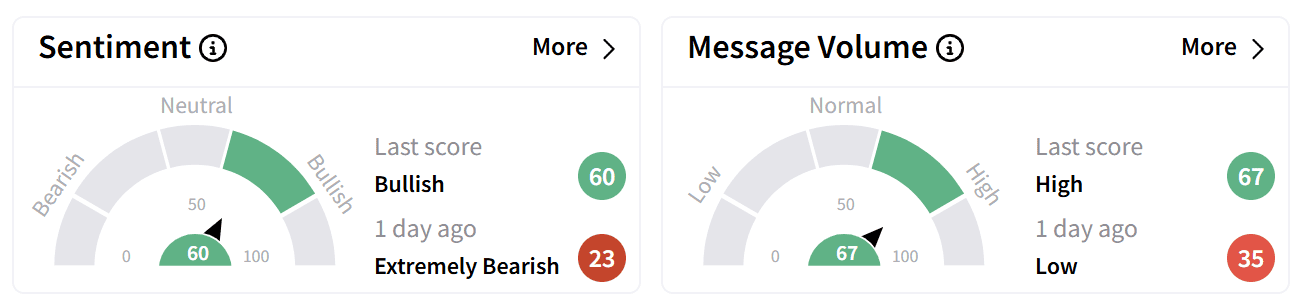

Retail sentiment on Stocktwits around XRP flipped to ‘bullish’ (60/100) from ‘extremely bearish’ a day ago, marking its highest level in a month. Chatter on Stocktwits also spiked to ‘high’ levels from ‘low’ a day earlier.

While many users remained optimistic about XRP’s long-term trajectory, some expressed disappointment that it failed to hold above $3.

Others saw the “slow bleed” coming.

Despite the turbulence, XRP has climbed 329% over the past year, while Sui has risen 88% compared to Bitcoin’s gains of 50% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)