Advertisement|Remove ads.

WLFI Edges Up Despite Congress Turning Up Heat On Foreign Ties To Trump-Linked Crypto

- World Liberty Finance rose more than 12% on Monday, even as a U.S. House investigation increased scrutiny over its foreign investment ties.

- Representative Ro Khanna opened the probe, citing reported links between WLFI, foreign sovereign capital, and Trump-era crypto activity.

- Khanna requested documents tied to a reported $500 million stake deal and the use of WLFI’s USD1 stablecoin in transactions linked to Binance.

On Monday, World Liberty Financial (WLFI) rose over 12%, despite a U.S. House investigation that put the company under more scrutiny due to its ties to foreign sovereign capital.

World Liberty Financial (WLFI) was trading at $0.1117, which is 12.14% higher than it was 24 hours ago. It had a market cap of about $2.98 billion and a daily volume of $212.9 million, which is 57% higher in the last 24 hours.

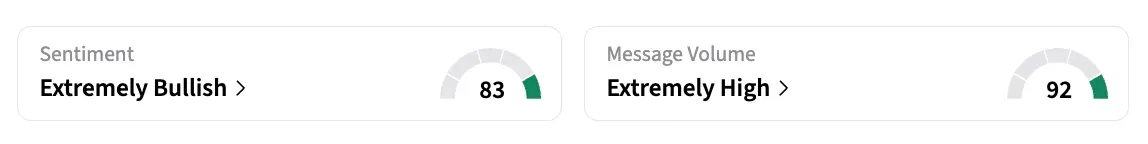

On Stocktwits, at the time of writing, WLFI was the top trending token at number 1, with the retail sentiment around WLFI changing from ‘neutral’ to ‘extremely bullish’ territory, with chatter at ‘extremely high’ levels over the past day.

House Probe Puts Focus On Foreign Ties And Governance

California's Congressional Representative Ro Khanna shared a letter starting an investigation into Trump's crypto ties for "information and documents" to better report on the connections between the UAE, the PRC, and the White House.

Khanna's letter to WLFI co-founder Zach Witkoff mentioned a Wall Street Journal article that says "lieutenants to an Abu Dhabi royal" signed a deal to buy a 49% stake in World Liberty Financial for $500 million just before Donald Trump took office. The letter also says that the reported investment led to more problems, such as the use of WLF's "USD1" stablecoin in a deal linked to a $2 billion investment in Binance (BNB).

WLFI: March 1 Deadline In Focus

World Liberty Financial has a deadline of March 1, 2026, to respond to Khanna's letter and send over documents and communications. These should include information about the supposed stake acquisition and the payments that went along with it.

The letter also frames the issue as a governance issue related to national security, saying that the optics could affect U.S. export-control policy and raising concerns about conflicts of interest and "Fed independence"-style institutional boundaries—this time between U.S. policymaking and private financial gain.

Khanna also points out a series of events that he says need to be looked into, such as MGX's reported $2 billion investment in Binance using USD1 and Changpeng Zhao's pardon in October last year, which the letter says took place about a month before the UAE got a few semiconductor export licenses.

Previously, Trump denied any knowledge of the reported stake deal, saying his family is the one who looks into WLFI’s. Crypto and AI czar had also cleared the air that Trump didn't get access to his crypto wealth, and it is “in a blind trust”.

Read also: A Top Hedge Fund Manager Is Warning Crypto Investors About Trump – Says He Is ‘Not’ A Friend To The Industry

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)