Advertisement|Remove ads.

5 Technology Names That Saw Brisk Retail Activity On Stocktwits Last Week

Stocks rose in the week of Feb. 14 as investors shrugged off data showing sticky inflation, weak retail sales data, and President Donald Trump’s tariff threats. The broader S&P 500 ended the week slightly below the record closing high of 6,115.07 on Thursday.

Against the backdrop, the following technology stocks saw a spurt in message volume on Stocktwits over the seven days that ended Feb. 14:

Trade Desk, Inc. (TTD)

Shares of Trade Desk, a provider of a self-service platform for ad buyers, closed the week ended Feb. 14 down about 31.6%. The weakness stemmed from the company’s mixed quarterly results, which prompted many sell-side analysts to lower their price targets for the stock.

Scotia Bank said the first revenue miss in Trade Desk’s history as a public company sets a negative tone to start the year, TheFly reported.

BofA Securities removed the company from its ‘US 1 list’ - comprising a collection of best investment ideas from among ‘Buy’-rated stocks.

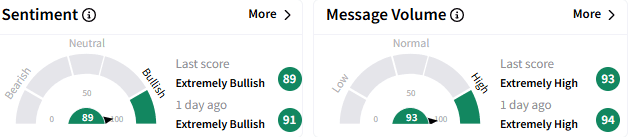

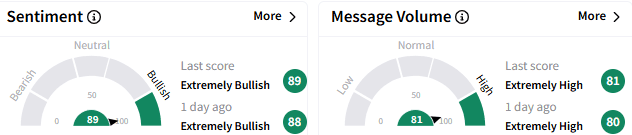

On Stocktwits, retail sentiment toward the stock remained ‘extremely bullish’ (89/100), with the positive mood accompanied by ‘extremely high’ message volume.

Retail chatter surrounding Trade Desk shares on Stocktwits rose 10,033% over seven days.

Informatica Inc. (INFA)

Informatica stock fell 22.4% in the past week before ending at its lowest since Nov. 1, 2023. The artificial intelligence (AI)--powered enterprise cloud data management platform provider reported a revenue miss for the fourth quarter and issued subpar forward guidance.

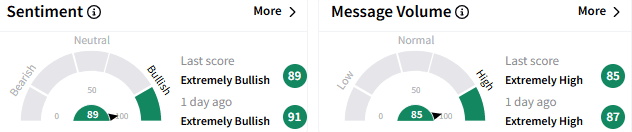

However, retail’s mood is uber-bullish (89/100), and retail activity has risen to an ‘extremely high’ level.

The seven-day change in message volume for Informatica is +6,200%.

Aurora Innovation, Inc. (AUR)

Pittsburgh, Pennsylvania-based Aurora Innovation stock gained over 41% last week. The self-driving technology company reported better-than-expected bottom-line result and its commentary regarding the imminent commercial launch supported the stock.

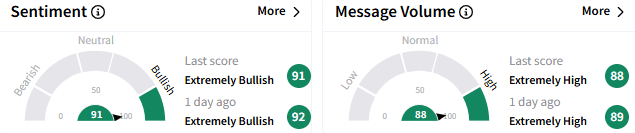

Retail sentiment toward the stock is ‘extremely bullish’ (91/100), and the message volume stayed ‘extremely high.’

The seven-day change in message volume for Aurora Innovation is +2,500%

JFrog Ltd. (FROG)

Shares of JFrog gained 11% last week after the Sunnyvale, California-based provider of software supply chain platform reported a double beat for the fiscal year 2024 fourth quarter.

The company’s first-quarter earnings per share guidance exceeded the consensus estimate, while the revenue guidance was in line.

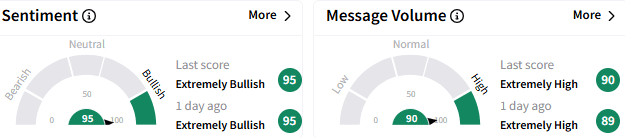

On Stocktwits, retail sentiment toward JFrog stock stayed ‘extremely bullish’ (95/100), with the positive mood accompanied by ‘extremely high’ message volume.

The seven-day change in message volume for JFrog stock is +2,000%

Cellebrite DI Ltd. (CLBT)

Cellebrite stock fell over 19% last week despite a fourth-quarter revenue beat and in-line earnings, according to Yahoo Finance. The forward revenue guidance for the first quarter and the fiscal year 2025 from the Israeli company that develops solutions for legally sanctioned investigations missed the consensus estimates at the midpoints.

Retail sentiment toward the stock is ‘extremely bullish’ (89/100), and the message volume remained at ‘extremely high.’

The seven-day change in message volume for Cellebrite DI stock is +1,200%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)