Advertisement|Remove ads.

Aarti Pharmalabs Q4 Print Supports Bullish Technical Trend: SEBI RA Varunkumar Patel

Aarti Pharmalabs Ltd. shows strong potential for future growth after delivering robust financial results in the fourth-quarter (Q4), according to SEBI-registered analyst Varunkumar Patel.

Current profitability growth, along with stable demand in core segments, suggest positive developments ahead for pharmaceutical manufacturing and CDMO services.

At the time of writing, shares of Aarti Pharmalabs were trading at ₹831.50, up ₹35.00 or 4.39%.

Aarti Pharmalabs achieved consolidated operational revenue of ₹5,638 million in Q4, which showed a 4.8% increase from the third quarter and an 11.5% rise compared to Q4 of FY24.

Core profit expanded by 13.2% compared to the prior quarter and by 23.9% compared to the same quarter last year, bringing the total EBITDA to ₹1,456 million as profit margins widened by 191 basis points.

The company hit a 13.9% quarterly gain and a 19.7% annual increase in profit before tax (PBT), reaching ₹1,146 million.

Its profit after tax (PAT) grew by 19.3% from the previous quarter and 35.2% year-over-year to ₹883 million.

The diluted earnings per share (EPS) reached ₹9.74, which marks an increase from ₹8.16 in the previous quarter.

Patel acknowledged that the margin growth resulted from improved operating leverage, a better product mix and effective strategic cost control.

He said the contract development and manufacturing organization (CDMO) and contract manufacturing organization (CMO) business was a principal growth driver, significantly impacting margin improvements.

The company's xanthine derivatives and API segments showed strong performance, driven by export demand and regulatory approvals.

Patel said that Aarti Pharmalabs continues its growth trajectory by expanding operations through the new Atali greenfield manufacturing site and increasing xanthine production capacity.

The company's high-value CDMO projects will experience increased momentum into FY26 thanks to strong R&D capabilities and worldwide certifications.

Patel pointed out that Aarti Pharmalabs' stock maintains a position above both its 20-day and 50-day exponential moving averages (EMAs), with the 20-day EMA continuing to stay above the 50-day EMA, demonstrating strong bullish momentum.

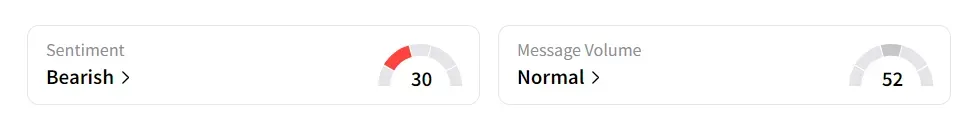

On Stocktwits, retail sentiment was ‘bearish’ amid ‘normal’ message volume.

The stock has risen 18.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)