Advertisement|Remove ads.

Abbott Labs Stock Dips Pre-Market On Narrowed Profit Outlook: Retail Turns Bearish

Shares of Abbott Labs (ABT) were down more than 1% pre-market after the pharmaceutical giant announced its third-quarter results.

The company reported earnings per share (EPS) of $1.21, slightly better than the Wall Street estimate of $1.20. Revenue for the quarter came in at $10.6 billion versus the consensus estimate of $10.53 billion.

This growth was largely fueled by robust performances in the Medical Devices segment, which reported an 11.7% increase in sales overall and a notable 13.3% rise on an organic basis. The standout drivers behind this growth included the FreeStyle Libre in Diabetes Care and the Amplatzer Amulet in Structural Heart.

Abbott has narrowed its full-year forecast, now expecting earnings per share to be between $4.61 and $4.70, while maintaining its sales growth projection of 9.5% to 10%, excluding any revenue from COVID-19 tests.

"Our results this quarter demonstrate the strength of our diversified business model," said the Chairman and CEO of Abbott, Robert B. Ford. "We're well-positioned to achieve the upper end of our initial guidance ranges for the year and have great momentum heading into next year."

In addition to its financial guidance, Abbott’s board of directors has authorized a new share repurchase program of up to $7 billion.

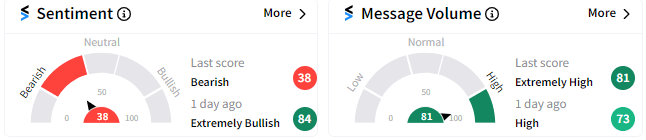

Retail investors on Stocktwits have soured on Abbott following the earnings release. Sentiment plummeted from ‘extremely bullish’ before the earnings to ‘bearish’ afterward, as a result of the company's narrowed EPS guidance.

Abbott’s stock has gained 7% in 2024 so far and 27% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com.

Read more: ASML Stock Plunges After Leaked Earnings Reveal Forecast Cut, Fuel Investor Concerns

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)